The return of "sound money" is not an overnight phenomenon, but rather a generational shift.

Written by: Daii

Currently, Bitcoin's price fluctuates around $84,000, which feels quite dull and boring. If you have invested using the DCA method introduced in this article, then the price should not be your primary concern. Instead, we need to continuously enhance our understanding and strengthen our beliefs, so that we can hold Bitcoin more steadily and for a longer time.

Reading is undoubtedly the fastest way to achieve self-improvement. Starting today, let's read a book together, "The Bitcoin Standard," which is translated into Traditional Chinese as "比特币标准" and Simplified Chinese as "货币未来."

I prefer the title "The Bitcoin Standard" because it quickly contrasts with the historical Gold Standard, helping us understand Bitcoin's core value. Compared to concepts like "standard" or "future," "The Bitcoin Standard" better highlights Bitcoin's potential as the cornerstone of a new global monetary system.

Since its publication in 2018, "The Bitcoin Standard" has rapidly become one of the most popular works on Bitcoin economics globally, translated into 38 languages, influencing countless investors, scholars, entrepreneurs, and even government policymakers.

1. How significant is the impact of "The Bitcoin Standard"?

Today, "The Bitcoin Standard" has become a must-read classic in the global Bitcoin community. The profound impact of this book is reflected in:

It has prompted businesses and institutions to consider Bitcoin as a long-term reserve asset;

It has made governments aware that Bitcoin could potentially become the future global reserve currency;

It has helped individual investors build faith and maintain long-term holdings amidst short-term volatility;

It has propelled Bitcoin economics into a legitimate academic research field.

Let's discuss these one by one.

1.1 Strategic Shift of Institutional Investors: Strategy's Bitcoin Standard

After the publication of "The Bitcoin Standard," more and more institutional investors began to seriously consider Bitcoin's long-term value. The most famous case is Michael Saylor, CEO of Strategy, who resonated deeply with Bitcoin's monetary attributes after reading the book.

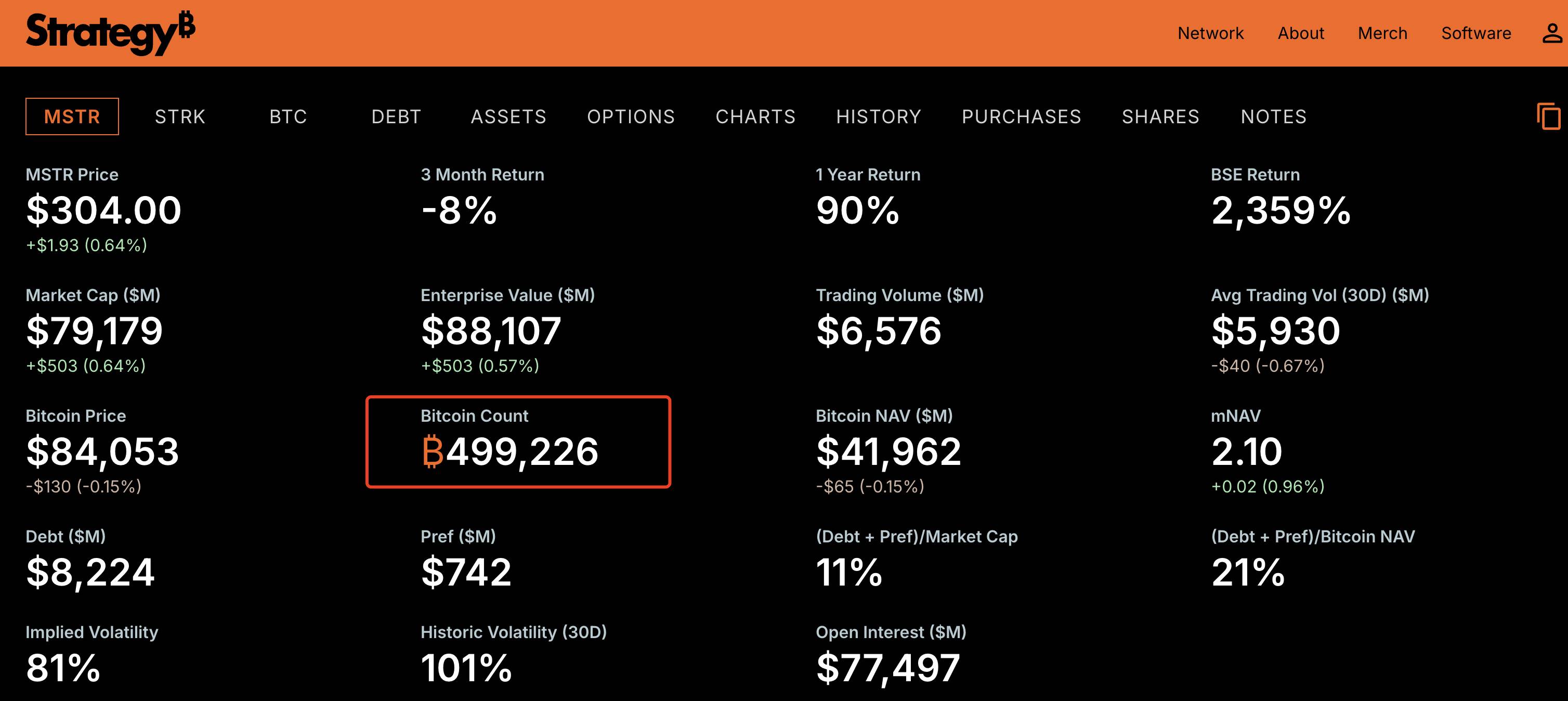

In 2020, Saylor decided to have Strategy purchase Bitcoin as a reserve asset, and to date, the company has become the largest publicly traded holder of Bitcoin, currently holding 499,000 BTC, as shown in the image below;

Saylor not only actively promotes the "Bitcoin Standard" company strategy but also encourages other businesses and institutions to allocate Bitcoin.

He has publicly stated multiple times that "The Bitcoin Standard" is a key reading for establishing his Bitcoin investment faith and recommends it to all entrepreneurs and investors interested in Bitcoin. I have previously conducted an in-depth analysis of Saylor's transformation in "The Bitcoin Dividend."

Saylor's actions have not only made Strategy the publicly traded company with the largest Bitcoin holdings but have also sparked a trend of institutional investment in Bitcoin, with companies like Tesla and Square (Block) beginning to include Bitcoin on their balance sheets.

The theories in "The Bitcoin Standard" have not only influenced corporate strategies but have also had a substantial impact on national policies.

1.2 Real-World Impact on Government Policy: El Salvador's Bitcoin Legal Tender Experiment

In 2021, El Salvador became the first country in the world to adopt Bitcoin as legal tender. The government referenced the views in "The Bitcoin Standard" during the decision-making process and invited economist Alex Gladstein to serve as an advisor, providing policy recommendations for the national application of Bitcoin.

President Nayib Bukele adopted Bitcoin as the national currency, promoting the global de-dollarization process;

The country launched Bitcoin bonds (Volcano Bonds) and the national Bitcoin wallet Chivo, attempting to integrate Bitcoin into the national financial system.

El Salvador's decision has drawn global attention, prompting some developing countries to consider the feasibility of Bitcoin as legal tender. Although this policy still faces challenges, it has set a historic precedent—Bitcoin is not just an investment asset; it is becoming a national financial tool.

1.3 Influencing Mainstream Economics and Policy Discussions

"The Bitcoin Standard" has not only influenced businesses and governments but has also become an important topic in global economic and policy discussions.

U.S. Congressman Warren Davidson praised the book as "one of the most important economics books in recent memory" and has cited its views multiple times in congressional policy discussions;

Many traditional economists have begun to re-examine the economic significance of Bitcoin, and the Austrian School's free-market economic theories have gained more attention as a result;

The theoretical framework of the book has been adopted by several Bitcoin education courses, becoming standard reading in universities, research institutions, and online education platforms.

This influence extends beyond the cryptocurrency circle, reaching broader financial, policy, and academic fields, making Bitcoin economics a formal area of research.

1.4 Cohesion of the Bitcoin Community and Global Consensus

The value of Bitcoin is not solely derived from technology but is built on global consensus. "The Bitcoin Standard" provides theoretical tools to help Bitcoin holders strengthen their beliefs and understand why Bitcoin is not a bubble but a monetary revolution.

This book has not only made discussions within the Bitcoin community more rigorous and profound but has also made people realize that Bitcoin's value far exceeds price fluctuations—it is a shield against inflation, a fortress against fiat currency overproduction, and the ultimate tool for achieving personal sovereign wealth.

Additionally, it has facilitated the creation of a large amount of Bitcoin educational content, with numerous discussions based on "The Bitcoin Standard" appearing on YouTube, podcasts, and social media, spreading Bitcoin's ideas more widely.

1.5 Triggering Subsequent In-Depth Research: Alex Gladstein's Other Works

After the tremendous success of "The Bitcoin Standard," Alex Gladstein continued to explore the economic logic of Bitcoin and published more related works, such as:

"The Fiat Standard" (2021) — systematically analyzing the flaws of the fiat currency system, revealing how it systematically deprives individual wealth, and comparing it to Bitcoin's superiority;

"Principles of Economics" (2022) — reconstructing the economics education system from the perspective of the Austrian School, challenging Keynesian economics.

These subsequent studies further solidified Gladstein's economic theories and established Bitcoin economics as an independent academic field, gaining increasing attention from scholars.

The immense impact of "The Bitcoin Standard" has also made it a book of significant importance in the history of Bitcoin.

2. How high is the historical status of "The Bitcoin Standard"?

The history of Bitcoin is not only a history of rising prices but also a history of consolidating consensus. In other words, without the cohesion of consensus, Bitcoin's price could not have risen so quickly. In this process, three books have played a decisive role, and "The Bitcoin Standard" is one of them. The other two are:

In 2011, "Digital Gold";

In 2015, "Mastering Bitcoin."

2.1 "Digital Gold": The Origin and Early Development of Bitcoin

Published in 2011, "Digital Gold" is the first book in Bitcoin's history to detail its early development, written by New York Times journalist Nathaniel Popper. The book narrates the journey of Bitcoin from Satoshi Nakamoto's white paper release to its gradual mainstream acceptance by 2014.

The core value of this book lies in its focus on people. It vividly depicts Bitcoin's earliest believers, including supporters of the cypherpunk movement, geek hackers, libertarians, Wall Street traders, and even early users of gray markets like Silk Road. The book details how Satoshi Nakamoto anonymously released the Bitcoin protocol and tells the stories of figures like Ross Ulbricht (founder of Silk Road), the Winklevoss twins (the first Bitcoin billionaires), and Charlie Shrem (founder of BitInstant), allowing readers to understand Bitcoin's rise from a human perspective.

2.2 "Mastering Bitcoin": Understanding the Technical Foundations of Bitcoin

In 2015, "Mastering Bitcoin" was written by Andreas Antonopoulos and is regarded as the "bible" of Bitcoin technology, helping countless developers and Bitcoin enthusiasts truly understand the underlying principles of this technology.

If "Digital Gold" tells the story and history of Bitcoin, then "Mastering Bitcoin" serves as a technical guide, with its greatest strength being its accessibility. It analyzes how Bitcoin works, including public key cryptography, blockchain data structures, transaction scripts, mining mechanisms, and how to build your own Bitcoin applications. The author uses clear language, code examples, and case studies to showcase the technical allure of Bitcoin.

The significance of this book lies in its portrayal of Bitcoin not just as a financial concept but as an open technical protocol that anyone can learn, develop, and improve. It can be said that "Mastering Bitcoin" has nurtured generations of developers within the Bitcoin ecosystem, making Bitcoin not just a speculative asset but a true decentralized financial network.

This book was also my introduction to blockchain; I started buying Bitcoin after reading it. If you are also in doubt, you might want to take a look at this book. I have previously written an article recommending it.

2.3 Why does "The Bitcoin Standard" hold a higher historical status?

If "Digital Gold" records the origin and initial consensus of Bitcoin, and "Mastering Bitcoin" lays the technical foundation of Bitcoin, then "The Bitcoin Standard" is the first work to truly place Bitcoin within an economic framework, viewing it as a form of sound money, rather than merely an innovative technology.

"The Bitcoin Standard" tells us that Bitcoin is not just an investment target; it is the "gold" of the digital age and the cornerstone of the future global monetary system. It not only explains why Bitcoin possesses monetary attributes but also argues why Bitcoin is more powerful than gold, why the central banking system is heading towards collapse, and why the world is transitioning to a Bitcoin standard.

These three books construct a knowledge system of Bitcoin from three different perspectives: history, technology, and economics, with "The Bitcoin Standard" undoubtedly being the most important ideological work in this financial revolution.

3. Why is "The Bitcoin Standard" so influential?

The influence of "The Bitcoin Standard" is not simply because it discusses Bitcoin's technical architecture, price trends, or investment strategies, but because Ammous employs a rigorous economic methodology, placing Bitcoin's rise within the evolutionary framework of monetary history. The most important value of this book lies not in providing short-term market predictions but in offering a foundational logic for understanding the evolution of money, allowing us to see the historical inevitability of Bitcoin becoming a global reserve asset through short-term price fluctuations.

Ammous's core methodology includes the following dimensions:

3.1 The "Evolutionary Theory" of Money: Interpreting Bitcoin's Rise through Historical Laws

Ammous does not discuss Bitcoin in isolation but reveals the historical logic of Bitcoin's rise by reviewing the evolution of money. He believes that money is not invented out of thin air by governments or individuals but is the result of natural selection in human society through long-term market interactions. This theory is based on the concept of "spontaneous order" in economics, meaning that the evolution of money is not a product of planned economies but rather a gradual evolution that emerges as markets optimize trading efficiency.

His argumentative method is similar to Darwin's theory of evolution:

The evolution of money is akin to biological evolution, where different forms of money (such as shells, salt, gold, and fiat currency) compete throughout history, with the most advantageous forms surviving;

The key factors influencing the competition among currencies are scarcity, verifiability, convenience, and stability;

Every major economic transformation in human society is accompanied by the rise of new forms of money, such as the agricultural revolution bringing about metal currency, the industrial revolution giving rise to fiat currency, and the information revolution currently fostering Bitcoin.

Within this framework, Bitcoin is not a speculative tool but the next stage in the evolution of money, just as gold replaced shells and the dollar replaced gold; it will ultimately replace the unstable fiat currency system.

3.2 The "Survival of the Fittest" in Money: Proving Bitcoin's Competitive Advantage through Economic Principles

Ammous does not simply state that "Bitcoin is better than fiat currency," but rather derives Bitcoin's competitive advantage based on the survival of the fittest principle in currency competition using economic principles. He employs several classic economic concepts, such as:

The "Sound Money" theory: Stable money must possess low inflation, high credibility, and long-term value storage capabilities, which Bitcoin has, while fiat currency does not;

The "Time Preference" theory: Bitcoin is a low time preference currency that encourages saving, while fiat currency stimulates consumption through inflation, undermining people's long-term economic planning;

The "Network Effect": The value of money derives from the scale of its users, and Bitcoin is entering an accelerated phase of network effects, becoming a global store of value.

His argumentation is akin to natural selection: money survives not through government coercion but through market choice. Fiat currency suffers from a crisis of trust due to overproduction, while gold suffers from insufficient liquidity due to its physical properties, and Bitcoin precisely compensates for the shortcomings of both, making it the inevitable future dominant currency.

3.3 The "Mathematization" of Money: Quantifying Bitcoin's Economic Value through Data Models

Ammous's discourse is not solely based on theoretical derivation; he extensively employs mathematical models and data analysis in the book to quantify Bitcoin's economic attributes. His research method is similar to that of financial analysts studying traditional assets, using data to validate hypotheses rather than making unfounded speculations.

The core tools he uses include:

Stock-to-Flow (S2F) model: A mathematical model explaining why Bitcoin is scarcer than gold and predicting its long-term value growth trend;

Comparison of the Federal Reserve's money supply growth rate vs. Bitcoin's supply growth rate: Using data to demonstrate how Bitcoin's fixed supply resists inflation, while the unlimited printing of fiat currency erodes purchasing power;

Historical Bitcoin prices vs. major economic events: Using data to compare Bitcoin's performance during the 2008 financial crisis and the massive money printing during the 2020 pandemic, illustrating how it has become a global safe-haven asset.

The significance of this methodology lies in that it establishes Bitcoin's value not on faith but on quantifiable, verifiable economic models, making Bitcoin a "mathematically supported monetary experiment" rather than a speculative concept.

3.4 The "Political Economy" of Money: How Does Bitcoin Affect the Global Financial Landscape?

In addition to economic analysis, Ammous also explores how Bitcoin influences the global financial landscape from a political economy perspective. His argumentative style is similar to that of the realist school of international relations, namely:

Money is a manifestation of power; the fiat currency system is a means for governments to control the economy, while Bitcoin undermines the government's monopoly on currency;

The core of dollar hegemony lies in the dollar standard, and Bitcoin is challenging this system; El Salvador's adoption of Bitcoin as legal tender is an important step towards global de-dollarization;

Bitcoin promotes economic freedom because it allows individuals to bypass government capital controls and directly hold and transfer wealth without the constraints of the banking system.

This analytical approach positions Bitcoin not merely as a technological or investment phenomenon but as a catalyst for the transformation of the global financial order.

3.5 The "Psychology" of Money: Interpreting Bitcoin's Long-Term Value through Human Nature

Ammous does not only discuss Bitcoin's technical and economic attributes; he also explores how human psychology influences the choice of monetary systems. He uses behavioral economics to explain why Bitcoin is undervalued in the short term but possesses high market appeal in the long term:

Loss Aversion: The pain of losing wealth is far greater than the pleasure of gaining wealth, and Bitcoin provides a way to avoid the risk of fiat currency depreciation;

Herding Effect: As institutions begin to enter the Bitcoin market (such as Strategy, Tesla, and Bitcoin ETFs), more individuals and businesses will follow suit;

Incremental Consensus: The adoption of Bitcoin is a continuously strengthening process; as more countries, institutions, and individuals use it, its value will continue to rise.

Through these psychological models, he explains why Bitcoin may experience severe fluctuations in the short term, but in the long run, its value trend is irreversible.

Summary: Ammous's Methodology

Ammous does not simply tell you that "Bitcoin will rise"; he employs a comprehensive analytical framework of history, economics, data models, political economy, and psychology to construct a complete understanding system of Bitcoin.

This makes "The Bitcoin Standard" not just a book about Bitcoin but a work on the essence of money, the global financial order, and the laws of human economic evolution.

If you finish reading this book, you will not only remember Bitcoin's price but will gain a deeper understanding of the essence of money, the operational logic of economic systems, and how Bitcoin is changing the world. This is the true uniqueness of this book.

4. What kind of person is Ammous?

Saifedean Ammous was born in 1980 in Nablus, Palestine, and spent his childhood in Saudi Arabia and Brazil before moving to Ramallah in the West Bank in 1990. Growing up in such a turbulent region, he witnessed early on the impact of currency devaluation, political conflict, and capital controls on the lives of ordinary people.

However, Ammous's academic starting point had nothing to do with economics. He initially studied mechanical engineering at the American University of Beirut and later shifted to social sciences, pursuing a master's degree in development management at the London School of Economics (LSE). Subsequently, he obtained a Ph.D. in sustainable development from Columbia University, focusing on energy economics, resource management, and the stability of monetary systems.

This academic background laid the foundation for his interdisciplinary analytical ability, allowing him to study money not only through traditional economic theories but also by integrating the rigor of engineering, the mathematical modeling of energy economics, and the profound insights of development economics into the real world.

After earning his doctorate, Ammous joined the Lebanese American University as an assistant professor of economics, teaching courses on capital markets, development economics, and energy economics. His research initially focused on resource economics, particularly oil, energy supply chains, and global economic growth patterns.

However, over time, he began to question the sustainability of the central banking system and fiat money. He gradually discovered in his teaching and research that:

The inflation mechanism of the fiat currency system continuously redistributes wealth to governments and financial institutions that hold the "money printing rights";

The monetary policy of central banks is unpredictable; governments can print money at will, while ordinary people can only passively bear the consequences of asset depreciation;

While gold possesses scarcity, it is still subject to government regulation and market manipulation in the modern economic system, preventing it from truly becoming hard currency in a free market.

During this process, he encountered Austrian economics, particularly the theories of Ludwig von Mises and Friedrich Hayek, and began to focus on the concept of sound money.

What truly changed his understanding was his in-depth study of Bitcoin's economic logic around 2013. He discovered that:

Bitcoin is the first completely decentralized, immutable currency in human history, guaranteed by mathematics to be scarce;

Bitcoin's issuance mechanism (block reward halving) gives it superior inflation control compared to gold;

Bitcoin does not rely on governments or central banks; its value is entirely determined by market consensus.

This prompted him to gradually abandon the mainstream Keynesian economic framework, turning to the Austrian school and becoming one of the most ardent advocates of Bitcoin's ideology.

Conclusion: Bitcoin Standard, a New Consensus of Global Capital

From El Salvador incorporating Bitcoin into national policy to Strategy (formerly MicroStrategy) practicing the "Bitcoin Standard" with billions of dollars in holdings, these events are not coincidental but early signals of a transformation in the global monetary system.

The Bitcoin standard is not a short-term strategy but a long-term paradigm.

In the past, gold was the world's reserve currency, but it could not adapt to the global liquidity demands of the digital age; fiat currency was once the cornerstone of the credit system, but it has gradually lost credibility in the face of an unlimited expansion of the money printing mechanism. Bitcoin, with its fixed supply, anti-inflation, and decentralized characteristics, has become the strongest candidate for "sound money" in this era.

Where national policy and capital resonate often gives birth to historic turning points.

When a sovereign nation adopts Bitcoin as legal tender, it is resisting global monetary hegemony; when a publicly traded company makes Bitcoin the core of its balance sheet, it is combating liquidity dilution. When capital and sovereignty simultaneously point to Bitcoin, we are witnessing the formation of a new monetary consensus.

The return of "sound money" is not an overnight phenomenon but a generational shift. The winners of this transformation will not be short-term speculators but those who can truly understand the logic of the Bitcoin standard and are willing to hold on for the long term. Mastering the underlying logic of the Bitcoin standard is akin to holding the ticket to the future monetary system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。