Article Author: Duo Nine YCC

Article Compilation: Block unicorn

Has the four-year cycle come to an end?

In this article, I will answer this question, explain why the past two years have changed everything, and then offer a very important suggestion. Let's get started.

What is the four-year cycle?

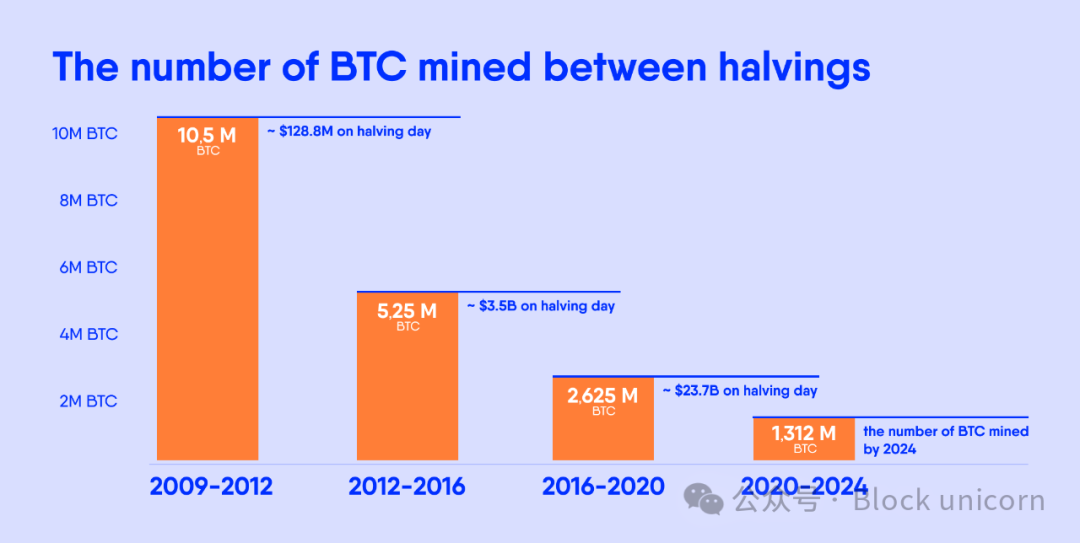

The four-year cycle originates from the fundamental principles of Bitcoin. Every four years, the inflation rate of Bitcoin is halved. The first halving event in 2012 reduced the issuance of new Bitcoins by 50%, from 50 BTC per block to 25 BTC.

This had a huge impact on the supply-demand balance of Bitcoin, especially during the first two halving events in 2012 and 2016. At that time, Bitcoin prices soared as supply could not keep up with demand. Other cryptocurrencies (altcoins) also rose accordingly.

However, the impact of each new halving event on prices has been diminishing. The most recent halving in 2024 only reduced the issuance of new Bitcoins from 6.25 BTC to 3.12 BTC.

Considering that nearly 95% of Bitcoins are already in circulation (nearly 20 million out of 21 million BTC), the impact of future halving events on prices is rapidly becoming negligible.

Methods that were effective a few years ago are no longer applicable today. You can’t “print free money” by buying any cryptocurrency as you did in the past. Now, we have new factors that fundamentally affect the crypto cycle more than Bitcoin's halving schedule.

It's time to elevate your thinking! More details will follow.

Why have the past two years changed everything?

Two things that have changed the cryptocurrency space over the past two years are:

- The launch of cryptocurrency ETFs (Exchange-Traded Funds)

- Altcoin inflation

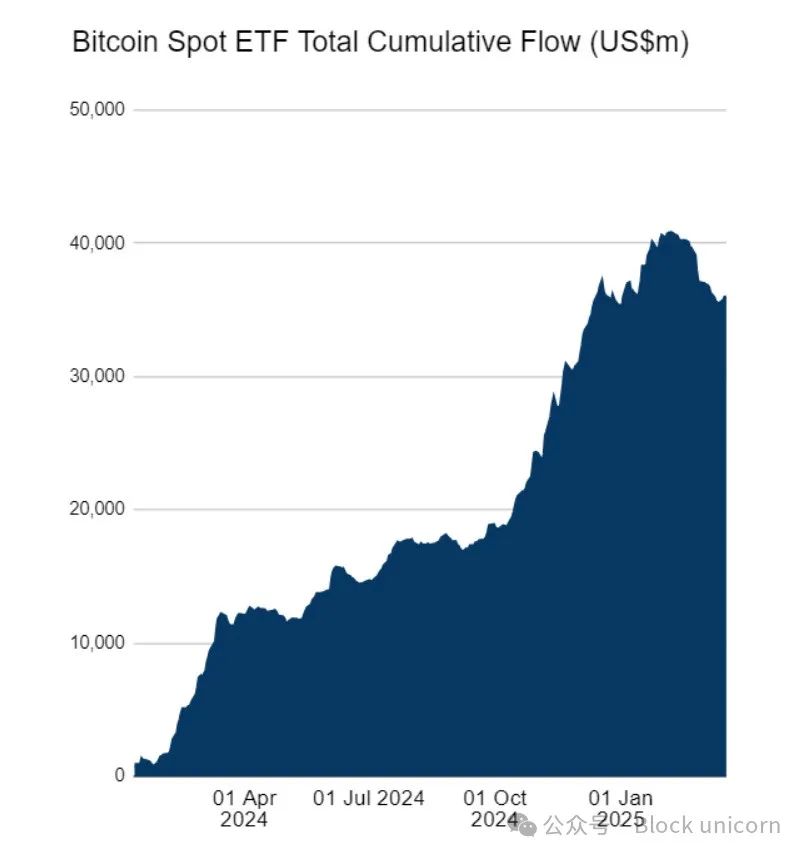

At the beginning of 2024, Bitcoin was approved for its first ETF. This suddenly opened up the global market for Bitcoin. Now, anyone can add Bitcoin to their retirement portfolio, which was impossible in the past.

This represents a massive influx of new funds into Bitcoin that did not exist before. But there is a problem.

As funds flowed into Bitcoin ETFs, this created buying pressure on the spot price of Bitcoin. However, this liquidity never really flowed from Bitcoin ETFs to altcoins, as there are no altcoin ETFs except for Ethereum. The demand for an Ethereum ETF has been disappointing to date, totaling only $2.5 billion.

By early 2025, almost all ETF liquidity flowed into Bitcoin, totaling $40 billion, as shown in the chart. It’s no wonder that Ethereum has been declining against Bitcoin for years. The same goes for most altcoins.

This is why everyone has been waiting for a “real” altcoin season over the past two years, a season that may never actually arrive. The altcoin rebound in November 2024 seems pale compared to previous cycles.

While SOL, XRP, BNB, and TRX reached new all-time highs, these prices are not far from past highs, and most altcoins, like Ethereum or ADA, failed to reach new all-time highs. This clearly indicates that altcoins are lagging behind Bitcoin.

What is the reason?

Dilution of altcoins.

Compared to previous cycles, there are simply too many altcoins today (millions). I explored this issue in detail in a previous article. In short, the altcoin season has been hijacked by Solana and its meme coins. This has essentially drained all liquidity from altcoins.

Soon after, when Solana was at its peak, Trump entered the stage in January 2025, breaking up the party. This also ended the meme coin season, with most meme coins plummeting by 80% to 90% since then.

The funds or liquidity in cryptocurrency are limited and are now divided among millions of altcoins. Moreover, Bitcoin is capturing an increasingly larger share. Just look at BTC's market dominance, which is at its highest since 2021, exceeding 60%!

Altcoins are in a tough spot. They only account for 40% of the market, and with millions of coins, there is little funding left for an altcoin season. If you plan to play the altcoin game, you really need to choose wisely.

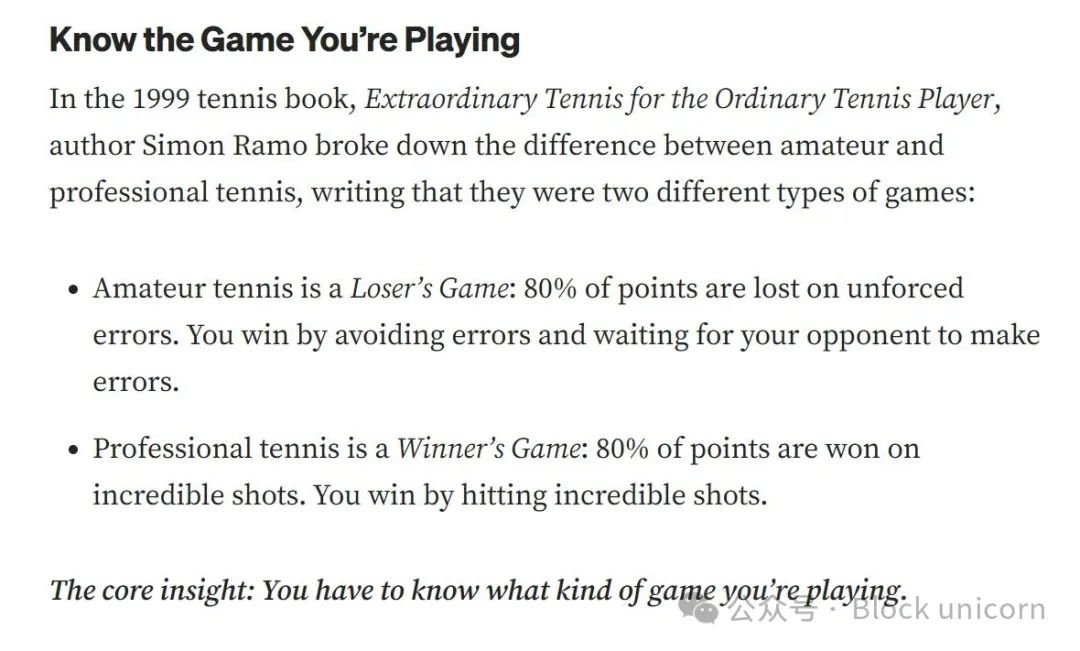

This brings to mind an interesting analogy. In tennis, there are two types of matches that players participate in:

- Playing the loser’s game (altcoins)

- Playing the winner’s game (Bitcoin)

In the first case, the tennis player must minimize errors because as long as they do this, they can beat most opponents who make more mistakes. This is a loser’s game because winning is simply about losing less than most.

In the second case, the tennis player is among the elite. Their game is no longer about minimizing errors but about technique and being a winner. This is the winner’s game played by winners (top players).

In cryptocurrency, if you play the altcoin game, you are playing a loser’s game; to win, you need to pick altcoins that lose less than others. However, you can completely ignore this and choose to play the winner’s game by buying Bitcoin!

It’s time to look at Bitcoin and why, regardless of the claims about the four-year cycle, it will continue to win, and this claim has become irrelevant based on the past two years.

Why is Bitcoin still king?

I promised you a piece of advice at the beginning of the article.

The goal is to play the winner’s game, focusing on Bitcoin. This is your way to win in the long term. Limit your exposure to the loser’s game (altcoins) to a manageable level. Otherwise, things could quickly turn bad.

With this premise, here are ten reasons why betting on Bitcoin makes you a winner:

- Dilution of fiat currency (USD) - Central banks cannot stop printing fiat currency. Look at gold; it keeps hitting new highs. Bitcoin will do the same in 2024, and that $100,000 resistance will eventually be broken. Be patient.

- Inflation - It’s easy to print new dollars out of thin air, but you can’t print Bitcoin out of thin air. This makes Bitcoin the hardest currency on Earth. That’s where you store your wealth.

- Quantitative tightening is coming to an end - This means quantitative easing is on the horizon, which will make dilution and inflation of fiat currency inevitable.

- Global money supply at an all-time high - It’s not just the U.S. diluting its citizens' wealth; every country is doing this, just at different speeds. Look at the price of Bitcoin in Turkish lira.

- Gold - Since the end of 2023, its record price trend seems endless. What’s better than gold? Bitcoin. Why do people buy gold? Because of points 1 to 4. It’s just a matter of time before people accept Bitcoin.

- Cryptocurrency ETFs - Calling them cryptocurrency ETFs is somewhat misleading because 95% of the funds flow into Bitcoin ETFs. This ratio is even more skewed towards BTC than Bitcoin's 60% market dominance.

- Dilution of altcoins - You cannot dilute Bitcoin. You cannot copy and paste it because you cannot replicate its multi-billion dollar security and mining equipment.

- Countries are buying Bitcoin - Look at El Salvador. More and more countries are adding Bitcoin to their sovereign wealth funds.

- U.S. cryptocurrency strategic reserves - This basically means what it means. No need to elaborate.

- You have no better choice - The only reliable currencies today are Bitcoin and gold, with the former having a clear advantage.

While Bitcoin's four-year cycle will continue to exist, its impact on prices is at best negligible. In this sense, the claim is no longer valid. However, the reasons to continue buying Bitcoin are stronger than ever.

I cannot say the same for altcoins.

The game is becoming increasingly difficult, and over time, picking winners has turned into a loser’s game. This is the complete opposite of betting on Bitcoin, which is more like betting on the Turkish lira to protect your wealth. We also know how that ends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。