Despite attempts to rally, bitcoin continues to exhibit signs of bearish momentum across multiple timeframes. On the daily chart, the digital asset remains in a downtrend that began after peaking at $99,508. It recently touched a bottom at $76,600 and has since rebounded, although with declining volume—an indication of weakening buyer interest. Resistance levels remain firm between $86,000 and $87,000, while support is anchored at $76,600. A sustained hold above $82,000 may invite bullish interest, yet failure to break above resistance could trigger renewed selling pressure.

BTC/USD 1D chart via Bitstamp on March 21, 2025.

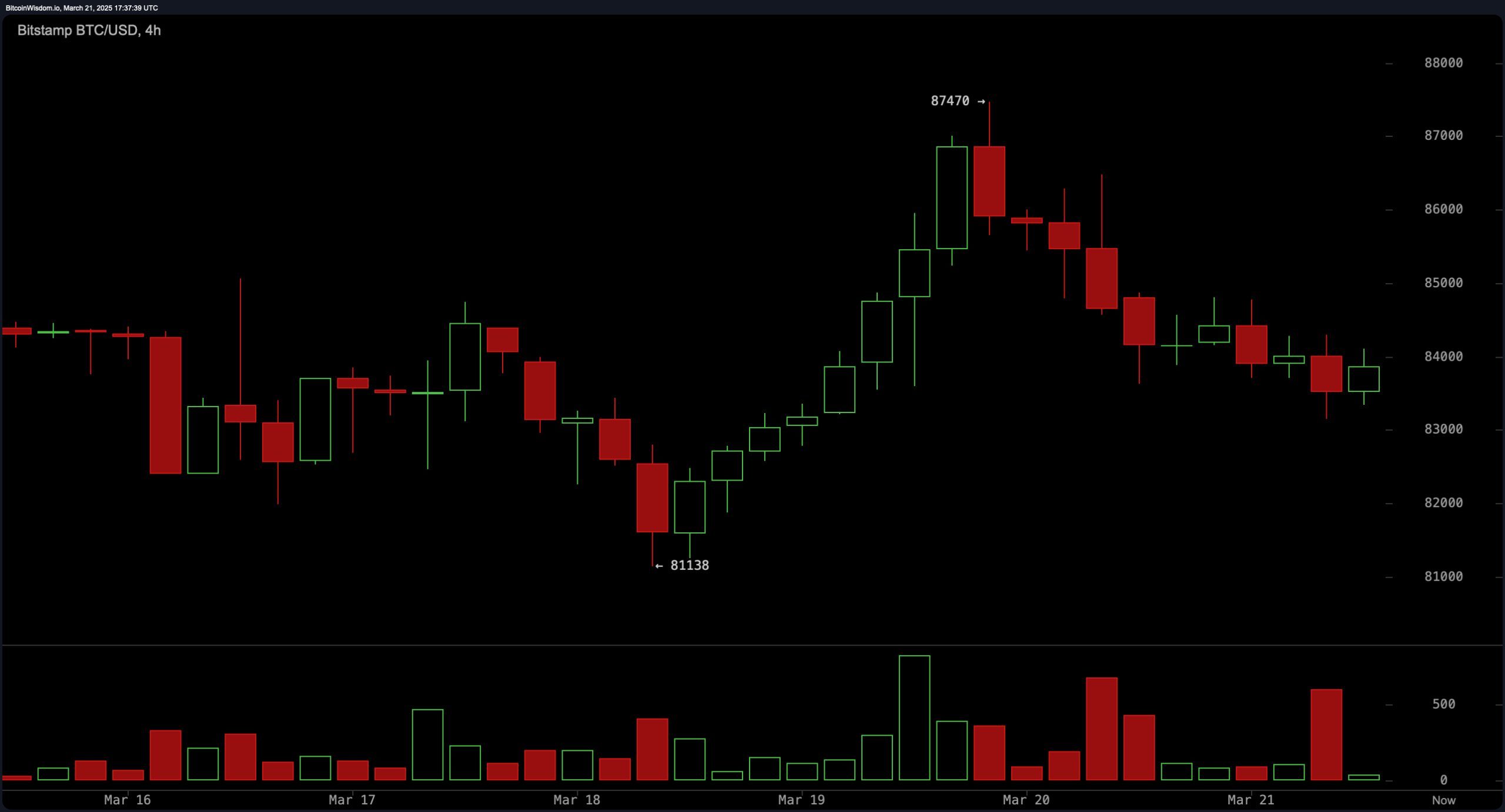

The 4-hour chart reveals a recent rally that topped at $87,470, followed by a pullback toward the $83,000 level. This timeframe is defined by lower highs and lower lows, suggesting a developing bearish structure. The recent wave of selling was backed by significant volume, signaling strong bearish conviction. Traders are closely watching the $85,000 mark as a potential pivot—an upside breakout could signal short-term bullish strength, whereas a drop below $82,000 may confirm a bearish continuation pattern.

BTC/USD 4H chart via Bitstamp on March 21, 2025.

On the 1-hour chart, bitcoin has entered a consolidation phase, trading in a narrow range between $83,000 and $84,500. Key support lies at $83,142, with resistance defined at $86,479. The choppy price action favors intraday strategies such as scalping; buyers may consider positions near $83,200 with tight stop losses below $82,800. A breakdown under $83,000 could expose the asset to near-term downside risk, targeting $81,500.

BTC/USD 1H chart via Bitstamp on March 21, 2025.

The technical indicators provide a mixed outlook. Among the oscillators, the relative strength index (RSI) at 45, Stochastic at 60, commodity channel index (CCI) at −27, average directional index (ADX) at 34, and awesome oscillator at −3,828 all signal a neutral bias. However, the momentum (10) indicator is issuing a bearish signal, suggesting weakness in bullish momentum. Interestingly, the moving average convergence divergence (MACD) level (12, 26) signals bullishness, reflecting conflicting short-term momentum dynamics.

Moving averages point firmly bearish across all timeframes. The exponential moving averages (EMAs) for 10, 20, 30, 50, 100, and 200 periods are all positioned above the current price and are issuing sell signals. Likewise, the simple moving averages (SMAs) for 20 through 200 periods confirm the same directional pressure, with the exception of the simple moving average (10) which shows a marginal buy. This broad bearish alignment underscores the weight of resistance bitcoin faces as it struggles to sustain upside moves.

Overall, bitcoin remains at a critical juncture. Bulls must reclaim and hold above the $86,000 level to invalidate the current bearish setup, while a failure to maintain $82,000 could catalyze a deeper correction toward $80,000 or below. Traders are advised to await clear price action confirmations before positioning for either breakout or breakdown scenarios.

Bull Verdict:

If bitcoin maintains support above $82,000 and manages a breakout beyond the $86,000 resistance with strong volume, the path toward $90,000 becomes technically feasible. The MACD (moving average convergence divergence) signaling a buy supports the possibility of a bullish resurgence if momentum follows through.

Bear Verdict:

A decisive break below $82,000, particularly on rising volume, would reinforce the prevailing downtrend across multiple timeframes. The consistent sell signals from both short- and long-term moving averages suggest sustained bearish pressure that could drive bitcoin toward the $80,000 level or lower in the coming sessions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。