After the launch of Pump.fun, the market experienced several waves in the meme sector, lasting from April 2024 to early January 2025.

However, after the significant price drop of $TRUMP, investors began to question whether utility tokens are worth investing in for the future.

Utility tokens are typically used as fees. This is common in the business models of many protocols and blockchains. Additionally, these protocols may also buy back or burn tokens, which can reflect the fundamentals.

Will the market shift bring higher returns for utility tokens?

1/ CEX Tokens Are More Stable

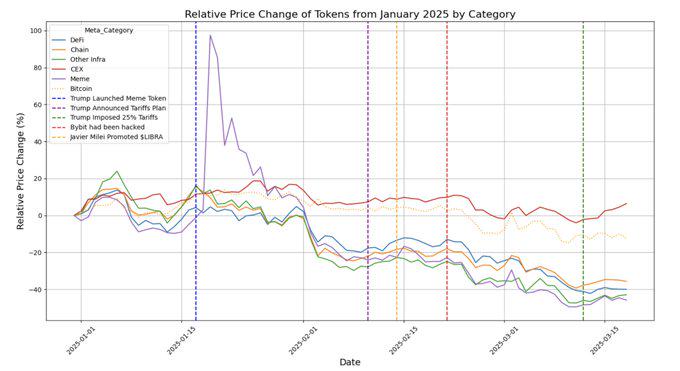

After the launch of Trump's meme token, the meme sector surged rapidly but cooled down within a month, with returns reversing by February 1.

During the subsequent decline, the prices of meme tokens continued to fall. Other sectors, including chains, DeFi, and infrastructure tokens, also experienced similar trends.

However, during this period, BTC and CEX tokens remained stable, with CEX tokens even seeing price increases.

2/ CEX Analysis

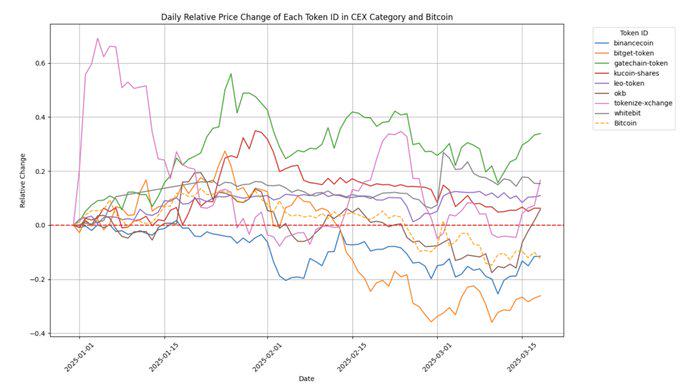

A closer look: Among the 8 CEX tokens this year, 7 outperformed BTC, with 6 achieving positive price returns.

Tokenize Xchange showed significant increases in the early stages, while Gate.io's token achieved the highest annual growth.

So, why are CEX tokens more stable?

3/ CEX Token Revenue

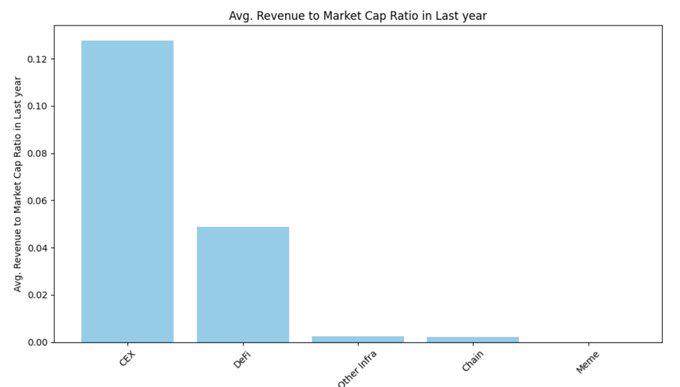

One possible reason is that CEX tokens have higher revenues (revenue refers to the amount used for token burns or buybacks).

Over the past year, the average revenue-to-market cap ratio for CEX tokens was 0.12, more than double that of DeFi.

4/ CEX Token Revenue and Returns

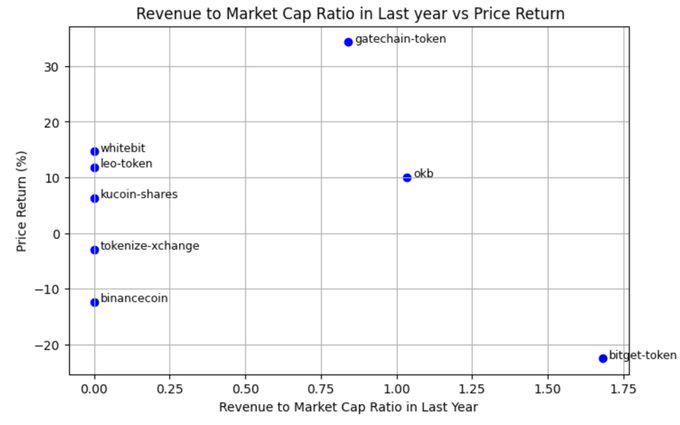

As mentioned earlier, among these CEX tokens, gatechain-token showed the most stable performance, reflecting significant price returns related to its revenue-to-market cap ratio from January 1, 2025, to March 18. However, this does not mean that every token will follow the same trend. For example, Bitget's token is located in the lower right corner because it had high returns in 2024, but this return could not be sustained into 2025. Note: whitebit, leo-token, kucoin-shares, and tokenize-xchange did not record any announcements of token burns or buybacks last year.

5/ Conclusion

During market downturns, prices in the CEX sector may remain robust due to expectations of revenue. However, when examining individual exchanges, many other factors are still driving changes in token prices.

6/ Methodology

57 tokens were selected from the top 100 projects by market cap, including: > Tokens confirmed to have revenue or fee data > Tokens confirmed to have no revenue (e.g., meme tokens) Excluded: > Wrapped tokens > Bridged tokens > BTC > BTC hard forks

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。