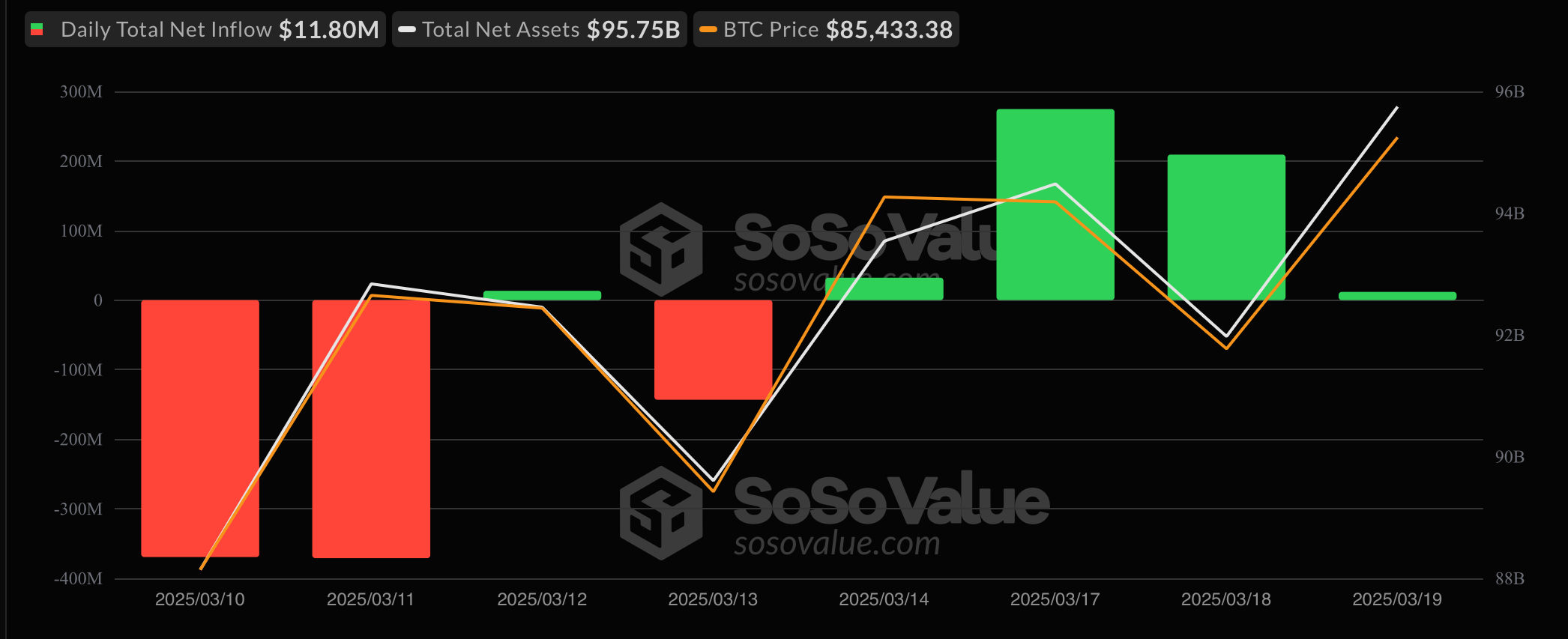

Midweek trading action continued to produce mixed results for bitcoin and ether ETFs. Wednesday, Mar. 19 marked the fourth consecutive day of net inflows for bitcoin ETFs, with a total of $11.80 million added to these funds.

Bitwise’s BITB led the charge, attracting $12.09 million. Grayscale’s GBTC and BTC funds also saw positive movements, with inflows of $5.41 million and $4.54 million, respectively. However, Invesco’s BTCO experienced an outflow of $10.24 million, slightly offsetting the day’s gains. The remaining eight ETFs remained stable, with no significant inflows or outflows reported.

Ether ETFs continued their downward trend, marking the 11th consecutive day of net outflows, totaling $11.75 million. Blackrock’s ETHA was the most affected, with a $12.94 million exit. Grayscale’s ETH and Fidelity’s FETH also faced outflows of $7.65 million and $2.03 million, respectively.

On a brighter note, Grayscale’s ETHE and 21shares’ CETH recorded inflows of $10.16 million and $711.86k, respectively, providing a slight cushion against the day’s overall outflows.

At the end of the trading day, bitcoin ETFs closed with $95.75 billion in total net assets while ether ETFs closed with $7.01 billion in total net assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。