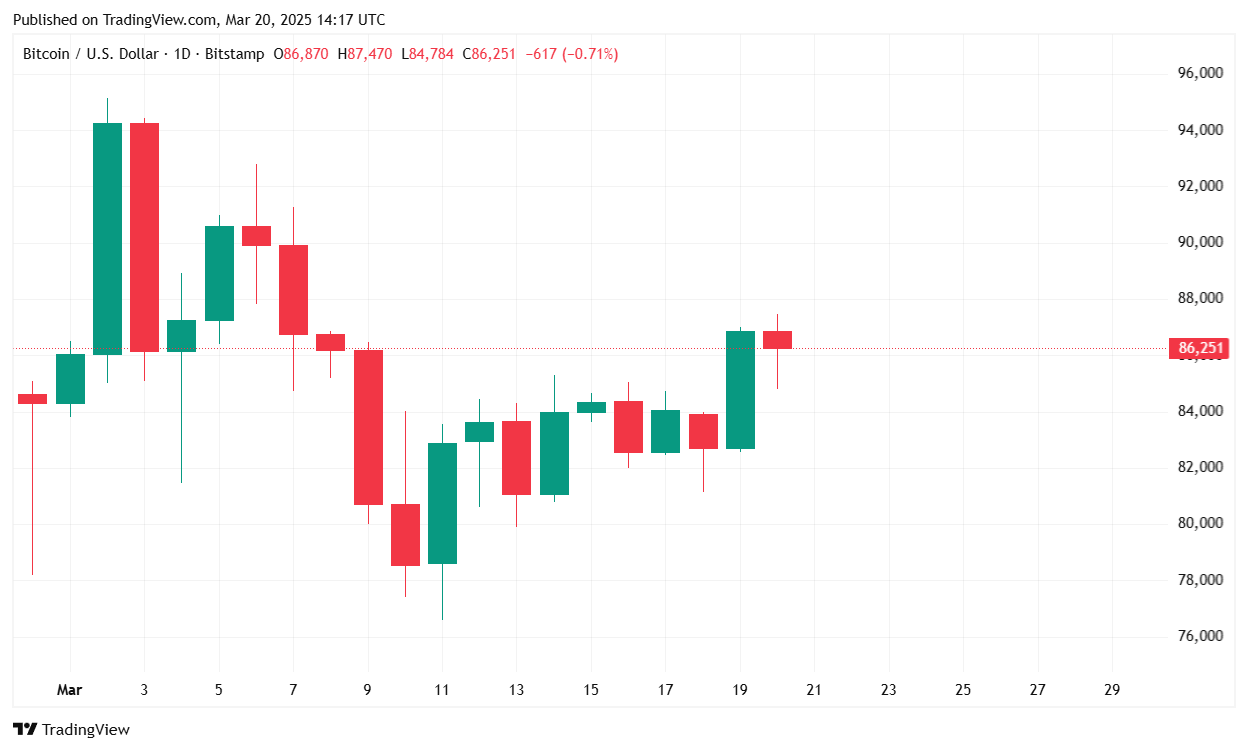

Bitcoin has extended its bullish momentum, reaching a high of $87,443 in the past 24 hours before settling at $86,053.70 at the time of reporting. The leading cryptocurrency is up 1.92% over the past day and has gained 4.92% over the last week as the Fed expressed concerns over inflation and announced plans for less aggressive quantitative tightening.

( BTC price / Trading View)

Trading volume has surged by 44.02% to $35.68 billion in the past 24 hours, reflecting heightened investor activity following the conclusion of the U.S. Federal Reserve’s latest policy meeting. Bitcoin’s market capitalization has risen by 1.81% to $1.7 trillion, reinforcing its dominance in the crypto market.

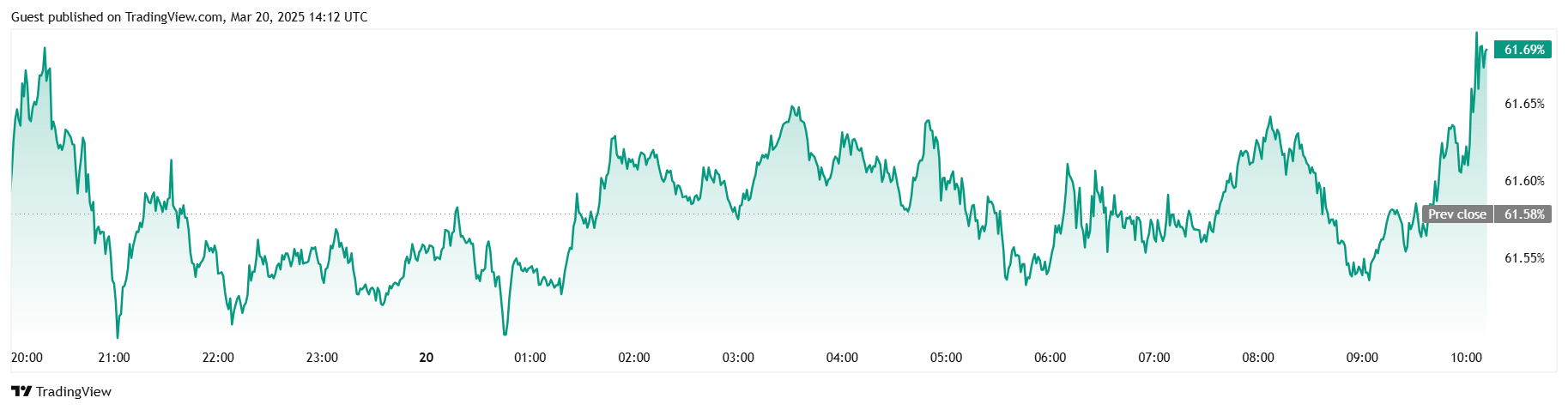

Bitcoin dominance stands at 61.68%, marking a slight increase of 0.16% over the last 24 hours. Futures market data from Coinglass reveals that total open interest in bitcoin futures has increased by 2.27% to $51.03 billion.

( BTC dominance / Trading View)

Significant liquidations have taken place over the past 24 hours, totaling $136.25 million. Notably, short positions bore the brunt of the losses, with $97.72 million in short liquidations compared to $38.53 million in long liquidations. This indicates that bearish traders misjudged the market direction.

The Federal Open Market Committee (FOMC) meeting concluded with the Fed maintaining its key interest rate within the 4.25%-4.5% range. The central bank cited stable unemployment and solid economic growth but acknowledged persistent inflationary pressures.

Revised projections from the Fed suggest a slowdown in economic growth to 1.7% for 2025, down from the previous estimate of 2.1%, while inflation expectations have been raised to 2.7% from 2.5%.

A notable shift in policy includes the Fed’s decision to slow the pace of balance sheet reduction beginning in April. The monthly redemption cap on Treasury securities will be lowered from $25 billion to $5 billion, signaling a shift toward a less aggressive form of quantitative tightening (QT). While this does not constitute a return to quantitative easing (QE), it suggests a more accommodative stance that could provide liquidity support to financial markets, including bitcoin.

Bitcoin’s recent uptrend has been fueled by increasing investor confidence and a less restrictive monetary policy stance from the Fed. The surge in trading volume indicates strong market participation, while short-sellers facing liquidations suggest continued upward pressure on prices.

With the Fed slowing its balance sheet reduction and inflation expectations rising, bitcoin may continue to act as a hedge against economic uncertainty. If buying momentum sustains, BTC could challenge new resistance levels above $88,000. However, investors should remain cautious of potential macroeconomic headwinds that could introduce volatility in the coming weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。