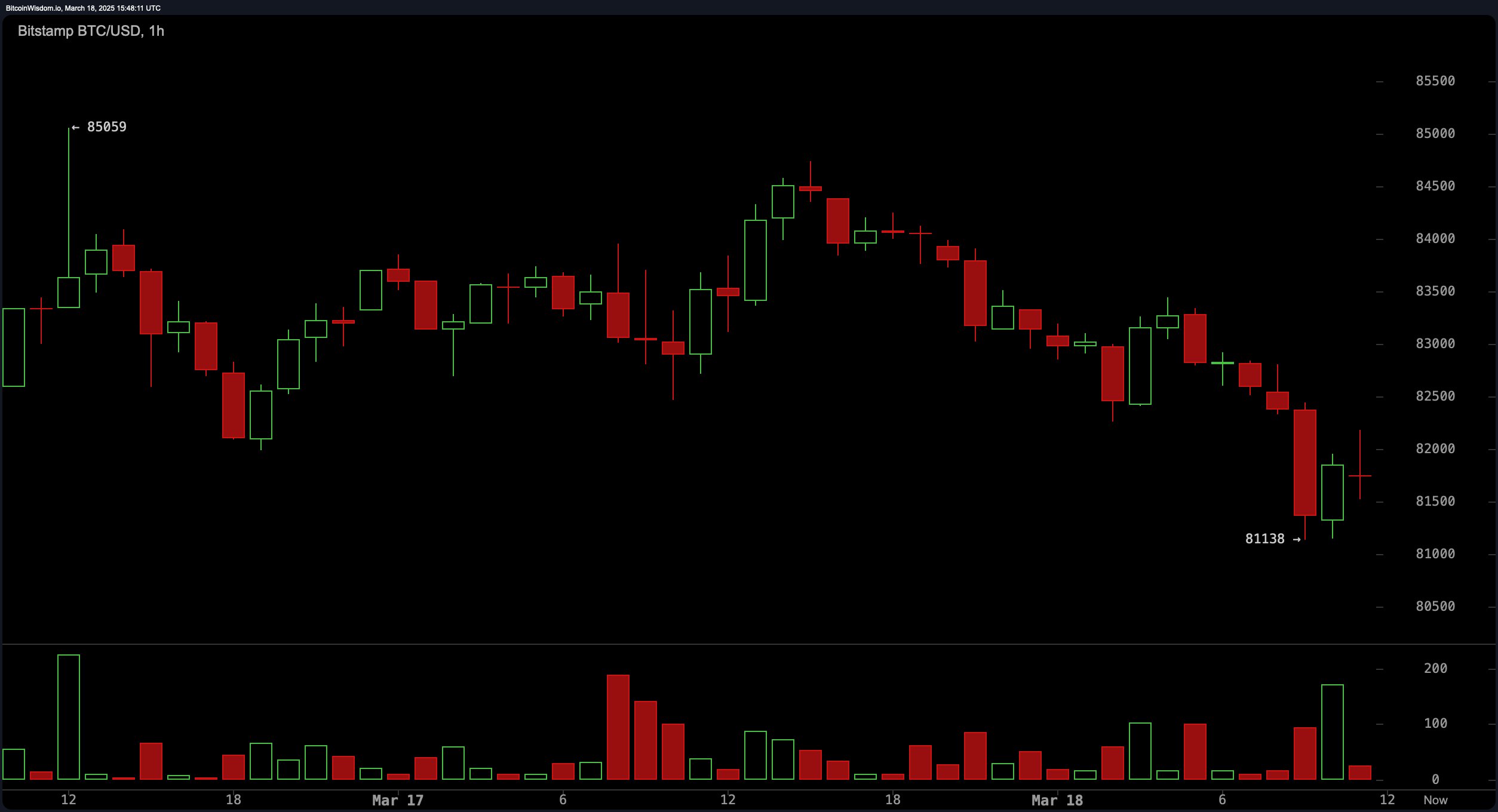

A crimson tide engulfed digital asset markets as every top-ten cryptocurrency faced downward pressure. Bitcoin ( BTC) retreated 1.84% by midday, brushing against $81,138 at 11 a.m. ET on March 18. DOGE and ADA led declines among major tokens, shedding 4.42% and 4.16%, respectively, while XRP fell 3.7% and solana ( SOL) slipped 3.5%.

March 18, 2025

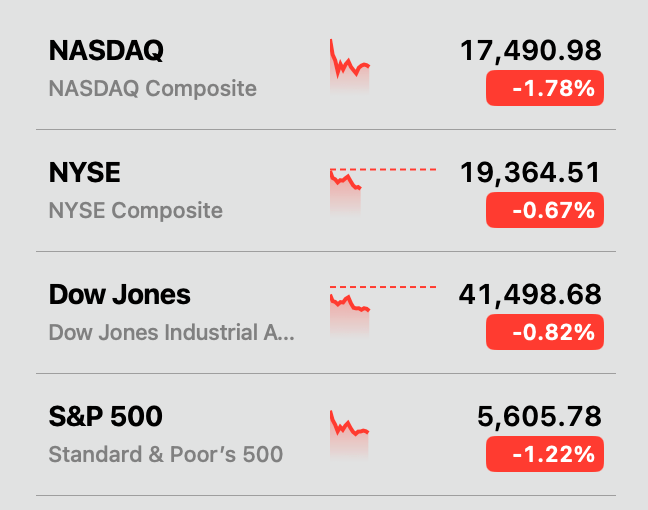

U.S. equities—including the Nasdaq, NYSE, Dow Jones, and S&P 500—similarly faltered. Investors grappled with multiple headwinds: anxiety over potential economic contraction, renewed geopolitical trade tensions, and anticipation of the Federal Reserve’s policy verdict due March 19 at 2 p.m. ET, concluding its two-day convening.

March 18, 2025

BTC’s midday rebound saw it oscillate near $82,000 by 11:45 a.m. ET, following reports of a Hyperliquid whale’s speculative maneuvers. Despite initial losses from a 40x leveraged short position highlighted by Bitcoin.com News, the entity ultimately netted over $9 million. By Tuesday, the same trader held a 5x leveraged long on MELANIA, a meme-inspired token.

Volatility erased $224.5 million from derivatives positions before noon, with $145.86 million stemming from bullish bets. BTC longs accounted for $45.83 million of losses, while ethereum ( ETH) derivatives traders saw $24.96 million vanish. Some 111,642 traders faced liquidations, topped by a $2.18 million BTC futures position on Binance. By 12 p.m., BTC has been struggling below the $82,000 zone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。