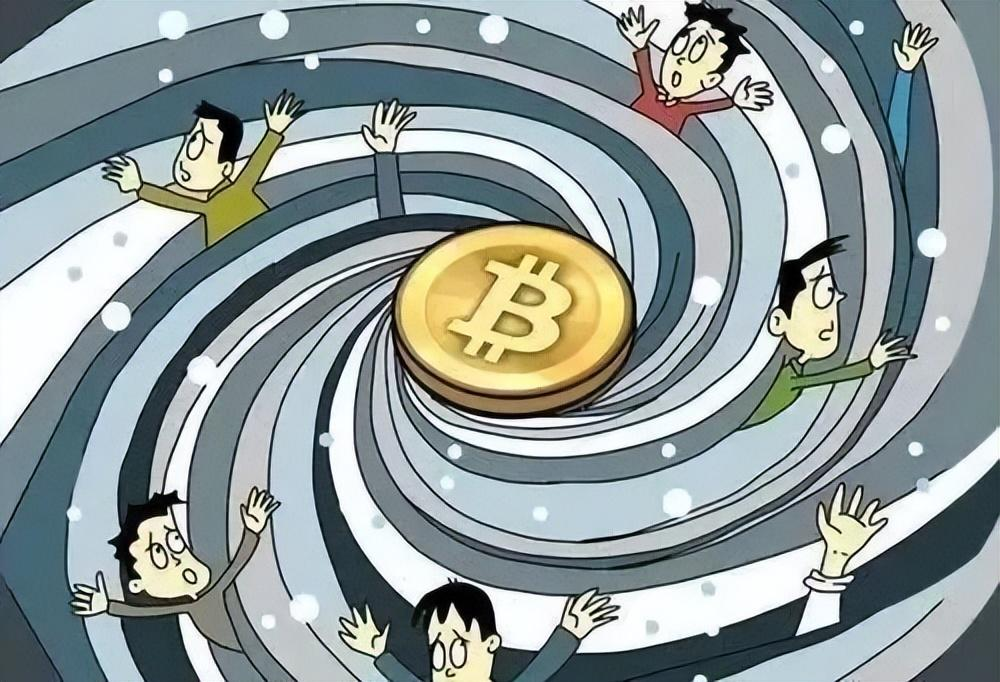

In the current cryptocurrency space, three significant phenomena are evident: celebrity endorsements, rampant scams, and pervasive bubbles. Recently, it's common to hear friends around me lament, "I've been scammed again!" The cryptocurrency market today resembles a wildly operating roller coaster; one moment you feel like you're enjoying a gentle breeze at the peak, and the next, without warning, you plunge into the depths. So, why has it become increasingly difficult to establish oneself in the cryptocurrency space? The root cause largely lies in the fact that celebrity endorsements have devolved into "scam tools," market manipulators have turned into "script killers," and concept hype has spawned a plethora of "air coins."

Strange Phenomena in the Cryptocurrency Space: "Riding the Hype, Issuing New Coins" Becomes Trendy

In the cryptocurrency space, there exists a rather bizarre phenomenon: "whoever is popular gets hyped, whoever is famous issues coins." For instance, when Trump issues a coin, or Musk merely changes his Twitter avatar, or the President of Argentina casually mentions "Libra," these seemingly ordinary actions can instantly send the cryptocurrency market into a frenzy, like a lit powder keg. Take the "WLF Coin" launched by the Trump family as an example; it received frenzied market attention upon its launch, with numerous investors rushing in, believing they could make a fortune. However, the good times didn't last long; as time passed, the hype quickly dissipated, and the coin's price was halved, resulting in significant losses for many followers. So, why are celebrity coins so deceptive, harming countless investors? The essence lies in the fact that short-term hype does not equate to long-term value. The act of celebrity endorsement is akin to the currently popular "influencer marketing" model, which can attract a large amount of traffic in a short time. However, the problem is that many related projects may not even have a complete PPT prepared in terms of technology and practical application. This means that when investors are drawn in by the celebrity's hype, their understanding of the project itself is minimal; they are merely deceived by the celebrity effect and ultimately become victims of scams.

Celebrity Endorsements Have Become "Scams"

Celebrity endorsements in the cryptocurrency space have gradually taken a turn for the worse, becoming a ruthless "scam tool." Essentially, those virtual currencies relying on celebrity endorsements mostly just leverage the immense popularity accumulated by the celebrity in the short term to attract investors' attention. Once the celebrity's hype fades, these virtual currencies become like castles in the air without support, and their prices often plummet. Taking "WLF Coin" as an example, it attracted a lot of investor attention and funding at its launch due to the Trump family's fame. Many investors were dazzled by the Trump family's aura and rushed to buy in, causing the coin's price to soar rapidly in the short term. However, as time passed, the hype surrounding the Trump family-related events gradually diminished, and market interest in "WLF Coin" significantly declined. At this point, due to the coin's lack of genuine technological strength and practical application scenarios, its price inevitably faced a halving situation. Many investors bought in at high prices, only to watch their assets shrink dramatically, with no recourse.

Moreover, celebrity endorsements function similarly to "influencer marketing," primarily serving to attract traffic. In the actual operation of the cryptocurrency space, we can see many projects attracting a large number of investors' attention through celebrity endorsements, yet they have serious deficiencies in technology and application. Many projects haven't even prepared a detailed, complete business plan (PPT), let alone possess a mature technological system and feasible application solutions. In this situation, investors often blindly follow the trend based solely on the celebrity's influence, lacking in-depth understanding and rational judgment of the project. Ultimately, when the true situation of the project gradually comes to light, investors realize that their invested funds face enormous risks, potentially leading to total loss.

Market Manipulation Plays Out Like a "Scripted Game"

In the complex market environment of the cryptocurrency space, the behavior of market manipulators resembles a meticulously planned "scripted game," ensnaring many investors without their knowledge. The methods used by manipulators to control coin prices are varied and difficult to guard against. During the private placement financing phase, manipulators often employ lock-up operations, controlling the circulation supply to lay the groundwork for subsequent price manipulation. In the early stages of a virtual currency's launch, due to the relatively small circulation supply, manipulators only need to use a small amount of capital, combined with a large number of chips in hand, to easily drive the coin price up to a remarkable height. At this point, uninformed retail investors, seeing the continuous price rise, are often swayed by greed and fear, rushing to buy in, hoping to share in what seems like a "sure-win" investment.

Once the coin price is elevated to the manipulators' expected level, they begin their selling plan. They gradually sell off their chips at high prices, dumping large amounts of virtual currency onto unsuspecting retail investors. During this process, to avoid causing market panic that could lead to a sharp price drop, manipulators also create false trading volumes through a method called "wash trading." They simultaneously use multiple accounts to sell virtual currency while buying it back with other accounts, creating a false impression of active market trading, misleading investors into believing the market is still in a strong upward phase, thus encouraging them to hold or even increase their buying power. Additionally, manipulators may use technical means to smooth out the price jumps caused by artificial manipulation through algorithms, further confusing investors and making it difficult for them to detect the truth behind the manipulated prices.

More seriously, the cryptocurrency space currently lacks independent, authoritative research and rating institutions. This leads to significant difficulties for investors in obtaining information, making it hard to comprehensively and accurately understand the true situation of projects. Meanwhile, manipulators can exploit this information asymmetry to spread false information through various channels, misleading investors into making poor decisions. For example, manipulators might post false positive news about a project on social media or cryptocurrency forums, boasting about the project's prospects and potential to attract investors. Or, just before a price drop, they might deliberately conceal negative information, preventing investors from taking timely action, ultimately making them victims of manipulation. This information asymmetry further exacerbates the unfairness of the cryptocurrency market, placing investors at a significant disadvantage in the game against manipulators.

Concept Hype Gives Rise to "Air Coins"

A severe issue currently facing the cryptocurrency space is the prevalence of concept hype, which has spawned a large number of "air coins." Nowadays, various virtual currencies claiming to be based on popular concepts, such as AI coins and metaverse coins, are emerging one after another. These projects often portray themselves as incredibly promising in their promotions, claiming to "revolutionize the future" and lead a new wave of technological development. However, when we delve into the actual situation of these projects, we find that they mostly remain at the conceptual level, with not even a decent product launched. Their so-called value is entirely supported by meticulously crafted PPTs and extravagant promotional materials.

Due to the lack of practical application scenarios and technological strength supporting these "air coins," their price movements often lack stability and predictability. Once market sentiment changes, or investors become aware of the false nature of these projects, their prices can burst like bubbles. In the cryptocurrency market, when the market is in a boom phase, and investors are enthusiastic and full of expectations for various emerging concepts, these "air coins" can often leverage the market's heat to attract significant amounts of investor funds. However, when the market experiences fluctuations or regulatory policies change, investor confidence can be severely impacted, leading them to reassess the true value of these projects. At this point, the bubble of "air coins" can burst rapidly, causing prices to plummet and leaving many investors with substantial losses. For example, there were once some metaverse coin projects that attracted a lot of investor attention and funding during a market boom. However, as the market rationally returned to the metaverse concept, these projects, lacking actual products and applications, saw their prices plummet, instantly erasing the wealth of many investors.

Chaos Caused by Lack of Regulation

The awkward situation currently faced by the cryptocurrency space largely stems from the lack of unified regulatory rules. In such an environment lacking effective regulation, there are significant disparities in treatment among different investors. Take Argentina's "LIBRA Coin" as an example; during the operation of this project, serious insider trading issues arose. However, when this problem was exposed, the relevant parties merely brushed it off with a statement that "participants are all professional investors and should be prepared for losses," and even the President of Argentina could easily "shift the blame," claiming he was unaware of the project's details. This lack of regulation and chaos prevents investors' rights from being effectively protected and makes the cryptocurrency market even more chaotic and disorderly.

Additionally, the prices of virtual currencies in the cryptocurrency space lack clear anchors. Take Bitcoin as an example; although its price movements are relatively complex, investors can still somewhat predict its price trends by analyzing market trends and macroeconomic factors. However, for many altcoins, their price fluctuations are almost entirely uncontrolled, either hovering on the brink of zero or already on the path to zero. This extreme price instability makes investing in altcoins far riskier than traditional investment methods, even more so than gambling. In the absence of regulation, these altcoin project teams can manipulate coin prices at will, leaving investors' funds unprotected.

The cryptocurrency space currently faces numerous severe issues, with factors such as celebrity endorsements, market manipulation, concept hype, and lack of regulation intertwining, collectively making it increasingly difficult for investors to achieve stable returns, turning it into an investment field filled with risks and uncertainties. Investors must fully recognize these risks before entering the cryptocurrency space, maintaining rationality and caution to avoid becoming victims of scams. If you are currently confused—lacking technical knowledge, unable to read charts, unsure when to enter, not knowing how to set stop losses, not understanding profit-taking, randomly increasing positions, getting stuck at the bottom, unable to hold onto profits, missing market opportunities… these are all common issues for retail investors. But don't worry, I can help you establish the right trading mindset. A single profitable trade speaks louder than a thousand words; finding the right direction is better than repeatedly failing. Instead of frequent operations, it's better to strike precisely, making each trade more valuable. If you need real-time guidance, you can scan the QR code at the bottom of the article to follow my public account. Market conditions change rapidly, and due to the timeliness of reviews, subsequent trends will be based on real-time layouts. I look forward to progressing steadily with you in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。