Source: Cointelegraph Original: "{title}"

On March 14, despite the S&P 500 index rising by 1.9%, Bitcoin (BTC) failed to maintain a price above $85,000. More importantly, it has been over a week since Bitcoin last traded at $90,000, raising questions among traders about whether the bull market has truly ended and how long the selling pressure will persist.

Bitcoin Basis Rate Rebounds from Bearish Levels

From a derivatives perspective, although Bitcoin's price has dropped 30% from its all-time high of $109,354 set on January 20, related indicators still show resilience. The Bitcoin basis rate, which measures the premium of monthly contracts relative to the spot market, briefly issued a bearish signal on March 13 but has since returned to healthy levels.

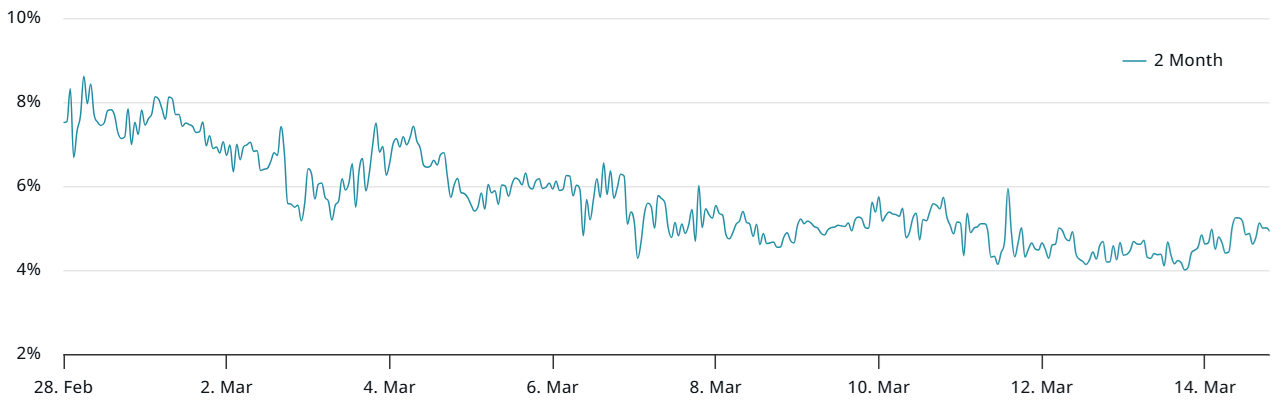

Annualized premium of Bitcoin 2-month futures contracts. Source: Laevitas.ch

Traders typically require an annualized premium of 5% to 10% to compensate for the longer settlement period. A basis rate below this threshold indicates weak demand from leveraged buyers. While the current 5% rate is lower than the 8% recorded two weeks ago, it remains within a neutral range.

Central Banks Will Ultimately Drive Bitcoin Prices Higher

Bitcoin's price movements are closely correlated with the S&P 500 index, suggesting that factors driving investor risk aversion may not be directly related to this mainstream cryptocurrency.

However, this also challenges the view of Bitcoin as a non-correlated asset, as its price movements have been more aligned with traditional markets, at least in the short term.

S&P 500 futures (left) compared to Bitcoin's exchange rate against the US dollar. Source: TradingView/Cointelegraph

If Bitcoin's price continues to heavily rely on a stock market pressured by recession fears, investors may continue to reduce their exposure to risk assets and turn to short-term bonds for safety.

Nevertheless, central banks are expected to implement stimulus measures to avoid economic recession, which could lead to strong performance for scarce assets like Bitcoin.

According to the Chicago Mercantile Exchange (CME) FedWatch tool, before the Federal Open Market Committee (FOMC) meeting on July 30, the market expects less than a 40% chance that US interest rates will drop below 3.75% from the current benchmark rate of 4.25%.

Even so, once the S&P 500 index recovers part of its recent 10% decline, Bitcoin should quickly reclaim the $90,000 level. However, in the worst-case scenario, panic selling of risk assets may continue.

In this case, Bitcoin may continue to perform poorly in the coming months, especially if Bitcoin spot exchange-traded funds (ETFs) continue to experience significant and sustained net outflows.

Bitcoin Derivatives Show No Signs of Pressure

Currently, professional traders are not actively using Bitcoin options for hedging, as indicated by the 25% delta skew. This means that few market participants expect Bitcoin's price to retest the $76,900 level in the short term.

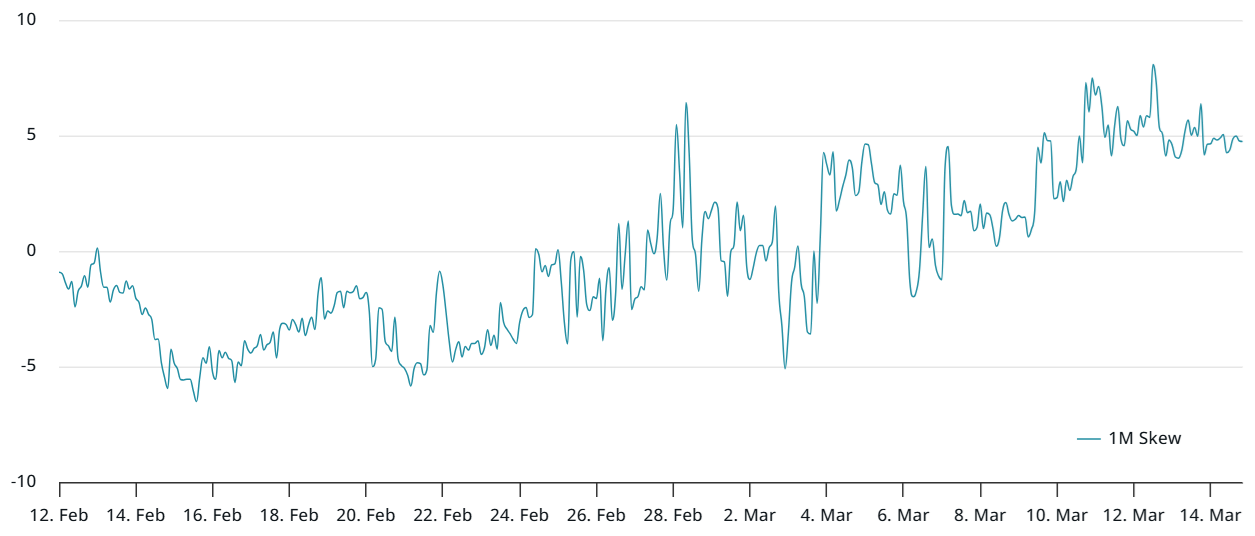

Bitcoin 1-month options 25% delta skew (put-call). Source: Laevitas.ch

Bullish sentiment typically leads to put (sell) options trading at a discount of 6% or more. Conversely, during bearish periods, this indicator rises to a premium level of 6%, as seen briefly on March 10 and March 12. However, the 25% delta skew has recently remained in a neutral range, reflecting a healthy derivatives market.

To better gauge trader sentiment, it is crucial to study the Bitcoin margin market. Unlike derivatives contracts (which maintain a balance between long (buyers) and short (sellers)), the margin market allows traders to borrow stablecoins to purchase Bitcoin spot. Similarly, bearish traders can borrow Bitcoin to establish short positions, betting on price declines.

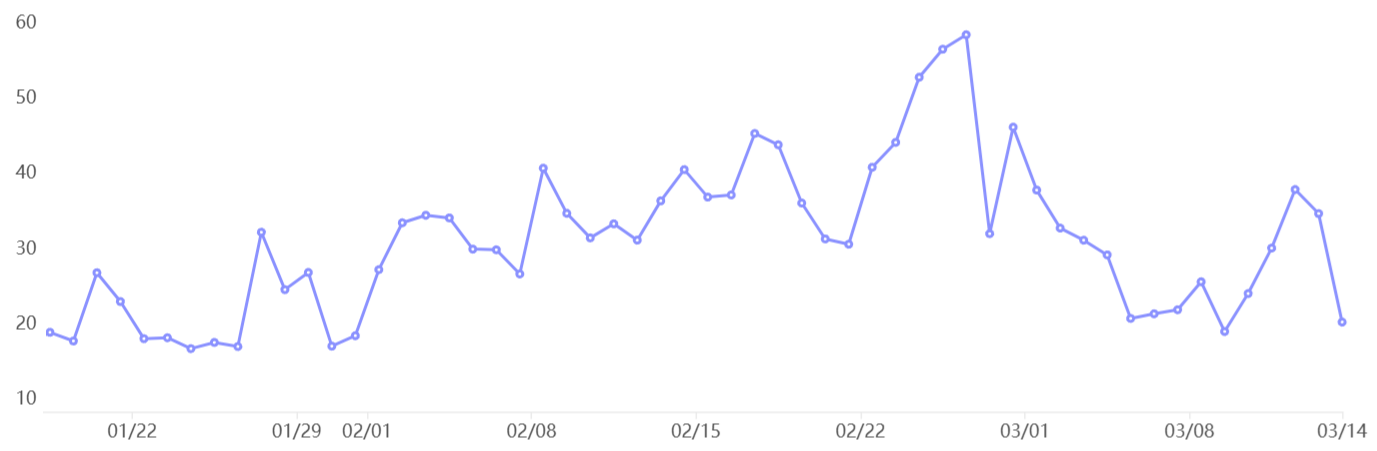

Bitcoin margin long-short ratio on the OKX platform. Source: OKX

The margin long-short ratio for Bitcoin on the OKX platform shows that the number of longs is 18 times that of shorts. Historically, excessive confidence has pushed this ratio above 40 times, while a level where longs are less than 5 times shorts is seen as a bearish signal. The current ratio aligns with market sentiment when Bitcoin traded above $100,000 on January 30.

The lack of pressure or bearish signs in the Bitcoin derivatives and margin markets is reassuring, especially after over $920 million in leveraged long futures contracts were liquidated in the seven days leading up to March 13.

Therefore, as recession risks ease and given the resilience of investor sentiment, Bitcoin's price may recover the $90,000 level in the coming weeks.

This article is for general informational purposes only and should not be considered legal or investment advice. The views, thoughts, and opinions expressed in this article are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Related: Uber angel investor sparks Bitcoin debate with comments on "building a better Bitcoin"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。