Trump said: Make America Great Again!

Source: Talking about Li and Talking Outside

In the article a few days ago, we mainly rethought the development of the market. In terms of current market sentiment, many people seem to be increasingly hopeful about the expectation of interest rate cuts (by the Federal Reserve).

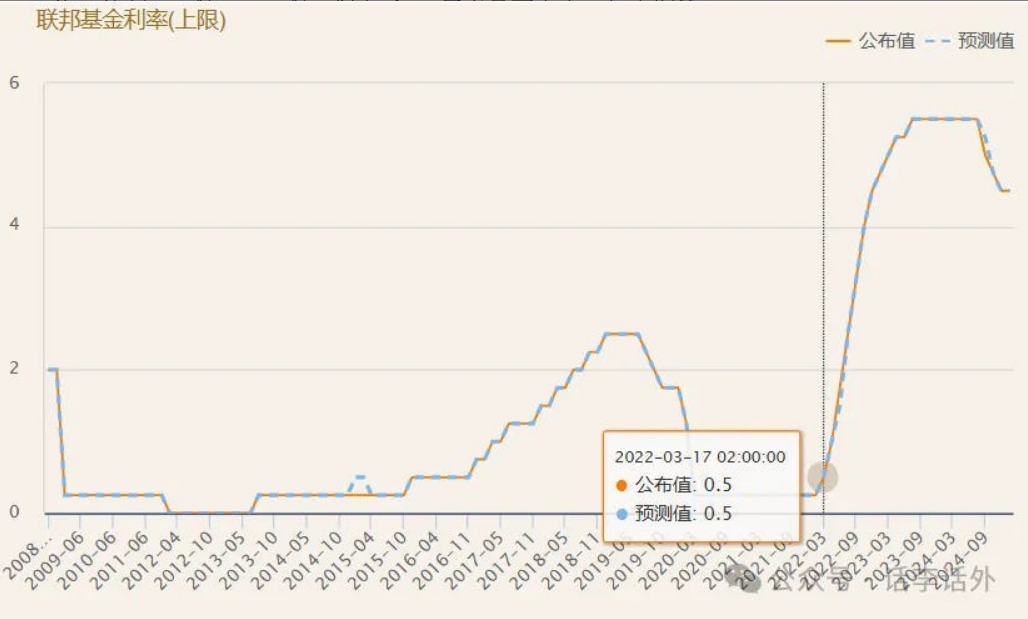

The last time the crypto market benefited from a large-scale interest rate cut was at the beginning of 2020. Before the outbreak of the COVID-19 pandemic, the federal funds rate (the rate adjusted by the Federal Reserve) was actually not high, only 1.5% - 1.75%. However, in response to the impact of the pandemic, the Federal Reserve made two emergency interest rate cuts within a month: the first cut was 50 basis points (0.5%), and the second cut was 100 basis points (1%).

As a result, the federal funds rate was directly lowered to 0% - 0.25%, which meant that borrowing (credit) became easier than ever. With the reduction in borrowing costs, a large amount of liquidity flooded into the market (including the crypto market) and pushed up the prices of various risk assets, becoming one of the main driving factors of the bull market in 2021.

1. Trump's Interest Rate Cut Complex

An interesting report from the BBC (March 16, 2020) noted that as the Federal Reserve urgently cut interest rates to zero, "using up all its ammunition at once," Trump, who had previously criticized Powell for being "ineffective," rarely changed his tune to praise it, saying "it's great," "very good news," and "it makes me happy." As shown in the image below.

From the reports at that time, it seems that Trump has always had a certain "complex" about "interest rate cuts."

Fast forward five years, and after Trump took office again as president in 2025, he publicly stated that he understands interest rates better than Federal Reserve Chairman Powell. As shown in the image below.

However, from the series of actions Trump has taken in the past two months, and the resulting significant volatility in the market (including the U.S. stock market and the crypto market), it seems that the Federal Reserve has not "listened" to his arrangements this time. This has led many in the market to speculate that the reason Trump is creating so many events now is to "force" the Federal Reserve to cut interest rates.

2. The Impact of Interest Rate Cuts on the Market

Let's return to the topic of the crypto market.

It was precisely because of the interest rate cuts in 2020 that extremely low borrowing costs and larger-scale liquidity gave rise to a new bull market.

However, if we look back at historical price trends, we can also find that the effects of the interest rate cuts were not immediately reflected in the crypto market; the bull market did not explode until 2021. This aligns with the viewpoint we mentioned in previous articles: the crypto market mainly enjoyed "excess liquidity," meaning that the large-scale liquidity brought by interest rate cuts first flowed into traditional markets like the U.S. stock market, and only then did the excess liquidity flow into the crypto market, which is a secondary high-risk market.

However, this situation is gradually changing, as more and more large institutions have begun to deeply participate in the crypto market in recent years. The crypto market is increasingly synchronized with the U.S. stock market. Once the market has large-scale liquidity, some funds may choose to flow into the crypto market in advance.

As time moved into 2022, the interest rate cuts (zero interest rates) also led to rising inflation in the U.S., with the CPI reaching a 40-year historical high. Therefore, the Federal Reserve restarted a new round of interest rate hikes, raising rates six times in 2022 (in March, May, June, July, September, and December), and by July 2023, it had raised rates 11 times, reaching 4.33% - 5.50%, the highest level in 20 years. As shown in the image below.

From a time perspective, the period of 2022-2023 coincided with a new bear market in the crypto market.

As we moved into 2024, the Federal Reserve began to cut interest rates again (starting a new round of interest rate cuts in September 2024) and injected new liquidity into the market. Coupled with the macro narrative driven by ETFs and the hype around new internal narratives in the BTC ecosystem, the crypto market reopened a new bull market.

Moreover, we can see from the continuous growth of stablecoins that some funds began to enter the market on a large scale around that time. The subsequent events we have all experienced, such as the large-scale prosperity of MemeCoins (price speculation) and BTC breaking the $100,000 milestone and continuously creating historical highs…

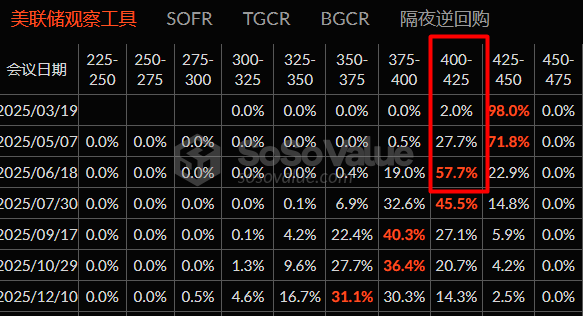

So, what will the next script look like? I don't know. We need to pay attention to the Federal Reserve's interest rate meeting next week (March 19). As shown in the image below.

However, from the current predictive data, the expectation for an interest rate cut in June is still relatively high, as shown in the image below.

Although the expectation for interest rate cuts this year is still present, we can see from the above that the differences between the interest rate cuts in 2020 and 2025 are notable: aside from the different starting rates, the biggest difference is the speed of the cuts. The previous round of cuts was rapid and substantial, while the current round appears to be a slow and gradual process, unless a larger-scale black swan event occurs, such as the stock market circuit breaker we mentioned in a previous article (March 11).

As we mentioned above, the crypto market mainly enjoys excess liquidity. Even if this situation may change in the future, if the process of interest rate cuts is slow and gradual, then for the current crypto market, it may also lead to a gradual market, making trading more difficult and requiring caution for ordinary investors, unless extreme conditions arise, such as:

On the positive side, meeting the other two core factors (narrative, macro, policy) we mentioned in previous articles, namely, new reforms or innovations within the crypto market (which currently seem absent), or significant new policy stimuli, primarily from the U.S. (of course, if a major Eastern country could open up, that would be a greater benefit, but it currently seems impossible). On the negative side, a black swan event larger than a trade war could directly crash the market.

Trump said: Make America Great Again!

Retail investors said: Viagra is fine, as long as it leads to interest rate cuts!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。