A contemplation on the future of risk, time, and currency.

Written by: Daii

I hope today's topic hasn't caught you off guard. Because reality has harshly slapped the title in the face:

Gold, today (March 16), briefly broke through $3,000 per ounce, setting a new historical high.

Bitcoin, after falling from a high of $102,000, has dropped below $77,000 and is now hovering around $84,000.

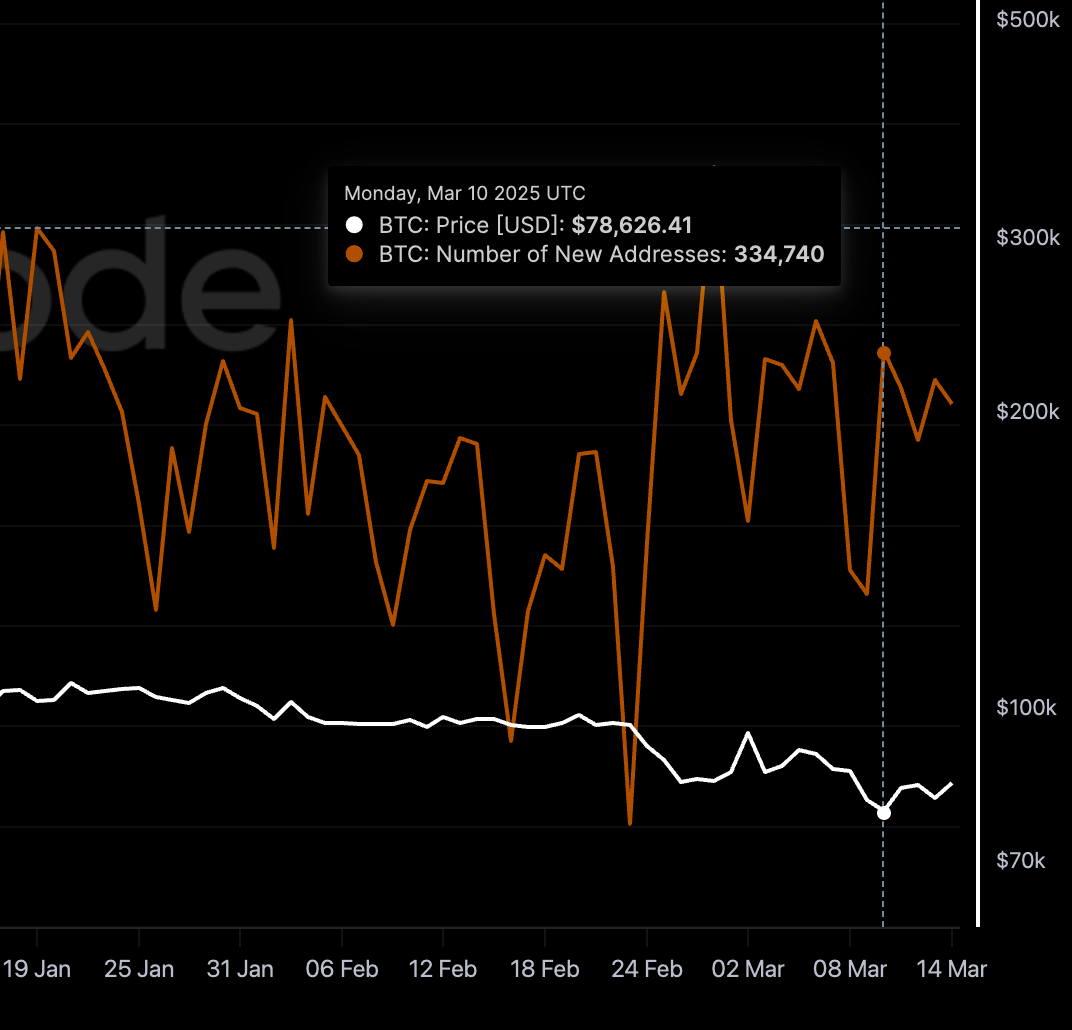

Such a stark contrast makes it clear that gold is a better safe-haven asset than Bitcoin. So I ask you, are you willing to sell your Bitcoin to buy gold right now? Personally, I wouldn't, and I think you probably wouldn't either. Moreover, not only are current Bitcoin holders likely unwilling to sell, but there are also many newcomers continuously joining the market, as shown in the image below.

From the image, you can see that even when Bitcoin was at a historical low of $78,000, there were still 330,000 new Bitcoin addresses created that day. Clearly, behind this contradiction lies an unknown secret. Your decision not to sell Bitcoin for gold is correct, and today I will tell you the real reason behind it. Without further ado, the answer is the title, minus the question mark:

Bitcoin, the ultimate safe-haven solution for long-termists.

Of course, just giving you the answer is far from enough; I should also tell you the reasons. As a popular science column, I should also achieve unity of knowledge and action. Therefore, in the end, I will provide a path and method to practice this concept. If you agree with long-termism and are not someone who wants to get rich through leveraged trading, then please continue reading.

First, let's understand what a safe-haven asset is.

1. What is a Safe-Haven Asset?

A safe-haven asset, as the name suggests, refers to an asset that can maintain or even increase its value during market turmoil, economic uncertainty, or other events that may lead to a decline in the value of traditional investments (such as stocks, bonds, etc.). Such assets are typically viewed by investors as a "safe harbor" to protect their wealth from loss during risky times.

Traditionally, safe-haven assets usually possess the following core characteristics:

Low volatility or negative correlation: An ideal safe-haven asset should demonstrate relative stability during market fluctuations, even showing a negative correlation with high-risk assets (such as stocks). This means that when the stock market declines, the price of the safe-haven asset may rise, thus serving as a hedge against risk.

Value storage capability: Safe-haven assets need to have the ability to retain value over the long term, resisting the erosion of wealth caused by inflation and other factors. When holding such assets, people care more about maintaining purchasing power rather than pursuing short-term high returns.

Strong liquidity: The ability to quickly buy or sell at reasonable prices when needed is also crucial for safe-haven assets. This ensures that investors can flexibly adjust their asset allocation when necessary.

Historical validation: Assets that have historically demonstrated safe-haven properties during multiple market crises or economic downturns are often more readily accepted and trusted by investors.

The three pillars of traditional safe-haven assets:

Gold: As a millennium-old hard currency, the myth of gold as a safe haven stems from its 70-fold increase after the collapse of the Bretton Woods system in 1971. Its physical scarcity (approximately 205,000 tons of gold have been mined globally) and anti-inflation properties (with an annualized return of about 7.3% over the past 50 years) make it a classic choice during crises.

Government bonds: Taking U.S. Treasury bonds as an example, their "risk-free" label is built on national credit. However, with U.S. debt expected to exceed $35 trillion in 2024 and real yields being negative for 18 consecutive months, the inflation trap behind "safe assets" is revealed.

Safe-haven currencies: The U.S. dollar, as the global settlement currency, accounted for 59% of foreign exchange reserves during the 2020 pandemic crisis; the Japanese yen relies on a low-interest environment (Japan -0.1%), and the Swiss franc maintains its safe-haven status due to banking secrecy laws.

However, for a long time, gold has been regarded as the classic safe-haven asset. In many historical periods, when the stock market declines or geopolitical risks rise, investors flock to gold, driving its price up. Gold itself does not generate interest or dividends, but its scarcity and historical recognition as a store of value make it an important means of preserving value during uncertain times.

However, with the continuous development and innovation of financial markets, as well as the diversification of investors' risk preferences, the definition of "safe-haven assets" is also evolving. Some emerging assets are beginning to show safe-haven potential in specific environments, even if they may not fully meet all the characteristics of traditional safe-haven assets. This is why we are discussing the relationship between Bitcoin and safe havens today.

The most critical sentence in the above paragraph is "investor risk preference." Because of the existence of "investor risk preference," everyone's perception and feeling of risk are different. For example, for me, I do not expect to get rich through leveraged trading, so the price fluctuations of Bitcoin have never been a risk or an opportunity for me.

So, what does risk mean to you?

2. The Relativity of Risk

Now, let's turn our attention to a broader stage and see how risk manifests differently with changes in geography and time.

Imagine living in different countries, where you would feel different pressures from risk. For instance, during the economic turmoil in Zimbabwe, hyperinflation rendered the currency almost worthless. For local residents, holding the national currency is the biggest risk, and they would do everything possible to convert their assets into more stable foreign currencies or tangible goods. In a stable economy like Switzerland, people might be more concerned about the long-term preservation of their assets rather than short-term currency depreciation risks.

This is the "spatial" relativity of risk— the same asset carries different risks in different economies.

The passage of time also profoundly affects our perception of risk. Assets once considered high-risk may gradually be accepted by the market and seen as mainstream over time; conversely, assets once deemed safe may expose new risks due to changes in the times.

Look at the image above; you might think such a significant pullback must be Bitcoin or other cryptocurrencies, but it is not; it is gold.

Because the safe-haven properties of gold are not immutable. In different historical periods, the price fluctuations and safe-haven effects of gold can also be influenced by various factors such as the economy and politics. For example, during certain economic recessions, gold may demonstrate good safe-haven functionality, but in other periods, its performance may not be satisfactory.

From the panoramic view above, you can clearly see that gold experienced significant pullbacks in the 1970s, 1980s, and 2010s.

So, repositioning the coordinates of time and space, what should long-termists do now?

First, it is essential to clarify that a long-termist does not take making money as a life goal. We all try to do something more meaningful; aside from work, I choose blockchain popularization, while you may choose something else. However, we share a common point: we do not want to worry too much about making money. We hope for a one-time solution to manage our investments; we do not have high profit demands and do not wish to bear unnecessary risks.

However, as long as we live on Earth, there is a type of risk we cannot avoid.

3. The Risks of Fiat Currency

Fiat currency, as the name suggests, is currency that has been given legal status by government decree and is mandated for circulation. The paper money we use daily, such as the U.S. dollar, euro, yen, etc., falls under fiat currency. Unlike historical currencies that were pegged to a physical commodity (such as gold or silver), the value of modern fiat currency is entirely based on people's trust in its issuing authority (usually the central bank) and the economic strength of the country.

3.1 Devaluation

The fatal flaw of fiat currency lies in its mechanism of unlimited supply. To cope with economic downturns, stimulate growth, or repay debts, governments and central banks often increase the money supply. While moderate inflation may have some positive effects on the economy in the short term, in the long run, persistent inflation leads to a continuous decline in the purchasing power of the currency.

Taking the U.S. dollar as an example, since it decoupled from gold in 1971, its purchasing power has diminished by 98%. In 2024, the Federal Reserve implemented quantitative easing to address the U.S. debt crisis, leading to a 23% surge in M2 money supply and a real inflation rate soaring to 8.5%, far exceeding the 2% policy target. This "printing tax" is creating a "time black hole" of wealth globally— the real yield on cash assets has been negative for 18 consecutive months, equivalent to an annual implicit loss of 6.3% in purchasing power.

Even more severe is the negative feedback loop between sovereign debt and fiat currency credit: the global sovereign debt has reached 356% of GDP, and U.S. debt has surpassed $35 trillion, with its "risk-free" label crumbling. The Bank of Japan holds over 52% of government bonds, leading to a 15% plunge in the yen against the dollar. This "debt monetization" mechanism is pushing the fiat currency system to the edge of a cliff.

In addition to devaluation, there is an even more significant personal sovereignty risk: banks can freeze or restrict your account at any time.

3.2 Freezing and Limiting

Imagine you have worked hard to accumulate a fortune stored in your bank account. Legally, this money belongs to you, and you can use it freely. However, in reality, your control over this money is not absolute. As an intermediary, banks may, in certain situations, restrict or even freeze your account. This could be due to involvement in legal disputes, cooperating with regulatory investigations, or even just an internal operational error at the bank.

This indirect control over funds is a potential risk of holding fiat currency. Although your wealth exists in digital form, the ultimate control lies with the state and financial institutions.

2013 Cyprus Capital Controls: To prevent the collapse of the banking system, Cyprus implemented strict capital controls in 2013. Initially, the daily withdrawal limit was set at €300. Even more shockingly, depositors with bank deposits exceeding €100,000 faced asset losses of up to 60%, with part of it directly converted into bank shares. These strict capital controls lasted for about two years, severely limiting the public's control over their own wealth.

2011-2015 Argentina Foreign Exchange Controls: To cope with economic difficulties and prevent capital flight, the Argentine government implemented complex foreign exchange control measures from 2011 to 2015, strictly limiting individuals and businesses from purchasing U.S. dollars. This led to the rise of an illegal "black market" for dollar trading, making it difficult for many individuals and businesses to obtain the dollars needed for international trade or savings. It is estimated that grain exporters hoarded billions of dollars' worth of agricultural products at that time, waiting for the controls to be lifted to sell at more favorable exchange rates, reflecting the significant impact of foreign exchange controls on economic activity.

2008-2017 Iceland Capital Controls: After the outbreak of the financial crisis in 2008, Iceland implemented capital controls for nearly a decade to prevent large-scale capital flight. These measures strictly limited foreign exchange outflows, including restrictions on cross-border payments and capital movements. The primary reason for implementing capital controls was the concern over the outflow of substantial funds held in bankrupt Icelandic banks, which could lead to a significant devaluation of the Icelandic currency, the króna. These controls were gradually lifted only in 2017.

2017 Venezuela Bank Withdrawal Restrictions: Amid the worsening economic crisis in Venezuela, the government imposed strict limits on bank withdrawals. In 2017, the daily withdrawal limit from ATMs was only 10,000 bolivars, worth less than $1 at the time. Worse still, ATMs often ran out of cash, forcing people to queue for hours to withdraw a maximum of 20,000 bolivars at bank counters, which was far from sufficient for daily needs.

These real cases and data clearly indicate that under the fiat currency system, during specific economic or political crises, governments may take strong measures to restrict or even freeze individuals' bank accounts to maintain financial stability or other policy objectives. This is undoubtedly a risk that long-termists, who pursue long-term wealth security and personal financial autonomy, need to consider seriously.

In more extreme cases, if a financial crisis or bank failure occurs, your deposits may also face the risk of loss. Although there is currently deposit insurance protection, there is still a certain limit.

For those seeking greater financial autonomy and personal sovereignty, this is a matter that requires serious consideration. Now, we should be able to answer why "Bitcoin" is a better safe-haven asset for "long-termists."

4. Why Should Long-Termists Choose Bitcoin?

In fact, we should first exclude fiat currencies; even the U.S. dollar, Japanese yen, and euro should not be chosen.

4.1 Fiat Currency vs. Bitcoin

We have seen that, for example, since the U.S. dollar decoupled from gold, its purchasing power has significantly diminished. In contrast, one of Bitcoin's most striking features is its fixed total supply. The total cap of 21 million coins is written into its underlying code and cannot be changed.

Bitcoin's supply mechanism is the first monetary contract in human history sealed by mathematics: the production is halved every four years, with a total cap of 21 million coins by 2140. This programmed deflationary model sharply contrasts with the unlimited issuance of fiat currencies. For example, in 2024:

U.S. Dollar: The Federal Reserve expanded its balance sheet by 23% to address the U.S. debt crisis, with M2 money supply exceeding $22 trillion and the actual inflation rate soaring to 8.5%;

Bitcoin: After the fourth halving, the annual inflation rate dropped to 0.9%, far below gold's 1.7%.

We also discussed the risks of restrictions on fiat currency accounts. The decentralized nature of Bitcoin effectively mitigates this risk. The Bitcoin network is not controlled by any single central authority; transaction records are transparently stored on the blockchain, and no one can arbitrarily alter or freeze users' Bitcoin assets unless the users themselves disclose their private keys.

4.2 Government Bonds vs. Bitcoin

Government bonds, especially sovereign debts like U.S. Treasury bonds, have long been considered "risk-free assets" in financial markets. This notion is based on national credit, with investors believing that the government has the capacity to repay the bonds it issues. During market turmoil, funds often flow into government bonds seeking safety.

However, for today's long-termists, viewing government bonds as ideal safe-haven assets may require more cautious consideration, especially in the current global economic landscape, where some data and facts have revealed potential traps behind traditional beliefs.

As we mentioned earlier, U.S. government debt is projected to exceed $35 trillion by 2024. Such a massive debt scale, along with negative real yields for 18 consecutive months, points to a core question: Can government bonds effectively resist inflation?

Negative real yields mean that, after accounting for inflation, holding these so-called "safe assets" is actually resulting in a loss of purchasing power. For long-termists seeking to preserve and grow their wealth over time, this is clearly unacceptable.

Moreover, the global sovereign debt has reached 356% of global GDP, a concerning figure. In some countries, like Japan, the central bank holds more than 50% of government bonds, leading to a significant depreciation of the yen. This trend of "debt monetization" challenges the long-term safety of traditionally considered safe government bonds. For long-term investors, pouring substantial funds into assets that may face risks due to sovereign debt crises is not a wise choice.

In contrast, Bitcoin, as a decentralized digital asset, does not directly rely on the credit of any single country. While it also faces its own risks, it offers a long-term option that is decoupled from the traditional financial system, which may be more attractive to long-termists concerned about sovereign debt risks.

Of course, government bonds, as low-volatility assets, may provide some stability during market turmoil in the short term. However, for long-termists focused on preserving and growing wealth over the coming decades, merely pursuing short-term stability may not be sufficient. They need assets that can withstand long-term inflation and possess long-term growth potential. From this perspective, despite Bitcoin's volatility, its unique scarcity and decentralized nature, along with its immense potential in the digital economy era, may make it a better long-term safe-haven choice than traditional government bonds.

4.3 Gold vs. Bitcoin

As we mentioned earlier, gold has achieved an annualized return of about 7.3% over the past 50 years, making it a decent long-term store of value. However, if we turn our attention to Bitcoin, its long-term performance is even more remarkable.

According to backtesting data from Curvo.eu (as of March 2025):

Over the past five years: Bitcoin's total return was approximately 1067.5%, while gold's was about 88.8%. Bitcoin's average annualized return was 63.5%, far exceeding gold's 13.5%.

Over the past ten years: Bitcoin's total return reached an astonishing 51259.5%, while gold's was about 142.7%. In terms of average annualized return, Bitcoin was around 86.7%, also significantly higher than gold's 9.3%.

An article from Nasdaq in September 2024 also pointed out that over the past decade, Bitcoin has been the best-performing asset globally, with an average annualized return of up to 693%, while gold was only around 5% during the same period.

Additionally, after Bitcoin's fourth halving, its annual inflation rate of 0.9% is only 53% of gold's (1.7%). Bitcoin is becoming increasingly scarce.

Furthermore, portability and storage costs are another limitation of gold. Holding large amounts of gold requires physical storage space and comes with security risks and storage costs. In contrast, Bitcoin exists in digital form and can be stored on various electronic devices with almost no storage costs, making it easy to transfer globally, which is a significant advantage in an increasingly globalized world.

Moreover, in terms of divisibility, Bitcoin far surpasses gold. Bitcoin can be divided down to eight decimal places (i.e., satoshis), making small transactions and investments more flexible and convenient. In contrast, the division and transaction costs of gold are relatively high.

More importantly, as a digital asset born in the internet age, Bitcoin has higher transparency and verifiability. All Bitcoin transactions are recorded on a public blockchain, and anyone can query and verify them, which reduces the risk of fraud and counterfeiting to some extent. In contrast, the authenticity and purity of gold can sometimes be difficult to ascertain.

Additionally, from the perspective of market capitalization growth, although gold's total market value still far exceeds that of Bitcoin, Bitcoin's growth rate is remarkable. Currently, Bitcoin's market value is approaching $2 trillion, while gold's estimated market value is about $18.5 trillion. Galaxy Research predicts that by 2025, Bitcoin's market value could reach 20% of gold's market value. This indicates strong market expectations for Bitcoin's future growth.

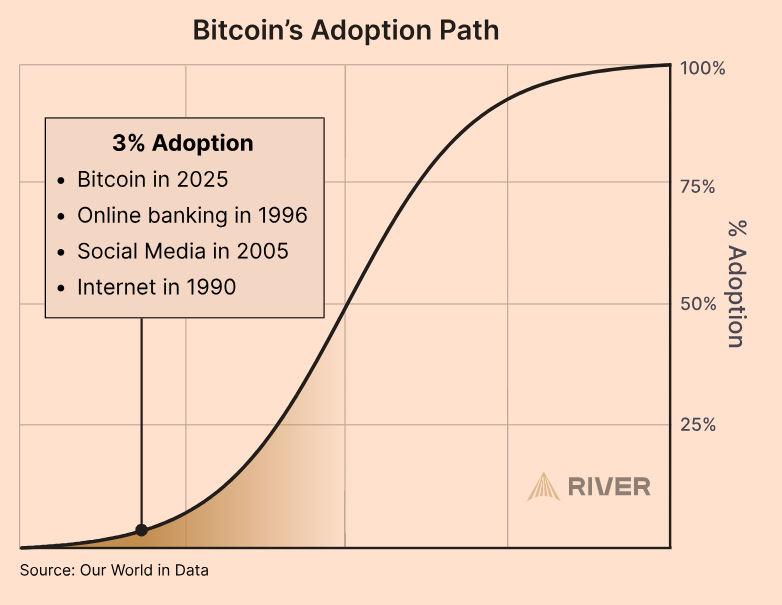

Finally, in terms of adoption rates, gold, as a mature asset, has been widely accepted, but Bitcoin, as an emerging digital asset, has an adoption rate of only 3%, indicating a broader future for Bitcoin. As I pointed out in "On Trends, Between Cycles: A Cool Reflection on Bitcoin's 'Pullback Moment'," a 3% adoption rate is comparable to the internet in 1990, online banking in 1996, and social media in 2005.

Long-termists choosing Bitcoin do not aim to completely abandon gold; rather, they see that in the future world, Bitcoin may demonstrate stronger potential than gold in combating fiat currency devaluation, protecting personal wealth, and seizing opportunities in the digital economy. We are willing to accept volatility in exchange for potential future returns.

So, how should long-termists invest in Bitcoin?

Set aside living expenses and start DCA.

5. Why DCA is the Investment Strategy for Long-Termists?

DCA stands for Dollar-Cost Averaging, an investment strategy that involves investing a fixed amount of money in a particular asset at regular intervals (e.g., weekly, monthly), regardless of the asset's price.

As we discussed earlier, Bitcoin, as an emerging asset, has much greater price volatility compared to traditional safe-haven assets like gold and government bonds. While we are confident in Bitcoin's value in the long term, short-term price fluctuations are difficult to predict. For long-termists, they do not seek profits from short-term market fluctuations but focus on long-term returns over the coming years or even decades. In this context, the DCA strategy becomes particularly important and effective.

The most direct benefit of this phased investment approach is that it alleviates the pressure on investors to "time the market." No one can accurately predict the market's lowest point, and even professional traders often make mistakes. Long-termists understand this well; they focus more on long-term trends rather than short-term fluctuations. The DCA strategy allows them to avoid guessing when the market will bottom out and simply stick to their established investment plan.

Additionally, DCA helps overcome human weaknesses. When the market rises, people often buy in fear of missing out; when the market falls, they may panic and sell at a loss. The DCA strategy, through regular investments, helps investors remain calm and rational, avoiding the influence of short-term emotions, thus enabling them to adhere to a long-term investment strategy.

Based on data from 2015-2025:

Monthly $100 DCA: Total investment of $12,000, with a final value of $111,000 and an annualized return of 25%;

During the same period, S&P 500 index DCA: Final value of only $21,000, with an annualized return of 9.8%.

This difference arises from the exponential growth characteristics of Bitcoin. DCA in the Bitcoin ecosystem is akin to "spatial-temporal arbitrage"—exchanging the depreciation rate of fiat currency for the scarcity premium of Bitcoin.

Looking back at Bitcoin's historical price trends, we can see that despite experiencing multiple significant corrections, its long-term trend remains upward. If an investor had adhered to a DCA strategy since Bitcoin's inception, regardless of how many "halvings" they experienced along the way, their ultimate investment returns would be quite substantial. Of course, past performance does not guarantee future results, but the essence of the DCA strategy lies in diversifying risk and reducing the impact of timing on the final returns.

For long-termists, we seek a "set it and forget it" investment approach, not wanting to spend excessive time and energy researching and predicting the market. The DCA strategy precisely meets this need. Once an investment plan is set, it can be executed automatically at regular intervals without frequent intervention, allowing more time and energy to be devoted to more meaningful pursuits, such as personal career development, family life, or social contributions.

Therefore, for long-termists who recognize Bitcoin's long-term value and wish to participate in a hassle-free manner, DCA is undoubtedly a very suitable investment strategy. You might ask, what should be done with money that hasn't been invested in Bitcoin? It's simple: convert it into a stablecoin like the U.S. dollar. Here is a beginner's guide on stablecoins.

In the cryptocurrency market, DCA has already become a relatively mature service, with many methods available. If you want to buy Bitcoin directly on a centralized exchange and then send it to a cold wallet, here are two beginner's tutorials: one on how to purchase Bitcoin and another on how to send Bitcoin to a cold wallet.

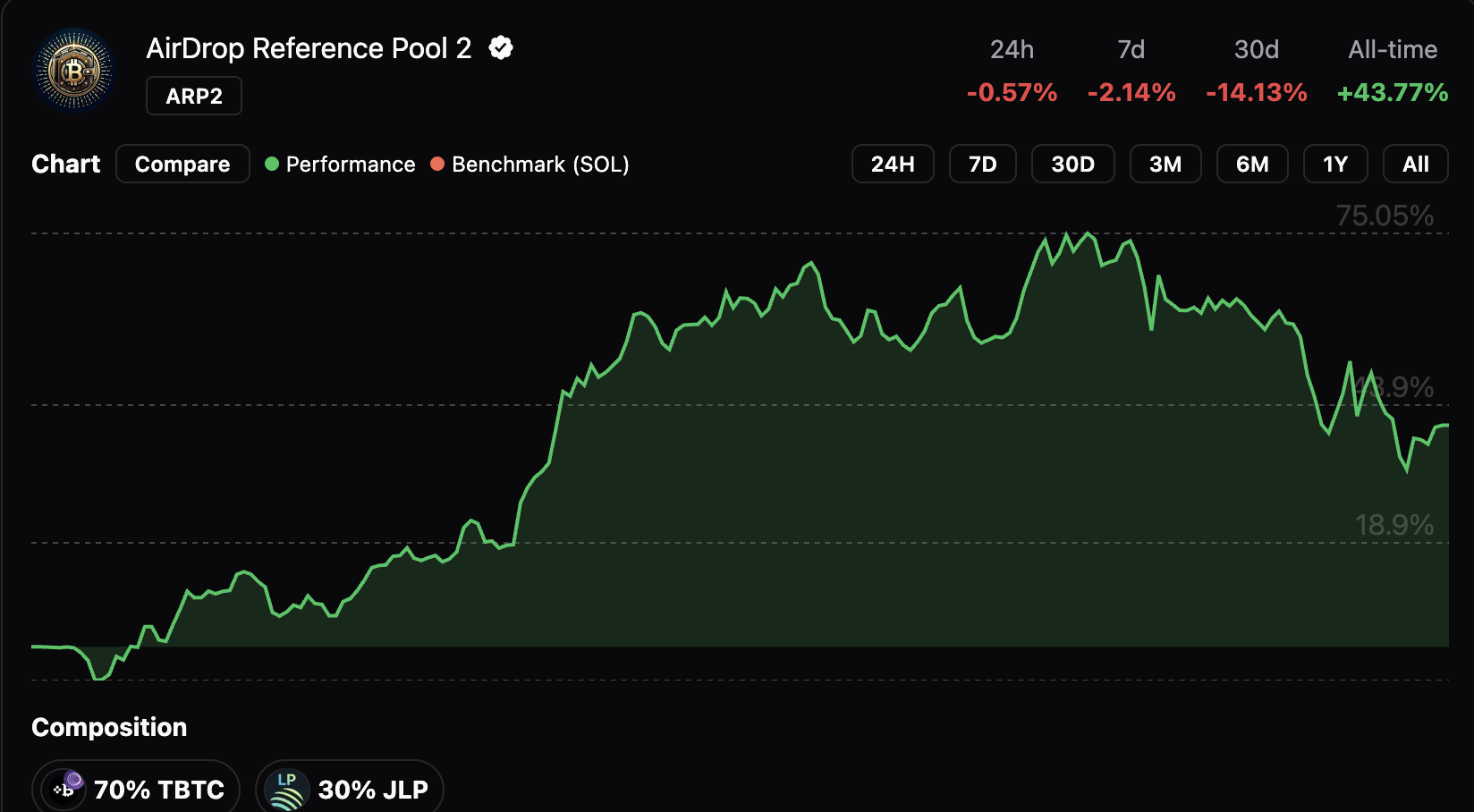

I recommend the ARP2 project from "Airdrop Reference," as this project allows you not only to dollar-cost average into Bitcoin but also to gain additional returns from automatic rebalancing. For specific operations, see here.

ARP2 still has a return of 43.77% even after Bitcoin has taken a significant plunge. The only downside of this project is that you need to manually complete the investment each time.

Conclusion: Awakening Value Across Time Dimensions

In the epic of human civilization's monetary history, gold has forged a "temple of value" over millennia, fiat currency weaves a "liquid illusion" based on national credit, while Bitcoin is reconstructing a "digital Babel" with mathematics and code. This discourse on safe-haven assets is essentially a game between human nature and time—gold embodies the ancient belief in physical scarcity, while Bitcoin signifies a future consensus on digital absoluteness.

The choice of long-termists has never been a simple asset replacement but a redefinition of monetary sovereignty. When the "inflation tax" of fiat currency erodes wealth, and when the "geopolitical shackles" of gold restrict mobility, Bitcoin, with its transparency of "code is law" and control of "private key is sovereignty," opens a third path for individuals to combat systemic risks.

History repeatedly confirms: true hedging is not about escaping volatility but anchoring to the future.

Just as time will ultimately reveal the folly of all bubbles, it will also crystallize the brilliance of true value. Bitcoin, a decentralized network built on mathematics and powered by consensus, is demonstrating its potential to surpass traditional safe-haven assets through its scarcity, verifiability, and ever-growing adoption rate under the test of time.

Choosing Bitcoin is not a short-term speculation but a belief in the future. It represents a new perspective on wealth—not relying on centralized authority but returning the control of value to individuals. For long-termists like us, who do not wish to expend our lives chasing wealth in the fog, Bitcoin may very well be the key to unlocking the door to future value.

Let us set sail with the patience of time as our sail and long-termism as our rudder, steering towards a more autonomous and secure wealth shore.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。