Author: Scof, ChainCatcher

Editor: TB, ChainCatcher

Recently, Strategy (formerly known as MicroStrategy) officially submitted documents to the U.S. Securities and Exchange Commission, planning to issue up to $21 billion of 8% Series A perpetual preferred stock. This move has attracted market attention, as it not only involves large-scale fundraising but may also have profound implications for Strategy's Bitcoin purchasing strategy.

According to official documents, these preferred shares have a par value of $100 per share, an annual interest rate of 8%, and pay dividends quarterly, which can be in cash, common stock, or a combination of both. Additionally, the preferred shares can be converted into common stock at a ratio of 10:1, meaning that every 10 preferred shares can be converted into 1 common share.

This preferred stock issuance will adopt a "market issuance plan" model, allowing the company to sell preferred shares directly in the market, similar to an ATM issuance of common stock. This means that Strategy now has both common stock and preferred stock ATM financing channels.

So, how is this preferred stock issuance different from previous ones? Will this innovative financing method bring new variables to the Bitcoin market? This article will provide an in-depth analysis.

Evolution of Strategy's Financing Methods

Before analyzing Strategy's latest financing method, let's briefly review its past methods of purchasing Bitcoin.

In the early stages, Strategy, as a software company, used idle cash on its balance sheet to purchase Bitcoin. The first three investments during this phase bought 40,700 Bitcoins.

As the company's investment in Bitcoin increased, they began to use convertible preferred bonds (convertible bonds) for financing. Convertible bonds allow investors to convert the bonds into company stock under certain conditions, providing both downside protection (the principal and interest can be recovered at maturity) and potential gains from stock price appreciation. This method acquired 119,481 Bitcoins.

In addition to convertible bonds, Strategy also issued preferred secured bonds, which are a type of secured debt instrument with lower risk than convertible bonds but a more fixed return model. Using this model for financing, the company bought 13,005 Bitcoins.

With the rise in MSTR stock price, starting in 2021, the company increasingly adopted the market price stock issuance (ATM) method for financing. ATM is a widely used financing method in the U.S., allowing publicly traded companies to issue new shares directly at current market prices to raise funds.

On February 20 of this year, Strategy issued $2 billion in convertible preferred notes, a financing method that requires a more complex and time-consuming review process than before, leading the market to speculate that Strategy's pace of purchasing BTC would slow down.

However, the submission of the $21 billion perpetual preferred stock has reignited market expectations for Strategy to return to a "buy, buy, buy" mode.

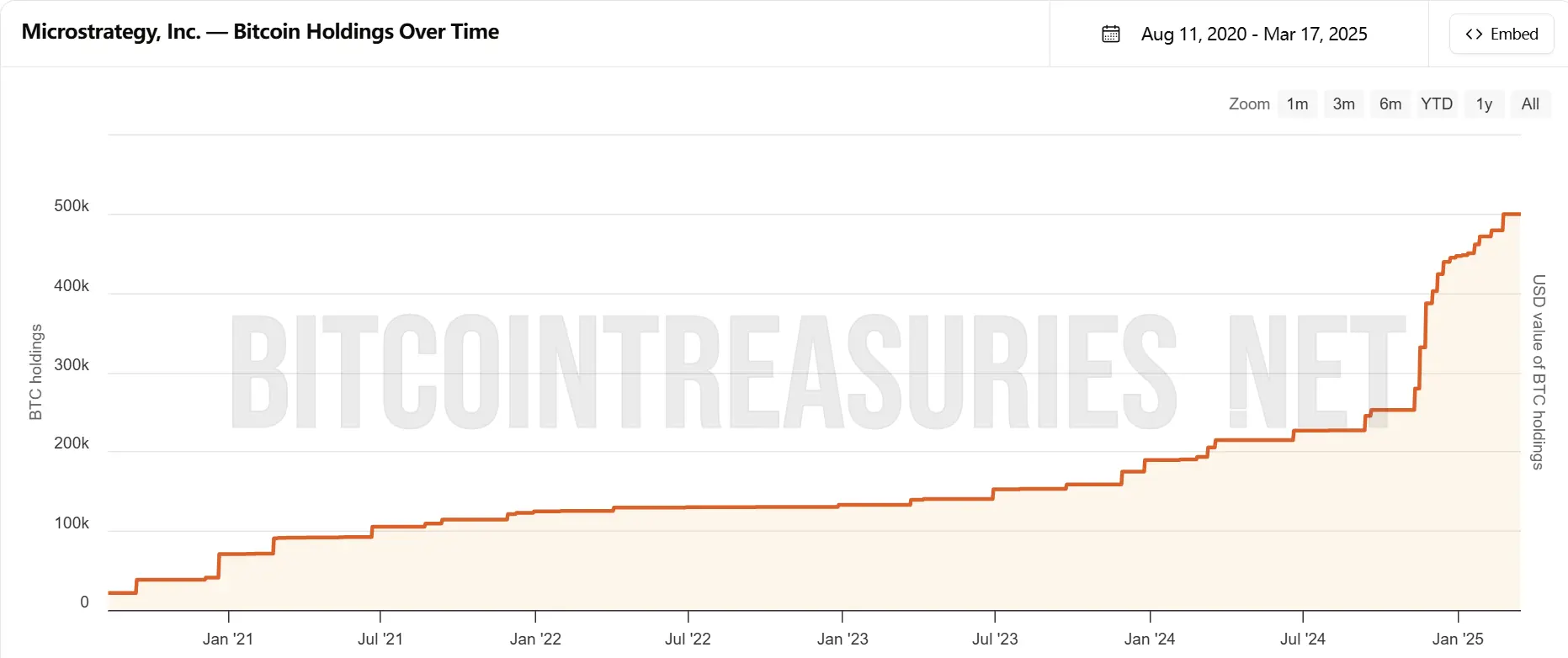

The number of BTC held by Strategy. Source: bitcointreasuries.net

What’s Different About Preferred Stock?

Compared to previous financing methods, the perpetual preferred stock that Strategy is applying for has a distinctly different structure. In the past, the company primarily relied on debt financing and stock issuance to obtain funds, while this preferred stock issuance finds a new balance between traditional equity financing and debt financing.

The biggest difference between preferred stock and common stock is that it does not fully depend on company performance and has no fixed maturity date or repayment requirements. It is more like a financial instrument that is "in between," allowing holders to receive fixed dividend income regularly while being convertible into common stock under certain conditions.

For Strategy, this means it can continuously raise funds by issuing preferred stock without the pressure of traditional debt financing repayment. Compared to previously issued convertible bonds and preferred secured bonds, this financing method offers greater flexibility and reduces short-term financial burdens.

Of course, this model is not without cost. The annual interest rate for preferred stock is set at 8%, which is significantly higher than the 0%-0.75% for previously issued convertible bonds and 6.125% for preferred secured bonds. The core question from the market is how the company will cover this substantial dividend cost.

Analysts speculate that Strategy may compensate for the funding gap by issuing common stock through ATM, or even directly using newly issued stock to pay dividends. While this model allows the company to raise funds quickly, it may also lead to the dilution of common stock shareholders' equity.

Is It a Good Time to Bet?

If Strategy's perpetual preferred stock is approved, it will undoubtedly bring new momentum to the Bitcoin market.

In simple terms, this preferred stock represents a more flexible and lasting way for the company to raise funds, and this money will ultimately be used to purchase Bitcoin.

Compared to past methods of issuing bonds or directly selling stock for money, perpetual preferred stock has no fixed maturity date, allowing the company to finance continuously without the need to repay principal like debt. Additionally, since this preferred stock adopts a model similar to common stock issuance, Strategy can sell preferred stock to raise funds based on market conditions without waiting for approval or seeking specific investors like in bond financing.

This means that Strategy's future pace of buying Bitcoin may accelerate and can even be more stable.

However, in the current sluggish market, is it appropriate to initiate such an aggressive financing method?

Goldman Sachs senior analyst James Carter stated, "Strategy's $21 billion preferred stock issuance plan shows Saylor's extreme optimism about Bitcoin, but such high-leverage operations may exacerbate volatility risks in the current market downturn."

Citigroup fintech researcher Michael Evans believes, "In the context of overall pressure on the cryptocurrency market, Strategy's choice reflects its judgment on future trends. If the market rebounds, the returns could be astonishing, but currently, attention should be paid to liquidity and changes in market sentiment."

Due to the complex financing structure of perpetual preferred stock, SEC approval may take months. The ChainCatcher editorial team will continue to follow the progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。