作者:Lawrence,火星财经

从巅峰到崩塌:Mirror的Web3梦幻与破灭

在Web3的狂潮中,Mirror曾一度被视为内容创作的未来。然而,随着时间的推移,这个曾引领去中心化革命的先锋平台,正迅速滑向沉寂。

根据网站流量分析平台SimilarWeb的数据,Mirror官网在最近一个月的总访问量为64.2万,较上月下降了23.8%,相比巅峰时期更是跌幅惊人——在区块链行业网站排行榜上,Mirror已跌至第2183名。

这一切的变化,背后藏着去中心化梦想的破灭与现实的残酷碰撞。从创新的火花到泡沫的破裂,Mirror的兴衰背后,究竟隐藏着怎样的行业反思?

起源:重构创作者经济的野心(2020-2021)

作为Web3浪潮中最早探索“所有权经济”的平台,Mirror的诞生与加密世界的两大叙事密不可分:NFT资产化与DAO治理实验。

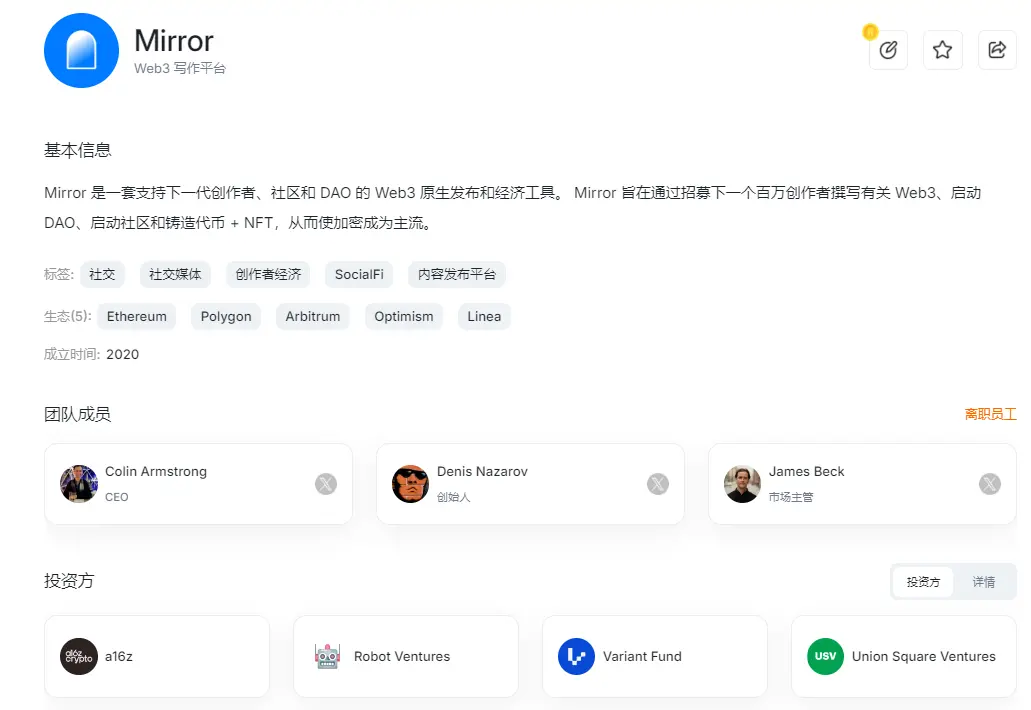

其创始人Denis Nazarov(前a16z合伙人)在2020年末推出产品原型时,便锚定了一个颠覆性命题——将内容创作从平台垄断中解放,让创作者直接掌握内容所有权与收益权。

初期功能设计直击传统平台痛点:

- 内容NFT化:每篇文章可铸造为NFT,创作者保留永久版权,并通过二级市场交易获得分成;

- 众筹工具:支持创作者发起链上众筹,支持者以ETH投资并获得项目代币,形成“创作-融资-收益共享”闭环(典型案例:Emily Segal小说众筹40.8万元);

- 去中心化存储:基于Arweave实现内容永久存储,规避平台删改风险;

- 代币经济实验:允许发行ERC-20代币,构建粉丝经济生态。

这些功能迅速吸引加密原生创作者,2021年巅峰期,Mirror月访问量突破千万级,位列区块链应用流量榜TOP 50,被视作“Web3版Medium”。

其成功逻辑在于:将内容价值直接映射为链上资产,并通过代币机制重构创作者、投资者、传播者的利益分配。

巅峰:DAO工具包与“Web3媒体帝国”幻梦(2021-2022)

2021年牛市期间,Mirror迎来高光时刻。随着DAO概念的爆发,平台推出Splits(收益分润)、TokenRace(社区投票)等工具,试图成为“DAO操作系统”。典型案例如篮球社区The Krause House通过Mirror众筹1000 ETH(约合280万美元),并借助代币实现治理权分配。

此时Mirror的定位已从内容平台转向Web3基础设施:

- 技术层:整合ENS域名、MetaMask钱包等组件,降低用户进入门槛;

- 生态层:开放API吸引开发者构建第三方工具(如文章搜索引擎Askmirror.xyz);

- 叙事层:宣称要打造“价值互联网的路演平台”,连接创作者、投资者与社区。

这一阶段,Mirror月均访问量稳定在千万以上,链上数据显示其累计铸造超10万篇NFT内容,众筹总额突破5000 ETH。Denis Nazarov甚至提出“每个DAO都需要一个Mirror主页”的愿景。

裂痕:战略摇摆与产品短板(2022-2023)

1. 功能定位迷失

Mirror在“工具平台”与“媒体社区”之间反复摇摆:

- 2022年8月突然下架NFT与众筹功能,转向纯内容发布;

- 2023年又重启“Subscribe to Mint”订阅制NFT功能,但未解决创作者流量分发难题;

- 基础功能(如数据分析、订阅系统)长期依赖第三方开发,官方迭代停滞。

2. 监管压力与合规困境

美国SEC对代币发行的审查趋严,迫使Mirror放弃最具吸引力的“众筹-代币”模式。部分项目(如The Krause House)因涉嫌证券违规遭调查,导致投资者信心崩塌。

3. 用户增长瓶颈

对比传统平台,Mirror始终未能突破加密圈层:

- 操作门槛高:需熟悉钱包操作、Gas费支付等流程;

- 内容质量参差:大量项目方软文与投机性内容充斥;

- 体验割裂:文章阅读、NFT交易、社区互动分散在不同界面。

至2023年底,Mirror月访问量暴跌至200万以下,跌出区块链应用前200名。

崩塌:收购、转型与行业反思(2024-2025)

2024年5月,Paragraph宣布收购Mirror,标志着其独立运营时代的终结。交易细节显示:

- Mirror估值较巅峰期缩水90%,母公司Reflective Technologies Inc.以“技术债务过高、商业模式模糊”为由低价抛售;

- 核心团队转向开发社交应用Kiosk,主打“链上社交+资产交易”,但产品未脱离Farcaster框架;

- 原有内容生态迁移至Paragraph,大量创作者因分成比例下降出走。

如果说此前的战略失误尚可归咎于市场环境,那么2025年1月13日凌晨的“链上断更事件”,则彻底撕碎了Mirror最后的遮羞布。

当日0点38分(GMT+8),平台在未发布任何公告的情况下,将所有新发布文章强制存储于中心化服务器,停止内容上链。

尽管团队辩称“Arweave存储成本过高,需优化用户体验”,但链上浏览器数据显示:此后两个月内,Mirror合约地址仅新增3笔交互记录,且均为旧文章修改操作。

这意味着,这个曾标榜“数据永久主权”的平台,在Web3叙事最核心的战场——内容不可篡改性上,亲手按下了删除键。

社区反应堪称惨烈:

- 创作者集体抗议:头部加密艺术家pplpleasr撤回全部作品,并公开嘲讽:“Mirror的服务器寿命可能比我家的Wi-Fi路由器还短”;

- 数据迁移潮爆发:Paragraph、Lens Protocol等竞品单周入驻创作者激增400%,部分用户甚至手动将文章哈希刻录至比特币Ordinals协议;

- 链上证据存档:匿名开发者@0xSisyphus抓取Mirror服务器数据对比链上记录,发现至少12%的历史文章已被篡改(包括删除监管敏感内容)。

这场闹剧的荒诞性在于:当用户质问“为何不提前告知”时,Mirror客服竟引用《用户协议》第4.7条——“平台有权单方面调整存储策略”。

而这份协议的早期版本中,该条款原本写着“所有内容默认永久上链”。有用户翻出2021年Denis Nazarov的演讲视频,画面中的他正高举“Storing on-chain is a human right”(上链存储是人权)的标语——如今这条视频在NFT市场挂价0.0001 ETH,标注“历史讽刺艺术品”。

解剖死亡:当“去中心化”沦为增长工具

Mirror的崩溃绝非偶然。回看其发展轨迹,“伪去中心化”基因早在2022年便已埋下:

1. 选择性上链的“障眼法”

尽管宣传“全链存储”,但Mirror始终将核心数据握于手中:

- 用户关系图谱:粉丝订阅、阅读记录等数据从未上链;

- 流量分配规则:文章推荐算法始终是未开源的黑箱系统;

- 收益分成逻辑:平台抽成比例调整无需社区投票,由旧金山总部直接决策。

- 这种“关键数据中心化,边缘数据上链”的策略,本质上与Web2平台“用API开放度换监管合规”的操作如出一辙。

2. 经济模型的“剥削性转身”

2023年推出的“Subscribe to Mint”功能暴露了Mirror的底层逻辑:

- 创作者:需支付5%平台税+Gas费才能发行订阅NFT;

- 读者:需质押代币获得投票权,影响文章推荐排名;

- 平台:通过控制代币释放节奏,事实上重建了“流量采买-算法操控-抽成收割”的Web2闭环。

这种设计被加密经济学家Tina Heidenberg痛批:“用区块链技术复刻了YouTube的广告分账体系,但效率更低、更不透明。”

3. 基础设施的“自杀式妥协”

为追求用户增长,Mirror多次降低技术标准:

- 2023年取消强制ENS域名绑定,允许邮箱注册(导致女巫攻击激增);

- 2024年引入“链下签名”方案,实质上将私钥托管给平台服务器;

- 2025年彻底弃用Arweave,改用AWS新加坡节点存储数据。

当团队在技术栈上层层退让时,Mirror早已不是Web3世界的圣杯,而沦为挂着骷髅旗的AWS子目录。

尾声:写在Web3的“柏林墙”倒塌之夜

2025年3月,当最后一批Mirror创作者在X平台发出“#RIPMirror”的悼词时,人们终于意识到:Web3革命从未承诺过温柔乡,它需要一场彻底的技术清剿——杀死所有不敢将服务器关进笼子的“仿冒先知”。

正如比特币核心开发者Jameson Lopp在悼文中所写:“Mirror的墓碑应当刻上所有Web3创业者的誓言:若你们仍想操控数据的生杀大权,请坦荡地回到硅谷,别用‘去中心化’亵渎加密信徒的教堂。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。