At 1 p.m. Eastern Time on Sunday, March 16, all eyes were on a Hyperliquid trader known as “0xf3f.” The trader placed about $16.2 million into the decentralized derivatives platform, securing a high-stakes bitcoin short position with 40x leverage.

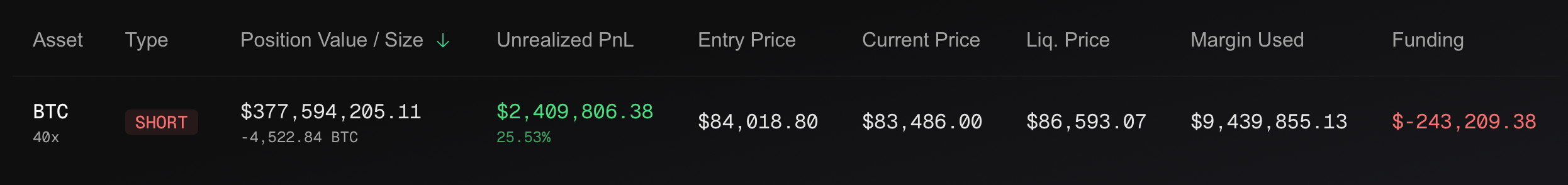

The trader’s position at 1 p.m. ET on March 16, 2025.

With an entry price of $84,018 and a liquidation threshold at $86,593, the position packs a notional value of roughly $379 million, keeping market watchers on edge. In an unexpected twist on Hyperliquid, trader “0xf3f” decided to switch up their account username to “Tether FUD.”

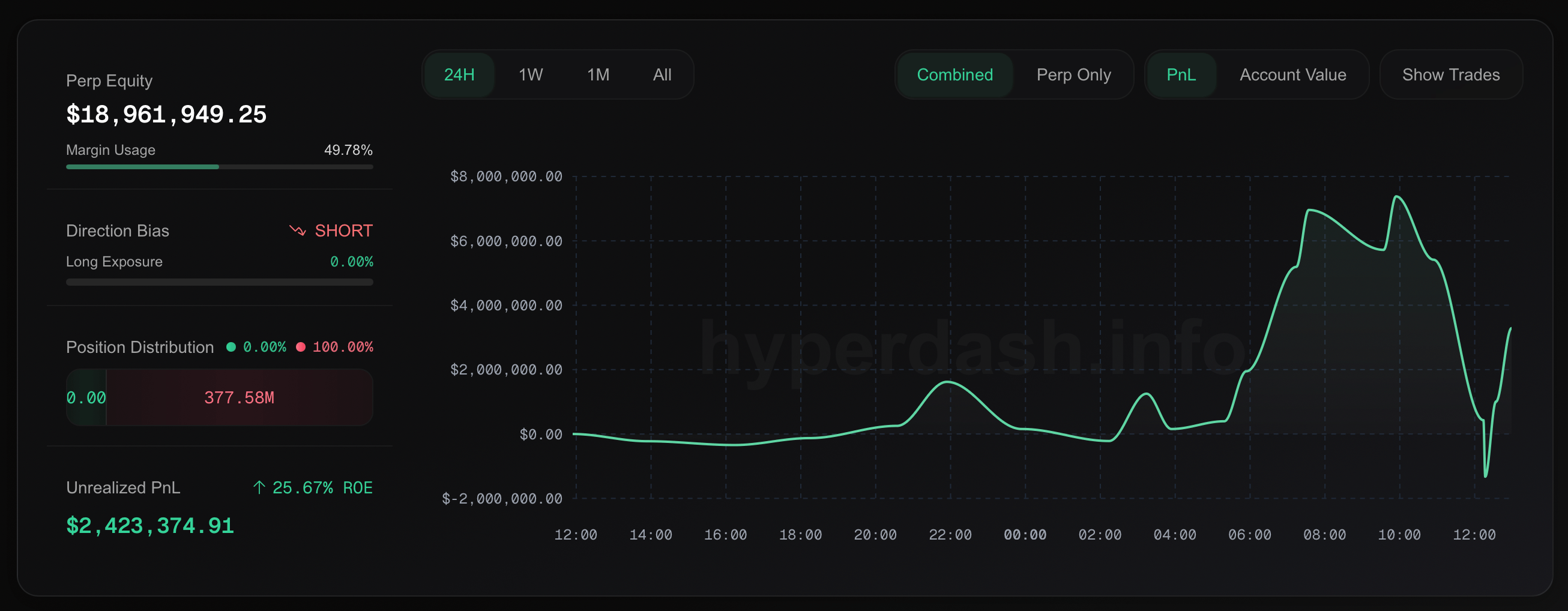

The trader’s position at 1 p.m. ET on March 16, 2025.

Meanwhile, BTC’s price was hovering just above $84,000, and at around 12:05 p.m. Eastern Time, the trader came dangerously close to liquidation when bitcoin briefly spiked to $85,059 per coin. Some in the crypto community were eagerly watching, convinced that market making hawks were aware of the short position and aiming to force it into liquidation.

But BTC didn’t stay elevated for long. The price quickly dipped back to the low-$84,000 range before sliding further down to $83,906 per coin. With every drop, the trader’s short position moves deeper into profitable territory.

BTC/USD price at 1 p.m. ET on March 16, 2025.

At BTC’s current value, they’re sitting on an unrealized gain of roughly $2.4 million. Many speculate that this trader might have insight that the general public lacks, given the size of their short bet. Regardless of what they know—or don’t know—one thing is clear: as long as BTC stays under $84,000, “Tether FUD” is in the green. By 1:10 p.m., BTC held above the $84,000 range, shortening the trader’s floating profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。