Author: defioasis

Editor: Colin Wu

Recently, Binance founder CZ expressed the idea of time-based assetization, where KOLs (Key Opinion Leaders) can assetize their time. The basic concept is that anyone can prepay an amount to a KOL to send a message, allowing KOLs to exist as advisors and be compensated for their expertise and fame. CZ's main idea advocates using BNB as the payment currency without the need to issue new assets. Before CZ's idea, there were attempts at KOL assetization, from friend tech to Clout and Tribe Run, which were invested in by AllianceDAO, but all ultimately failed. Another platform, time fun, which is backed by AllianceDAO and core members of Solana, is still exploring time assetization with ongoing support from Solana co-founder toly.

Unlike CZ's consideration of using BNB as a payment method and not needing to issue new time assets, time fun's core includes creators (celebrities/KOLs) issuing time assets and using time assets as a payment method. In simple terms, after launching on time fun, creators allow users to purchase time assets within the platform, and when the internal market cap reaches $100,000, it will launch to external DEX; users can hold a certain amount of time assets to join the creator's chat group or pay the required time assets in exchange for interaction opportunities, including DMs, voice meetings, and video conferences. This means that before practicality, creators need to issue their own time assets, which can actually be seen as a variant of celebrity token issuance, as only the time of celebrities holds value. [Note: In the following text, "celebrities" will replace "creators," and KOLs are also part of celebrities.]

Since Trump launched his own Trump Memecoin, Trump's wife, Argentine President Milei, and some leaders of small countries have successively launched their own Memecoins. Among these, incidents of certain celebrities or government officials' accounts being hacked to post fake CA links have emerged one after another, making it one of the challenges to verify the authenticity of celebrity posts; another challenge is that celebrities have no obligation to manage the assets after posting. Time fun provides solutions to these two issues to some extent.

First, celebrities need to go through at least two layers of verification to issue assets on time fun, which includes binding their Twitter account on time fun and platform manual verification. After manual verification is completed, a Time Market Code will be given to the celebrity, which is used to set the amount required to join group chats or DM/voice/video meetings. The former is priced in coin units, while the latter is priced in U units, but both are paid with time assets. After completing the setup, the celebrity can launch their own time assets.

After the celebrity launches, users can prepay a certain amount of time assets based on the amount set by the celebrity to gain interaction opportunities. Of course, celebrities can refuse DMs/meetings, and the prepaid time assets will be refunded; however, time fun has set up a response rate and user rating mechanism as a form of supervision. A low response rate from celebrities or users giving low scores due to dissatisfaction with the celebrity's performance in private chats could theoretically affect the functionality of the celebrity's time assets in terms of practicality, further impacting the price.

Currently, the platform is mainly active with investors behind time fun, such as Solana co-founders toly and raj, and AllianceDAO co-founder QwQiao. These investors with backgrounds in ecosystems provide Web3 entrepreneurs with opportunities to face high-level individuals directly, but if the platform wants to gain more exposure, it cannot be limited to celebrities within the crypto circle. How to bring in non-crypto or weakly related celebrities, even national presidents, is a significant test of the team's and investors' resources and influence in the real world. Time fun CMO Pedro recently stated in the community that they will introduce some OnlyFans creators. The once-popular friend tech surged in KOL assetization due to a large number of OnlyFans creators joining.

From the perspective of product trading forms, celebrity token trading on time fun can be divided into three situations: limited to internal trading on the platform, external trading on the platform, and external trading directly on DEX without using the platform. It is worth noting that whether in internal trading or already launched to external DEX, users can recharge USDC into the time fun platform to trade time assets without paying gas fees under non-custodial wallets.

Limited to Internal Trading on the Platform

Although the text has been discussing "celebrities issuing tokens," in the actual chain of launching on time fun, the platform takes on the role of Token Creator for any celebrity, which may help celebrities avoid certain legal risks.

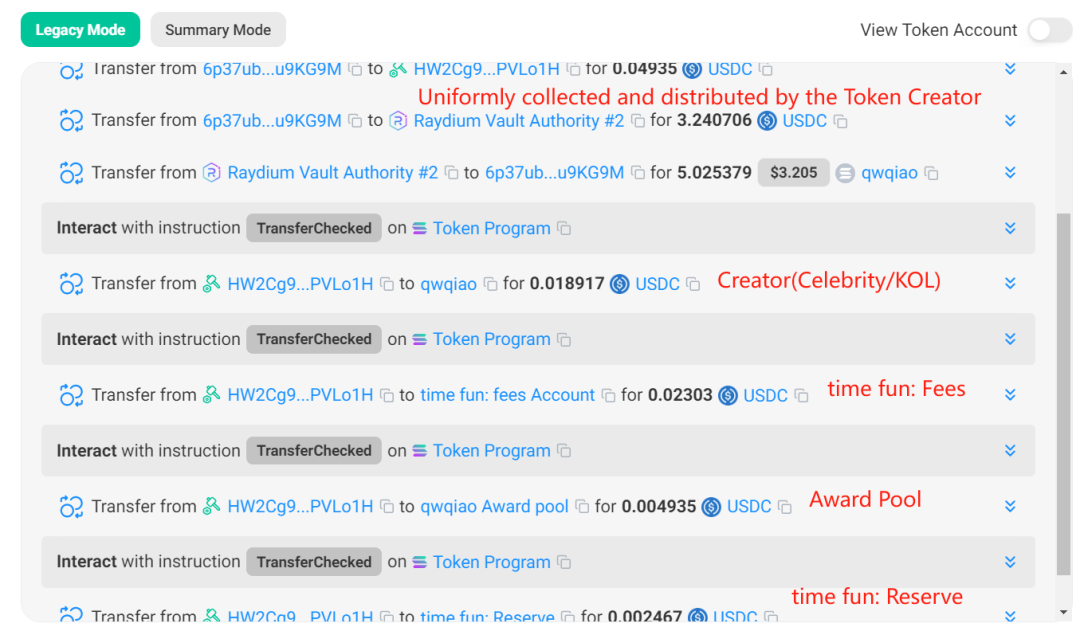

In internal trading, users are required to pay 0.5 USDC to the platform as the Token Creator. After deducting this 0.5 USDC, 2.15% of the total amount of USDC exchanged by the user will be allocated to multiple entities, including 0.87% to time fun as fee income, 0.15% to the time fun reserve address (exit circulation), 1% to the celebrity address, and 0.13% to the Bonding Curve (which may flow into the dividend pool).

External Trading on the Platform

External trading on time fun refers to when the market value of celebrity time assets reaches $100,000, at which point liquidity will be migrated to DEX - Raydium, using USDC as the trading pair. The total amount of any celebrity's time assets is fixed at $100,000, meaning that when the price reaches $1, liquidity migration will occur. After successfully launching to external trading, it can still be traded within the platform.

In external trading on the platform, the platform, as the Token Creator, charges users 1.5% of the USDC when exchanging time assets for distribution to multiple entities, including 0.575% to the celebrity address, 0.7% to time fun as fee income, 0.15% to the dividend pool, and 0.075% to the time fun reserve address (exit circulation).

External Trading Directly on DEX Without Using the Platform

When trading celebrity time assets directly on DEX or DEX aggregators without using the time fun platform, there are no USDC fees to be paid to the platform or the celebrity.

For users, in addition to trading and spending time assets, holding time assets and remaining active on the time fun platform can earn rewards from the dividend pool in the future. However, the dividend pool is currently in the accumulation stage and has not yet opened for formal dividends.

For celebrities, the ways to earn income are divided into taxing user transactions on the platform and returning 94% of the USDC from time assets paid by users through DMs/meetings after being sold on DEX back to the celebrities. Of course, based on the donation ratio set by the celebrity, 0-100% of the received USDC income can be donated to charitable organizations, with the remaining portion as the celebrity's net income.

For the platform, the main way to earn income comes from taxing user transactions on the platform. However, whether for the platform or celebrities, when traders directly trade on the external Raydium, they cannot earn income, so actual income will be limited by the platform's deposit scale and user base. On-chain data shows that since its inception, as of March 12, the time fun platform has captured approximately 422,000 USDC in user transactions and has collected about 2,130 USDC in total income as the Token Creator in internal trading. Enhancing the platform's visibility and income is more important, and the platform needs to work hard to attract more non-Web3 traffic celebrities.

Overall, from the perspective of product design, time fun still has some areas for improvement. First, the platform needs to support direct connections with external wallets. Currently, the platform only supports email registration and login, and after completing email registration, a non-custodial wallet is generated and bound to the platform. This design may aim to provide a more convenient way for Web2 celebrities to join and offer a gas-free experience within the platform, but the problem it brings is that the platform is limited by the deposit scale and deposit users, and users who purchase directly on DEX cannot log in through wallet connections, thus failing to utilize the practicality of assets, ultimately becoming more of a speculative tool. The most significant phenomenon is that the number of addresses meeting the minimum holding requirement can join the celebrity's group chat, but the actual number of people joining the chat group is far less than the number of qualifying holding addresses.

Another notable issue is that the time assets paid to celebrities for DMs/meetings are used for direct sale on DEX and then returned to the celebrities, meaning that the action of users interacting with celebrities through DMs/meetings is essentially a sale. The demand for interaction with celebrities will exist in the long term, but when trading is not very active, prices will continue to be under pressure. The newly introduced reserve mechanism somewhat hedges this issue by extracting a portion as reserves in transactions to reduce actual circulation.

Finally, the platform lacks a user sharing mechanism. User-initiated sharing helps the platform expand its user base. Most users seek to share profits from celebrity time assets, but aside from the trading aspect, the platform could introduce a "paid unlock content" sharing model. After users send DMs to celebrities and receive answers, they can choose to set the celebrity's reply to "hidden" or "semi-hidden" status and share the DM question, such as on Twitter. Other users interested in this content can unlock and view it by paying a certain amount of time assets, with a portion of this as income distributed to the celebrity, and the questioner can also receive a certain asset reward. Interesting questions and celebrity replies can enhance user engagement and the platform's attractiveness.

This article does not constitute any financial advice, and readers are advised to strictly comply with the laws and regulations of their location.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。