作者:equilibrium

翻译:善欧巴,金色财经

链上借贷协议作为互联网金融的基石,其愿景是为全球个人和企业提供公平的资本获取渠道,无论他们身在何处。这种模式有助于建立更公平、更高效的资本市场,从而推动经济增长。

尽管链上借贷潜力巨大,但当前的主要用户群仍然是加密原生用户,且用途大多局限于投机交易。这极大地限制了其可覆盖的市场总量(TAM)。

本文探讨了如何逐步扩大用户群体,并向更具生产力的借贷场景过渡,同时应对可能面临的挑战。

链上借贷的现状

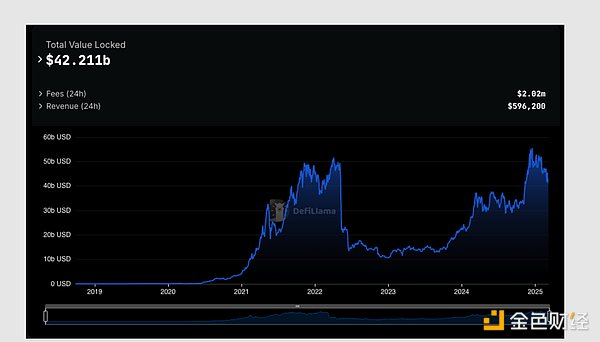

在短短几年内,链上借贷市场从概念阶段发展成为多个经过市场考验的协议,经历了多次剧烈波动的市场考验,且未产生坏账。截至目前,这些协议共吸引了 437 亿美元的存款,并发放了 186 亿美元的未偿贷款。

来源:DefiLlama

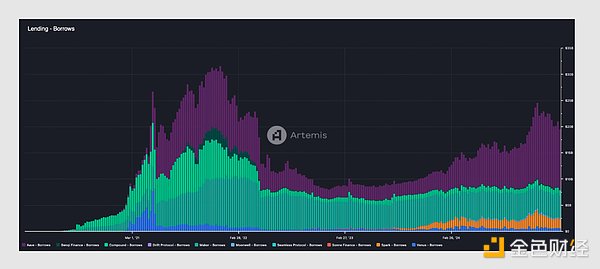

来源:Artemis

目前,链上借贷协议的主要需求来源包括:

- 投机交易:加密投资者利用杠杆购买更多加密资产(例如,以 BTC 作为抵押借入 USDC,然后再买入更多 BTC,甚至循环多次以提高杠杆倍数)。

- 流动性获取:投资者通过借贷获取加密资产的流动性,而无需出售资产,从而避免资本利得税(视所在司法管辖区而定)。

- 套利闪电贷:一种极短期贷款(在同一区块内借入并归还),用于套利交易者利用市场短暂的价格失衡并进行价格修正。

这些应用主要服务于加密原生用户,并以投机为主。然而,链上借贷的愿景远不止于此。

相较于全球未偿债务总额 320 万亿美元,或家庭和非金融企业的贷款总额 120 万亿美元,链上借贷协议当前的 186 亿美元未偿贷款 仅占其中的微不足道的一部分。

来源:国际金融协会全球债务监测

随着链上借贷逐步向更具生产力的资本用途(例如小企业融资、个人购车或购房贷款)转型,其市场规模(TAM)有望实现数个数量级的增长。

链上借贷的未来

要提升链上借贷的实用性,需要进行两大关键改进:

1. 扩大抵押资产范围

当前,只有少数加密资产可用作抵押品,这极大地限制了潜在借款人的数量。此外,为了弥补加密资产的高波动性,现有的链上借贷通常要求 高达 2 倍或更高的抵押率,进一步抑制了借贷需求。

扩大可接受的抵押资产范围,不仅可以吸引更多投资者使用其投资组合进行借贷,还能提高链上借贷协议的放贷能力。

2. 推动超低额抵押借贷

目前,大多数链上借贷协议都采用超额抵押模式(即借款人必须提供的抵押资产价值高于借款金额)。这种模式导致资本利用效率低下,使许多实际应用场景(如小企业融资)难以实现。

通过采用超低额抵押借贷,链上借贷可以覆盖更广泛的借款人群体,进一步提升其实用性。

上述改进措施的实现难度各不相同,其中一些相对容易实施,而另一些则会带来新的挑战。然而,优化过程可以从易到难,逐步推进。

此外,固定利率借贷 也是链上借贷发展中的一项重要特性,不过这一问题可以通过第三方承担借款人的利率风险(如通过利率掉期或借贷双方的定制协议)来解决,因此本文不作详细讨论(目前已有协议,如 Notional,提供固定利率借贷服务)。

1. 扩大抵押资产范围

与全球其他资产类别相比,例如 公共股权市场(124 万亿美元)、固定收益市场(140 万亿美元) 和 房地产市场(380 万亿美元),加密货币市场的总市值 仅为 3 万亿美元,仅占全球金融资产的一小部分。因此,将抵押品范围限制在部分加密资产上,大大限制了链上借贷的增长,尤其是当抵押要求高达 2 倍甚至更高 以补偿加密资产的高波动性时。

将资产代币化 与链上借贷结合,使投资者能够更有效地利用其整个投资组合 进行借贷,而不仅限于加密资产的一个小部分,从而拓宽潜在借款人的范围。

扩大抵押资产范围的第一步 可能会从流动性高、交易频繁的资产(如股票、货币市场基金、债券等)开始,这类资产对现有的借贷协议影响较小,改动成本较低。然而,监管审批的速度将成为该领域增长的主要限制因素。

长期来看,扩大到流动性较低的实物资产(如代币化房地产所有权)将提供巨大的增长潜力,但也会带来新的挑战,例如如何有效管理这些资产的债务头寸。

最终,链上借贷可能会发展到抵押房产进行按揭贷款 的程度,即 贷款发放、房产购买、以及房产存入借贷协议作为抵押品 可以在一个区块内原子性完成。同样,企业也可以通过借贷协议进行融资,例如购买工厂设备并同时将其作为抵押品存入协议。

2. 推动低额抵押借贷

目前,大多数链上借贷协议都采用超额抵押模式,即借款人必须提供的抵押资产价值高于借款金额。这种模式虽然确保了贷方的安全,但也导致资本利用效率低下,使得许多实际应用场景(如小企业营运资金贷款)难以实现。

在加密行业内,低额抵押借贷的初期需求可能会来自做市商和其他加密原生机构,这些机构在中心化借贷平台(如 BlockFi、Genesis、Celsius)倒闭后,仍然需要融资渠道。然而,早期的去中心化低额抵押借贷尝试(如 Goldfinch 和 Maple)大多将借贷逻辑放在链下处理,或者最终转向了超额抵押模式。

一个值得关注的新项目是 Wildcat Finance,它试图在保留更多链上组件的同时,重新引入低额抵押借贷。Wildcat 仅作为借款人与贷款人之间的匹配引擎,由贷款人自行评估借款人的信用风险,而非依赖于链下的信用审核流程。

在加密行业之外,低额抵押借贷借贷已经广泛应用于个人贷款(如信用卡债务、BNPL 先买后付) 和商业借贷(如营运资金贷款、小额信贷、贸易融资和企业信用额度)。

链上借贷产品的最大增长机会 在于那些传统银行无法有效覆盖的市场,例如:

1.个人借贷市场:近年来,非传统贷款机构 在个人低额抵押贷款市场中的份额持续增加,特别是在 低收入和中等收入群体 中。链上借贷可以作为这种趋势的自然延伸,为消费者提供更具竞争力的贷款利率。

2.小企业融资:由于贷款金额较小,大型银行往往不愿向小企业提供贷款,无论是用于业务扩张还是营运资金。链上借贷可以填补这一空白,提供更便捷、高效的融资渠道。

待解决的挑战

尽管上述两项改进将大幅扩大链上借贷的潜在用户群,并支持更多高效的金融应用,但它们也引入了一系列新的挑战,包括:

1. 处理由非流动性资产支持的债务头寸

加密资产 24/7 全天候交易,其他流动性较高的资产(如股票、债券)则通常在 周一至周五交易,但非流动性资产(如房地产、艺术品)的价格更新频率远低于此。价格更新的不规律性会使债务头寸的管理更加复杂,尤其是在市场剧烈波动的时期。

2. 物理抵押资产的清算问题

虽然实物资产的所有权 可以通过代币化的方式映射到链上,但其清算过程远比链上资产复杂。例如,在代币化房地产的场景下,资产所有者可能会拒绝腾出房产,甚至需要通过法律程序才能执行清算。

鉴于链上借贷协议(以及个体贷款人)无法直接处理清算过程,一种解决方案是将清算权折价出售 给本地的债务催收机构,由其负责处理清算事务。这类机制需要与现实世界的法律体系深度结合,以确保资产变现的可行性。

3. 风险溢价的确定

违约风险是借贷业务的一部分,但这种风险应反映在风险溢价中(即在无风险利率基础上增加的额外利率)。特别是在低额抵押贷款 领域,准确评估借款人的违约风险至关重要。

目前已有多种工具可以用于估算违约风险,取决于借款人类别:

•个人借款人:Web 证明、零知识证明(ZKP)和去中心化身份协议(DID) 可帮助个人在保护隐私的前提下证明其 信用评分、收入状况、就业情况等。

•企业借款人:通过整合主流会计软件和经审计的财务报告,企业可以在链上证明其 现金流、资产负债表等财务状况。未来,如果金融数据完全链上化,公司财务信息可以直接与借贷协议或第三方信用评级服务无缝集成,以更去信任化的方式评估信用风险。

4. 去中心化信用风险模型

传统银行依赖于内部用户数据 和 外部公开数据 训练信用风险模型,以评估借款人的违约概率。然而,这种数据孤岛效应 带来了两大问题:新进入者难以竞争,因为他们无法访问同等规模的数据集。数据的去中心化处理难度较大,因为信用评估模型不能由单一实体控制,同时用户数据必须保持隐私性。

幸运的是,去中心化训练与隐私计算 领域正在快速发展,未来的去中心化协议 有望利用这些技术训练信用风险模型,并以隐私保护的方式执行推理计算,从而在链上实现更公平、高效的信用评估体系。

其他挑战包括链上隐私、随着抵押品池扩大而调整风险参数、法规遵从性以及更容易将借入的收益用于现实世界的效用。

结论

过去几年,链上借贷协议奠定了坚实的基础,但它们尚未真正发挥出其全部潜力。

下一阶段的链上借贷将更加激动人心:协议将逐步从 以加密原生和投机为主的场景过渡到更加高效和现实世界相关的金融应用。

最终,链上借贷将帮助消除金融不平等,让所有企业和个人,无论身处何地,都能平等地获得资本。正如 Theia Research 所总结的:“我们的目标是建立一个净息差压缩至资本成本的金融体系”。

这将是一个值得奋斗的目标!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。