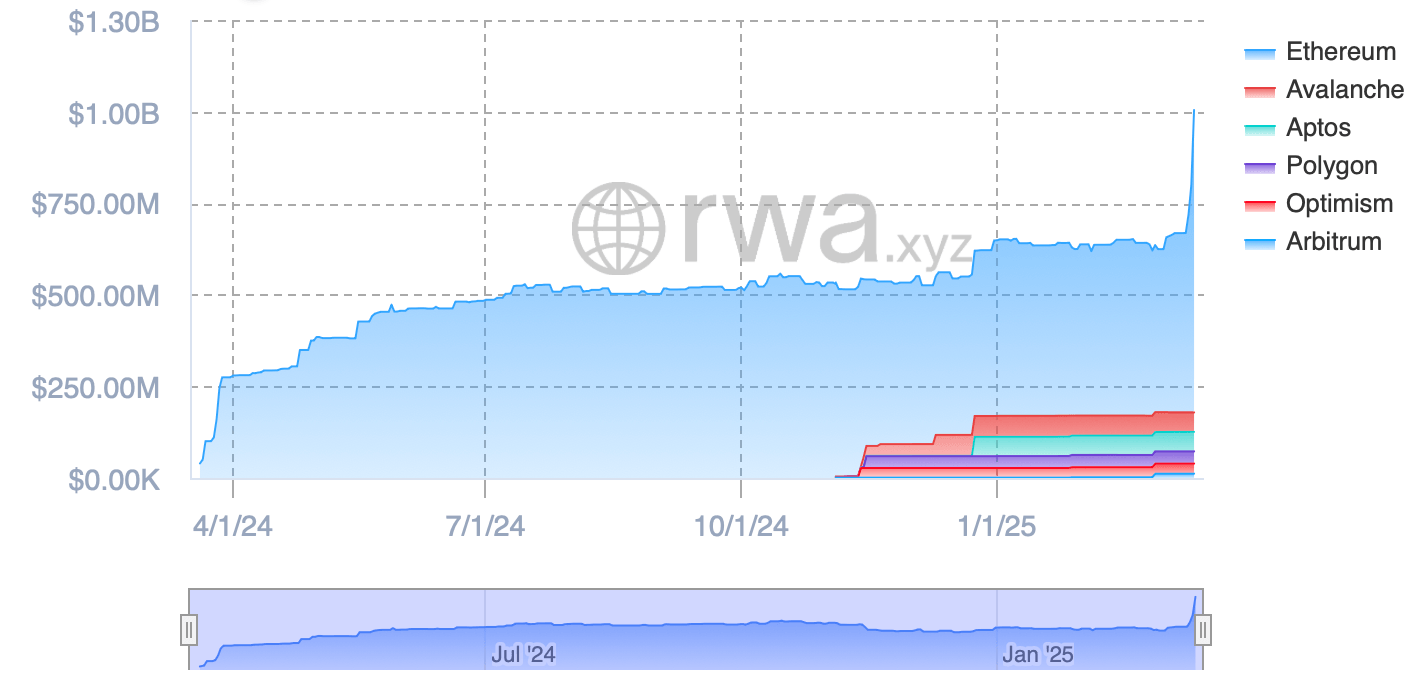

Launched in March 2024, this pioneering tokenized fund—issued on several public blockchains by Blackrock—now commands $1.004 billion in AUM. In a statement to Bitcoin.com News, Securitize, the fund’s issuer and a leading tokenization provider, highlighted this $1 billion milestone as a significant achievement, positioning BUIDL as the leading tokenized Treasury fund by AUM.

Blackrock USD Institutional Digital Liquidity Fund (BUIDL).

“Blackrock’s BUIDL surpassing $1B in AUM represents a significant moment for onchain finance,” Securitize co-founder and CEO Carlos Domingo stated. “BUIDL has set a new standard, proving to the investment community that this market is here to stay—and the momentum behind that recognition is only growing.”

On March 8, Bitcoin.com News highlighted the tokenized Treasury market surpassing the $4 billion milestone, and as of today, it has swelled to $4.4 billion, per rwa.xyz data. Trailing BUIDL is the Hashnote Short Duration Yield Coin (USYC) fund, with approximately $868 million in AUM, followed by the Franklin Onchain U.S. Government Money Fund—dubbed BENJI—holding $689 million in AUM.

Securitize noted that the BUIDL ecosystem has grown significantly since its launch, now integrating Wormhole for seamless cross-chain token transfers and accessible on blockchains including Optimism, Arbitrum, Polygon, Avalanche, and Aptos. Current metrics reveal 557 holders collectively stewarding the circulating BUIDL tokens.

“We’re grateful to Securitize, [Bank of New York Mellon] and all of our partners, and we are thrilled to see BUIDL’s growth accelerate even further,” Joseph Chalom, the head of Strategic Ecosystem Partnerships at Blackrock stated.

Many believe the tokenized bond economy is poised for exponential expansion, with analysts projecting it will reach $1 trillion by 2028. Expanded forecasts for asset tokenization suggest the market could scale to between $2 trillion and $30 trillion by 2030, spanning diverse asset categories such as equities, real estate, bonds, and commodities. Out of all the real-world-assets (RWAs) listed on rwa.xyz, the RWA economy stands at $18.34 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。