On the one-hour chart, XRP has demonstrated a strong recovery, climbing toward $2.38 with buyers maintaining control. Volume data suggests continued buying pressure; however, resistance has formed between $2.38 and $2.40. Should the price break above this level, it could trigger an extension toward $2.50 and beyond. Conversely, if XRP fails to hold support at $2.30, a decline toward $2.25 could indicate renewed selling momentum. Traders looking for short-term gains may find opportunities in this price range, with a cautious stop-loss strategy below $2.25 to mitigate potential downside risk.

XRP/USDC via Binance 1H chart on March 14, 2025.

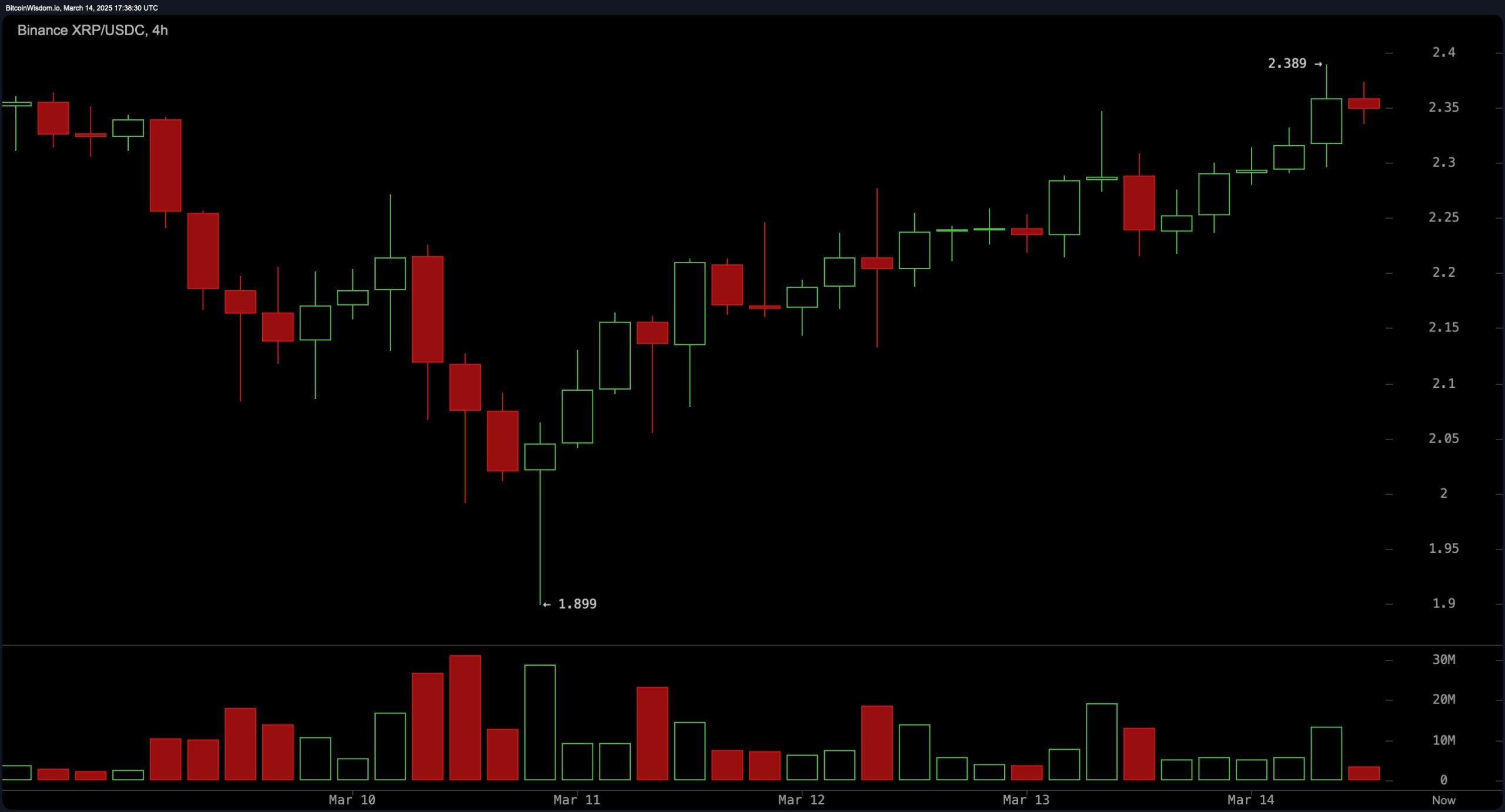

The four-hour chart reflects a steady upward trajectory after XRP reached a low of $1.89 on March 10. The price is currently testing $2.38, though trading volume has slightly declined, signaling potential exhaustion in the recent rally. Higher lows indicate a short-term uptrend, and if XRP maintains support above $2.20 to $2.25, the cryptocurrency could continue its ascent toward $2.40. A drop below $2.15, however, may weaken bullish momentum and shift market sentiment toward the downside.

XRP/USDC via Binance 4H chart on March 14, 2025.

On the daily chart, XRP has exhibited high volatility, briefly surpassing $3.00 before retracing to a low of $1.89. A strong support level has emerged between $1.89 and $2.00, while resistance remains at $2.60 to $2.70. If XRP successfully breaks above $2.50 with increasing volume, it could pave the way for a push toward $2.70 and potentially a retest of the $3.00 threshold. Failure to hold $2.30, however, could lead to a downward retest of the $2.00 region, reinforcing the importance of key technical levels in shaping the next price movement.

XRP/USDC via Binance 1D chart on March 14, 2025.

Oscillator indicators present a largely neutral outlook, with the relative strength index (RSI) at 48.79 and the Stochastic at 33.78, both indicating a lack of strong momentum in either direction. The commodity channel index (CCI) and the average directional index (ADX) are also neutral, while the awesome oscillator and momentum indicators show mild bullish signals. However, the moving average convergence divergence (MACD) remains in negative territory at -0.08376, suggesting that downward pressure is not entirely absent.

Moving averages provide mixed signals, with short-term indicators showing divergence. The exponential moving average (EMA) at 10 periods and the simple moving average (SMA) at 10 periods are both signaling a buy, while the EMA at 20, EMA at 30, SMA at 30, EMA at 50, SMA at 50, and SMA at 100 indicate selling pressure. Longer-term support remains intact, as the EMA at 100 and EMA at 200 both suggest a buy. This divergence highlights the importance of key resistance and support levels in shaping XRP’s near-term trajectory.

Bull Verdict:

XRP’s current price action indicates a steady uptrend, supported by higher lows and strong buyer interest. If the price breaks above $2.50 with increasing volume, it could trigger a move toward the $2.70 resistance level, potentially setting up a rally toward $3.00. With long-term moving averages still signaling strength and key support levels holding, the bullish case remains intact as long as XRP maintains its momentum above $2.20.

Bear Verdict:

Despite recent gains, XRP faces key resistance between $2.38 and $2.40, with declining volume on the four-hour chart suggesting a potential slowdown in buying pressure. The moving average convergence divergence (MACD) remains negative, and multiple moving averages signal selling pressure. If XRP fails to hold $2.30 and breaks below $2.15, selling momentum could push the price back toward $2.00, increasing the risk of further downside movement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。