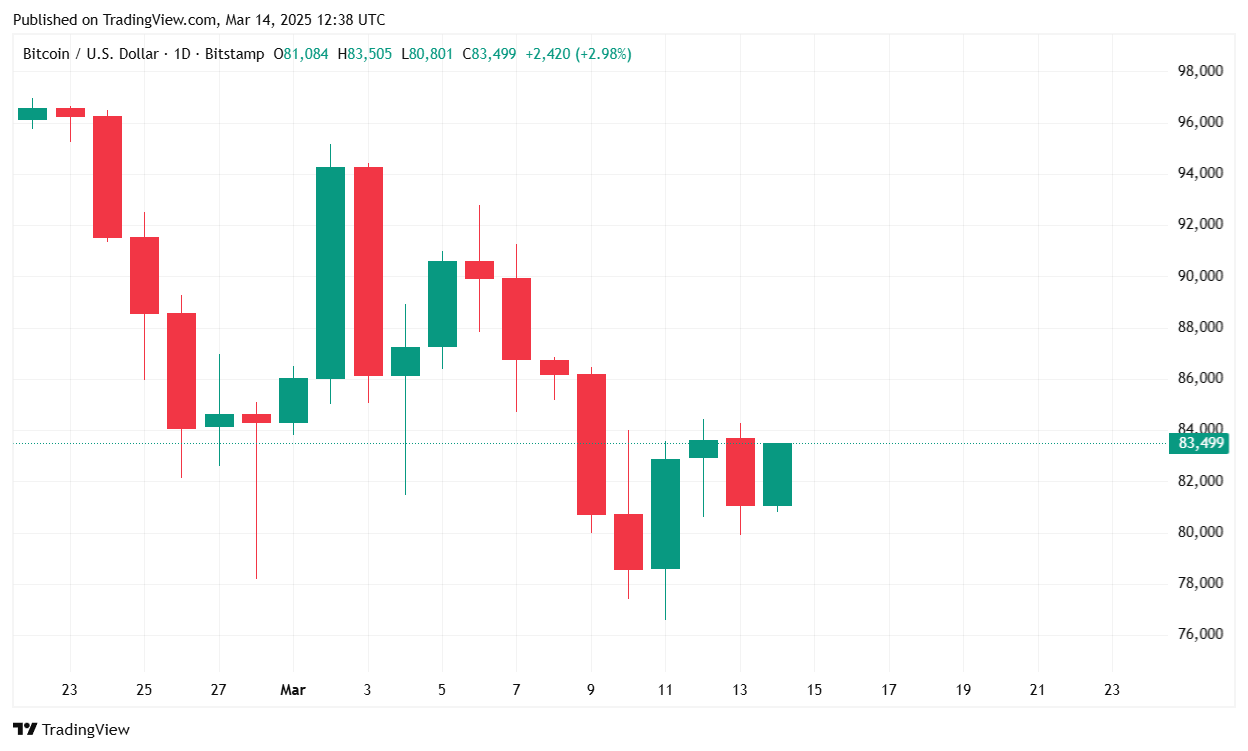

Bitcoin (BTC) saw modest gains over the past 24 hours, rising 0.76% to $83,486.74, though it remains down 6.14% over the past week. Meanwhile, gold reached as high as $3,004.86, an all-time high. BTC however, continued experiencing volatility as it traded within a 24-hour range of $79,931.85 to $83,465.91.

(BTC Price / Trading View)

- 24-hour trading volume: $28.56 billion (-15.89%)

- Market capitalization: $1.65 trillion (+0.53%)

- BTC dominance: 61.98% (-0.70%)

- BTC futures open interest: $48.38 billion (+2.11%)

- 24-hour liquidations: $66.72 million (longs: $44.56 million, shorts: $22.16 million)

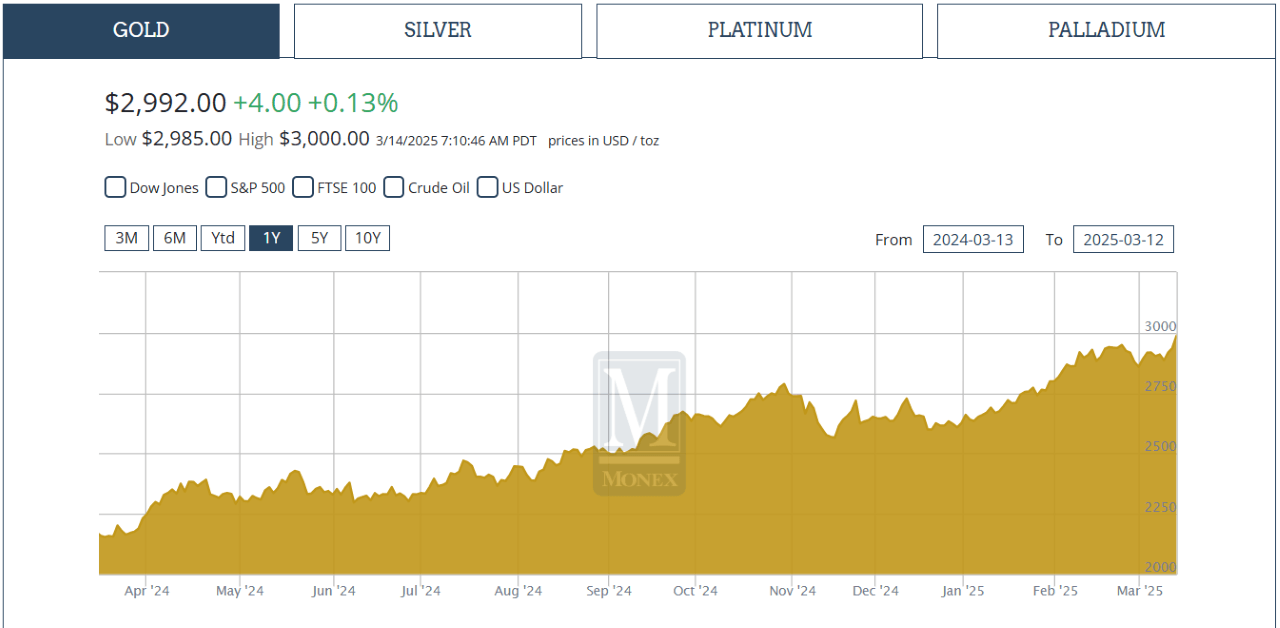

Spot gold briefly surged past $3,000 for the first time in history before settling at $2,992, according to Monex Precious Metals. The milestone is believed to be a reaction to President Donald Trump’s escalating trade tariffs, which have stoked investor concerns and driven demand for traditional safe-haven assets. While bitcoin is often dubbed “digital gold,” its muted response suggests that investors may still view physical gold as the preferred hedge against macroeconomic uncertainty.

(Gold hits all-time high of $3,000 / Monex)

The ongoing tariff dispute between the U.S. and its trading partners took another turn as the European Union retaliated against American steel and aluminum tariffs with a 50% tax on U.S. whiskey exports. In response, President Trump threatened a steep 200% tariff on European wine and spirits. These developments have heightened fears of a prolonged trade war, potentially weighing on global economic growth and influencing risk sentiment in the crypto market.

Bloomberg reports that the U.S. Federal Reserve intends to maintain current interest rates through the first half of the year, with two rate cuts expected starting in September. Lower interest rates typically benefit risk-on assets like bitcoin, as they reduce the appeal of fixed-income investments and increase liquidity in financial markets. However, for now, BTC remains under pressure from macroeconomic uncertainties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。