SIMD 228 proposes a static curve that reduces the issuance of SOL based on the staking participation rate.

Author: Carlos

Compiled by: Deep Tide TechFlow

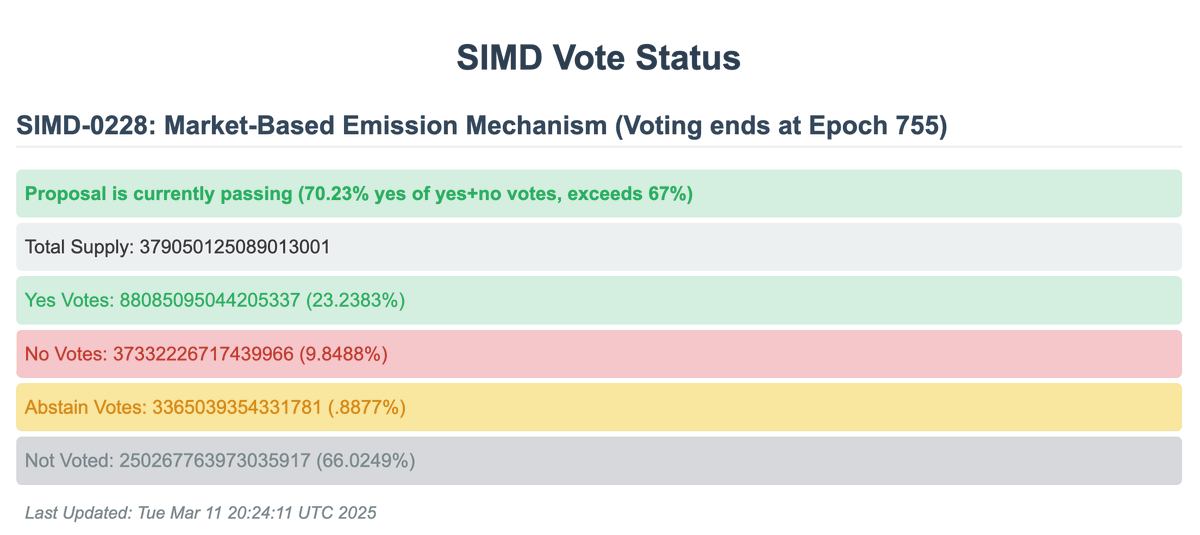

@solana The SIMD 228 proposal has reached quorum, with 70% voting in support. Voting will end at epoch 755, approximately 52 hours from now.

What is SIMD 228?

What are the reasons for support?

What are the reasons for opposition?

Let's take a closer look.

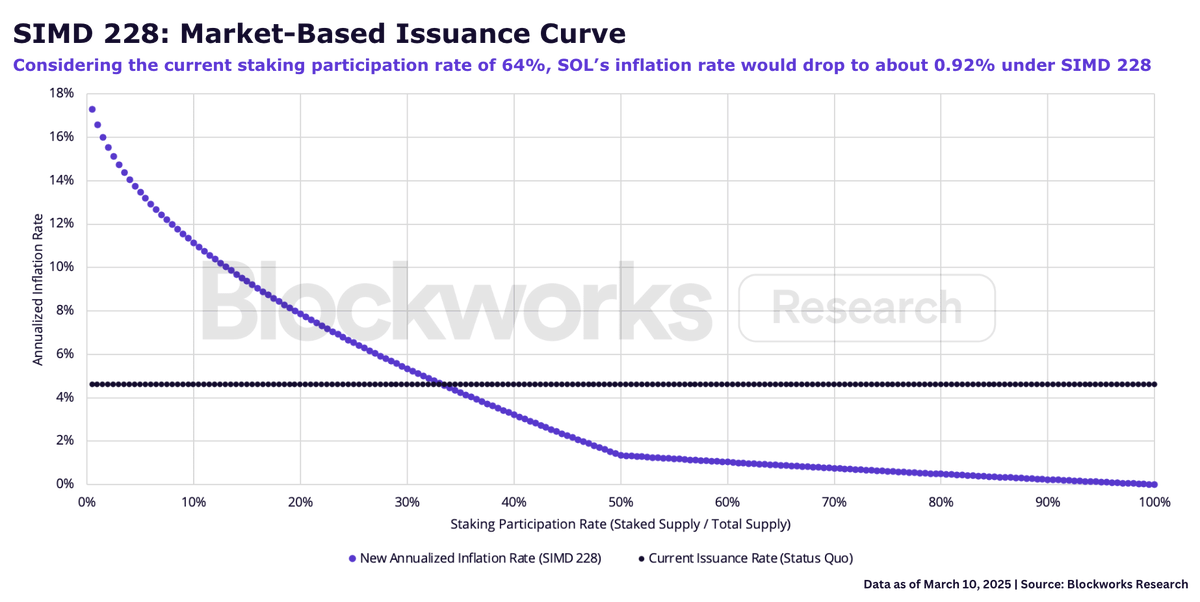

SIMD 228 proposes a static curve that reduces the issuance of SOL based on the staking participation rate. With the current staking rate at 64%, after a smoothing period following the implementation of SIMD 228, the inflation rate of SOL will drop to about 0.92%. Notably, when the staking rate falls below 50%, the curve becomes more aggressive, resulting in a new issuance rate above the current fixed issuance plan, which is particularly evident when the staking participation rate equals 1/3 (approximately 33.3%).

Reasons for Support

Reason for Support 1: Solana is currently paying too high a cost for security.

The most effective token issuance rate is the minimum level required to ensure network security. The original authors of the proposal (@TusharJain_, @kankanivishal) point out that a fixed issuance plan was reasonable when Solana was an emerging ecosystem without real economic value (REV). At that time, relying on token issuance to attract staking and ensure security was necessary.

However, given the current level of economic activity and fees (REV) on the network, the fixed issuance plan has become less reasonable, as it issues more SOL than is currently needed to ensure network security. This is known as the "leaky bucket problem," which @MaxResnick1 defines as the loss transfer caused by taxes or intermediaries with market power (such as high-commission validators like Coinbase or Binance).

Reason for Support 2: Nominal yield vs. real yield.

As pointed out by @y2kappa, SOL issuance is an accounting trick that only dilutes the holdings of non-staked SOL holders and leads to artificially high yields, incentivizing indiscriminate staking without distinguishing between nominal (based on issuance) and real (based on REV) yields. As Solana matures, the network should become economically sustainable and operate entirely on fees, reflecting the true economic demand for transactions on the network.

Reason for Support 3: The market is the best mechanism for price determination, and Solana's issuance should be no exception.

The conclusion of the above arguments is that even if SIMD 228 is not perfect, a market-based approach represents a significant improvement over the current fixed issuance plan, which is arbitrary and inefficient, leading to increased selling pressure.

Reasons for Opposition

Reason for Opposition 1: SOL inflation subsidizes institutional allocations.

While token holders should only care about real yields, custodians and ETP issuers are the opposite. They are incentivized to pursue the highest possible nominal yields because they charge commission rates and are not exposed to the underlying assets (thanks to @smyyguy's framework).

Taking the staking SOL ETP as an example, ETP issuers take a portion of the staking rewards but are not exposed to the underlying asset (i.e., SOL). Therefore, high nominal yields incentivize these players to sell SOL products to customers to increase their own revenue. From this perspective, what Resnick calls the "leaky bucket problem" is actually a distribution of expenditure ( @calilyliu). In my view, this is the strongest argument against SIMD 228.

Reason for Opposition 2: Institutional appeal.

This is related to the above point. According to @calilyliu, changing the fixed issuance plan just as institutional interest peaks and the Solana ETF launches (possibly this year) is a strategic mistake. Liu's core argument is that a market-based approach would make inflation unpredictable and unstable, reducing SOL's appeal as an asset.

The counterargument is that SOL is a highly volatile asset, and its 7-8% yield is not a reason to buy; those who stop buying SOL due to declining nominal yields did not understand its investment logic from the start.

Reason for Opposition 3: Impact on validator profitability / decrease in the number of validators.

The voting fees priced in SOL are currently the largest expense for validators. Some ( @David_Grid) are concerned that SIMD 228 may impact the profitability of small validators, especially if network activity and REV decline from current levels. In other words, the inflation curve of SIMD-228 may lead to a shrinkage of the validator pool, although some estimates suggest that this impact is limited (in a 70% staking rate scenario, according to @0xIchigo and @__lostin__, the number of profitable validators is expected to decrease by 3.4%).

There are also some minor concerns about the potential impacts of SIMD 228, including its potential effects on Solana DeFi rates, whether inflation will increase SOL selling pressure, and insufficient discussion of the proposal.

Regardless of how validators vote, it is crucial to understand both sides of the argument to make an informed decision.

If passed, SIMD 228 will be implemented in a few months, followed by a transition period of 50 epochs (approximately 100 days) to smooth the curve between the old and new rates.

Note: As of the time of publication, the voting for this proposal SIMD-0228 has temporarily not passed. The proposal received a support rate of 61.39% (only counting votes for and against), which is below the required 66.67% threshold for passage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。