- 复杂的链上活动,正在被简单化,技术基建已经成熟;

- 凡是旧有的,都面临被重塑的历史机遇,新的机会已经出现;

- Intent、TG/Onchain Bot、AI Agent,都要解决授权问题。

4 月 16 日,Glider 完成 a16z CSX (创业加速器)领投的 400 万美元融资,能在看起来简单,做起来复杂的链上投资领域卡位,得益于 Intent、LLM 等技术风口的眷顾,但是 DeFi 整体确实需要重新组合,以简化投资门槛。

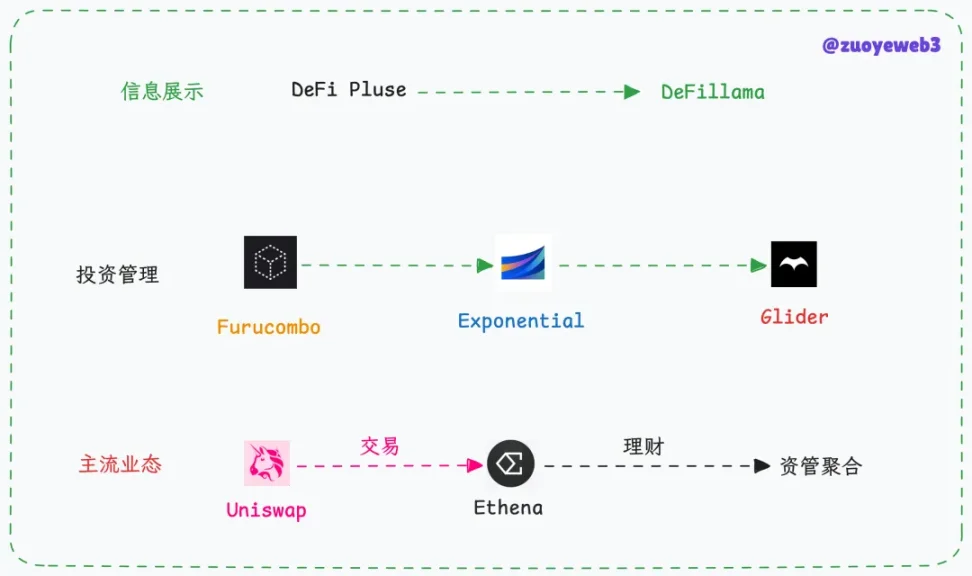

图片说明:DeFi 工具发展史,图片来源:@zuoyeweb3

DeFi 乐高时代不再,安全耦合的理财时代来临。

过往:Furucombo 出师未捷身先死

Glider 起步于 2023 年底 Anagram 的内部创业,当时的形态是 Onchain Bots,即组合不同的操作步骤,便于用户投资和使用。

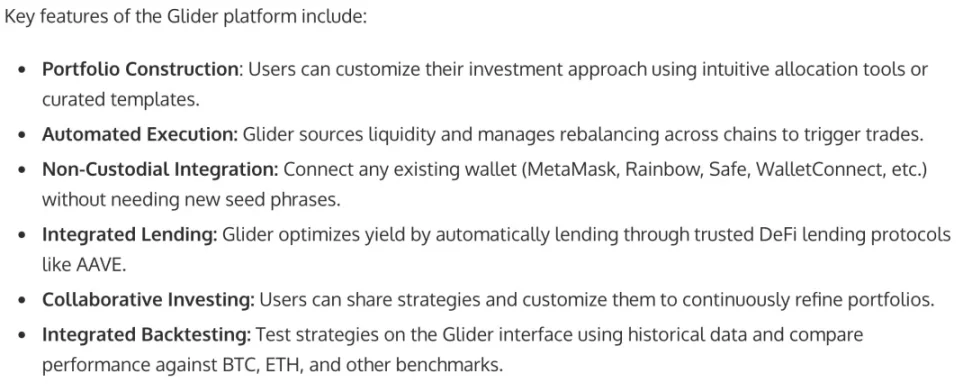

图片说明:Glider 功能前瞻,图片来源:businesswire

但这不是新鲜业态,帮用户理财是长久的生意,TradFi 如此,DeFi Summer 也如此,目前 Glider 还处在内部研发阶段,仅从 PR 稿内容可以描绘其大致思路:

- 链接现有 DeFi 工具,包括各赛道龙头,以及新兴协议,以 API 接入方式搭建 B2B2C 的获客逻辑;

- 允许用户搭建投资策略,并支持分享,以便于跟投、复制交易或者集体投资以换取更高收益。

在 AI Agent、LLM 和意图以及链抽象的配合下,搭建出此类堆栈,从技术角度并不难,真正难的是流量运营和信任机制。

涉及到用户资金的流转总是敏感,这也是链上产品还未打倒 CEX 的最重要原因,大部分用户可以接受去中心化换资金安全,但是基本不接受去中心化增加安全风险。

2020 年,Furucombo 便获得 1kx 等机构投资,主打帮助用户减少面对 DeFi 策略时的慌乱,如果要强行类比,和今天的 GMGN 等 Meme Coin 工具最像,只不过 DeFi 时代是组合收益策略,GMGN 是发现高潜力、低价值 Meme。

但是,大多数人并未留存在 Furucombo,链上收益策略是个公开市场,散户在服务器和资金量上根本无法和巨鲸抗衡,即大部分收益机会无法被散户捕捉。

相较于收益的不可持续性,安全问题和策略优化反倒在其次,高回报时代没有稳健理财的任何空间。

现在:资管的平民时代

富人的 ETF,散户的 ETS。

ETF 工具不仅可在股市运行,币安等交易所 2021 年便有过试水,技术角度的资产代币化,最终催生出 RWA 范式。

图片说明:Exponential 页面,图片来源:Exponential

更进一步,如何完成对 ETF 工具的链上化成为创业焦点,从 DeFillama 的 APY 计算和展示,再到 Exponential 的持续运行,都表明市场对其有需求。

Exponential 严格而言是一个策略销售和展示市场,海量专、精确算,人工和 AI 辅助策略决策,但是链上透明性导致没有人真正能藏着高效策略不被人模仿和改造,进而导致军备竞赛,最终卷到收益率拉平。

最后是新一轮大鱼吃小鱼的无聊游戏。

但始终未能标准化,发展成类似 Uniswap、Hyperliquid 或者 Polymarket 这样重新定义市场的项目。

最近一直在思考,Meme Supercycle 结束后,旧时代的 DeFi 形式很难复活,行业触顶是暂时性的还是永久的?

这关系到,Web3 究竟是互联网的下一步,还是 FinTech 2.0 版本,如果是前者,那么人类的信息流和资金流运作方式都会被重塑,如果是后者,那么 Stripe + 富途牛牛就是一切的终点。

从 Glider 的策略可以解耦出,链上收益即将转化为平民资管时代,如同指数基金和 401(k) 共同造就了美股的长牛,绝对的资金量和极大数量的散户,市场会对稳定收入有庞大的需求。

这就是下一个 DeFi 的意义,以太坊之外还有 Solana,公链仍旧要承担互联网 3.0 的革新,而 DeFi 才应该是 FinTech 2.0。

Glider 增加 AI 辅助,但是从 DeFi Pulse 的信息展示开始,到 Furucombo 的初次尝试,再到 Exponential 的稳定运行,5% 左右的稳定链上收益,依然会吸引 CEX 之外的基础人群。

未来:生息资产上链

币圈产品发展到如今,只有少数产品真正获得市场认可:

- 交易所

- 稳定币

- DeFi

- 公链

剩余任何产品类型,包括 NFT 和 Meme coin 都只是阶段性的资产发行模式,它们并没有持续性的自维持能力。

但是,RWA 从 2022 年开始扎根生长,尤其是 FTX/UST-Luna 崩溃后,如 AC 所言,大家并不真正在乎去中心化,而是更在乎收益和稳定。

即使没有特朗普政府主动拥抱比特币和区块链,RWA 的产品化和实用化都在加速,如果传统金融可以拥抱电子化和信息化,那就没道理放弃区块链化。

在本轮周期中,无论是复杂的资产类型和来源,还是目不暇接的链上 DeFi 策略,都在严重阻碍 CEX 用户向链上迁移,先不管 Mass Adaption 的真伪,至少庞大的交易所流动性可以被吸走:

- Ethena 通过利益联盟的方式将费率收益转为链上收益;

- Hyperliquid 将交易所永续合约通过 LP Token 方式泵吸至链上。

这两个案例,都证明流动性上链可行,RWA 证明资产上链亦可行,现在是行业奇景时刻,ETH 被大家认为没活,但是明明大家都在上链,某种意义上,胖协议不利于胖应用的发展,也许这也是公链回归基础设施,应用场景大放光芒的最后的黑夜,晨光熹微。

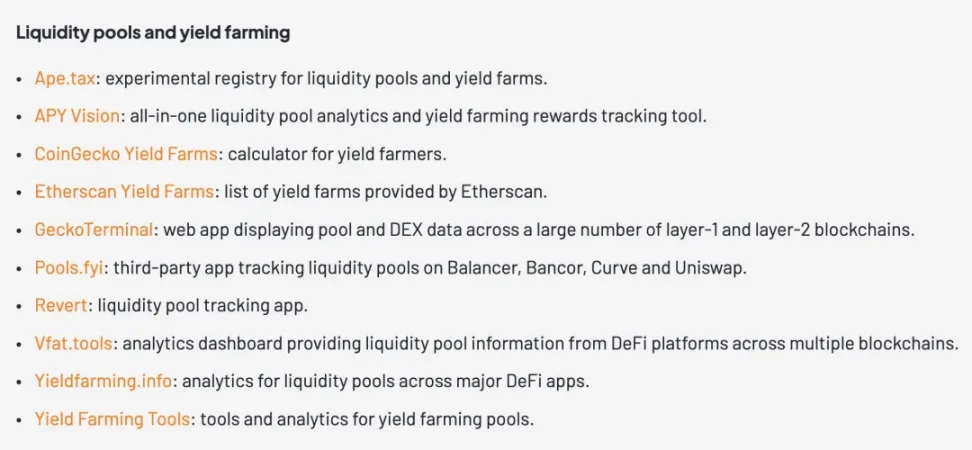

图片说明:收益计算工具,图片来源:@cshift_io

在以上产品之外,vfat Tools 作为开源 APY 计算工具已经运行数年以上,De.Fi、Beefy、RWA.xyz 都各有侧重,展示项目方 APY,收益工具的重心,随着时间变化,已经越来越集中在 YBS 等生息资产。

目前来看,该类工具增加对 AI 的信任度,就要面临责任划分,增强人工干预,就会降低用户使用体验,难办。

可能将信息流和资金流分离,打造 UGC 策略社区,让项目方内卷,让散户得利,可能是个比较好的出路。

结语

Glider 因为 a16z 获得市场关注,但是赛道长期的问题依然会存在,授权和风险问题,这里的授权不是指钱包和资金,而是 AI 有没有能力让人类满意,如果 AI 投资损失惨重,责任又如何划分?

这个世界,依然值得探索未知,Crypto 作为崩裂世界的公共空间,依然会生生不息。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。