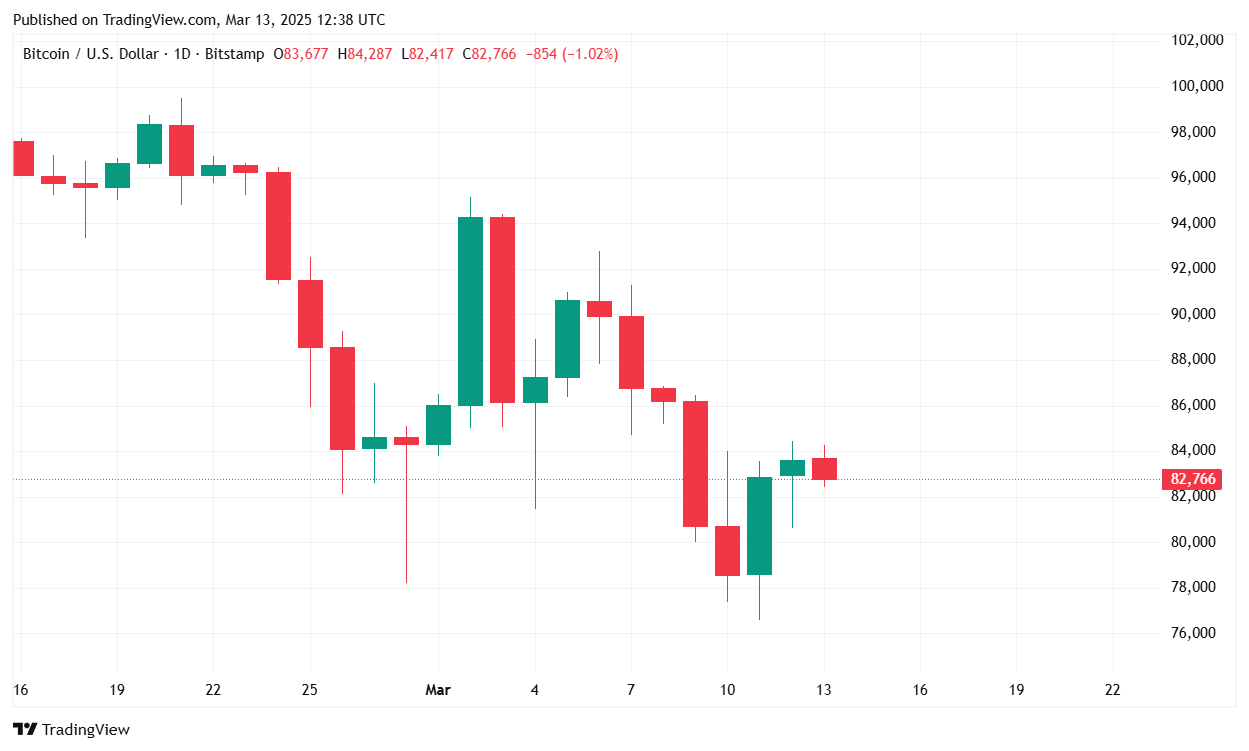

Bitcoin (BTC) has remained mostly flat over the past 24 hours, as global economic concerns, sparked by President Donald Trump’s tariffs, weighed on investor sentiment. The leading digital asset is currently priced at $82,692.45, reflecting a 1.30% drop over the past day and an 8.58% decline over the past week.

- 24-hour price range: $80,635.25 to $84,301.69

- Market capitalization: $1.64 trillion, down 0.84% since yesterday

- 24-hour trading volume: $33.89 billion, down 27.03%

- BTC dominance: 61.82%, down 0.47% in the past 24 hours

- BTC futures open interest: $47.32 billion, down 0.33%

- 24-hour liquidations: $83.64 million, with longs at $49.63 million and shorts at $34.02 million. The relatively equal ratio of longs and shorts suggests a somewhat balanced distribution of bears and bulls.

Global trade woes intensified on Wednesday as Canada and the European Union slapped on retaliatory tariffs on U.S. exports to the tune of billions in response to President Donald Trump’s fees on steel and aluminum imports. Fears of a global recession have become heightened, although U.S. inflation data that came in yesterday was more favorable than expected. A recessionary environment will likely impact bitcoin’s price negatively.

Despite the current downturn, analysts remain divided on bitcoin’s trajectory. Some believe that economic uncertainty could drive more investors toward BTC as a hedge against inflation, while others caution that risk-off sentiment may lead to further declines in the near term.

For now, bitcoin’s ability to hold key support levels near $80,000 will be crucial in determining its next move. If global economic instability persists, further volatility in the crypto market should be expected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。