Source: Cointelegraph Original: "{title}"

A new world is quietly growing in platform tokens!

One must seek anchor points in chaos. As the wave of cryptocurrency in 2025 comes with uncertainty, a beam of light is needed to penetrate the fog. When mainstream coins like Bitcoin (BTC) and Ethereum (ETH) oscillate between euphoria and decline, and institutional capital builds high walls to enclose itself, platform tokens stand at the entrance of the crypto world — they are not just a passport for exchanges, but also Noah's Ark that traverses bull and bear markets.

As a unique asset class, platform tokens have become a core component of the exchange ecosystem. They not only provide users with trading fee discounts and opportunities to participate in ecosystem development but also serve as an important pillar of the exchange's revenue model. Binance's BNB and OKX's OKB are undoubtedly the leaders in the platform token space, occupying a large share of the market and user attention. However, can Gate.io's platform token GT (GateToken), as a rising star, stand out in fierce competition?

This article will compare GT, BNB, and OKB from multiple perspectives, exploring GT's potential advantages and its unique positioning in the market, while analyzing GT's future development potential in conjunction with the current market conditions.

Platform Tokens: The Transformation Path from Ecological Points to Value Engines

The birth of platform tokens marks a significant turning point in the business model of cryptocurrency exchanges. In July 2017, Binance completed a paradigm revolution in the industry by issuing BNB — shifting the operational logic of exchanges from merely matching trades to "platform economy." Initially, BNB served as a trading fee discount tool (users holding BNB could enjoy a 25% reduction in trading fees), but its design implied deeper commercial wisdom: binding users' interests with the platform through tokens, creating a positive feedback loop. This model was quickly validated by the market, with BNB's price increasing over 100 times in 2017, directly propelling Binance's trading volume into the top three globally within six months.

With the success of BNB, the platform token sector experienced explosive growth between 2018 and 2020: OKX launched OKB, Huobi (HTX) listed HT, and Gate.io released GT, forming the "four major platform tokens" landscape. During this period, the functions of platform tokens became homogenized, mainly focusing on basic aspects like trading fee discounts, voting for new tokens, and periodic buybacks. The real watershed moment came during the DeFi wave in 2021, when leading platform tokens began to break through exchange boundaries, extending into public chain ecosystems, decentralized finance, NFTs, and other scenarios, marked by the rise of Binance Smart Chain (BNB Chain). Platform tokens officially evolved from "exchange fuel" to "ecological value hubs."

As of March 12, 2025, at 3 PM, the total market capitalization of centralized exchange platform tokens reached $101 billion, with BNB occupying the first position at $78.8 billion, OKB exceeding $2.4 billion, and GT's market cap being around $1.8 billion. Although GT has a lower market cap, its relatively small circulation means it has greater upside potential. Over the past two years, Gate.io has developed rapidly, particularly excelling in product experience, marketing, and community building, especially in contract trading, where Gate.io is expected to capture more market share.

Gate.io's Market Performance

Currently, the market cap/GMV (total trading volume) ratio of GT is only 0.03, which is not only lower than BNB's 0.31 but also significantly less than BGB's 0.17. This valuation gap continues to narrow as Gate.io's derivatives market share expands. If GT can maintain its current growth rate, its market cap is expected to exceed $5 billion within the next two years, becoming the most explosive potential mid-sized target in the platform token sector.

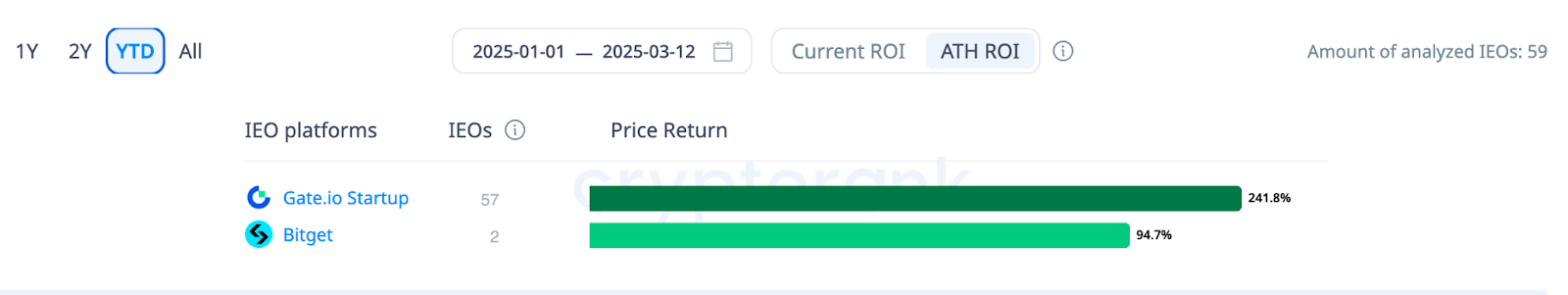

From the beginning of the year to now, Gate.io has launched a total of 57 IEO projects, with an ROI of 241.8%, far ahead of other exchanges.

Centralized exchange Launchpads ROI data. Source: Cryptorank

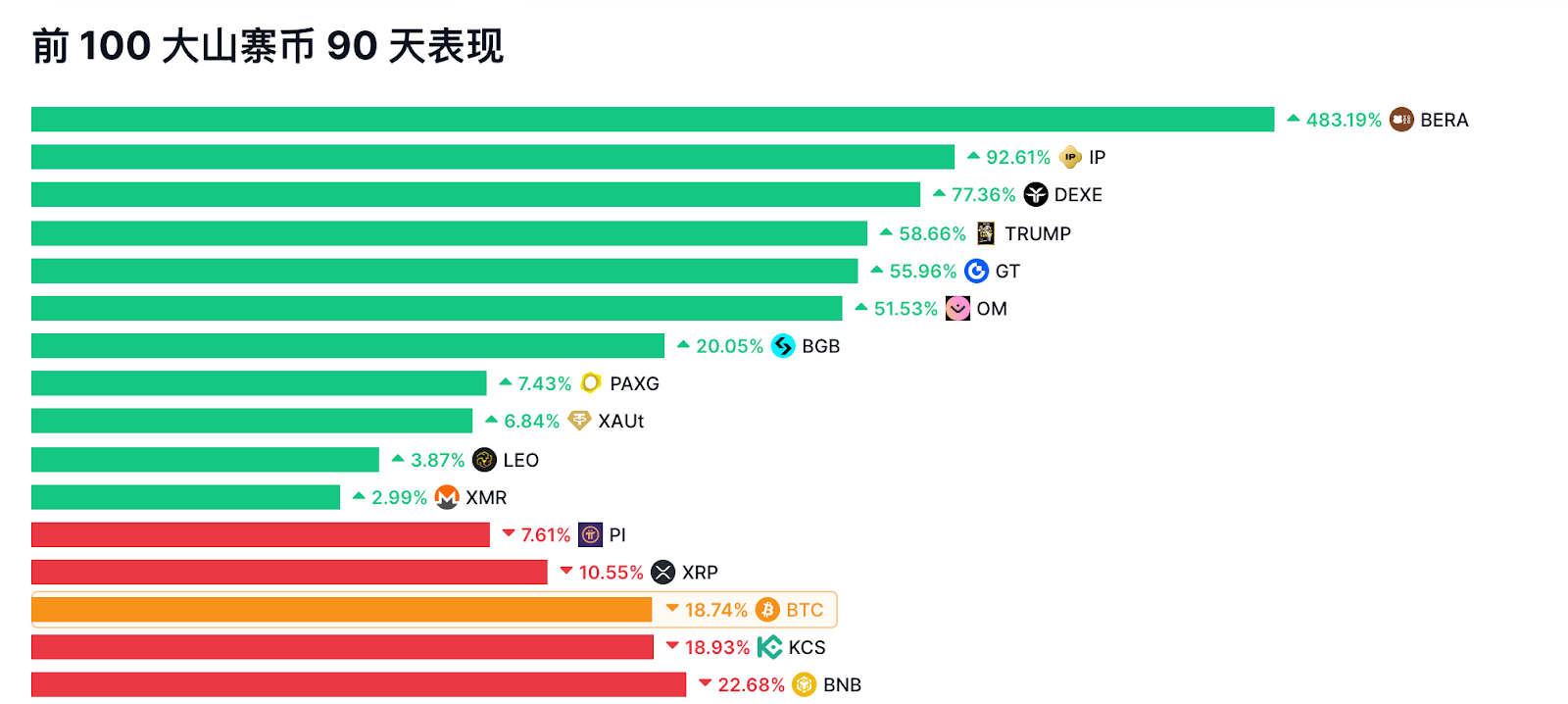

According to CoinMarketCap data, as of March 12 at 3:47 PM, among the top 100 tokens by market cap, only 12 tokens had a price increase exceeding BTC in the past 90 days, including BERA (483.19%), IP (92.61%), and GT (55.96%). In contrast, BTC's performance during the same period was -18.74%, and BNB was -22.68%.

Top 100 altcoins' performance over 90 days. Source: CoinMarketCap

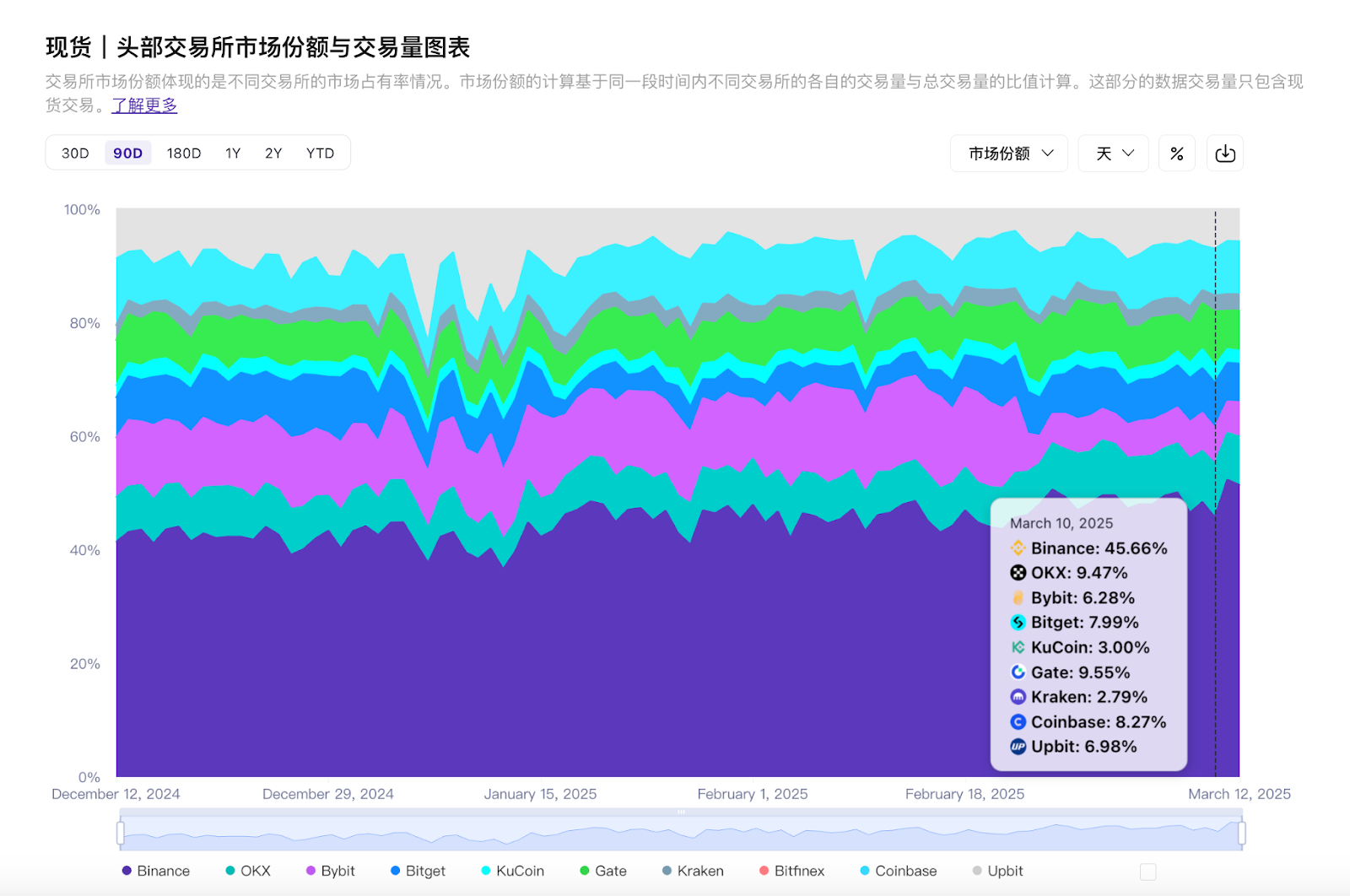

In terms of total spot trading volume, in the past 90 days, Binance ranked first with 45.66%, while Gate.io ranked second with 9.55%.

Top exchanges' spot trading market share. Source: TokenInght

Trading depth is an important indicator of the quality and efficiency of an exchange, directly affecting the smooth operation of the market and the trading costs and experience of investors. Coinglass data shows that for Bitcoin's 24-hour contract positions, Gate.io ranks third with $5.31 billion, following CME and Binance; for Ethereum's 24-hour contract positions, it ranks second with $3.37 billion, only behind Binance. Regarding this achievement, Gate.io founder Han Lin stated in a media interview, "In terms of contracts, Gate.io has been making efforts since last year. This will be a key business in 2025."

BTC, ETH 24-hour contract positions. Source: Coinglass

Reconstructing the Value of Platform Tokens

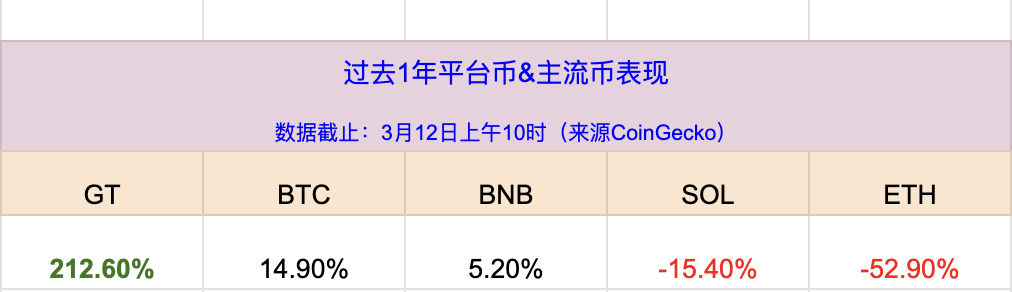

In a market cycle where crypto assets exhibit strong Beta attributes, platform tokens with real value capture capabilities are demonstrating unique Alpha attributes. Data shows that over the past year, mainstream CEX platform tokens have outperformed the market: Gate.io's platform token GT leads with an annual increase of 212.6% (with a nearly 6-month increase of 152.14%), far surpassing BNB (5.2%), the established platform token, and leaving mainstream assets like SOL (-15.4%), BTC (14.9%), and ETH (-52.9%) behind.

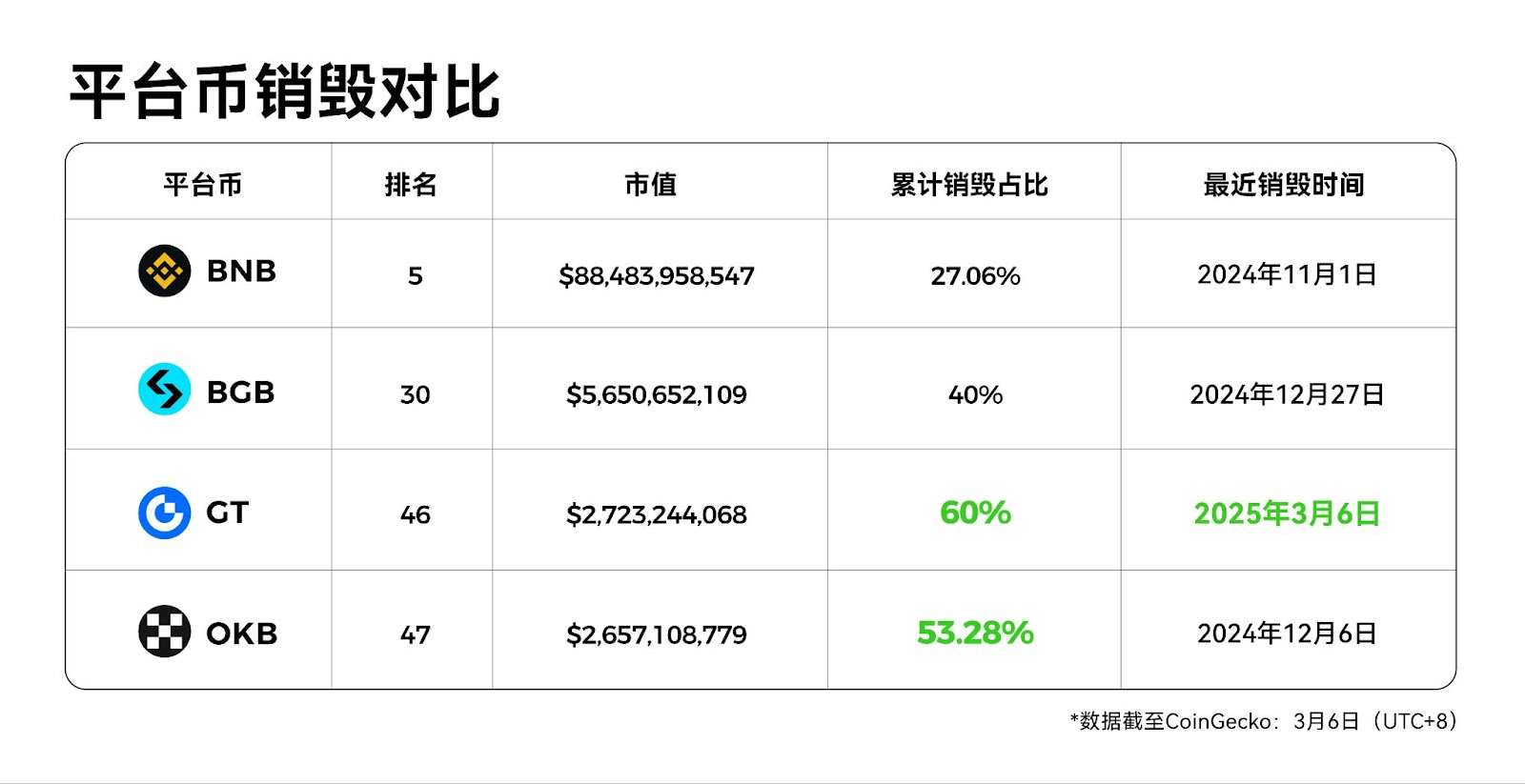

Additionally, in terms of the periodic buyback and burn mechanism, GT's deflationary force is very strong. According to official announcements, the on-chain destruction of GT in the fourth quarter of 2024 has been completed, with approximately 2.9 million tokens destroyed, valued at over $63.9 million. Currently, GT has destroyed 177 million tokens, accounting for about 60% of its initial issuance, leading other platform tokens.

Platform token destruction. Data source: CoinGecko

Buyback and destruction is essentially a defensive mechanism that does not significantly boost the price of platform tokens but can provide strong support. From a correction perspective, as of March 12 at 5 PM, BNB's decline over the past month reached 9.56%, BGB's decline was 34.67%, while GT's decline was only 5.78%.

Gate.io's ecological empowerment of GT has formed a unique "new listing - user benefits - value feedback" closed loop, with its core driving force being the construction of an efficient new asset value capture in the crypto field. According to statistics, Gate.io's Launchpool launched 33 projects in February, with current staking funds reaching $278 million and rewards to be distributed amounting to $957,700, with GT pool APR consistently maintained above 10%.

Gate.io Launchpool. Source: Gate.io official website

Mining is the offensive mechanism of platform tokens, representing the most significant way to enhance the price of platform tokens and is also the platform rights that holders care about the most.

Related: U.S. Congressman Emmer: The U.S. must support stablecoin legislation and reject CBDCs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。