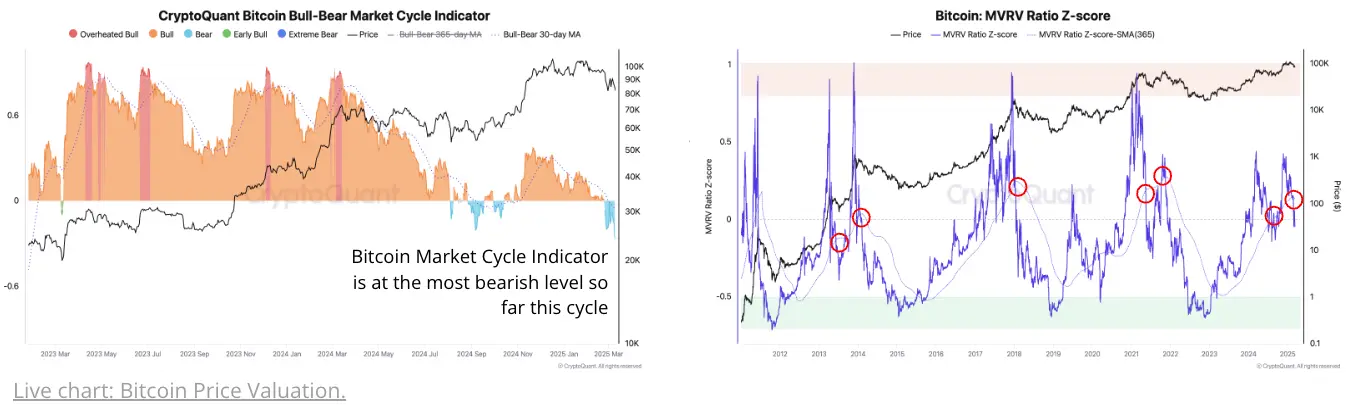

Cryptoquant’s latest institutional insights report reveals bitcoin is navigating its most bearish phase of the current market cycle, with valuation metrics and demand trends suggesting heightened volatility. According to the report, the Cryptoquant Bitcoin Bull-Bear Market Cycle Indicator has plunged to its lowest level this cycle, while the MVRV Ratio Z-score—a measure of market momentum—has dipped below its 365-day moving average.

Source: This week’s Cryptoquant institutional insights report.

Historically, such conditions precede sharp corrections or extended bear markets, researchers noted. Demand contraction is accelerating, with bitcoin’s apparent demand dropping by 103,000 BTC last week, the steepest decline since July 2024. Large investors, or “whales,” have also slowed accumulation, reducing their annualized buying rate from 368,000 BTC in January to 268,000 BTC.

Cryptoquant analysts emphasized that whale activity nearing sub-trend levels has historically aligned with bearish price action, compounding current risks. U.S. spot bitcoin exchange-traded funds (ETFs), once a pillar of institutional demand, have turned net sellers in 2025, offloading 200 BTC year-to-date compared to 165,000 BTC in net purchases during the same period last year. In dollar terms, ETF inflows have collapsed from $8.7 billion in early 2024 to just $700 million this year, per Cryptoquant data.

This reversal has intensified selling pressure, exacerbated by Coinbase outflows signaling diminished US demand. Bitcoin’s significant correction from its 2025 peak mirrors past bull market pullbacks in magnitude, but Cryptoquant warns this downturn differs due to deteriorating onchain fundamentals. For instance, the Inter-exchange Flow Pulse—tracking bitcoin movements between exchanges—has remained in “correction territory” since mid-February, when prices hovered near $96,000.

Sustained outflows from Coinbase, often a bull market hallmark, now reflect weakening investor sentiment. The $75,000–$78,000 range, slightly below the Trader’s Onchain Realized Price lower band, is critical short-term support. Cryptoquant researchers cautioned that a breakdown here could send bitcoin tumbling toward $63,000, the “ultimate support” level during deep corrections. This zone represents the minimum threshold of the Trader’s Realized Price bands, a metric tracking the average cost basis of short-term holders.

While past cycles saw rapid recoveries after similar corrections, Cryptoquant stressed that current metrics suggest a potential structural shift. The 2016–2017 bull market, for example, endured multiple 20%+ drops, but only one triggered a prolonged bearish phase. With ETFs retreating, whales sidelined, and momentum fading, bitcoin’s path hinges on whether buyers can defend key support levels—or capitulate to a broader downturn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。