Has the decline reached its limit? Will the U.S. stock market and Bitcoin continue to fall, or have they already hit the bottom and are ready to rebound? Where is the market bottom?

To begin with, although this discussion revolves around the decline or rise of the U.S. stock market and Bitcoin, it does not involve any specific price levels. If you want to know, for example, how low Bitcoin might drop, I’m sorry, this article cannot provide that information.

To summarize, whether the decline has reached its limit depends on whether the main reasons for the current drop will reoccur. If they do, then the decline has not reached its limit; if they do not, then it truly has. Bitcoin does have the opportunity to develop an independent trend, but the difficulty is quite high, and a definitive bull market will only occur if it rises in sync with the U.S. stock market. The market bottom will gradually appear only after inflation has decreased, no economic recession has occurred, and the Federal Reserve begins to shift back to monetary easing, initiating the halt of balance sheet reduction and lowering the SLR, thus achieving a transition from rebound to reversal.

In simpler terms, the interaction of tariffs, inflation, and monetary policy affects market trends. When the factors causing price declines disappear one by one, prices will shift from rebound to reversal.

Now, to the main point: the most critical question is whether we are at the bottom now, and whether the U.S. stock market or cryptocurrencies will continue to decline.

Before answering this question, we need to clarify the reasons for the current decline, which have led to the short-term and rapid drop in the U.S. stock market and Bitcoin.

The answer: trade wars and recession expectations. Even if these two are not the only reasons, they are certainly the main ones.

Based on this answer, there are roughly three scenarios for stopping the decline:

A. Investor panic has peaked, and all panic-driven investors have almost exited the market. The market believes it has fallen enough. (Data level)

B. The tariff issue is resolved and will not become a factor affecting inflation. At worst, the inflation caused by tariffs can be offset by reduced inflation. (Policy level)

C. The U.S. will not enter an economic recession, or the recession has already ended. At worst, investors no longer expect a recession. (Macro level)

Now, based on these three scenarios, let’s continue to analyze whether investor panic has peaked. Here, we mainly refer to the VIX (Volatility Index). On the evening of March 10, Beijing time, the VIX data broke through the highest point since 2024, reaching 29.5, which is almost at the threshold of a bear market, where a typical bear market ranges from 30 to 50.

I have extracted a 10-year VIX chart from 2014 to the present. It can be seen that the number of times it exceeded 30 is quite frequent, but the number of times it exceeded 50 is relatively rare. In the last decade, there have only been 4 instances where it exceeded 50. Each time it exceeded 50 was indeed a good buying opportunity, and profits were made. Even after exceeding 50, the market gradually shifted from panic to calm.

(The VIX can be added to your watchlist in TradingView by entering VIX and finding the Volatility S&P 500 Index, which can be accessed for free.)

However, as mentioned earlier, in the past 10 years, there have only been 4 instances where it exceeded 50, and even during the bear market decline in 2022, it did not exceed 50. The only instance after 2021 occurred on August 5, 2024, so waiting for a panic index of 50 can be said to be a rare opportunity.

So, is buying when the panic index reaches 30 a compromise solution? From a long-term data perspective, buying when the panic index exceeds 30 does indeed present a profit opportunity, but this opportunity may lead to a short-term rebound or may require long-term waiting.

For example, in the red area of 2022, there were six instances where the VIX exceeded 30. Although each time presented a short-term opportunity, the bear market essentially ended only after all six instances had passed, leading to an upward trend. Of course, from a god's-eye view, buying at any of these six instances and holding for a year would have been profitable, but that year, especially with the subsequent continuous declines, made it difficult for many investors to hold on.

Therefore, looking solely at the VIX data may not be accurate, but as long as the VIX breaks 30, then making a small purchase with a plan for long-term holding can indeed be profitable, especially since Bitcoin's overall price trend is quite similar to that of the Nasdaq index, so Bitcoin can also be applicable to VIX data.

Now, has the VIX reached its peak, meaning has investor panic eased? On one hand, we need to assess this through policy and macroeconomic indicators; on the other hand, we may need to gauge market sentiment. The VIX merely measures the level of panic, while the factors that trigger panic are still policy and macroeconomic conditions.

Policy and macroeconomic conditions are also the basis for our judgment on whether the VIX has ended its panic or will continue.

Next, we will move on to policy analysis. Since we already know that the trade war and inflation caused by tariffs are among the reasons for the decline in risk markets, policies that can reverse the trade war and inflation will help stabilize the market.

Thus, we need to focus on:

- Is Trump's tariff policy a weapon or a result? Is it a stick to wield or merely a tool for intimidation?

There have already been two instances where tariffs on Mexico and Canada were implemented and then suspended the next day. To be honest, the market's perception of Trump's tariff policy has transitioned from previous panic to a level where it may not be enforced. However, Trump has again stated that on April 2, he will initiate reciprocal tariffs and has indicated he will not back down, so tariffs will still significantly impact inflation.

If Trump continues to enforce a 25% tariff on Mexico and Canada, it will create negative expectations for the risk market, anticipating continued inflation, and the Federal Reserve will not choose to lower interest rates quickly, leading to further market declines.

So tariffs are a key focus, but if tariffs are indeed implemented, does that mean inflation cannot decrease in the short term?

Not necessarily, because there is also a hedge in the form of the end of the Russia-Ukraine war and agreements for the U.S. to mine rare earth minerals. In simpler terms, the end of the Russia-Ukraine war could offset the tariffs on Mexico and Canada and even resolve tariff issues with Europe.

- Will tariffs trigger the Federal Reserve's concerns about inflation, leading to a more cautious approach to interest rate cuts?

From Powell's recent speech, it can be seen that the Federal Reserve is still very concerned about tariffs. Although they believe tariffs will affect inflation, as long as tariffs are one-time events and not recurring or gradually increasing, the impact on prices will be temporary, potentially affecting inflation data for a few months, but inflation will still naturally decline.

For example, if eggs in the U.S. cost one dollar each, it seems very expensive and affects food inflation. However, as long as the price of eggs does not continue to rise and everyone agrees on the one-dollar price, then egg inflation will inevitably decline. (Because it remains at one dollar each)

Of course, eggs are just an example. The Federal Reserve's concerns about tariffs will ultimately transform into concerns about inflation. For instance, today, Trump imposed an additional 25% tariff on Canadian steel and aluminum products, bringing the total tariff to 50%. This is one aspect; the immediate implementation tomorrow is the second aspect, and the third aspect indicates that Trump's actions are unpredictable.

One-time tariffs may still be manageable for the Federal Reserve, but if tariffs become frequent, the Federal Reserve may find it difficult to ignore them.

- What will the trend of national inflation and GDP look like after the U.S. increases tariffs?

If the first two points are our speculations about the market, then the third point is the most direct proof of whether this speculation is correct. If I were the Federal Reserve, even if I planned to cut interest rates in May or June, I could not do so now because I need to observe the changes in inflation brought about by U.S. tariffs in May and June and look at the GDP data for the second quarter in July.

From this perspective, the probability of the Federal Reserve choosing to cut interest rates before July is low, especially after the changes brought about by tariffs, which may increase the difficulty of the Federal Reserve's inflation assessment. The same reasoning applies to GDP; while tariffs may increase fiscal revenue, they will inevitably lower GDP.

So now the policy clues are clear: tariffs affect inflation, continued inflation leads the Federal Reserve to be cautious about cutting interest rates, and high interest rates are more likely to trigger an economic recession. Therefore, the increase in tariffs indirectly equates to an increased possibility of recession.

At this point, all paths lead back to macroeconomic data: will the U.S. economy enter a recession?

Returning to the question of recession, will the U.S. economy enter a recession? Currently, the U.S. has not entered an actual or nominal recession. In simpler terms, the current U.S. data does not support the idea that the U.S. is entering an economic recession, as the two conditions for a recession are:

- Two consecutive quarters of declining GDP data.

- A very high unemployment rate in the U.S. (generally around 5.5%).

Thus, a bear market and a recession are two different concepts; a bear market does not necessarily mean a recession, but a recession almost always occurs during a bear market. Although GDPNow shows a negative 2.4%, this is not the final GDP data, which can only be confirmed by April 30, 2025, and unemployment data will also have to wait until April.

This indicates that in March, there is actually no data to prove whether the U.S. economy has truly entered a recession. Similarly, there is no ability to prove that the economy has not entered a recession.

Why emphasize this seemingly trivial content? Because when we are trying to determine whether prices are rebounding or reversing, whether they will continue to decline or surge again, we need to rely on actual data and indicators for judgment, rather than making guesses, especially when the current market dominance lies in Trump's hands.

So, is it the bottom now, and will there be further declines?

Before concluding, we have clearly analyzed that the main reasons for the decline are inflation and recession. Therefore, whether it is possible to stop the trade war and recession will determine whether the decline can be halted and the overall market reversed.

How to reverse inflation:

A. No more tariff increases; is this possibility there? Yes, as we mentioned earlier, if Trump is merely using tariffs as a tool for intimidation to achieve the U.S.-Canada-Mexico agreement and as a means to end the Russia-Ukraine war, then it is possible to significantly reduce tariffs or even not impose them at all.

This indicates that if Trump continues to exert pressure on tariffs, the risk market will decline. If Trump stops exerting pressure on tariffs or reduces the pressure, the decline will stop, but it may not necessarily reverse.

B. The end of the Russia-Ukraine war. If not increasing tariffs only returns to the starting point, then only the end of the Russia-Ukraine war can quickly reduce inflation. Why do I say this? We need to analyze the main sources of current inflation.

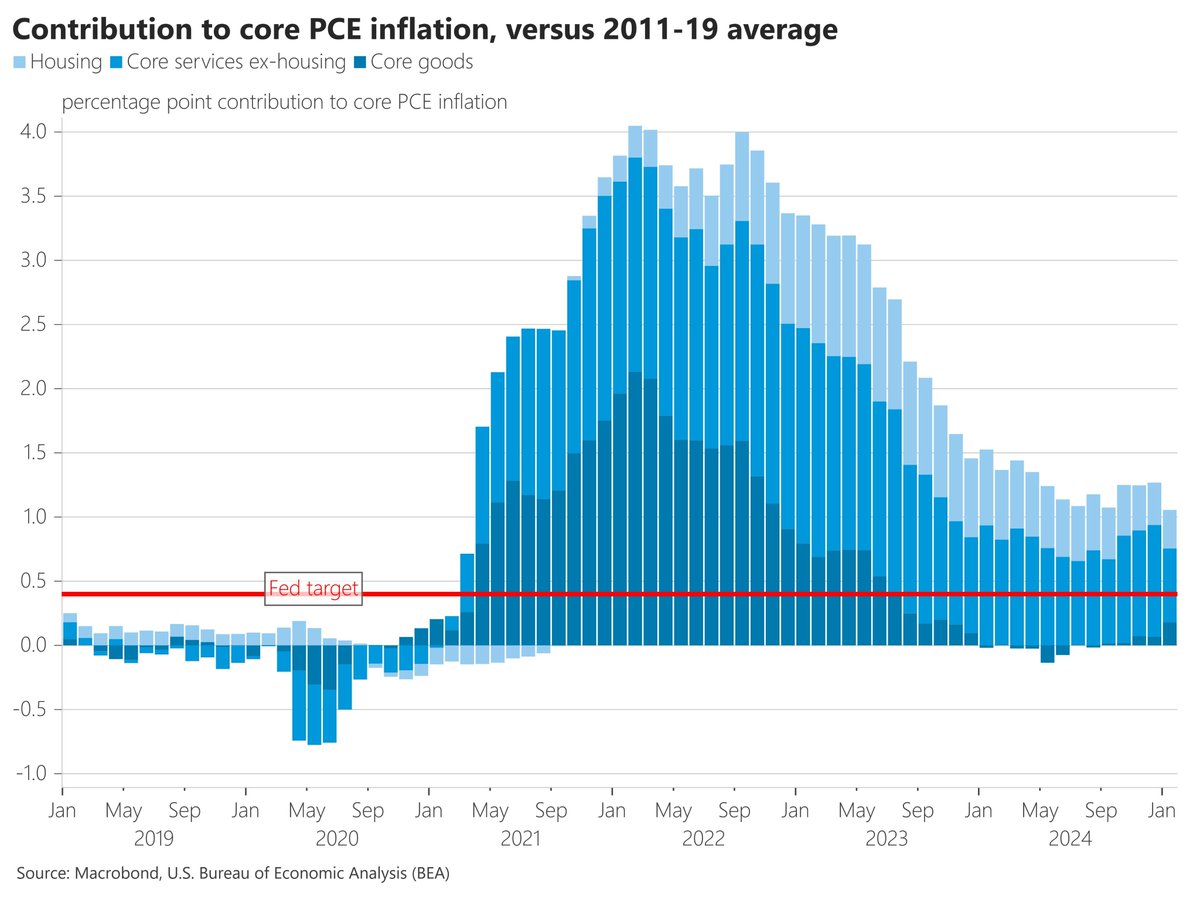

Core commodities: Previously, commodity prices were falling, but now they are starting to rise again. After tariff increases, core commodity prices will continue to rise, but if the Russia-Ukraine war ends, it may lower the prices of bulk commodities (such as oil, natural gas, and metals), thereby reducing production and transportation costs. Additionally, the global supply chain will return to normal, reducing supply shortages and thus decreasing commodity inflation.

Housing: The overall trend is beginning to cool. After the war ends, the prices of building materials will fall, indirectly reducing housing costs. Although this will not immediately affect rent or housing prices, it will inevitably lower housing-related inflation in the long term.

Core Services: These remain the main source of inflation exceeding the Federal Reserve's target, typically related to wage growth and the labor market. Although the end of the Russia-Ukraine war will not directly impact core services, it will lower energy prices, which in turn will indirectly reduce costs in transportation, logistics, hotels, and other services. Additionally, the end of the Russia-Ukraine war will also reduce food inflation. While food and energy are not included in the core PCE, a decline in food inflation will indirectly lower costs in the service sector.

Thus, we can see that while the end of the Russia-Ukraine war may not comprehensively reduce U.S. inflation, it can indeed lead to a decrease in inflation in certain industries, aiding the Federal Reserve in achieving its goal of bringing inflation back to 2%.

C. A cooling labor market, rising unemployment rates, and declining wage levels will all contribute to a cooling labor market. Only when there is insufficient purchasing power will consumers lack the funds to support high prices, thereby forcing the supply side to lower prices. However, the labor market is highly linked to the economic market; if the labor market cools too much, it will raise concerns about an economic recession.

Therefore, we can clearly see that A + B + C constitutes a plan to reduce inflation, where A and B are politically driven, while C is market-driven. If Trump can achieve A and B politically, then U.S. inflation will inevitably ease in the short term, and the long-term decline will accelerate.

How to Reverse a Recession:

As mentioned earlier, GDP and unemployment rates are the main indicators of recession.

- GDP is strongly related to tariffs. Increasing tariffs means sacrificing some GDP revenue because it enhances export competitiveness, encourages manufacturing to return, provides tax incentives, and encourages companies to produce domestically. However, increasing tariffs will reduce export competitiveness.

Of course, increasing tariffs is not without benefits; it can develop local supply chains and reduce dependence on imports from countries like China and Mexico. Energy independence can be achieved by increasing oil and natural gas exports, thereby reducing reliance on foreign energy.

Expanding government spending is also a channel for increasing GDP. However, Trump has reduced government spending through DOGE, which, while reducing the fiscal deficit, has indeed lowered GDP output.

Increasing corporate investment, lowering corporate taxes, reducing tax rates, enhancing investment willingness, reducing regulation, and relaxing oversight in the environmental, financial, and energy sectors can improve corporate investment returns.

This part is actually what Trump wants to do and is currently doing, especially in reducing regulations in the cryptocurrency industry to stimulate its development. Trump will also implement domestic tax reduction measures, but these have not yet begun.

- Stimulating consumption is also a major support for U.S. GDP. However, it is evident that stimulating consumption and reducing inflation are contradictory. To reduce inflation, consumption must decrease; increasing wages will raise service sector inflation, and providing personal tax cuts will increase goods inflation. Even stimulating housing consumption will affect housing inflation.

Therefore, it can be seen that without stimulating consumption, achieving 1 + 2 + 3 is the path to increasing GDP while reducing inflation. The increase in GDP itself partially contradicts the Federal Reserve's goal of reducing inflation, which is why bear markets and economic recessions often occur during periods of high interest rates.

Thus, whether we are at the bottom now and whether there will be further declines depend on all the factors mentioned above.

If the U.S. provides a path for declining inflation, it will be beneficial for the Federal Reserve to lower interest rates, but this does not mean the market has bottomed out, as it is necessary to determine whether the decline in inflation is triggered by an economic recession.

If the end of the Russia-Ukraine war can reduce U.S. inflation in this way, it will be favorable for the risk market, as it lowers U.S. inflation without creating recession risks.

If tariffs are not increased, it can not only lower U.S. inflation but also boost GDP. The return of manufacturing can be achieved through the U.S.-Canada-Mexico agreement.

If the Federal Reserve accelerates interest rate cuts, although the negative impact on inflation may be somewhat significant, it will reduce the likelihood of an economic recession. Additionally, it can stimulate liquidity and increase risk appetite.

If the Federal Reserve stops balance sheet reduction, halting this process will release more liquidity into the market, increasing investors' risk appetite, which will also benefit the risk market.

If the Federal Reserve lowers the SLR (Supplementary Leverage Ratio), banks can support the same asset scale with less capital, increasing leverage. Banks can increase lending, releasing more liquidity to support economic growth. The motivation for banks to purchase low-risk assets like government bonds will increase, lowering long-term interest rates. This will release more liquidity into the market, benefiting the overall risk market.

Conclusion:

From my perspective, cryptocurrencies are still attempting to establish an independent trend. When the U.S. stock market experiences a slight decline, cryptocurrencies, especially Bitcoin, may stand out. However, if the U.S. stock market continues to decline significantly, even Bitcoin may continue to follow suit.

What is slightly different is that after the approval of Bitcoin spot ETFs, external funds are beginning to buy BTC. While this has an arbitrage effect, it is indeed a real purchase. If traditional investors view BTC as a hedge against declines in the stock market, then BTC does have the opportunity to establish an independent trend, although this opportunity is relatively challenging.

Another factor is that BTC is still subject to circulation limits. Currently, some short-term investors in BTC have shifted from selling to buying again, and they have plans for long-term holding. However, it cannot be ruled out that some of these investors have become long-term holders due to losses, and when prices rise back to their cost basis, they may choose to exit.

Therefore, it is most beneficial for cryptocurrencies and Bitcoin when the U.S. stock market can also establish an upward trend.

As for whether the U.S. stock market is at the bottom now, it should be assessed based on whether the factors that triggered the decline will reappear, such as whether inflation caused by tariffs will emerge. The answer is affirmative; the monthly inflation data is clear. Unless increasing tariffs does not lead to rising inflation, or if the end of the Russia-Ukraine war offsets the impact of increased tariffs.

For example, will recession expectations reappear? The answer is also affirmative, unless GDP and unemployment rate data do not continue to worsen.

For instance, has the Federal Reserve already begun to cut interest rates? Has it started to lower the SLR? Both of these actions would enhance liquidity in the risk market. If neither has occurred, the market may temporarily stop declining, but when macro data emerges, the sentiment of decline will still appear.

Thus, a new bottom will gradually emerge, and the anticipated "bottom" will continue to be adjusted downward.

The only factor that does not need to be expressed through macro and political data is the VIX. If the panic index spikes above 50 or even higher, it is indeed likely to represent a temporary bottom, but this does not guarantee a reversal rather than a rebound.

To achieve a true reversal and welcome a bull market, in addition to needing time to reduce inflation, the U.S. economy must remain strong, the Federal Reserve must gradually begin to cut interest rates, halt balance sheet reduction during the rate-cutting process, and stimulate liquidity through lowering the SLR and QE. Only under these conditions can the bull market reach its most glorious moment.

In simple terms, reducing tariffs, ending the Russia-Ukraine war, lowering interest rates, halting balance sheet reduction, lowering the SLR, and ensuring the economy does not enter a recession are all crucial. Each of these factors could halt the decline and lead to a rebound; the more of these conditions that are met, the greater the probability that a rebound will turn into a reversal.

Finally:

Nominal recession may only appear after an actual recession occurs, or it may disappear after an actual recession has emerged. In simpler terms, the market may quickly reflect the results of a recession, such as a direct drop of over 50% in the U.S. stock market and a VIX rise above 80, which could lead to a rapid rebound in the context of quickly consuming the recession.

Moreover, the market may not wait for two consecutive quarters of negative GDP growth to bottom out; it may rebound or reverse before nominal economic recession is confirmed, primarily relying on judgments about inflation and interest rate trends.

However, it is still important to note that the current decline is directly or indirectly related to Trump. Therefore, Trump has some ability to reverse the market's pessimistic sentiment during declines in the risk market. However, in the long run, only aligning with the Federal Reserve's expectations, reducing inflation, and achieving a soft landing may be the safest solution. Otherwise, any occurrence of recession or actual recession will have a significant impact on the risk market.

If such a situation truly occurs, BTC may create a very deep pit during this period.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。