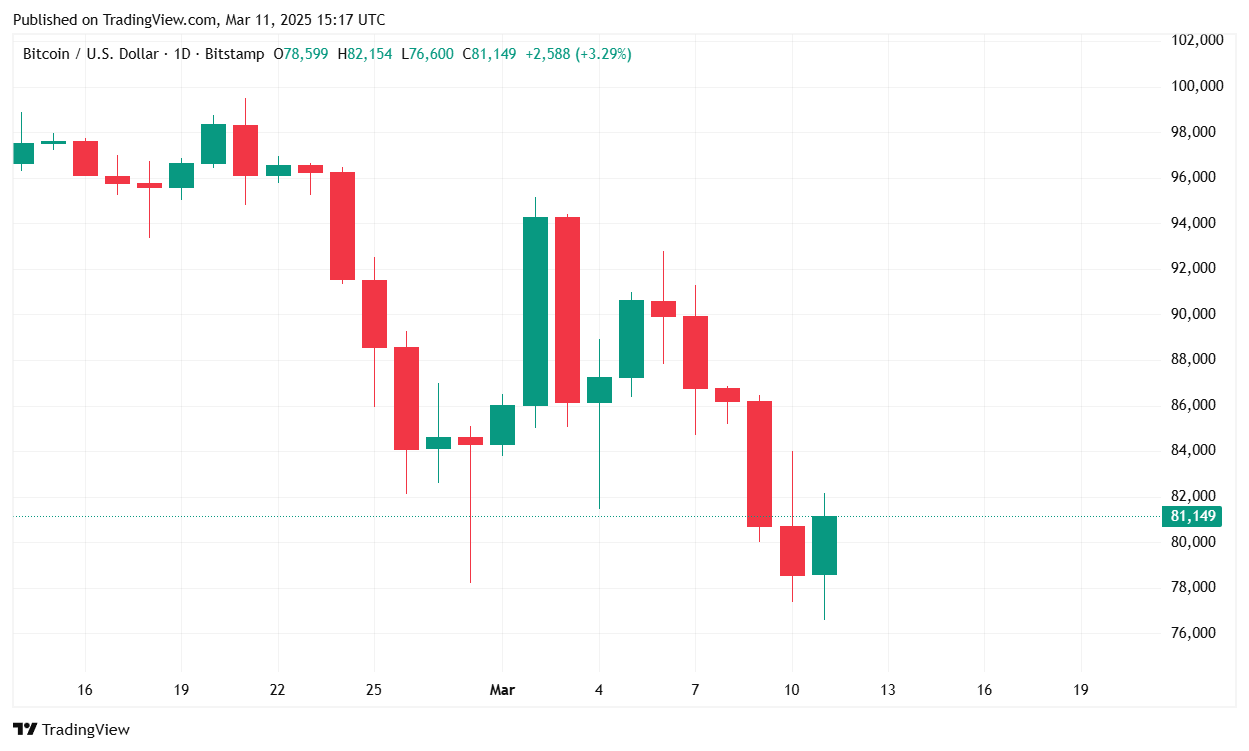

Bitcoin tumbled all the way to $76,624.25 late last night, a 4-month low, before later recovering. The entire cryptocurrency market has lost more than a $1 trillion in value since mid-December 2024, according to Coin Market Cap data.

In the last 24 hours, bitcoin traded between a low of $76,624.25 and a high of $82,087.03. As of the latest data, Bitcoin is priced at $80,645.13, marking a slight 0.66% increase over 24 hours and a 2.56% decline over the past week.

(BTC price / Trading View)

The 24-hour trading volume reached $59.56 billion, a significant 23.40% increase, indicating heightened trading activity. Bitcoin’s market capitalization currently stands at $1.58 trillion, slightly up 0.04% from the previous day.

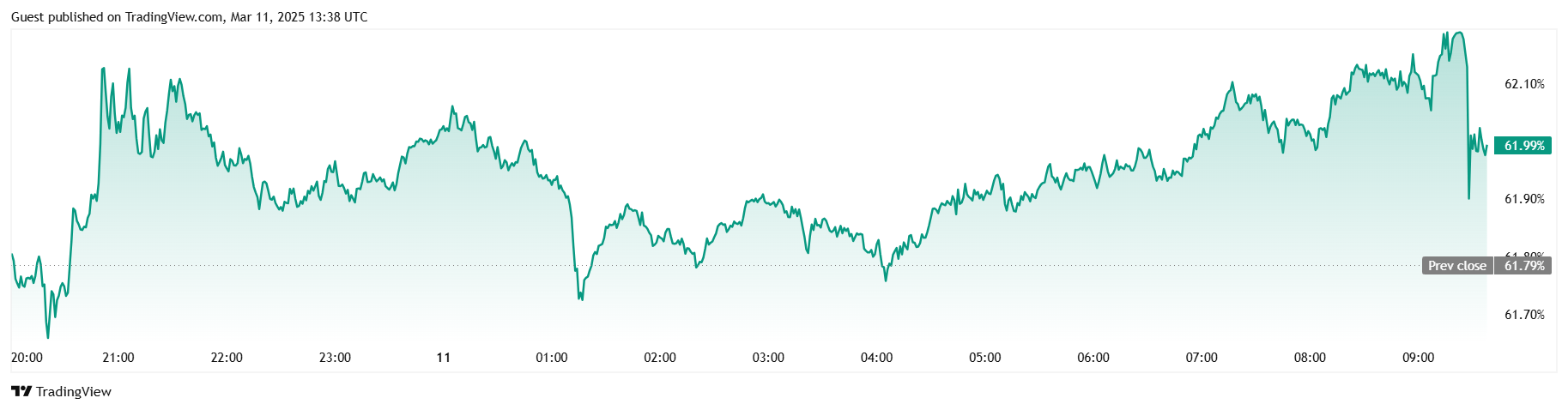

Bitcoin’s market dominance has risen slightly to 62%, a 0.36% increase over 24 hours. Futures markets show a total open interest of $46.05 billion, a decrease of 0.72% over the past day. Liquidation data reveals total liquidations of $260.97 million, with long positions accounting for $185.50 million and short positions for $75.48 million.

(BTC dominance / Trading View)

In an unprecedented move on Tuesday, President Donald Trump said his administration will raise tariffs on Canadian steel and aluminum imports by an additional 25% for a total of 50%.

Trump remarked he was responding to the Ontario government’s 25% tax on electricity exports to the U.S., announced by Premier Doug Ford in February. The tax took effect on Monday.

The price of bitcoin briefly dipped below $80,000 on the news.

Blackrock CEO Larry Fink issued a warning about Trump’s trade policies, stating:

I think if we all are becoming a little more nationalistic – and I’m not saying that’s a bad thing, you know, it does resonate with me – that it’s going to have elevated inflation.

Higher inflation could lower the prospects of a cut in interest rates by the Federal Reserve, a situation that would impact bitcoin’s price.

The convergence of heightened trading activity, inflationary concerns due to trade policies, and significant liquidations, suggests that bitcoin may continue to experience volatility in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。