Bitcoin and the crypto market, in general, have not been doing well during the month of March 2025. Bitcoin has dropped below the 200-day simple moving average (SMA) which stood at $83,362 after sliding to Monday’s intraday low of $78,377 per coin. The leading crypto asset’s market cap stands at $1.55 trillion, which encompasses 60.2% of the $2.61 trillion crypto market cap.

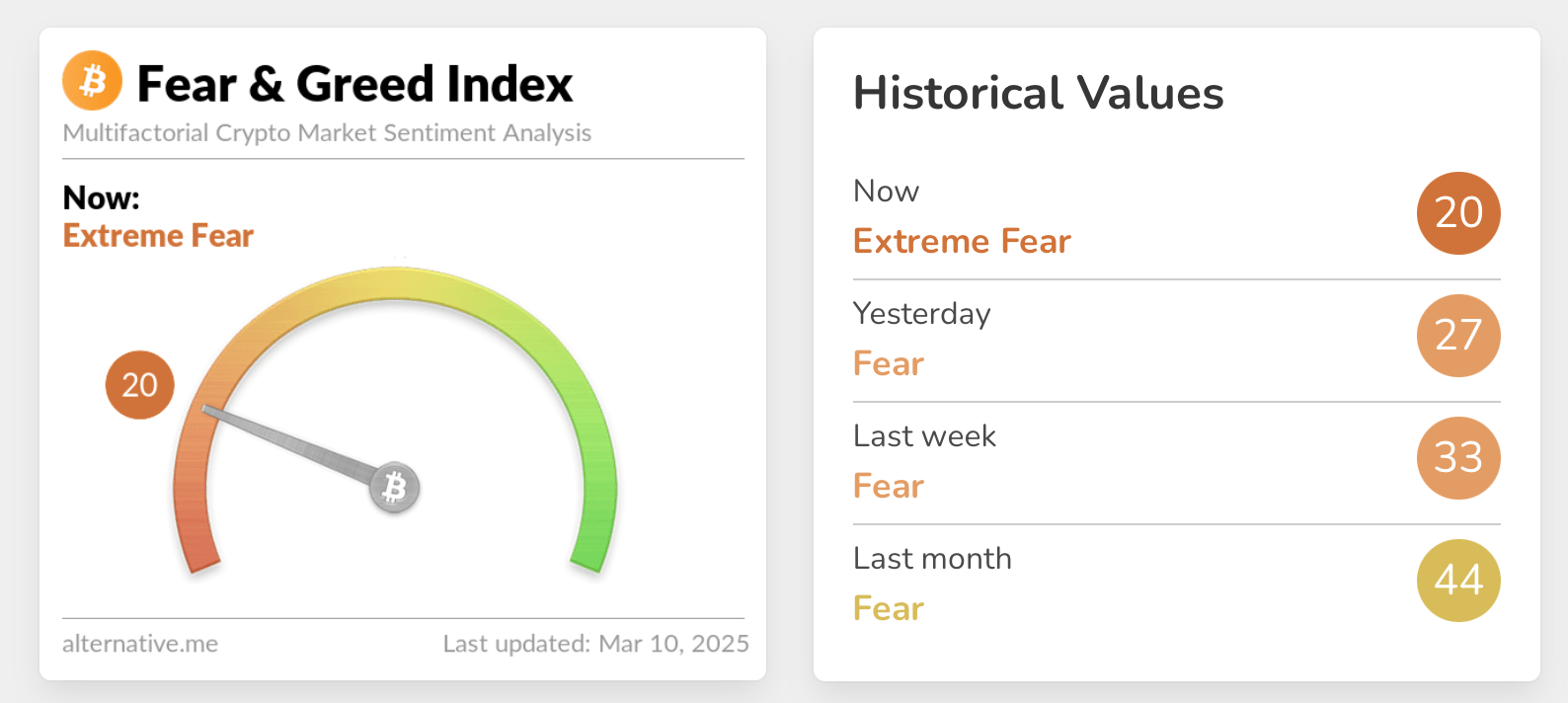

According to the Crypto Fear and Greed Index (CFGI) hosted on alternative.me, the sentiment across the crypto market stands in “extreme fear” as there’s a chance the $78,000 footing may not be BTC’s bottom. Three days ago, the CFGI score stood at 34 out of 100, which equals “fear,” and today it is now a 20 out of 100 and into the “extreme fear” range.

The CFGI has not been this low in over 12 months, but it did crash lower at the end of February. On Feb. 27, 2025, the score was in the “extreme fear” zone with a 10 out of 100. Alternative.me’s CFGI description notes that the crypto market is highly emotional and the index is meant to help mitigate these emotional responses by operating on two key assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

In a climate defined by heightened apprehension, cautious optimism may emerge from a recalibration of risk. Observers note that market fluctuations reflect underlying volatility rather than fundamental shifts, prompting some to consider measured opportunities. The current landscape highlights the value of emotional discipline, encouraging investors to balance skepticism with strategic insight as market dynamics evolve cautiously, amid shifting market sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。