The Trump administration’s lackluster White House Crypto Summit was largely ceremonial in nature and appears to have contributed to a precipitous drop in the price of bitcoin (BTC).

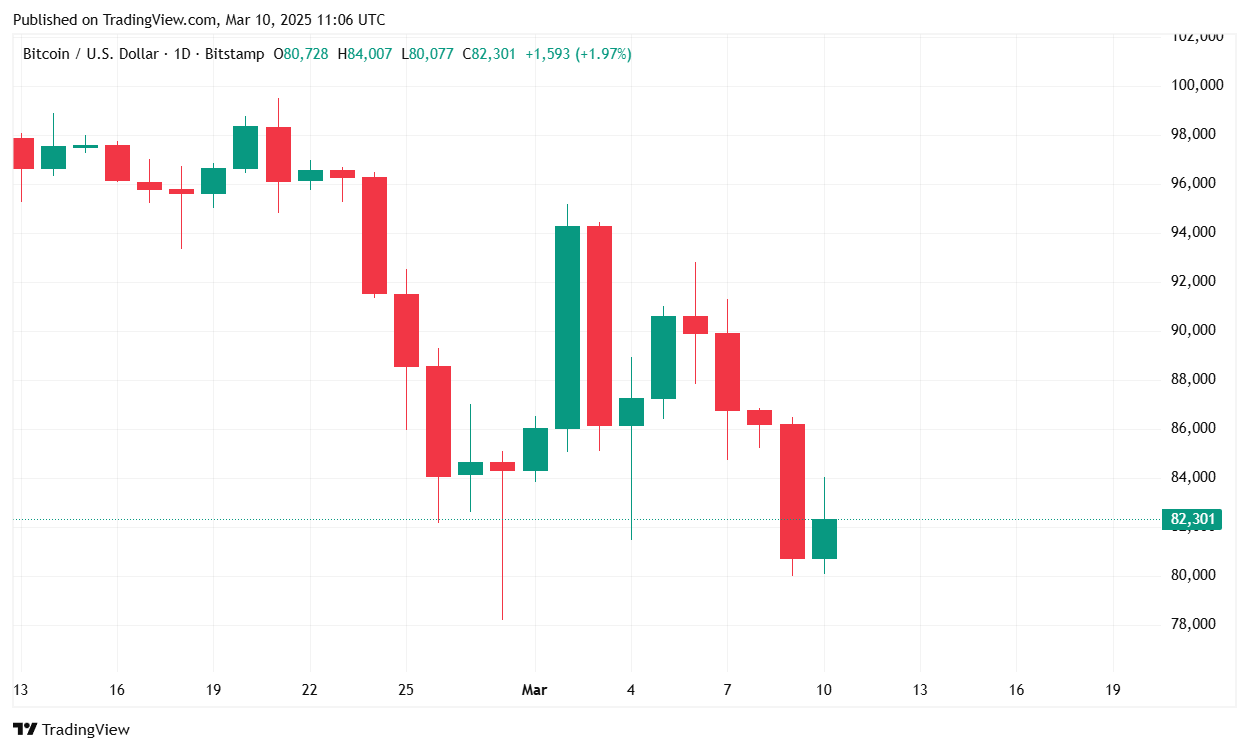

- 24-hour Price Range: Bitcoin traded between $80,559.45 and $86,471.13.

- Current Value: As of the latest data from Coin Market Cap, BTC is priced at $82,418.30, marking a 2.93% decline over the past 24 hours and a 10.87% decrease over the past week.

(BTC price / Trading View)

- Trading Volume: The 24-hour trading volume stands at $43.33 billion, a significant increase of 181.16%, likely due to post-weekend trading activities.

- Market Capitalization: Bitcoin’s market cap is approximately $1.63 trillion, down 3.07% since yesterday.

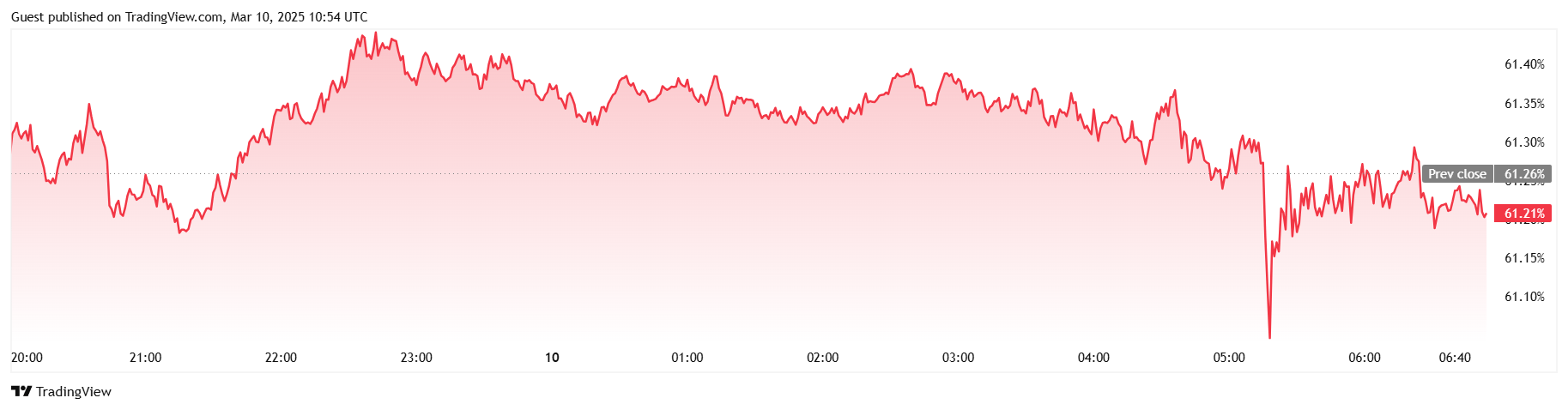

- BTC Dominance: According to TradingView, BTC’s market dominance is at 61.21%, a slight decrease of 0.07% over the past 24 hours.

(BTC Dominance / Trading View)

- Futures Open Interest: Data from Coinglass indicates that total bitcoin futures open interest is $47.06 billion, reflecting a 2.54% decline in the last 24 hours.

- Liquidations: Coinglass reports total liquidations of $97 million in the past 24 hours, with long positions accounting for $209.52 million and short positions for $54.89 million.

President Donald Trump signed an executive order on Thursday, establishing a national strategic bitcoin reserve and digital asset stockpile.

Key leaders in the cryptocurrency industry were subsequently invited on Friday to the White House Crypto Summit. Many anticipated further details around the strategic bitcoin reserve would be revealed, but the event appeared merely ceremonial in nature, which some are saying could have contributed to the sharp price correction that left bitcoin at $82K.

The establishment of a strategic bitcoin reserve by the U.S. government signifies a growing institutional acceptance of cryptocurrencies. While the immediate market reaction has been negative, with bitcoin’s price declining, some analysts believe this move could enhance the U.S.’s standing in the crypto space and attract more institutional investors in the long term.

However, the lack of immediate, concrete policy changes and the broader economic concerns, such as potential recessions and trade tensions, continue to weigh on investor sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。