💡 Investment mogul Duan Yongping: Having too much cash is a pleasant thing; being fully invested is enjoyable, while being in cash feels a bit uncomfortable——

Many people criticize Duan Yongping, but have they ever considered that mindlessly being fully invested is something anyone can do, while being in cash requires learning and discipline?

The joy of being fully invested is essentially the exhilaration of aligning knowledge and action. When investors complete the "cognitive loop"—thoroughly understanding the project's value, clearly recognizing the flaws in the market pricing mechanism, and gaining insight into their own capability boundaries—putting money into the investment is merely a natural outcome of that understanding.

Everyone has made a mistake in investing: focusing on a target without setting stop-loss or take-profit levels, and not managing positions dynamically, leading to a situation where after a -90% drop, there’s still another -90%. Your sunk cost keeps increasing until your principal approaches zero, at which point you fully awaken to the reality.

It’s worth asking yourself: is your full investment merely an emotional switch, or is it truly an alignment of knowledge and action?

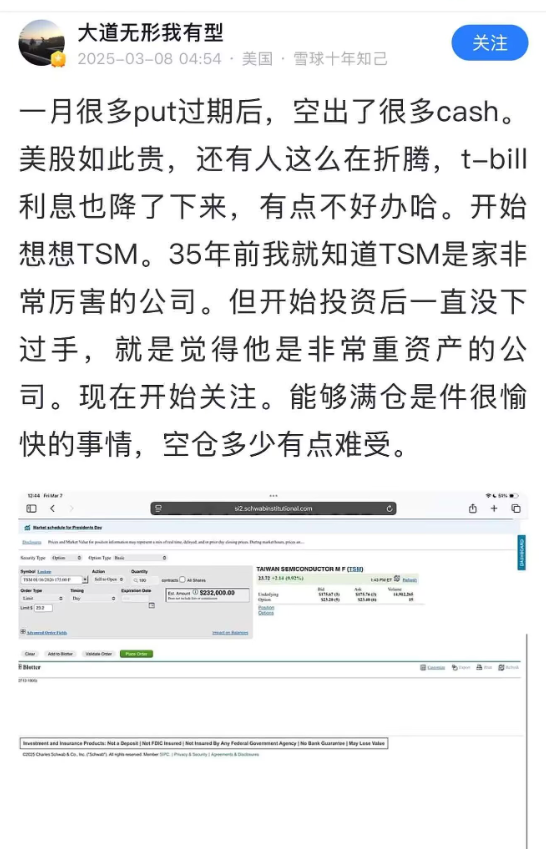

As for being in cash, it is an "art of waiting." Both Duan Yongping and Buffett have held large amounts of cash since last year; what are they worried about? What are they waiting for?

In their logic, cash is not a "defensive asset," but rather an "offensive reserve." The core logic is:

1⃣ Valuation discipline: Refusing to pay excessive premiums for short-term hot spots, and adhering to a margin of safety.

2⃣ Opportunity cost: The "time value" of cash must be weighed against potential investment returns; in the current environment, waiting is better than rushing in.

3⃣ Long-termism: The patience to hold cash is essentially a practice of the "lifetime investment" philosophy—only by rejecting mediocre opportunities can one capture truly great targets.

This is also why I repeatedly emphasize that in the crypto space, one should always maintain stable cash flow and always leave some room to be "in cash." This will allow you to remain calm both when there are few opportunities and when new opportunities arise.

Therefore, position management is not an independent judgment; it’s not as simple as feeling that the market will rise and increasing your position, or feeling it will fall and reducing your position. It should be an organic part of your investment system, and at the very least, it should not create conflict.

There is no "correct action"; all wisdom lies in the cognitive dimension beyond your "actions."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。