Author: Shijun

Introduction

Today, the importance of cross-chain bridges remains self-evident.

However, the tide of VC infrastructure coins has dimmed after the storm of inscriptions and Meme+AI. In this period of market calm, it is more suitable to use objective emotions to examine the evolution of history and seize the opportunity to uncover the timeless truths behind it.

In 2023, LayerZero rapidly rose to prominence with its unique "Ultra Light Node" architecture, becoming a star project in the cross-chain track, with a valuation reaching $3 billion. The LayerZero V2 version launched in 2024 brought 30 million on-chain cross-chain transactions, further establishing its position as an industry leader.

The omnichain vision attracted numerous developers and garnered the favor and investment of top institutions such as Sequoia Capital, a16z, and Binance Labs. However, on the other hand, it also faced skepticism due to issues of centralization and security, sparking heated discussions in the industry.

Some mockingly referred to it as "technical garbage" and "super intermediaries," arguing that its V1 version merely created a framework without practical implementation, labeling it as "technical garbage" that essentially relied on a 2-of-2 multi-signature model, while the V2 version itself did not bear the security responsibility of the cross-chain verification network (DVN), likening it to a wolf in sheep's clothing.

Others claimed that LayerZero's business model over the past three years was astonishing, reminiscent of the alliances and collaborations of contemporary times.

Who is right and who is wrong? Let Shijun conduct an in-depth analysis of its business model based on the technical solution to assess whether its foundation is solid or merely an air castle built on sand.

I. Technical Analysis: The Evolution of LayerZero's Architecture and Security Assumptions

1.1 V1: Ultra Light Nodes and Security Risks

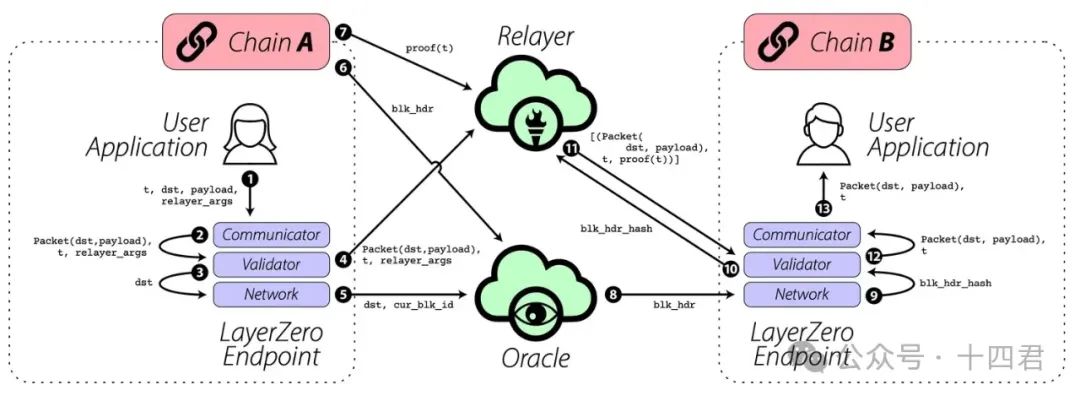

LayerZero V1 (hereinafter referred to as V1) introduced the concept of "Ultra Light Nodes (ULN)," with its core being the deployment of a lightweight endpoint contract on each chain as a message sending and receiving point, with the collaboration of oracles and relayers as off-chain entities to complete cross-chain message verification.

【Image Source: Official White Paper of LayerZero V1, illustrating the roles of Relayer and Oracle】

Essentially, it shifted the heavy burden of block synchronization and verification computation to oracles and relayers, thereby keeping on-chain contracts extremely simple.

V1 referred to this design as "ultimate trust layer separation," and by avoiding the need for a fully operational light node on the target chain, the costs were significantly lower than other cross-chain bridge architectures.

Thus, it is evident that V1's "2-of-2" trust model has efficiency advantages, but it also has obvious security risks:

- Collusion risk: This "anti-collusion" is entirely based on social trust and economic incentives, lacking the coercive constraints of cryptoeconomics.

- Unclear responsibility boundaries: Both oracles and relayers are off-chain roles, and V1 cannot directly control their operations. If the oracle service goes down or the relayer stops functioning, cross-chain messages will fail to be delivered, affecting availability (as seen in 2023 when the Stargate bridge was dubbed the "cross-chain assassin" due to fee issues, which was essentially a service supply problem).

- Chain-level risks: It relies entirely on the security of the public chains it connects to, while LayerZero lacks an arbitration mechanism for intermediary roles.

- Although V1 claims that oracles and relayers are permissionless roles that "anyone can run," this is not the case in practice. In early 2023, during the voting on the Uniswap cross-chain bridge proposal, some questioned V1's excessive centralization and preferred the Wormhole with large institutional validators.

1.2 V2: DVN Mechanism and Its Security Analysis

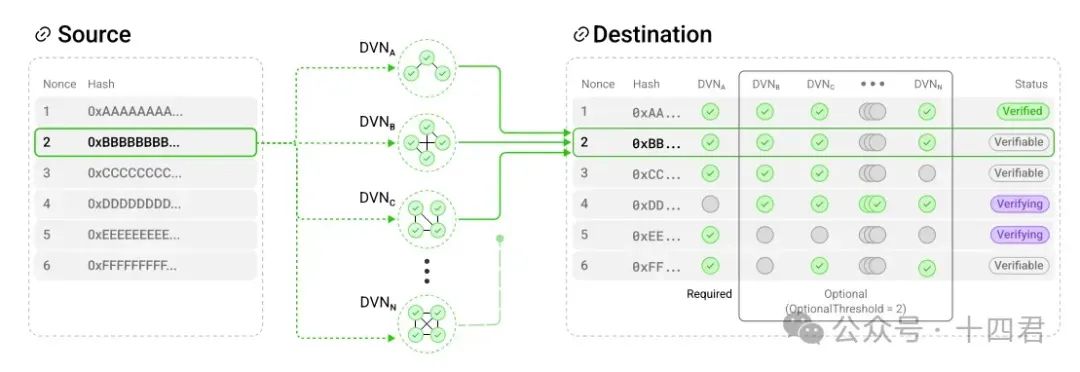

LayerZero V2 (hereinafter referred to as V2), launched in early 2024, introduced the concept of a "Decentralized Verifier Network (DVN)" in the verification layer, moving away from the previous reliance on oracles and relayers.

【Image Source: Official White Paper of LayerZero V2, illustrating the optional multi-group voting of DVN】

With a network composed of multiple verification nodes for cross-chain message signature confirmation, developers can choose and combine multiple DVNs based on application needs to verify messages, thus moving beyond the fixed 2-of-2 model for security strategies.

Clearly, there are advantages:

- The sources of DVN can be very diverse. According to LayerZero's strategic director Irene, the team can run its own DVN or use existing cross-chain bridges/networks as DVNs. Even individual teams can participate, introducing more independent stakeholders into the system, which naturally increases the overall pie.

- Different cross-chain verification solutions can coexist: Whether it's the validators of the official Arbitrum cross-chain bridge, the 19 guardians of Wormhole, the PoS nodes of Axelar, or MPC multi-signatures, they can all be part of its verification layer.

- User choice autonomy: Users can choose combinations such as "Chainlink oracle network + LayerZero Labs DVN + community DVN."

Is that enough?

No, the security of users indirectly depends on the quality and combination strategy of the DVN itself, which is still the weakest link in the barrel:

- Fragmentation of security strategies: The strength of different DVNs can vary significantly. Some DVNs are backed by professional institutional nodes with staked tokens, while others may just be multi-signatures or a few nodes. The entire network lacks a unified security standard and operates as independent security islands.

- Although V2 offers multiple DVNs as options and recommends combined use, the final choice lies with the application side. If developers choose a weak DVN for independent verification, they are laying the groundwork for risk. From a market perspective, if a single DVN is already strong enough, other DVNs are often seen as redundant, and many projects may prefer to use only one (for cost or convenience reasons). Therefore, DVNs need to ensure that staking penalties exceed the potential theft value or are supplemented by other deterrents (legal, reputational).

- The introduction of multiple DVN combinations also increases system complexity. Attackers can exploit technical vulnerabilities rather than economic attacks. For example, the design of the Nomad bridge was optimistic verification, but a bug in implementation led to the theft of $190 million.

1.3 How to Comment on the Technical Transition from V1 to V2?

First, from the perspective of compatibility:

The current V2 is undoubtedly the king of compatibility, easily integrating with EVM, SVM, and even Move systems. Its accompanying documentation, use cases, developer community, and developer relations (hackathons, etc.) are all industry-leading benchmarks, which reduce the difficulty of integration and ultimately make it one of the preferred solutions for many new public chains.

Second, from the perspective of security:

While V2 offers a stronger upper limit on security, it also lowers the lower limit, as it previously at least had reputable oracle institutions.

It has become more like a market platform, allowing various verification networks to compete in providing security services.

However, from the user's perspective, issues of responsibility and dispute will inevitably arise. Today, the official claims to provide a neutral protocol, with specific security determined by the DVN chosen by the application. Once an incident occurs, there will be a situation of mutual shirking of responsibility.

Moreover, the current "decentralization" banner raised by V2 still has considerable ambiguity. While DVN appears to have removed single points of failure, most applications still tend to use a small number of officially recommended DVN combinations, with the actual control of the system still in the hands of LayerZero and its partner institutions.

Unless the DVN network can develop hundreds or thousands of independent validators and ensure honesty through strong economic game mechanisms (such as staking + penalties), LayerZero will still be unable to escape the shadow of a fragile trust model. However, at that point, issues of economic incentives may conversely affect the motivations of the DVNs.

Next, let us continue our research from a business perspective.

II. The Subtle Shift in the Cross-Chain Track

2.1 Macroeconomic Trends in Capital Attention

Let's look directly at the data. Below is the financing situation in various tracks of the Web3 field from 2022 to 2024:

Due to the fact that track divisions may not be entirely consistent, different statistical amounts may vary. The statistics in this article are only to reflect trends, and it is recommended to refer to the original text for accuracy. Data sources can be found in the reference links at the end of the article.

Overall:

The significant decline is seen in CeFi-type facilities. My understanding is that in 2022, CeFi still needed financing, while by 2023/2024, those that could self-generate revenue have survived and occupied the market, thus reducing competition in the red sea, leading to an overall decline.

Web3 gaming saw a surge in 2024 after a boom in TG, bringing some volume. However, from a personal perspective, with the decline of TG's popularity, both GameFi and OnChain have been nearly disproven by the market, leaving behind only a mess of pseudo-demand.

I won't elaborate further; however you look at it, infrastructure has indeed found the best certainty in an uncertain market.

2.2 Is Financing Still Enthusiastic About the Cross-Chain Track?

As a type of infrastructure, aside from public chains, the most typical is the cross-chain bridge, and its track advantages are very clear:

- Multi-chain explosion: Cross-chain is a necessity. Whoever can master cross-chain traffic has the opportunity to become the "highway" toll collector in a multi-chain world.

- Pain points and opportunities coexist: Cross-chain bridges are hailed as key elements of Web3 innovation, capable of stimulating new applications such as cross-chain DeFi, cross-chain NFTs, and inter-chain identities. However, cross-chain bridges frequently experience security incidents, with black funds accounting for nearly 70% of the total amount stolen in the industry.

- Platform network effects and moats: Capital is particularly focused on future monopoly or oligopoly potential. If a cross-chain protocol becomes a de facto standard (like the status of TCP/IP in the internet era), early investments will yield substantial returns. This also explains why a16z, Jump, and others are willing to go to war over the choice of the Uniswap cross-chain bridge.

- Cross-chain is not just about asset transfer: Traditionally, cross-chain bridges are seen as tools for transferring tokens, but capital's greater imagination lies in the prospects of "Arbitrary Message Bridges (AMB)," with LayerZero, Hyperlane, and others positioning themselves as full-chain communication protocols.

In short, the capital's enthusiasm for the cross-chain track is the result of multiple overlapping factors: there is a real drive for explosive demand and unresolved pain points, as well as strategic considerations for competing for standards in the future multi-chain interconnected landscape.

However, in reality, the number of new financing rounds for cross-chain bridges in 2024 is very limited, but this does not mean that they are no longer popular. Instead, it indicates that this track is no longer something new players can easily enter, and the product forms of bridges in the market have also changed.

2.3 The Transformation of Parties A and B in Cross-Chain Bridges Under the Multi-Chain Trend

In the early blockchain era, cross-chain bridges typically appeared as independent service providers. However, with the development of the multi-chain application ecosystem, the positioning of cross-chain bridges is changing, leaning more towards underlying services (Party B) and integrating into the user experience of applications or wallets:

- Cross-chain services are gradually becoming backend-oriented and service-oriented, approaching interface standards. For example, wallets like MetaMask and OKX have integrated bridging aggregators, meaning that bridges no longer directly control end-users but instead acquire traffic through B-end (DApp, wallets). This requires cross-chain solutions to be easy to integrate, modular, and meet application needs; otherwise, application providers will choose other service providers, turning cross-chain bridge providers into a B2B model.

- The polarization of discourse power: In the model where "bridges control users," the bridge decides which chains to connect and how much fee to charge. If project parties want to connect to a certain bridge, they often have to comply with its rules, which is still the case for new chains. However, the opposite is true for large chain projects. For example, when Uniswap deployed on BSC, it selected the cross-chain bridge solution through governance voting, and bridges had to bid for the opportunity.

Another role transformation is that in the initial V1 version of LayerZero, it relied on reliable oracles, where the bridge was Party B and the oracle was Party A.

Now, with the launch of V2, more competition has arisen among DVN roles, which has turned LayerZero into Party A, while the actual execution of bridge verification functions has become Party B. To secure better recommendation positions, Party B will naturally change the profit-sharing logic with Party A.

Being a platform is always more appealing than being a shop; it is closer to transactions and remains untainted. It must be said that this indeed reflects LayerZero's own transformation in business positioning, bringing about its current market discourse power.

2.4 LayerZero's Strategic Alliances

LayerZero has a unique positioning; it serves as a public facility for cross-chain communication but is not the ultimate bearer of business responsibilities.

As a witness to the explosive growth of mobile internet platforms over the past decade, it must be said that this strategy of initially subsidizing the market and later competing for profits is all too familiar!

After platformization, the responsibility for security has shifted downwards.

As mentioned earlier, LayerZero hands over the choice of verification security to user applications, meaning "applications own their own security." From a contractual perspective, if a cross-chain theft occurs, LayerZero Labs can fully claim that they did not participate in asset custody, and the responsibility should lie with the relevant DVN or application.

Cooperation and win-win replace subsidies: Many infrastructure projects offer incentive programs or subsidies to attract applications. LayerZero, however, prefers to bind interests (such as investing in each other's projects).

These chains even allocate funds from ecological funds to encourage protocol integration with LayerZero. LayerZero Labs is also actively attracting various parties for financing and cooperation (Coinbase and Binance are both shareholders, not to mention a16z, Circle, and many other resource-rich backgrounds), and this VC lineup already signifies recognition from most on-chain ecological entities.

2.5 Why is LayerZero's Series C Financing Hard to Find?

However, looking at it from another angle, it has already completed Series B financing (with a valuation of $3 billion), and two years have passed. What scale should Series C financing achieve to meet its expectations?

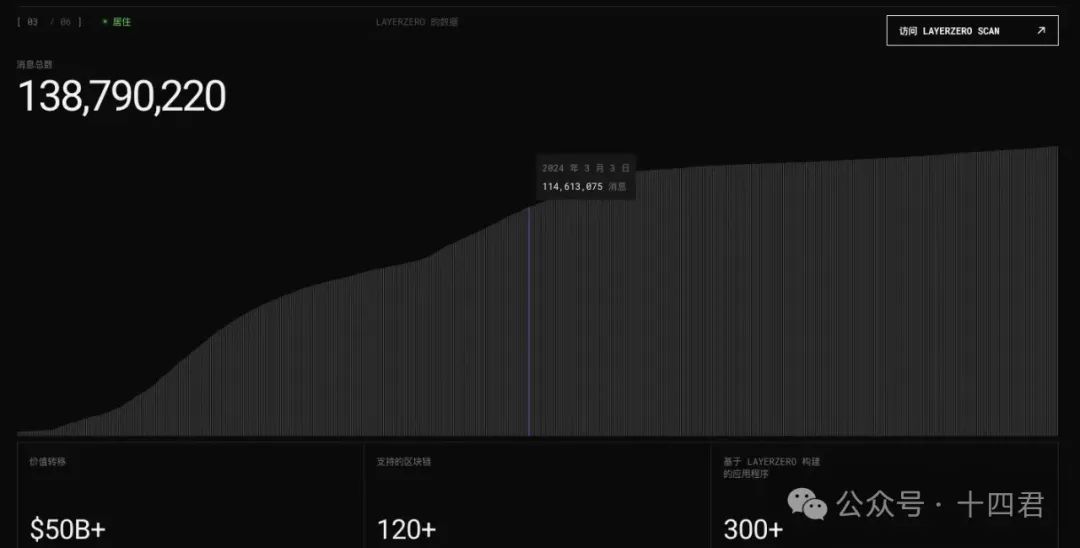

Let’s look at its current transaction scale based on its official data, comparing the figures to the number of messages from a year ago:

【Image Source: LayerZero Official Website】

The total number of messages is now 144 million, compared to about 114 million a year ago, with an annual increase of 30 million transactions, resulting in an annual growth rate of only 26.3%, which is significantly more subdued compared to 2022/2023.

Clearly, the main reason is that the issuance of tokens has significantly digested the expectations of airdrops. Nevertheless, issuing tokens is a form of revenue, even if it is considered a prepayment of future earnings, but project valuations must return to revenue.

However, once we calculate the revenue amount, it becomes awkward. Let’s simply estimate based on transaction fees: 30 million × $0.10 = $3 million/year.

$0.10 is the typical fee range for low-amount transactions on bridges. If the amounts are larger, they follow a staking fee route, with the market average take rate being 0.05%. In the 2023 data, based on the asset cross-chain bridge Stargate implemented by LayerZero, users need to pay a fee of 0.06% each time they use it.

Assuming a total transfer amount of $10 billion over the past year (estimated based on transaction numbers), at a rate of 0.06%, the revenue would be $600,000.

So, combining both calculations, a gross revenue of between $300,000 and $600,000 seems reasonable. However, considering the actual operational support, it is very likely that it is still in a loss state.

Therefore, even completely ignoring costs, if we calculate based on the highest revenue, with a valuation of $3 billion, its PE would reach 500 times. It’s worth noting that even leading internet companies like Apple and Amazon, which are often criticized for being in a bubble, only have PEs in the 30s.

Clearly, for the next Series C, it will be difficult to negotiate a good price in the short term, as no one can digest the expectation of a 500 times PE.

Conclusion

After two years, the author revisits LayerZero and compares its evolution, revealing its creative breakthroughs and glimpsing the shadow of the next generation of cross-chain bridges. Finally, I offer objective commentary for reference.

Since its inception, LayerZero has completed the journey from 0 to 1 and from following to leading in the cross-chain bridge space in just three years.

It innovated with "Ultra Light Nodes" in the V1 version, combining a simplified 2-of-2 multi-signature model with oracles, making small, rapid strides to capture the market.

In the V2 version, it adopted a platform strategy of "framework as protocol" to bind the multi-chain ecosystem, ensuring its stability through the clever design of "risk sinking." It is currently the cross-chain protocol supporting the most chains and types of chains in the market, truly deserving of its position as an industry leader.

Despite criticisms that it does not engage in "dirty work" (DVN verification) and merely acts as an intermediary, it cannot be denied that this is precisely LayerZero's successful business logic: to establish the most universal and stable standard at the base level while leaving the specific implementations to market choices. As a platform, it leverages competition at the lower levels to convert traffic into revenue.

This approach indeed aligns with the needs of a multi-chain world (the emergence of numerous new chains urgently requires cross-chain foundational support) and follows the trend of the role of cross-chain bridges shifting from Party A to Party B.

Technically, the evolution of LayerZero V1/V2 demonstrates the industry's ongoing exploration of balancing security and decentralization. The oracle + relayer model and the DVN mechanism prompt us to reflect on the boundaries of minimal trust.

I believe that while the V2 version may not currently achieve complete decentralization, it theoretically has the potential to do so. However, the market and users may not frequently demand such high levels of decentralized security.

From a business perspective, LayerZero's platform strategy is worth studying, as it brings the strongest compatibility by focusing on developer standards. Through modularization and standardization, it has become a torch that everyone can contribute to, rather than a stove that burns wood alone.

This model reduces its own risks, and although it shares profits with DVNs, it creates a larger ecological landscape.

Finally, the PE estimation, in the absence of officially disclosed operational costs, is merely my opinion. Future changes in revenue models, such as shifting from cross-chain fees to asset management fees, could instantly bring about significant monetization, as traffic is always king in any era, and monopolies always yield exorbitant profits.

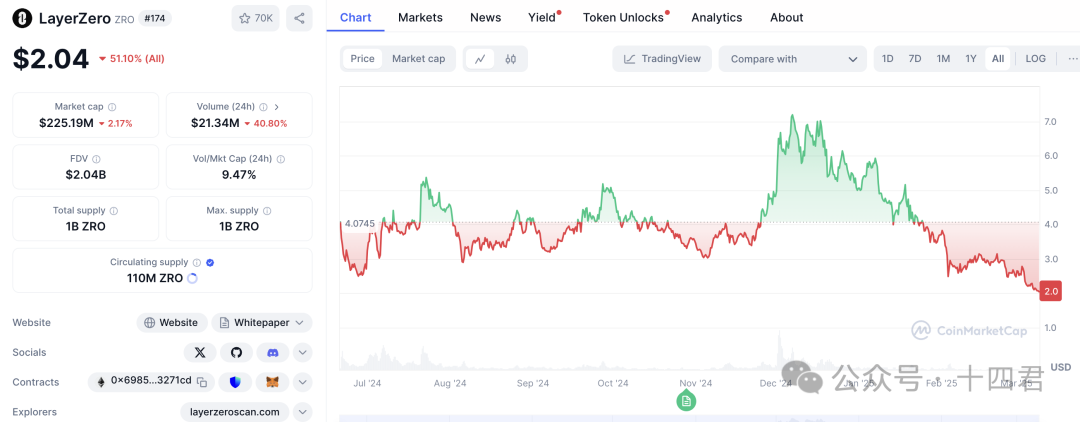

【Image Source: CoinMarketCap】

Lastly, another metric to consider is the market capitalization of circulating tokens. $7 billion clearly reflects a fervent sentiment; how should we interpret the current B2B landscape?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。