Bitcoin‘s 1-hour chart reveals an immediate downtrend, with BTC struggling below key resistance at $86,800. Selling pressure dominates, as reflected in the momentum indicator at -75 and the moving average convergence divergence (MACD) level at -2,720, both signaling bearish momentum. The relative strength index (RSI) at 39 remains neutral, suggesting that bitcoin is not yet oversold. A potential support level at $84,200 is being tested, and a confirmed double-bottom formation with rising volume could provide a short-term reversal opportunity. However, a failure to hold this support could lead to further downside pressure.

BTC/USD 1H chart via Bitstamp on March 9, 2025.

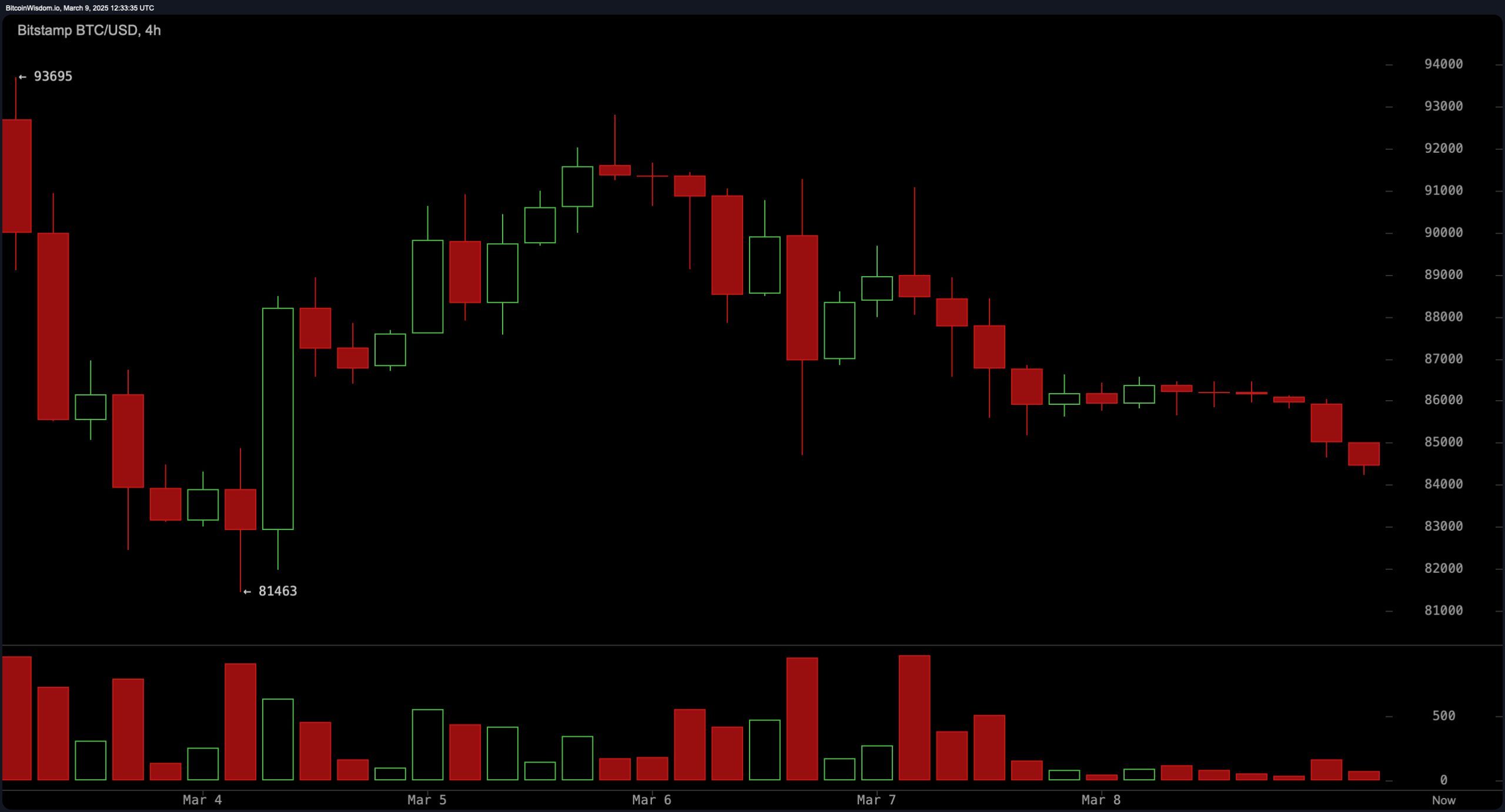

The 4-hour chart shows a broader consolidation within a bearish framework. Bitcoin faces resistance near $88,000, with support levels around $81,000. Large red candles indicate sustained sell-offs, while occasional green volume spikes suggest short-lived buying attempts. The average directional index (ADX) at 34 reflects a weak trend strength, implying that while the bearish bias is intact, volatility remains high. Traders may look for short entries near resistance if bitcoin fails to break higher, while potential long positions may emerge if the $81,000–$82,000 zone attracts substantial buy volume.

BTC/USD 4H chart via Bitstamp on March 9, 2025.

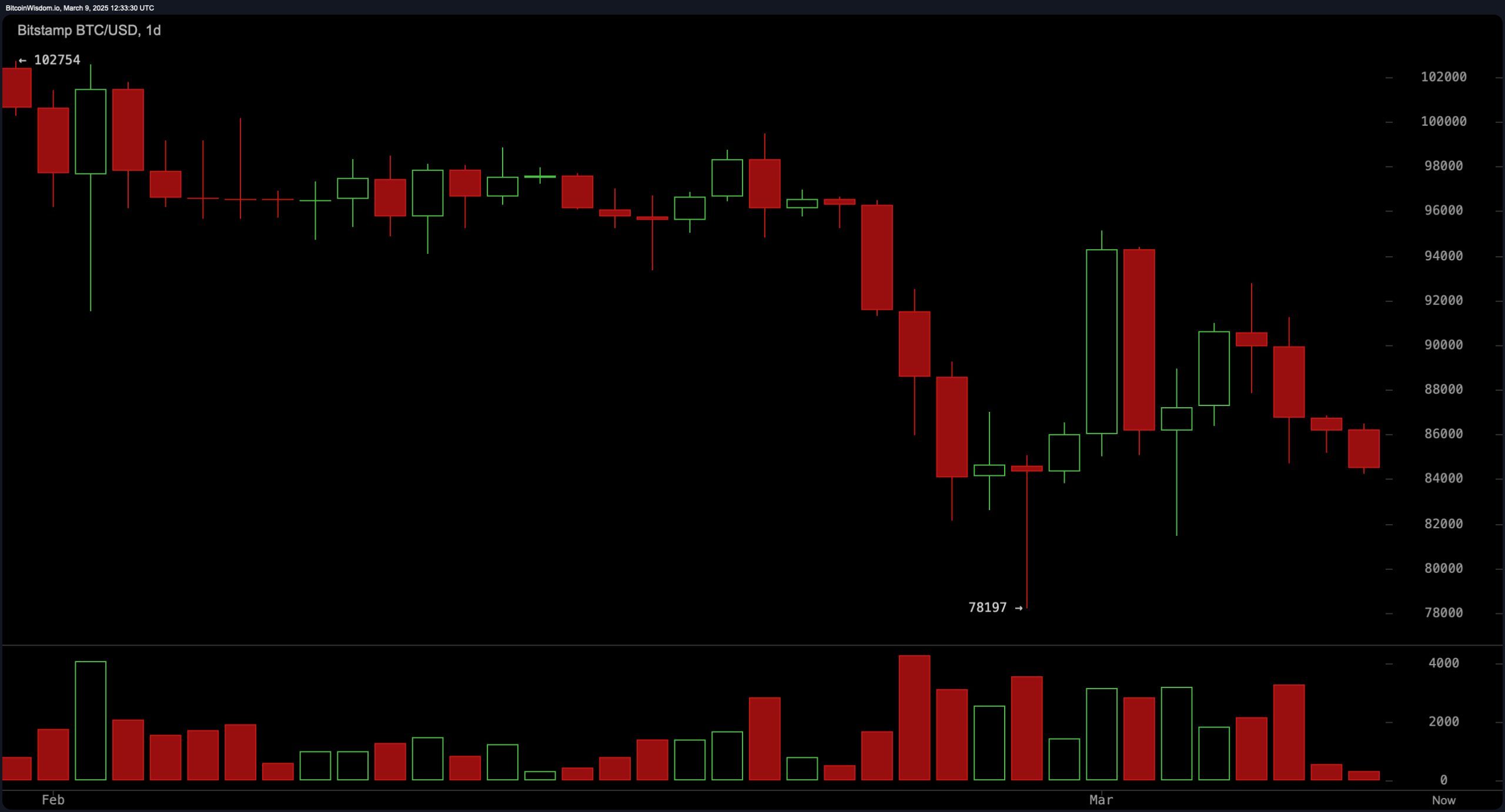

On the daily chart, bitcoin remains in a firmly bearish structure, with key resistance near $94,000 and support at $78,000. The presence of bearish engulfing candles reinforces the downtrend, and the formation of lower highs and lower lows suggests continued weakness. Moving averages (MAs) confirm this trend, with the exponential moving average (EMA) 10 at $87,729, EMA 20 at $89,813, and EMA 50 at $93,298, all signaling sell pressure. The simple moving average (SMA) 200 at $83,290 offers some long-term support, contrasting with the EMA 200 at $85,822, which remains a bearish indicator.

BTC/USD 1D chart via Bitstamp on March 9, 2025.

Oscillator readings further support the bearish outlook, as the commodity channel index (CCI) at -80 remains neutral, while the awesome oscillator at -5,285 also lacks bullish momentum. With most moving averages suggesting sell signals, traders may look for a potential short-term bounce if bitcoin finds support at the lower range. However, failure to hold key levels could result in a deeper correction toward the $78,000 support zone.

Overall, bitcoin’s price action remains under downward pressure, with a short-term outlook dependent on whether the $84,200 level holds. A sustained break above $87,000 could shift momentum, while a failure to reclaim resistance could see bitcoin retesting lower support zones. With low trading volume and persistent bearish technical signals, caution is warranted in the near term.

Bull Verdict:

Despite short-term bearish momentum, bitcoin holds above key support levels, and a potential bounce could emerge if buying volume increases. A break above $87,000 could trigger renewed bullish sentiment, with a recovery toward $90,000 or higher. If the market stabilizes and buyers regain control, the long-term uptrend remains intact.

Bear Verdict:

Bitcoin remains in a firm downtrend across multiple timeframes, with all key moving averages signaling strong sell pressure. The failure to hold $84,200 could lead to a retest of the $81,000–$78,000 support range. With low trading volume and persistent bearish technical indicators, further downside remains the dominant scenario unless buyers step in with conviction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。