This editorial is from last week’s edition of the Week in Review newsletter. Subscribe to the weekly newsletter to get the editorial the second it’s finished.

It has been a red week for markets, with bitcoin down nearly 20% from last Friday to this Friday. Ethereum is down 26% and SOL down 28% in the same time period. Solana is down more than 50% from the Trump memecoin induced all-time high 40 days ago.

Bitcoin spot ETF outflows reached record highs this past week, with a record-breaking single day outflow of $1 billion on Feb 26. The outflow streak currently sits at seven as of Thursday, with Friday likely to continue the streak. These are the biggest and most sustained outflows since the launch of the spot bitcoin ETFs last year.

The crypto fear and greed index is now in ‘extreme fear,’ the most fearful it has been since July 2022. I thought this X post overlaying bitcoin’s price action with the classic Wall St. cycle cheat sheet was funny in that macabre sort of way. Funny because I don’t think we’re at the end of the cycle.

Michael Howell of Cross Border Capital noted that the bitcoin sell-off isn’t surprising given that his global liquidity metrics indicated a ‘liquidity speedbump.’ Howell’s global liquidity data suggests that liquidity will stabilize, causing the liquidity-sensitive bitcoin and crypto assets to stop falling. There are indications of potential sources of liquidity in the near-future from the U.S. and China. This would cause bitcoin and crypto to surge.

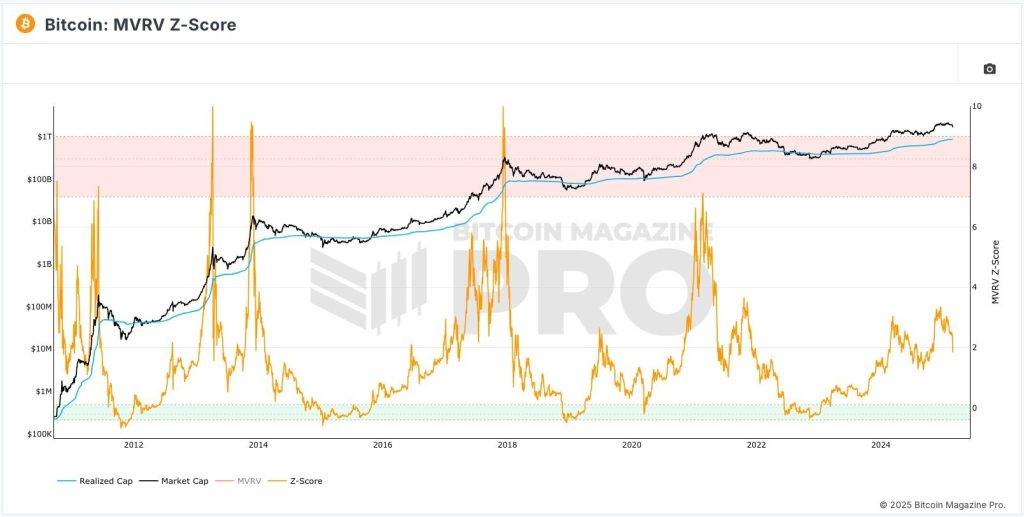

Ryan Selkis, formerly of Messari, posted the following MVRV-Z chart with the two words, “March 2017.” The words plus the chart seem to indicate that this little dip could precede an aggressive run up in price similar to what happened after March 2017.

While it’s clear that I remain bullish on Bitcoin, this does not extend to other parts of the market, especially meme coins. As discussed on Token Narratives this week, I lean towards the view that aside from a very select few of meme coins such as DOGE, meme coins that had performed well will be discarded for new ones. Your meme coin is likely never going to recover. The attention game will always prefer to seek out new, novel coins to capture attention. Put another way: if you must buy meme coins, avoid the old ones.

If meme coin sentiment is low, feelings towards Pump.fun, the project (other than Solana) most associated with meme coin, could best be described as hateful. Here’s a post describing Pump.fun’s legacy:

pump fun managed to hold the mindshare of the entire crypto market for a full year uncontestedand zero of these 8.1m coins currently have a market cap over $500m

Or how about the chart in this post showing the number of coins “graduating” from Pump.fun to Raydium dropping precipitously low? Now, some have disputed the exact numbers in the chart in that post, but even the data these people point to as accurate still tell the same basic story: interest in Pump.fun is waning. Indeed, Pump.fun’s revenue is the lowest since October of last year, and with the way markets are going it is likely to fall further.

The silver lining to all this red is that meme coin exhaustion could finally be upon us. The question of whether people were finally fed up with meme coins was asked pretty much all last year, and people clearly never tired of them. It does feel like this time might be different. The craziness kicked into high gear by Trump’s meme coin feels like it culminated with the LIBRA craziness last week. We might get a rotation, at least a partial rotation, away from meme coins into coins that at least ostensibly have merit/value/utility. From a purely selfish standpoint, I hope that happens because I was never good at the meme coin game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。