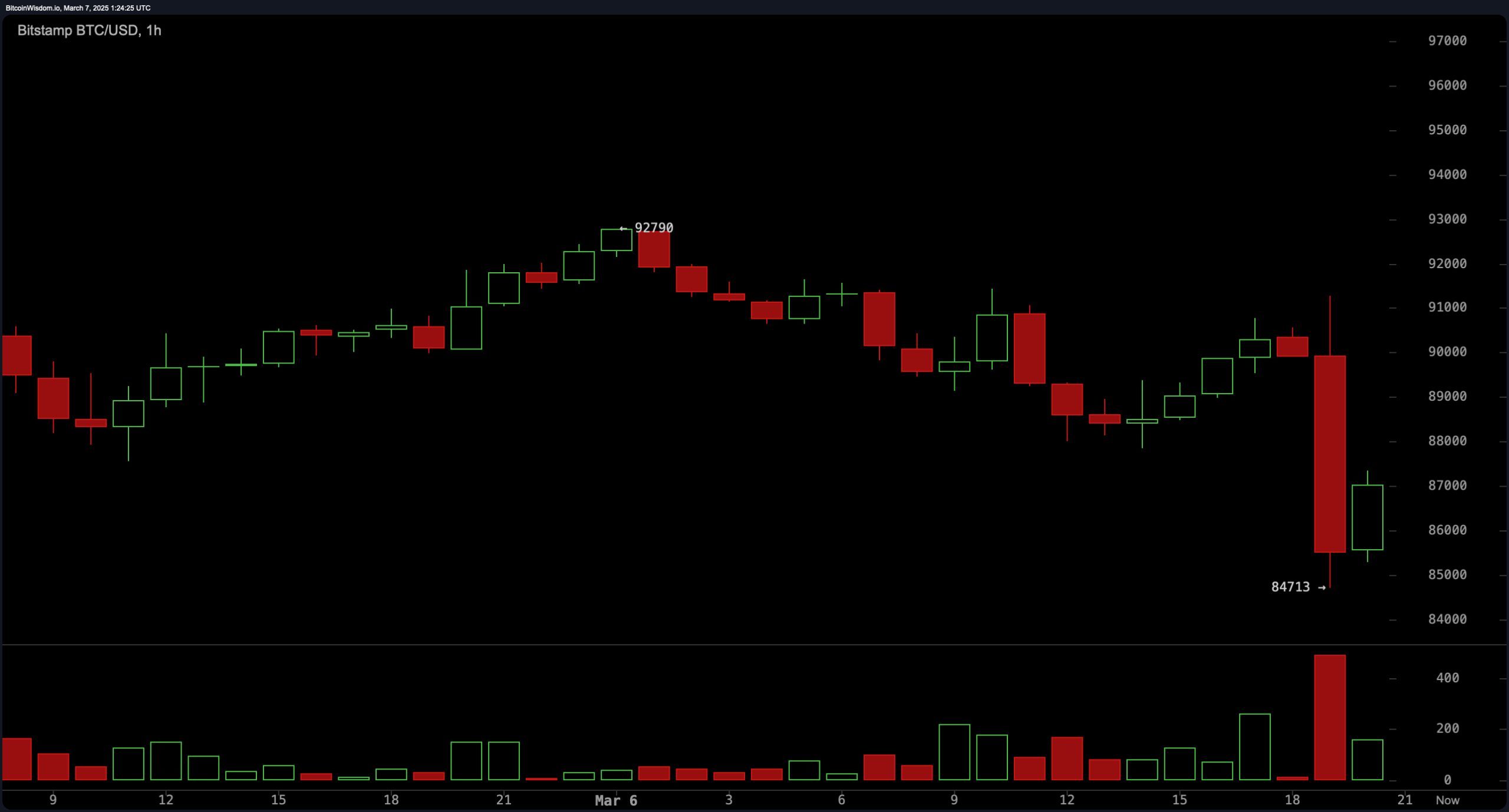

Bitcoin nosedived to $84,713 Wednesday, erasing gains from its recent $90,000 peak, as traders reacted sharply to former President Donald Trump’s Bitcoin Reserve executive order. The crypto economy’s market capitalization fell 4.55%, with all top 10 cryptocurrencies—including ethereum, solana, and XRP—sliding in tandem.

The executive order, which directs federal agencies to add bitcoin to U.S. reserves via criminal forfeitures, amplified a sell-off for some odd reason. The move’s vagueness fueled profit-taking, particularly after BTC’s rally above $90,000 today.

By 8:45 p.m. ET, BTC prices recovered some to $88,663 per unit.

In the past hour alone, $101 million in bitcoin long positions were liquidated, contributing to $245 million wiped out across crypto markets in 24 hours. Trading volumes surged, with exchanges reporting heightened volatility as leveraged positions unraveled.

The drop highlights crypto’s sensitivity to policy signals. As of 8:45 p.m. ET, bitcoin hovered above $88,663. Analysts warn further volatility is likely as the White House Crypto Summit approaches.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。