Analyzing the daily chart, bitcoin is in a correction phase following a peak at $106,447, with support at $78,000–$82,000 and resistance at $92,000–$95,000. Increasing volume during sell-offs contrasts with recent buying interest at lower levels, suggesting potential long positions if bitcoin holds above $88,000–$89,000. A failure to breach $92,000–$95,000 could trigger short opportunities.

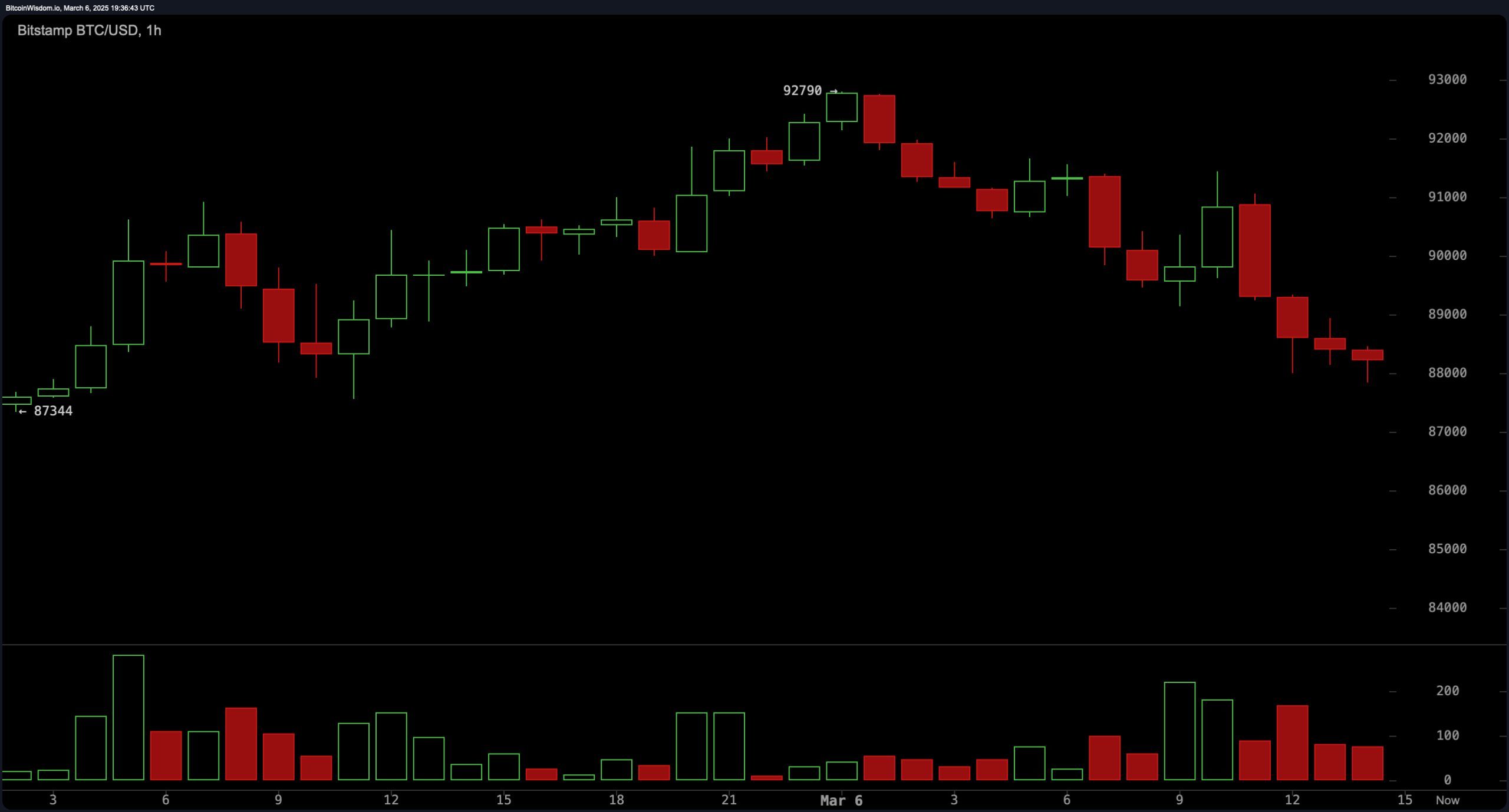

BTC/USD via Bitstamp 1H chart on March 6, 2025.

The 4-hour bitcoin chart reveals a volatile pattern: a sharp rally to $95,152, a retracement to $81,463, and a subsequent rebound. Immediate support lies at $87,000, with resistance at $92,000–$95,000 per BTC. Heavy volume during the decline transitioned to accumulation on green candles, signaling bullish confirmation above $88,000–$89,000. A rejection at $91,500–$92,500 may prompt short positions.

BTC/USD via Bitstamp 4H chart on March 6, 2025.

On the 1-hour chart, bitcoin’s short-term trend shows a pullback from $92,790, with support at $87,300–$88,000 and resistance at $90,000–$91,000 per BTC. Declining volume hints at seller exhaustion, offering a potential buying opportunity if bitcoin forms a bullish structure near $88,000. A breakdown below $87,000, however, could accelerate downward momentum.

BTC/USD via Bitstamp 1D chart on March 6, 2025.

Oscillators present mixed but mostly neutral signals. The relative strength index (RSI) reads 43, while the Stochastic holds at 49. The commodity channel index (CCI) is at -32, and the average directional index (ADX) shows 37, reflecting a neutral trend. The awesome oscillator (AO) is -5,272, and the momentum (MOM) at -3,686 suggests a bullish signal. Conversely, the moving average convergence divergence (MACD) at -2,619 indicates a bearish flash.

Moving averages (MAs) highlight short-term bearishness and long-term optimism. The exponential moving average (EMA) (10) at $89,039 and EMA (20) at $91,035 signal sells, while the simple moving average (SMA) (10) at $87,381 suggests a buy. Longer-term SMAs (200) and EMAs (200) at $82,891 and $85,801, respectively, show bullish bias. Short-term traders may lean on resistance near $92,000, while long-term holders could view dips as accumulation zones.

In summary, bitcoin faces a pivotal test at $92,000–$92,500. A sustained break above could target $95,000–$98,000, while a rejection may revisit $87,000–$88,000. Traders should monitor volume trends and oscillator shifts for confirmation, balancing short-term volatility with macro bullish underpinnings.

Bull Verdict:

– Breakout Potential: A sustained close above $92,000–$92,500 could fuel a rally to $95,000–$98,000, backed by bullish momentum (-3,686) and long-term SMAs (200) at $82,891–$85,801.

– Buyers in Control: Declining sell-side volume on the 1-hour chart and accumulation near $88,000 suggest exhaustion among sellers, aligning with a $1.74T market cap push.

Bear Verdict:

– Resistance Wall: Failure to crack $92,000–$93,000 risks a sharp drop to $87,000–$88,000, amplified by bearish EMAs (10, 20, 50) and MACD (-2,619) sell signals.

– Summit Uncertainty: White House Crypto Summit could trigger selling in a sell the news event, with a breakdown below $87,000 opening doors to $78,000 lows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。