On the eve of the White House Crypto Summit, options data shows that the probability of BTC returning to $100,000 is only about 30-40%?

Macro Interpretation: The price of BTC is currently fluctuating around $91,000, as the market experiences a historic moment of multiple resonances. Former Federal Reserve Chairman Bernanke recently warned about the increasing difficulty for central banks to control inflation, which subtly counters the Trump administration's micro-managing of delaying auto tariffs. The former suggests that global monetary policy may remain hawkish for a long time, while the latter injects confidence into risk assets by easing trade frictions. The market has begun to increase the probability of a dollar rate cut in response to ADP employment data hitting an eight-month low, a seemingly contradictory scenario that serves as the best footnote for understanding the current crypto market ecology. This policy-level controversy has created a tense stage for the crypto market, and the upcoming White House Crypto Summit on March 7 will determine the final direction of this capital drama.

Observing data from Coinank, the past week has seen a spectacular net outflow of 11,734 BTC from CEX, with major platforms collectively seeing over 17,500 BTC leave. Coupled with multiple whale addresses withdrawing 6,930 ETH in a single day, this large-scale asset migration often indicates two possibilities: either institutional players are building strength in the spot market, or smart money is laying the groundwork for the derivatives market. Interestingly, these two speculations are also reflected in the options market, where $2.36 billion in BTC options and $490 million in ETH options will be concentrated for delivery on March 7, with the maximum pain points targeting key psychological levels of $89,000 and $2,300, respectively.

From a technical perspective, Bitcoin has formed a hammer candlestick with a fluctuation of over 15% for two consecutive weeks, a signal reminiscent of the 2017 bull market, akin to Mr. Market striking a gong on the candlestick chart. Some market analysts point out that the "spring compression" effect formed by the current price range of $81,000 to $94,000 bears a striking resemblance to the volatility structure during the Silicon Valley Bank crisis. However, history does not simply repeat itself; against the backdrop of the dollar index falling to a four-month low, capital is changing from traditional markets—tech stocks like Microsoft have seen single-day gains of over 3%, creating a ripple effect in the crypto market.

The butterfly effect of policy expectations has already stirred up a storm in the options market. Data shows that the market's expectation probability for Bitcoin to reach $100,000 by the end of June has risen to 48.64%, compared to about 30% at the end of March. This figure reflects the potential policy dividends that the White House Crypto Summit may release, quantified in options contracts. As the Trump administration releases flexibility on tariffs, the crypto industry is more concerned about whether rumors of its team's "Bitcoin strategic reserve" will be confirmed at the summit. This policy game must guard against the tightening risks brought by Bernanke's warning of a "second wave of inflation" while seizing the institutional dividends brought by regulatory thawing.

Market participants' strategies show interesting divisions. Some top traders liken the current price range to a "quantum superposition state," choosing to observe from the sidelines and wait for mean reversion opportunities. Meanwhile, on-chain whales are playing a new game of "staking arbitrage" through DeFi protocols like Morpho and AAVE, with a mysterious address executing a single-day operation of 16,000 ETH, reminding me of the Wall Street saying, "When sharks start to cruise, small fish better learn to surf." This institutional-level operation stands in stark contrast to retail investors' "death by a thousand cuts" losses, yet it also confirms the increasingly significant institutional characteristics of the crypto market.

The policy direction of the White House Crypto Summit on March 7 may determine the final trajectory of this round of market trends—whether it will replicate the frenzied bull market of 2017 or reflect the last hurrah before the peak of 2021? The answer may lie in the subtle changes in the Greek letter Gamma values in the options market, revealing market makers' vigilance against volatility explosions. The only certainty is that in this era where the cracks in fiat currency credit are becoming apparent, Bitcoin is completing a daring leap from "digital gold" to "sovereign asset alternative," and every pulse of the global capital market is composing a new chapter for this crypto symphony.

Data Analysis:

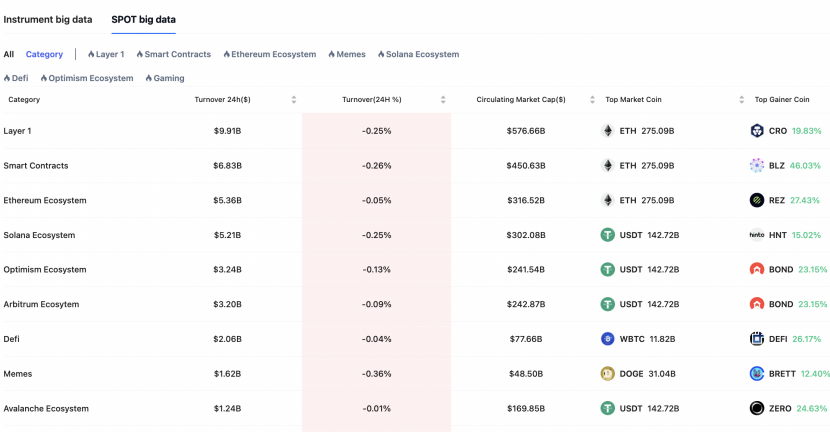

According to Coinank data, recent market dynamics show that the crypto asset market is exhibiting a multi-sector coordinated upward trend. In terms of performance in specific sectors, the DeFi sector continues its strong momentum, with a 24-hour increase of 7.22%, where LINK, ONDO, and AAVE recorded significant rises of 15.10%, 18.13%, and 14.30%, respectively. This phenomenon confirms the core characteristics of DeFi achieving non-custodial and blockchain settlement through smart contracts.

Leading cryptocurrencies are also strengthening, with BTC breaking through the $90,000 mark, showing a 24-hour increase of 4.58%; ETH has risen above $2,200, with a single-day increase of 4.40%. In terms of market benchmark index performance, mainstream coins, DeFi, and MEME have risen by 2.78%, 10.82%, and 2.89%, respectively, indicating a continued increase in market risk appetite. The performance of layered architecture and underlying protocol sectors shows significant differentiation:

The Layer 2 sector has risen overall by 4.68%, with ARB and Move achieving increases of 11.16% and 14.95%, reflecting a surge in demand for scaling solutions; the Layer 1 sector has increased by 2.32%, with APT leading the way at 11.71%, highlighting the ongoing development of public chain ecosystems; the CeFi sector has risen by 1.97%, with CRO surging by 22.38% in a single day, indicating that centralized financial platforms still possess competitiveness in asset custody and liquidity supply.

It is noteworthy that while the Meme sector has an overall increase of 2.45%, its volatility is significantly higher than that of other sectors, which aligns with the characteristic of this field lacking fundamental support. The PayFi sector's mild increase of 1.35% continues the previous trend, indicating that payment-related financial protocols are in a value discovery phase. Market data shows that DeFi and CeFi are exhibiting a symbiotic development trend, with the former enhancing transparency through smart contracts, while the latter maintains advantages in user experience and regulatory adaptability.

From the perspective of market linkage and policy expectations, the recent synchronized rebound of U.S. stocks and the crypto market has multiple driving factors. The Trump administration's delay of auto tariffs has released signals of easing trade frictions, temporarily boosting tech stocks and risk asset preferences, creating a resonance effect in market sentiment. It is important to note that the rise in the crypto market is not only driven by U.S. stocks but is also related to the warming of policy expectations—the upcoming White House summit may promote the clarification of Bitcoin reserve plans and other regulatory frameworks, accelerating institutional capital's expectations for compliant pathways and value recovery. However, caution is warranted as the Federal Reserve's Beige Book reveals consumer fatigue and the potential for intensified market volatility due to the tug-of-war over rate cuts. The current rebound reflects more of a short-term policy dividend, while the medium-term still requires observation of substantial progress in real economic indicators and regulatory dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。