Author: Ignas

Compiled by: Tim, PANews

The Uniswap Foundation has voted to approve a massive investment plan of $165.5 million. Why?

Because the performance of Uniswap v4 and Unichain after their release has fallen far short of market expectations.

In just over a month:

- The total locked value (TVL) of Uni v4 is only $85 million

- The TVL of Unichain is just $8.2 million

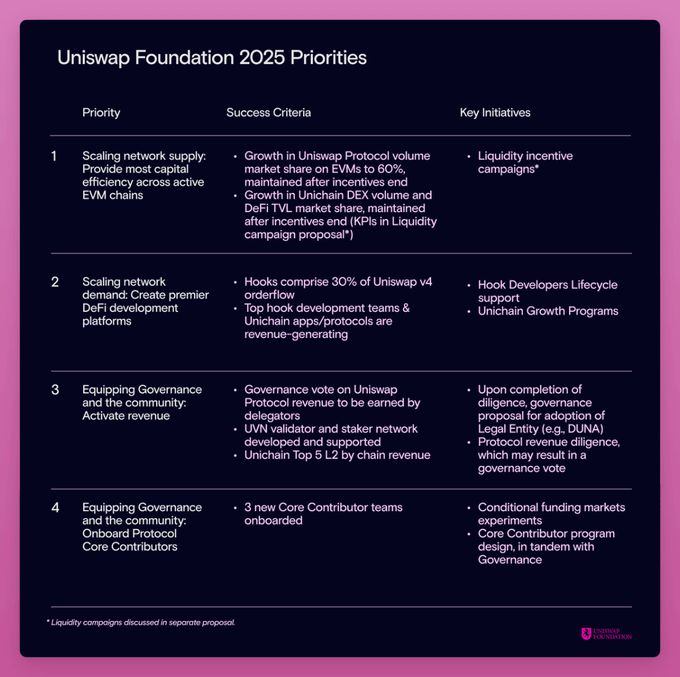

To promote growth, the Uniswap Foundation proposed allocating $165.5 million to the following areas:

- $95.4 million for funding (developer programs, core contributors, validators);

- $25.1 million for operations (team expansion, governance tool development);

- $45 million for liquidity incentives.

As you can see, Uni v4 is not just a DEX, but also a liquidity platform, and Hooks are applications built on top of it.

Hooks should drive the ecological growth of Uni v4, and thus need to be accelerated through the funding program.

Detailed allocation of the funding budget:

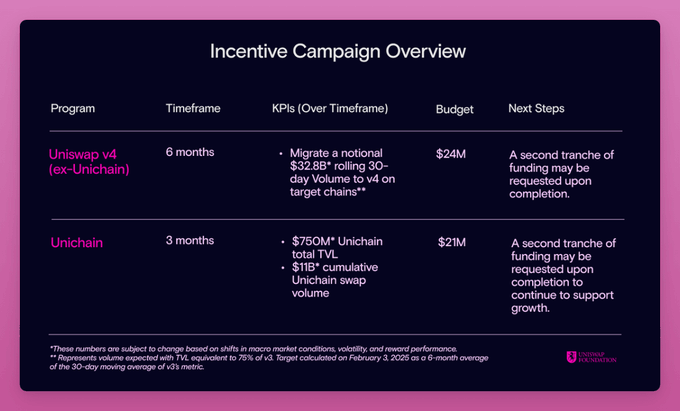

The $45 million liquidity provider (LP) incentives will be used for the following:

- $24 million (distributed over 6 months): to incentivize liquidity to migrate from other platforms to Uni v4;

- $21 million (distributed over 3 months): to drive the total locked value (TVL) of Unichain from the current $8.2 million to $750 million.

In contrast, Aerodrome mints AERO tokens worth about $40 million to $50 million per month for liquidity provider (LP) incentives.

The proposal has passed the temperature check phase but still faces some criticism:

At a time of changing industry dynamics, Aave proposed to buy back $1 million of AAVE tokens weekly, Maker plans to buy back $30 million monthly, while UNI holders seem to be treated like a "cash cow" being drained of value, with their token value never being captured.

The UNI token has not enabled a fee-sharing mechanism, while Uniswap Labs has earned $171 million through front-end fees over the past two years.

The key to the entire system lies in the organizational structure of Uniswap:

- Uniswap Labs: Focused on protocol technology development;

- Uniswap Foundation: Promoting ecological growth, governance, and funding programs (such as grants, liquidity incentives).

What a clever legal team.

Aave and Maker have established a closer alignment of interests with token holders, and I don’t understand why Uniswap's front-end fees cannot be shared with UNI holders.

In summary, other criticisms mainly focus on the high salaries of the core team, Gauntlet's responsibility for executing liquidity incentives, and the establishment of a new centralized DAO legal structure (DUNA).

As a small governance representative of Uniswap, I voted in favor of this proposal, but I still have significant concerns about the future of UNI holders: the incentive mechanism has failed to align with the interests of holders.

However, I am a loyal fan of Uniswap and highly recognize its role in driving the DeFi space. Currently, the growth momentum of Uni v4 and Unichain is very bleak, and they need to introduce incentives to promote development.

The next vote of the Uni DAO should focus on the value capture mechanism of the UNI token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。