一、结构和核心意义

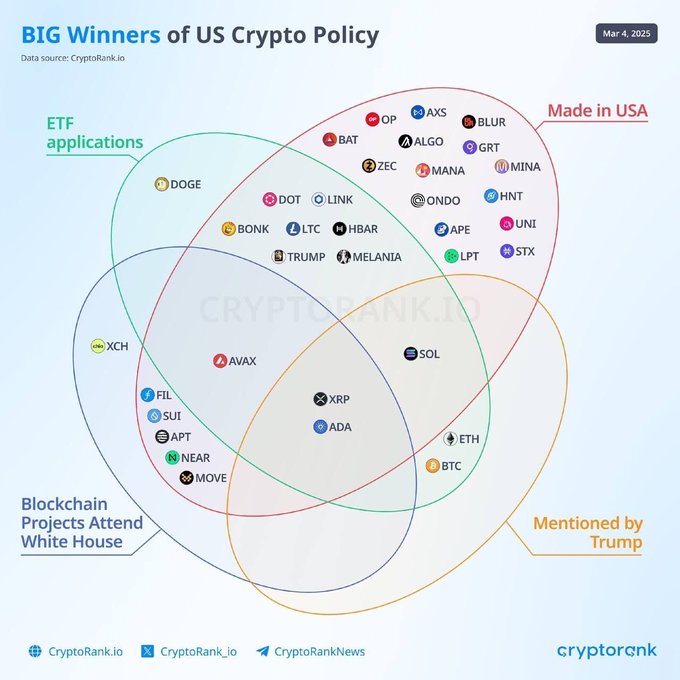

下图展示了美国加密货币政策的几个主要受益因素,包括:

1、ETF Applications(ETF申请):绿色区域,ETF是传统金融市场的重要工具,加密货币ETF的推出意味着这些项目在机构投资者和主流金融市场中的接受度提高。2024年比特币和以太坊现货ETF的获批已经证明了ETF对市场价格和采用率的推动作用。

2、Blockchain Projects Attend White House(区块链项目参与白宫):红色区域,这一类别表明这些项目可能参与了与美国政府的直接对话或政策制定活动。白宫的关注通常意味着这些项目在监管合规性、技术应用(如供应链管理、去中心化身份)或国家战略层面具有重要性。

3、Mentioned by Trump(特朗普提及):橙色区域,特朗普近年来对加密货币的态度从批评转为支持,尤其是在2024年竞选期间,他公开支持加密货币并推出了自己的NFT项目和MEME币。被特朗普提及的项目可能因其名人效应而获得市场关注度和短期价格推动。

4、总部位于美国的加密货币项目(Made in USA):橙色区域。它们可能在政策支持上具有天然优势,尤其是在中美科技竞争的背景下。

二、重叠区域的意义

双重重叠区域:项目同时出现在两个类别中,表明它们在多个方面具有优势。例如,BTC(比特币)和ETH(以太坊)同时在“ETF申请”和“特朗普提及”区域,显示其在政策支持和公众关注度上的双重利好。

三重重叠区域:位于图中心,包含SOL(Solana)、XRP(Ripple)和ADA(Cardano)。这些项目同时满足“ETF申请”、“白宫参与”和“特朗普提及”三个条件,是美国加密货币政策的最大潜在受益者。

三、具体项目分类与分析

1、 三重利好项目(中心区域:ETF + 白宫 + 特朗普提及)

这些项目位于三个区域的重叠部分,是政策支持的“核心赢家”。

SOL(Solana):

背景:Solana是一个高性能Layer 1区块链,以高吞吐量和低交易成本著称,是以太坊的主要竞争对手之一。

分析:Solana出现在中心区域,表明其在美国政策制定中受到高度关注,可能正在申请ETF,同时获得了特朗普的认可。Solana的高性能使其在DeFi(去中心化金融)和NFT(非同质化代币)领域有广泛应用,这可能吸引了政府的兴趣,尤其依靠MEME币的领先优势,获得链上活跃用户较大份额。)

XRP(Ripple):

背景:Ripple主要用于跨境支付,其代币XRP长期以来与美国证券交易委员会(SEC)有法律纠纷(始于2020年)。

分析:XRP出现在中心区域可能表明其法律问题正在解决,或其在政策层面的地位有所提升。2024年SEC对加密货币的监管态度有所缓和,XRP若能通过ETF申请,可能迎来大规模资金流入。

ADA(Cardano):

背景:Cardano是一个注重学术研究和分层架构的区块链项目,以其科学方法和可持续发展性著称。

分析:Cardano在中心区域的位置表明其在美国市场中获得了更多认可,可能在政策制定或政府合作中扮演了角色。其技术实力可能使其成为政府支持的候选项目。

2、 双重利好项目

ETF申请 + 特朗普提及(绿色+橙色区域)

BTC(比特币):

背景:比特币是市值最大的加密货币,被视为数字黄金。2024年初,美国批准了比特币现货ETF,推动了其价格和机构采用,2025年BTC更是将被积极推动成为美国甚至各国及各大上市公司的战略储备货币。

分析:比特币同时出现在“ETF申请”和“特朗普提及”区域,表明其市场地位稳固。特朗普的提及可能进一步提升其公众形象,吸引更多散户投资者。

ETH(以太坊):

背景:以太坊是第二大加密货币,支持智能合约和DeFi生态系统。2024年5月,以太坊现货ETF获批。

分析:以太坊在这一区域的位置反映了其在政策和公众关注度上的双重优势。以太坊生态系统的广泛应用使其成为机构投资的重点。

白宫参与 + 特朗普提及(红色+橙色区域)

TRUMP:

背景:可能是与特朗普相关的模因币或代币,常见于名人效应驱动的项目。

分析:其出现在这一区域表明它更多是基于特朗普的个人影响力,而非技术实力。这类代币通常波动性较高,适合短期投机。

MELANIA:

背景:可能是与特朗普的妻子梅拉尼娅相关的一个代币或项目。

分析:与TRUMP类似,MELANIA代币可能也是基于名人效应,缺乏长期技术支撑。

HBAR(Hedera):

背景:Hedera是一个企业级区块链,使用哈希图共识机制,适用于供应链管理和去中心化身份等场景。

分析:Hedera在这一区域表明其可能与美国政府有深入合作,同时受到特朗普的关注。其企业级应用可能使其在政策支持下有长期发展潜力。

ETF申请 + 白宫参与(绿色+红色区域)

这一区域没有项目,表明目前没有项目同时满足“ETF申请”和“白宫参与”但未被特朗普提及的条件。

3、 单类别项目

3.1 ETF申请(绿色区域)

项目:DOGE(狗狗币)、BONK、XCH(Chia)、AVAX(Avalanche)、FIL(Filecoin)、SUI、APT(Aptos)、NEAR、MOVE。

分析:

模因币:DOGE和BONK是模因币,社区驱动性强,但技术应用有限。它们申请ETF可能更多是为了吸引散户资金。

Layer 1区块链:AVAX、SUI、NEAR是高性能Layer 1区块链,与Solana类似,可能寻求通过ETF进入传统金融市场。

存储和基础设施:FIL(去中心化存储)、XCH(绿色区块链)等项目的技术应用更广泛,ETF申请可能反映了机构对其长期价值的看好。

3.2 白宫参与(红色区域)

项目:LTC(莱特币)、LINK(Chainlink)、DOT(Polkadot)。

LTC:莱特币是比特币的分叉,交易速度更快,可能在政府支付或结算场景中被关注。

LINK:Chainlink提供去中心化预言机服务,是DeFi生态系统的关键基础设施,其白宫参与可能与数据可信性相关。

DOT:Polkadot是一个跨链协议,旨在连接不同区块链,其技术可能吸引政府在互操作性方面的兴趣。

3.3 特朗普提及(橙色区域)

项目:OP(Optimism)、AXS(Axie Infinity)、BAT(Basic Attention Token)、ZEC(Zcash)、MANA(Decentraland)、ONDO、APE(ApeCoin)、LPT(Livepeer)、UNI(Uniswap)、STX(Stacks)。

分析:

多样性:这一区域包含Layer 2解决方案(OP)、DeFi(UNI)、游戏(AXS)、隐私币(ZEC)、元宇宙(MANA)等多种类型项目,反映了特朗普提及的广泛性。

投机性:特朗普的提及可能更多是为了市场炒作,而非基于技术评估。这些项目可能短期内因关注度提升而上涨,但长期价值需看其基本面。

3.4 Made in USA(橙色区域内子标签)

项目:BLUR(NFT市场)、ALGO(Algorand)、GRT(The Graph)、MINA、HNT(Helium)。

分析:

美国制造:这些项目起源于美国,可能在政策支持上具有优势。例如,ALGO和GRT是基础设施项目,分别专注于高性能区块链和数据索引,可能受益于政府在技术领域的优先支持。

技术应用:HNT(物联网)、MINA(轻量级区块链)等项目的技术创新可能使其在政策制定中更具吸引力。

四、宏观趋势和政策背景

4.1 ETF的推动

历史背景:2024年是加密货币ETF的突破年,比特币现货ETF(1月获批)和以太坊现货ETF(5月获批)为市场注入了大量机构资金。

图中趋势:更多项目(如SOL、XRP、ADA、AVAX等)正在申请ETF,表明加密货币与传统金融的融合正在加速。ETF的推出可能显著提升这些项目的市场价值和采用率。

4.2 特朗普的影响

背景:特朗普近年来对加密货币的态度从批评转为支持。他在2024年竞选期间多次公开支持加密货币,甚至推出了自己的NFT项目。

图中体现:特朗普提及的项目种类繁多,包括模因币(TRUMP、MELANIA)、DeFi(UNI)、游戏(AXS)等,反映了他的影响力主要集中在市场炒作和公众关注度上,而非技术评估。

4.3 白宫参与

背景:美国政府对区块链技术的态度正在从监管压力转向合作与支持。白宫参与的项目可能涉及去中心化身份、供应链管理或金融创新等领域。

图中体现:SOL、XRP、HBAR等项目在白宫参与区域,表明它们可能在政策制定中扮演了重要角色。

4.4 美国制造的优势

背景:在中美科技竞争的背景下,美国政府可能优先支持本国区块链项目,以确保技术主权。

图中体现:标记为“Made in USA”的项目(如ALGO、GRT、HNT)可能在政策支持下获得长期发展优势。

五、潜在市场影响

5.1 中心区域项目(SOL、XRP、ADA)

市场前景:这些项目因三重利好而成为最大赢家,可能吸引更多机构资金和散户投资者。

具体影响:

SOL:Solana的高性能可能使其成为DeFi和NFT领域的首选,ETF获批可能推动其价格进一步上涨。

XRP:若其与SEC的法律问题解决,ETF获批可能引发大规模资金流入。

ADA:Cardano的科学方法可能使其在政府合作中更具优势,长期发展潜力较大。

5.2 ETF相关项目(BTC、ETH、AVAX等)

市场前景:ETF的推出将为这些项目带来更多机构资金,提升市场价值。

具体影响:

BTC和ETH:已获批ETF,市场地位稳固,特朗普的提及可能进一步吸引散户。

AVAX、SUI、NEAR:若ETF获批,可能成为下一波高性能区块链的受益者。

5.3 特朗普提及项目(TRUMP、MELANIA、UNI等)

市场前景:这些项目可能短期内因炒作而上涨,但长期价值需看其基本面。

具体影响:

TRUMP、MELANIA:模因币特性明显,波动性高,适合短期投机。

UNI、OP:DeFi和Layer 2项目的技术实力较强,特朗普的提及可能为其带来更多关注。

5.4 白宫参与项目(HBAR、LINK、DOT等)

市场前景:这些项目可能获得更多政府合同或政策支持,长期发展潜力较大。

具体影响:

HBAR:企业级应用可能使其在政府合作中占据优势。

LINK:预言机服务的广泛应用可能使其成为DeFi和政府合作的桥梁。

六、总结

最大赢家:Solana、XRP和Cardano因同时满足三重利好而成为核心受益者,可能在政策支持和市场表现上表现突出。

市场龙头:比特币和以太坊继续保持主导地位,ETF和特朗普提及为其增添了更多关注。

政策支持:白宫参与的项目(如HBAR、LINK)可能在长期发展中受益于政府合作。

美国制造:起源于美国的项目(如ALGO、GRT)可能在政策支持下获得竞争优势。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。