The Asian market has shown tremendous growth potential in the field of Bitcoin lending.

Author: Tiger Research Reports

Translation: Shenchao TechFlow

Abstract

Bitcoin collateral loans provide users with a way to obtain funds without selling their cryptocurrency, with innovations from companies like Vield and Coinbase leading the industry development.

Despite the clear advantages of this model, it still faces significant challenges such as high volatility of cryptocurrencies, forced liquidation, and regulatory uncertainty.

The Asian market has demonstrated enormous growth potential in Bitcoin lending, but the key to success lies in clear policies and regulations, widespread adoption by institutions, and effective risk management.

1. Introduction

Bitcoin collateral loans are an emerging financial tool that allows cryptocurrency holders to obtain funds without selling their assets. This model is gradually gaining popularity, with specialized institutions like Vield in Australia and Coinbase in the United States launching related services.

Through this type of loan, users can use Bitcoin as collateral while retaining the potential for appreciation. As digital assets become more widespread, Bitcoin collateral loans are becoming a strong complement to traditional financing.

However, this loan model also comes with high risks. Unlike traditional collateral such as real estate, Bitcoin prices are highly volatile, which can lead to forced liquidation of loans, resulting in losses for borrowers.

Additionally, the regulatory environment for cryptocurrency lending remains unclear. Governments and financial institutions around the world are still exploring how to integrate such services into the existing financial system. Therefore, both lending institutions and borrowers need to proceed cautiously in this market filled with opportunities and challenges.

This report will analyze classic cases of Bitcoin collateral loans, explore their potential in the Asian market, and assess the associated risks and regulatory issues.

2. Case Studies from the West: The Crypto Lending Models of Coinbase and Vield

2.1 Vield: Integrating Bitcoin Lending into Traditional Finance

Vield's CEO Johnny Phan led a $35 million cryptocurrency collateral loan business last year. Source: afr.com.

This Australia-based lending company is striving to position itself as a "crypto-native bank." Vield offers Bitcoin collateral loans as well as a hybrid loan product that combines digital assets and real estate collateral, aiming to establish Bitcoin as a legitimate asset class within the financial system, similar to traditional mortgage-backed securities. Unlike traditional banks that primarily rely on real estate as collateral, Vield innovatively uses Bitcoin and Ethereum as loan guarantees, creating a new asset class.

According to data from Tiger Research, the loan amounts offered by Vield range from $2,000 to $2 million, with a term of 12 months and an annual interest rate of 13%, along with a 2% service fee. For an average loan of $120,000, the borrower needs to deposit 1.5 Bitcoins (approximately $240,000) as collateral. If the price of Bitcoin falls, causing the loan-to-value (LTV) ratio to reach 75%, the borrower must add more collateral to maintain the 65% LTV requirement. Conversely, if the price of Bitcoin rises, the borrower can request to withdraw part of the collateral.

To ensure the safety of funds, Vield stores the borrower's collateral in separate secure digital wallets and does not mix or repurpose these assets. All collateral transactions can be traced through the blockchain, further enhancing the transparency of the loans. Currently, Vield manages approximately $35 million in loans and has not experienced any defaults. This indicates that Bitcoin collateral loans show real potential in the financial services sector, despite the inherent volatility of the market.

However, traditional financial institutions remain skeptical of this model. Many institutions refuse to accept cryptocurrencies as collateral, primarily due to their high price volatility and lack of intrinsic value. Economist Saul Eslake warns that under market pressure, Bitcoin collateral loans could exacerbate financial instability, forcing borrowers into costly asset liquidations.

This phenomenon reflects the complexity of integrating cryptocurrencies into the mainstream financial system. Some institutions are beginning to accept digital assets, while others remain cautious.

2.2 Coinbase: Bitcoin Lending Driven by DeFi

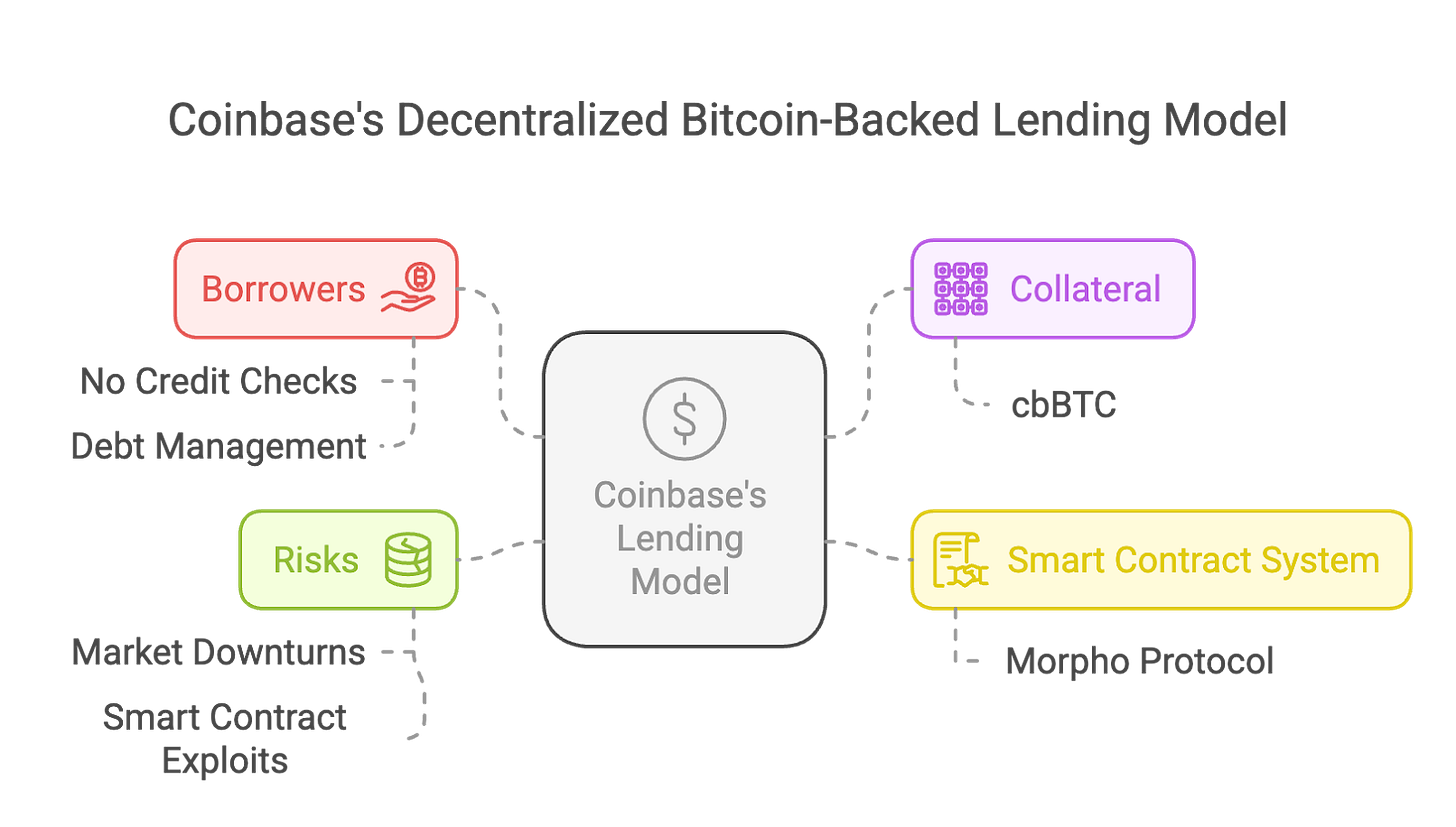

Source: Tiger Research.

Coinbase has launched a decentralized Bitcoin collateral loan service by integrating with the Morpho protocol on the Base blockchain. Users can use Bitcoin as collateral to borrow up to $100,000 in USDC stablecoins. This model does not require credit checks or fixed repayment plans; instead, it determines borrowing limits through a forced loan-to-value (LTV) ratio, ensuring that the collateral always covers the outstanding debt.

Coinbase utilizes Coinbase Wrapped Bitcoin (cbBTC) to implement this model. cbBTC is a tokenized form of Bitcoin held in Morpho smart contracts, which enhances liquidity and decentralization while also introducing potential risks of smart contract vulnerabilities and attacks.

For borrowers, the biggest risk is the automatic liquidation of assets. If the price of Bitcoin falls, causing the LTV ratio to exceed 86%, the system will automatically liquidate the collateral and impose additional penalties. While this mechanism protects the lender's interests, it also exposes borrowers to the risk of passive liquidation during market fluctuations. Unlike traditional loans, Coinbase's automated liquidation model requires borrowers to constantly monitor the value of their collateral to avoid asset loss.

From a regulatory perspective, Coinbase's decentralized lending model has both advantages and disadvantages. On one hand, using the Morpho protocol increases transaction transparency and reduces counterparty risk; on the other hand, the legal and tax status of cbBTC remains unclear, which could lead to tax compliance issues. Although this model avoids the risks associated with the failures of centralized platforms like BlockFi and Genesis, it still faces challenges related to regulation, security, and market stability.

At the same time, concerns about financial stability persist. Economists point out that widespread adoption of Bitcoin collateral loans could pose systemic risks. A sudden drop in Bitcoin prices could trigger mass liquidations, leading to market sell-offs. For lending institutions that rely on private funding, Bitcoin's high volatility could result in liquidity crises. Furthermore, as policymakers continue to raise demands for investor protection and risk disclosure, regulatory pressure may intensify.

Nevertheless, if Bitcoin collateral loans continue to develop, they could have a profound impact on traditional lending structures. However, their long-term sustainability will depend on the ability to manage risks effectively and achieve compliance within a regulatory framework.

3. Case Study in the Asian Market: Fintertech

Fintertech is a subsidiary of Japan's Daiwa Securities, focusing on cryptocurrency collateral loan services. This is an important case in the field of cryptocurrency lending in Asia. Fintertech allows users to use Bitcoin or Ethereum as collateral to obtain loans in Japanese yen or US dollars, with an annual interest rate ranging from 4.0% to 8.0%. Borrowers can receive loans of up to 500 million yen (approximately $3.3 million) within as little as four business days, providing cryptocurrency holders with a fast and flexible financing option.

In Japan, Bitcoin collateral loans are popular due to their tax advantages. According to Japanese tax law, the tax rate on cryptocurrency investment gains can be as high as 55%. By using Bitcoin collateral loans, users can obtain liquidity without selling their cryptocurrencies, effectively reducing their tax burden. Both businesses and individuals can utilize this method to meet various funding needs. This indicates that in markets with high tax rates, Bitcoin collateral loans are an efficient financing tool.

However, compared to traditional financial products, Fintertech's model faces certain challenges. The high volatility of cryptocurrency prices poses risks for lending institutions. To ensure the sustainability of the model, institutions need to establish a robust risk management framework and optimize their collateral valuation systems. If other financial institutions in Asia can adopt similar models, Bitcoin collateral loans have the potential to become an innovative financial product, bridging traditional finance and digital finance.

4. Advantages of Bitcoin Loan Services in Asia

As cryptocurrency becomes more popular in Asia, Bitcoin collateral loans are emerging as a new source of income for financial institutions (FIs). According to forecasts, by 2030, the global cryptocurrency lending market is expected to reach $45 billion, with a compound annual growth rate (CAGR) of 26.4%. An increasing number of investors and businesses are looking to obtain liquidity through this method without selling their Bitcoin holdings.

Financial institutions in Singapore and Hong Kong have advantages in this field, thanks to their advanced regulatory frameworks, such as Singapore's Payment Services Act and Hong Kong's Virtual Asset Service Provider (VASP) licensing system. As of early 2024, the cryptocurrency lending platform Ledn has achieved $1.16 billion in loan business. This indicates that similar services are also expected to achieve significant results in the Asian market.

In addition, traditional banks can attract more cryptocurrency-savvy customers by collaborating with cryptocurrency exchanges and fintech companies. This cooperation not only expands the user base but also increases revenue through loan interest, service fees, and fiat currency exchange fees.

5. Key Risks and Regulatory Challenges

The following table summarizes the main risks of Bitcoin collateral loans and helps to intuitively understand these risks and regulatory challenges through real cases or hypothetical examples.

5.1. Risk Factor: Regulatory Compliance

The regulatory environment for Bitcoin collateral loans varies significantly worldwide. Different countries have different attitudes toward cryptocurrency lending. For example, Japan has incorporated cryptocurrency lending into its existing financial regulatory framework, while China has completely banned such activities. To prevent illegal activities, businesses must comply with anti-money laundering (AML), know your customer (KYC), and virtual asset service provider (VASP) regulations. Example: South Korea has implemented stricter anti-money laundering policies due to concerns about the potential risks of cryptocurrency lending. This requires lending institutions to submit detailed compliance documents and conduct rigorous due diligence. Some companies have had to terminate their cryptocurrency lending operations because they could not meet these requirements. This indicates that changes in regulatory policies can directly impact the sustainable operation of businesses.

5.2. Risk Factor: Price Volatility and Liquidation Risk

The price of Bitcoin is highly volatile, posing significant challenges for both lenders and borrowers. A sudden drop in Bitcoin prices may trigger margin calls or forced liquidations, putting financial pressure on borrowers. To mitigate risks, lending institutions typically require borrowers to provide over-collateralization and protect their investments by monitoring the value of collateral in real-time. Example: A borrower in Singapore used Bitcoin as collateral to obtain a $100,000 loan. However, after a sudden 30% drop in Bitcoin prices, the lending institution quickly liquidated the borrower's Bitcoin collateral to cover losses, resulting in the borrower losing not only the collateral but also facing a significant financial shortfall. This situation highlights the potential impact of price volatility on borrowers.

5.3. Risk Factor: Asset Custody and Security

Ensuring the security of Bitcoin collateral is a significant challenge faced by lending institutions. Due to the susceptibility of cryptocurrencies to hacking or fraud, institutions need to adopt professional custody solutions and collaborate with trusted custodial service providers to ensure that assets are well protected. Example: A decentralized finance (DeFi) lending platform suffered a hacking attack due to a smart contract vulnerability, resulting in the theft of $50 million in Bitcoin collateral. This incident illustrates that technological security is a critical issue that cannot be overlooked in the cryptocurrency lending model.

5.4. Risk Factor: Market Liquidity

Large-scale Bitcoin lending operations rely on high market liquidity. However, when market volatility occurs, lending institutions may be forced to liquidate large amounts of collateral assets. If market liquidity is insufficient, asset prices can drop rapidly, triggering a chain of liquidations and potentially causing severe impacts on the entire market. Example: After the collapse of FTX, Genesis and BlockFi declared bankruptcy because they could not cope with the sudden drop in collateral values and large-scale withdrawal requests. They failed to sell cryptocurrency assets at reasonable prices, leading to problems spreading throughout the industry and causing widespread market turmoil. This incident indicates that insufficient market liquidity is a significant risk that cannot be ignored in the Bitcoin lending model.

6. Conclusion and Future Outlook

Bitcoin collateral loans represent a promising financial innovation, providing cryptocurrency holders with a solution to obtain liquidity without selling their digital assets. However, this model still faces multiple challenges, including price volatility, regulatory uncertainty, and security issues, which limit the sustainable development of the industry.

In the future, the growth of Bitcoin collateral loans may be concentrated in regions with friendly regulatory environments, such as Singapore and Hong Kong. These areas have well-established regulatory frameworks and high cryptocurrency adoption rates, providing ideal conditions for innovation and revenue growth for financial institutions. Through Bitcoin collateral loans, financial institutions can not only expand their market influence but also diversify their business and open new growth channels.

For businesses and financial institutions, the key to success lies in implementing effective risk management strategies. For example, adopting conservative loan-to-value (LTV) ratios, requiring borrowers to provide over-collateralization, and selecting reliable custody solutions to ensure asset security. Additionally, collaboration among traditional financial institutions, cryptocurrency platforms, and regulatory bodies will play an important role. This cooperation can build industry trust and lay the foundation for the long-term development of Bitcoin collateral loans.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。