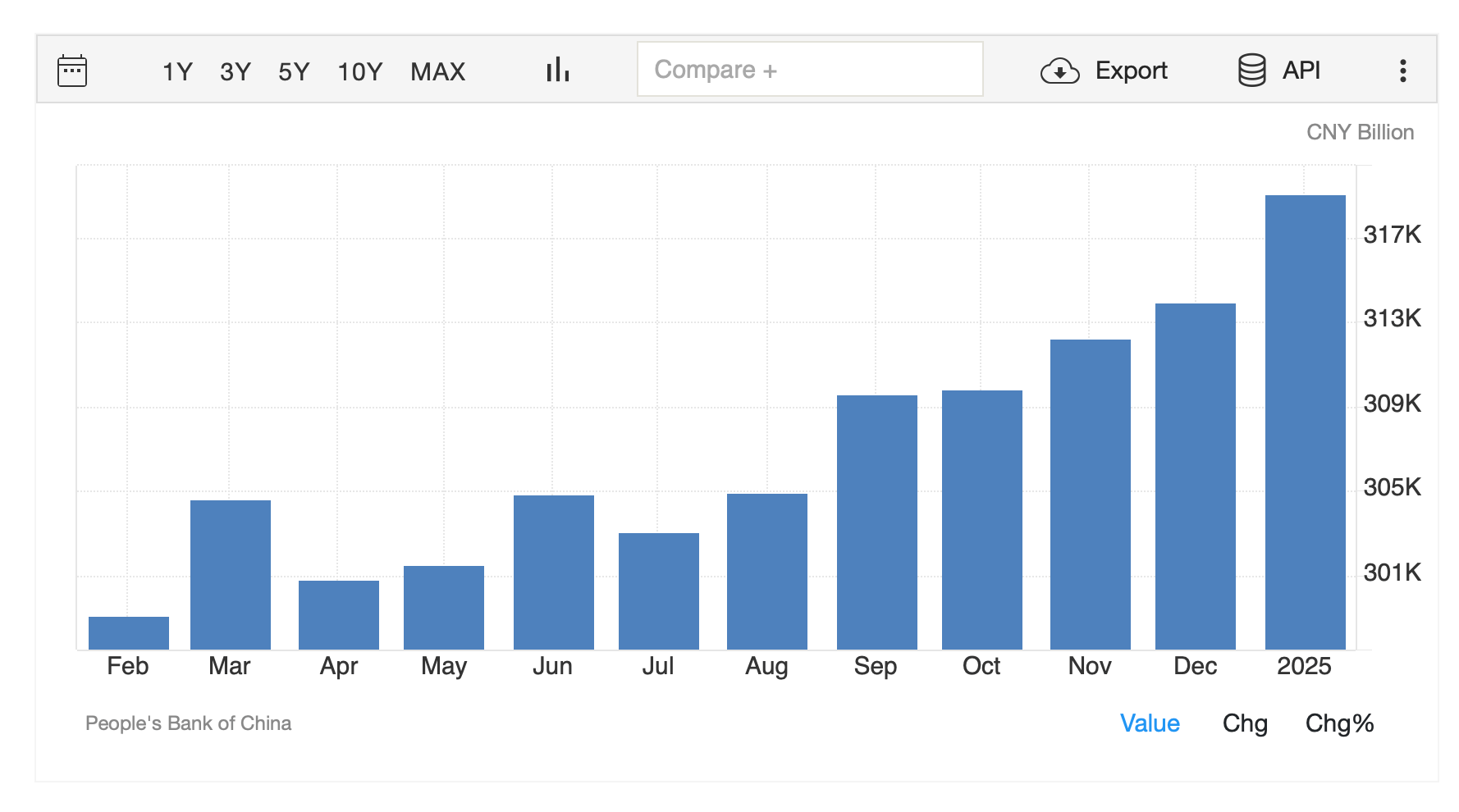

In December 2024, China’s Politburo announced a shift to a “moderately loose” monetary policy for 2025, a decisive break from the “prudent” policy stance previously maintained. This strategy aims to foster economic growth by expanding domestic demand and bolstering consumer spending. According to data from January 2025, China’s M2 money supply jumped notably to 318.46 trillion yuan ($43.6 trillion) from approximately 313.61 trillion yuan ($42.9 trillion) in December 2024.

China M2 Money Supply

The People’s Bank of China (PBOC), China’s central bank, has outlined several monetary policy instruments to maintain ample liquidity and cut financing costs. Governor Pan Gongsheng explicitly detailed tools including reducing reserve requirement ratios (RRR) and adjusting interest rates downward, tactics designed to stimulate economic activity amid internal deflationary pressures. China has seen two consecutive years of deflation, a rare economic circumstance paralleling Japan’s historical challenges.

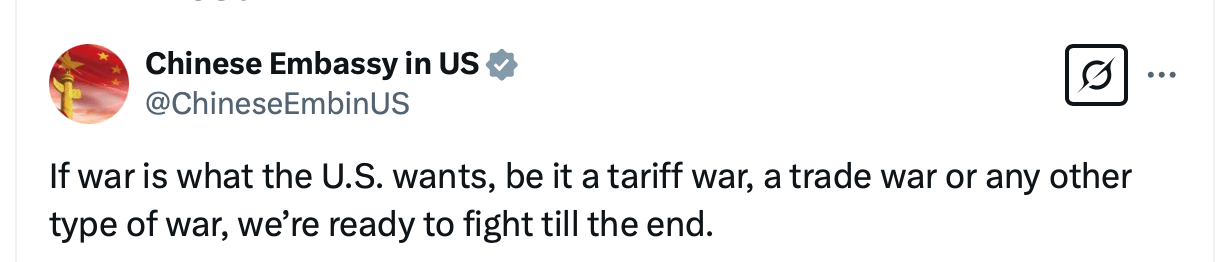

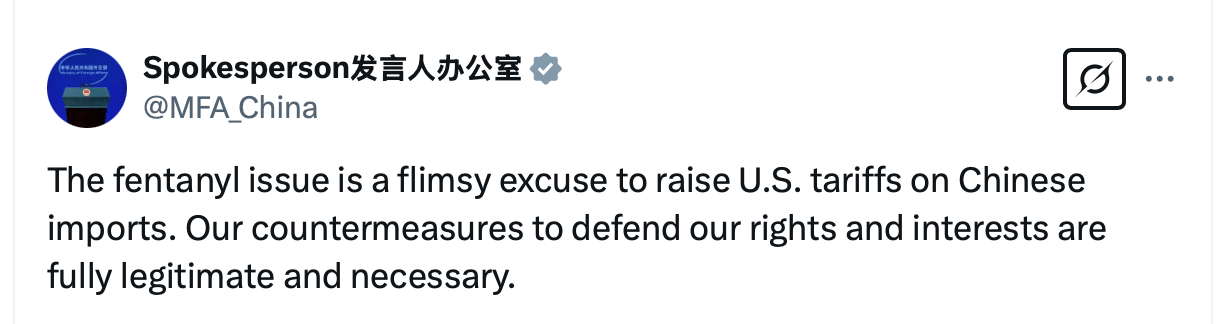

Though China’s policy shift focuses significantly on domestic economic stabilization, international dynamics—particularly the anticipated trade tensions with the U.S.—are key considerations. Trump, who previously enacted aggressive tariff measures during his first term, has implemented tariffs potentially on Chinese goods during his second run. China’s Politburo has openly stated its intent to brace for these potential trade battles, viewing economic strengthening as a method to diminish U.S. economic influence.

Yet, despite clarifications, substantial monetary easing is apparent. The monetary base (M0) is projected to grow roughly 17.2% in 2025, equivalent to approximately 2.21 trillion yuan ($303 billion), while the broader M2 money supply might expand by approximately 7%, adding around 22.17 trillion yuan ($3.04 trillion). This considerable increase in monetary aggregates highlights China’s readiness to use monetary policy aggressively to achieve economic objectives.

Observers note this move could prompt similar actions from other central banks globally. A widespread response, characterized by monetary loosening in multiple economies, would potentially lead to increased liquidity across global financial markets. Historically, such expansions in money supply have created environments conducive to rising asset prices, particularly in alternative financial assets like bitcoin.

🚨🇨🇳China’s Economic Defense Against Trump Tariffs—Money Printing🖨️ pic.twitter.com/82Cauq7z1C

— Bitcoin.com News (@BTCTN) March 5, 2025

Cryptocurrencies, particularly bitcoin (BTC), often respond positively in situations involving global monetary expansions. Investors perceive bitcoin as a hedge against potential inflationary impacts of extensive monetary easing and increased fiat currency supply. Speculators also believe that China’s moves could drive BTC’s price much higher. This sentiment was evident during previous global economic stimulus measures, notably during pandemic-era financial responses when central banks increased liquidity substantially.

Thus, China’s aggressive monetary policy shift, combined with the expected domino effect among global central banks, presents a compelling case for cryptocurrency assets that are not manipulated like fiat currencies. The potential for inflation and currency depreciation traditionally associated with large-scale monetary easing further strengthens bitcoin’s allure as a monetary alternative.

As China’s monetary printing presses accelerate and Trump’s tariff threats loom large, investors globally are closely watching. Should more central banks follow China’s lead, the resulting liquidity wave could significantly bolster prices of cryptocurrencies like bitcoin, positioning digital assets as key beneficiaries in the unfolding global monetary landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。