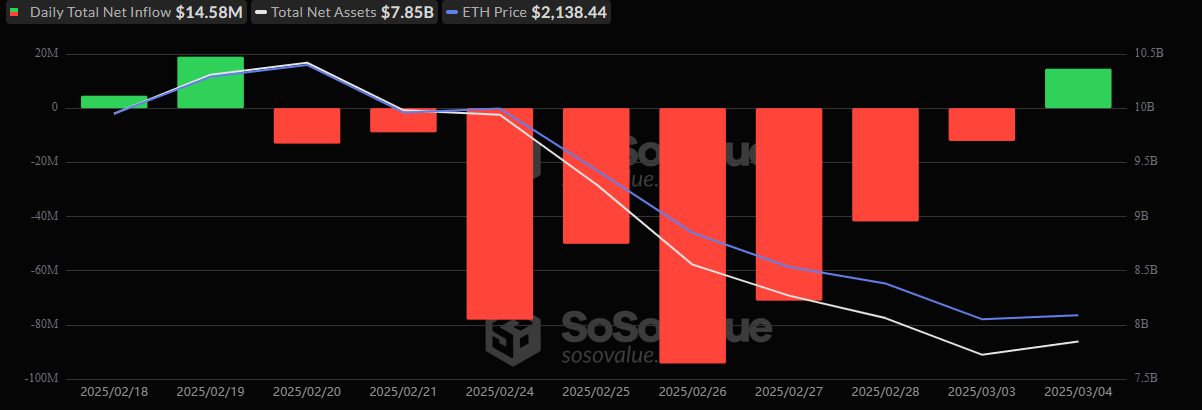

On Tuesday, Mar. 4, bitcoin exchange-traded funds (ETFs) experienced net outflows totaling $143.43 million. Conversely, ether ETFs broke their eight-day outflow streak, registering net inflows of $14.58 million.

The persistent outflows were seen on 7 of 12 U.S. spot bitcoin ETFs on Mar. 4. Fidelity’s FBTC led the outflows with $46.08 million, followed by Ark 21Shares’ ARKB, which saw $43.92 million exit the fund.

Franklin’s EZBC and Bitwise’s BITB recorded outflows of $35.71 million and $23.96 million, respectively. Invesco’s BTCO and Wisdomtree’s BTWC also faced withdrawals, losing $16.47 million and $13.07 million. In contrast, Grayscale’s BTC fund bucked the trend, attracting inflows of $35.77 million.

Ether ETFs roared back to life with a resurgence in inflows. Fidelity’s FETH led the inflows with $21.67 million, while Grayscale’s ETHE and ETH funds contributed positively, adding $10.71 million and $8.46 million, respectively. However, Blackrock’s ETHA experienced an outflow of $26.27 million, highlighting mixed sentiment among ether investors.

As of the close of trading on Mar. 4, total net assets for bitcoin ETFs stood at $99.37 billion, while ether ETFs reached $7.85 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。