Macroeconomic Interpretation: As Washington politicians begin to frequently discuss cryptocurrency as a strategic reserve, this field, which originally existed outside the mainstream financial system, is experiencing an unprecedented dramatic turn.

Recently, Bitcoin's price has been like a roller coaster, rising from $78,000 to a peak of nearly $95,000, then dropping to $81,000 and rebounding to nearly $89,000 at present. The market volatility perfectly illustrates the essential characteristics of a "news-driven market." In this crypto drama led by the White House, every participant seems like a poker player holding a winning hand, with Trump as the dealer who keeps raising the stakes.

As the most significant "macro variable" in the crypto market, the Trump administration's policy toolbox is sending multiple signals. Although the topic of cryptocurrency was deliberately avoided in congressional speeches, the president clearly understands the principle that "actions speak louder than words"—the plan to include mainstream cryptocurrencies like Bitcoin in the national strategic reserve essentially opens a second front outside the traditional fiat currency system. Interestingly, details revealed by The New York Times show that the Trump family has already invested millions of dollars in crypto assets, reminiscent of the old fable of "the guard stealing from the treasury." A well-known professor at Cornell University commented vividly: "It's like confiscating the gold mine dug up from your own backyard and then casually stuffing a few gold bars into your pocket."

The market's reaction to this policy shift is quite fragmented. While the three major U.S. stock index futures are collectively rising, the crypto market is showing a rare cautious attitude. Behind this split market is the complex expectations of investors regarding the White House crypto summit on March 8. Although executives from leading companies like Coinbase and Chainlink will gather in Washington, the lack of specific policy commitments in the discussions has exacerbated market unease. QCP Capital analysts bluntly stated: "It's like inviting hunters to discuss how to protect the sheep, which could ultimately turn into a barbecue party where they feast on lamb chops."

The unusual movements in traditional financial markets add more variables to this crypto game. The U.S. dollar index has fallen below 105 for the first time in four months, the yield curve of U.S. Treasuries has deepened its inversion, and the Atlanta Fed's GDP forecasting model has flashed a recession warning with a -2.8% prediction. These signals are forcing the market to reprice the Federal Reserve's monetary policy, reviving expectations for three interest rate cuts within the year. Interestingly, the crypto market and U.S. stocks have recently shown a disjointed correlation—when tech stocks plummeted due to tariff threats, Bitcoin staged a dramatic V-shaped rebound. This dual personality of safe-haven attributes and risk assets reflects the market's confusion regarding the positioning of digital currencies.

Amidst the policy fog, Wall Street capital hunters have begun to lay their groundwork. Rumors of a merger between Coinbase and traditional exchanges are not unfounded; the potential acquisition interest from the Intercontinental Exchange (ICE) aligns with the Trump administration's regulatory approach of "traditional + innovation." If this multi-billion dollar marriage comes to fruition, cryptocurrency exchanges will gain compliance endorsement comparable to the New York Stock Exchange, but the cost may be sacrificing the belief in decentralization. This "if you can't beat them, join them" business logic is reshaping the power structure of the crypto world.

However, the specter of security always looms behind the market's revelry. A monthly loss of $1.53 billion has set a historical high, and the North Korean hacker group Lazarus's single heist of $1.4 billion has rendered Bybit's security defenses virtually useless. These shocking figures remind us that when mainstream capital enters the arena, the infrastructure of the crypto world still lags behind the pioneering days of the West. As one security expert quipped: entering the crypto market now requires both a trading terminal and a bulletproof vest.

At this current juncture, investors may need to focus on three key points: the substantive outcomes of the White House summit, the economic truths revealed by March's non-farm payroll data, and the Federal Reserve's policy response to the threat of stagflation. From a technical perspective, Bitcoin's oscillation range between $78,000 and $95,000 resembles the calm before the storm. If it breaks through the previous high, it may initiate a sprint towards $100,000; if it loses the psychological support at $80,000, it could trigger a cascading sell-off.

In this game of policy versus market, ordinary investors might remember the old Wall Street adage: when the shoeshine boy starts talking about stocks, it's time to be cautious. Now that the occupant of the Oval Office is personally discussing crypto strategy, is this a sign of industry maturity or a precursor to a bubble burst? Perhaps only time will tell. But one thing is certain: the cryptocurrency market is experiencing the most surreal chapter of realism since its inception—where the president's tweets, hackers' keyboards, and miners' computing power are collectively writing a new script for the crypto era.

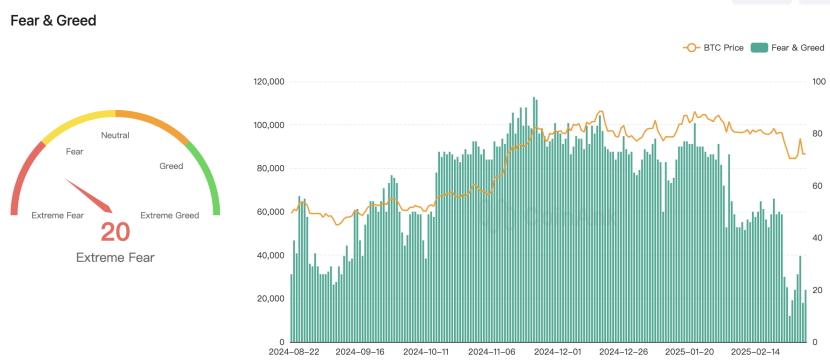

BTC Data Analysis: According to CoinAnk data, today's cryptocurrency fear and greed index has slightly rebounded from yesterday's 15 to 20, still in the "extreme fear" state. The average for #fear&greed last week was 21 (extreme fear), and the average for last month was 44 (fear), indicating that market sentiment remains low.

We believe that the rebound of the cryptocurrency fear and greed index from 15 to 20, while still in the "extreme fear" range, reveals that the current market is still in the tail end of a liquidity squeeze. Compared to last month's average of 44 (fear), the prolonged emotional low may indicate that the adjustment is shifting from short-term shocks to the release of structural pressures.

In terms of short-term repair momentum, the marginal improvement of the index may stem from technical buying entering the market, with #BTC forming local support around $78,000, and the funding rate for derivatives rebounding from -0.25% to -0.08%, showing initial signs of a rebound driven by short covering. However, the stablecoin balance on exchanges has only slightly increased by 0.7%, indicating that incremental funds have not yet entered the market on a large scale, raising doubts about the sustainability of the rebound.

Mid-term structural contradictions are reflected in the behavioral disconnection of market participants: on-chain data shows that whale addresses (holding 1,000+ BTC) have increased their holdings by 23,000 BTC in the past week, while retail holdings (<1 BTC) have decreased by 41,000 BTC, accelerating the concentration of chips among strong hands. This kind of differentiation often signals that a bottom is nearing, but emotional recovery needs to wait for macro catalysts (such as cooling U.S. CPI data).

In historical cycle comparison, the current situation differs from June 2022 (index 10) in that the average daily net outflow of Bitcoin ETFs has decreased from $560 million to $120 million, and the total market cap of stablecoins has surpassed $161 billion (a 47% increase since then), providing better liquidity buffers. However, Ethereum's staking yield has dropped to 3.2%, and SOL's ecosystem TVL has shrunk by 36%, weakening the overall risk appetite in the market.

The future path may exhibit an "L-shaped bottoming" characteristic: Bitcoin may maintain range-bound oscillation relying on institutional holding resilience, while altcoins need to undergo liquidity rebalancing (such as the clearing of VC unlock waves) before entering a new cycle. Emotional indicators typically lag behind price bottoms by 1-2 months after hitting the floor, so investors should pay attention to the dual signals of ETF fund flow reversal and on-chain turnover rate hitting the bottom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。