Michael Saylor’s Strategy has accumulated approximately 499,096 BTC, and its bitcoin position remains in positive territory relative to the company’s acquisition cost. Despite recent price fluctuations over the past few days, the firm’s BTC reserves remain 29% above the purchase price. Strategy initially spent $33.087 billion to amass its bitcoin, an investment now valued at $42.813 billion at prevailing market rates, according to data collected by blockchaincenter.net.

Source: blockchaincenter.net

The decision to concentrate solely on bitcoin has proven advantageous. Had the company opted for ethereum (ETH) instead, its holdings would currently be at a loss. With an initial outlay of nearly $33.1 billion, an equivalent ETH position would now be worth only $27.4 billion—a 17% decline. Instead of securing a $9.7 billion gain, the firm would be grappling with a $5.7 billion deficit.

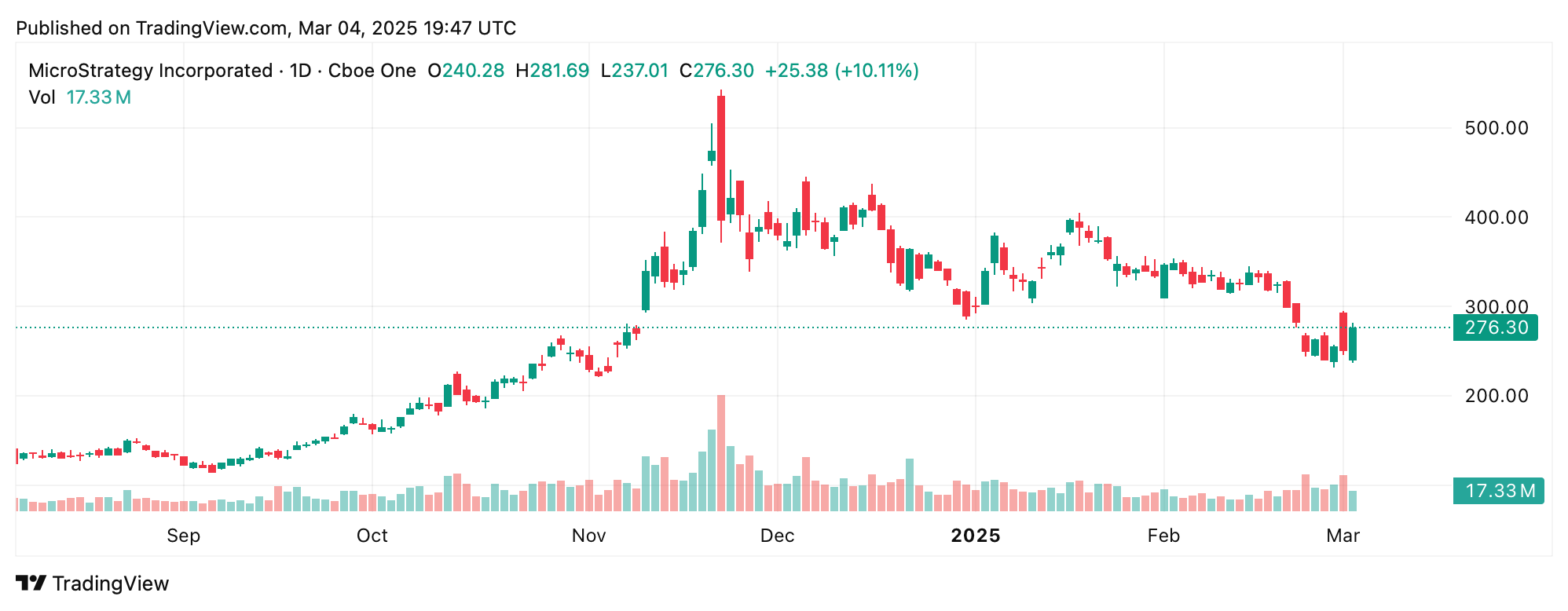

MSTR shares on March 4, 2025.

Even if Strategy had staked its hypothetical ethereum holdings—accumulating an additional 631,758 ETH in rewards—the total valuation would still fall short, reaching just $28.734 billion. Meanwhile, MSTR shares have continued their upward trajectory, gaining more than 11% this week and appreciating over 8% against the U.S. dollar on Mar. 4, just two and a half hours before Wall Street’s closing bell.

However, on a year-to-date basis, MSTR remains down nearly 9%, with a decline exceeding 19% over the past month. By Tuesday afternoon at 2:20 p.m. Eastern Time (ET), shares were trading at $277, marking a 28.45% drop from the company’s all-time high of $387.

Contrasting Ethereum’s hypothetical losses, the firm’s BTC-centric approach exemplifies targeted conviction over diversification. As share prices oscillate between weekly surges and broader downturns, the company navigates crypto’s unpredictability by anchoring its fortunes to bitcoin’s evolving narrative. Thus far, Strategy’s BTC acquisition decisions have proven successful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。