Since the birth of Bitcoin, it has gradually evolved from a marginal technological experiment into a global financial asset. Its core features—decentralization, a fixed supply (21 million coins), and censorship resistance—have attracted attention from individuals, institutions, and even nation-states. In recent years, the concept of "Bitcoin as a strategic reserve" has emerged, primarily referring to countries or institutions holding Bitcoin as foreign exchange reserves or a store of value.

In February 2025, the Salvadoran Congress quietly passed an amendment to the "Bitcoin Law." The new legislation includes three main points: Bitcoin is no longer considered "currency," merchants are no longer required to accept Bitcoin payments; its use has become voluntary and no longer has legal tender status; and the government will no longer accept Bitcoin for tax payments. This policy shift occurred after El Salvador's application for a $1.4 billion loan from the International Monetary Fund (IMF) was stalled due to the IMF's concerns about Bitcoin. This three-year experiment with fiat currency has come to an end, but it has opened a new battleground for global central banks regarding cryptocurrency strategic reserves.

First, let's look at what "strategic reserve assets" are. Strategic reserve assets refer to key assets held by national or regional governments to respond to economic fluctuations, financial crises, or geopolitical risks, in order to maintain national financial stability, economic security, and international competitiveness.

Traditional strategic reserve assets include: Gold: With its scarcity and inflation resistance, it has become the first generation of physical reserve assets. Foreign exchange reserves: Primarily composed of reserve currencies like the US dollar, serving as important means to support international trade and payments. Special Drawing Rights (SDR): Allocated by the International Monetary Fund (IMF) to supplement the official reserves of member countries.

In September 2021, El Salvador designated Bitcoin as legal tender, and President Nayib Bukele has been as active on social media as Trump, encouraging the public to use it. He even launched a national digital wallet, Chivo, invested over $1 million, and installed about 1,500 Bitcoin ATMs in El Salvador. Nayib Bukele has emphasized on various occasions that Bitcoin serves as an asset to hedge against inflation and can effectively reduce the cost of cross-border remittances.

According to data from the Salvadoran Ministry of Finance, El Salvador currently holds 6,088.18 Bitcoins.

Not only this small country, but since Trump took office in 2025 and Bitcoin broke the $100,000 mark, various states in the US have put "Bitcoin as a strategic reserve" on their agendas. According to media statistics, more than 20 states out of 50 in the US have proposed or are considering legislation related to Bitcoin strategic reserves:

Two Bitcoin reserve bills in Arizona have already passed the Senate and are submitted for House review.

The Texas Bitcoin reserve bill SB 21 will be submitted for Senate review.

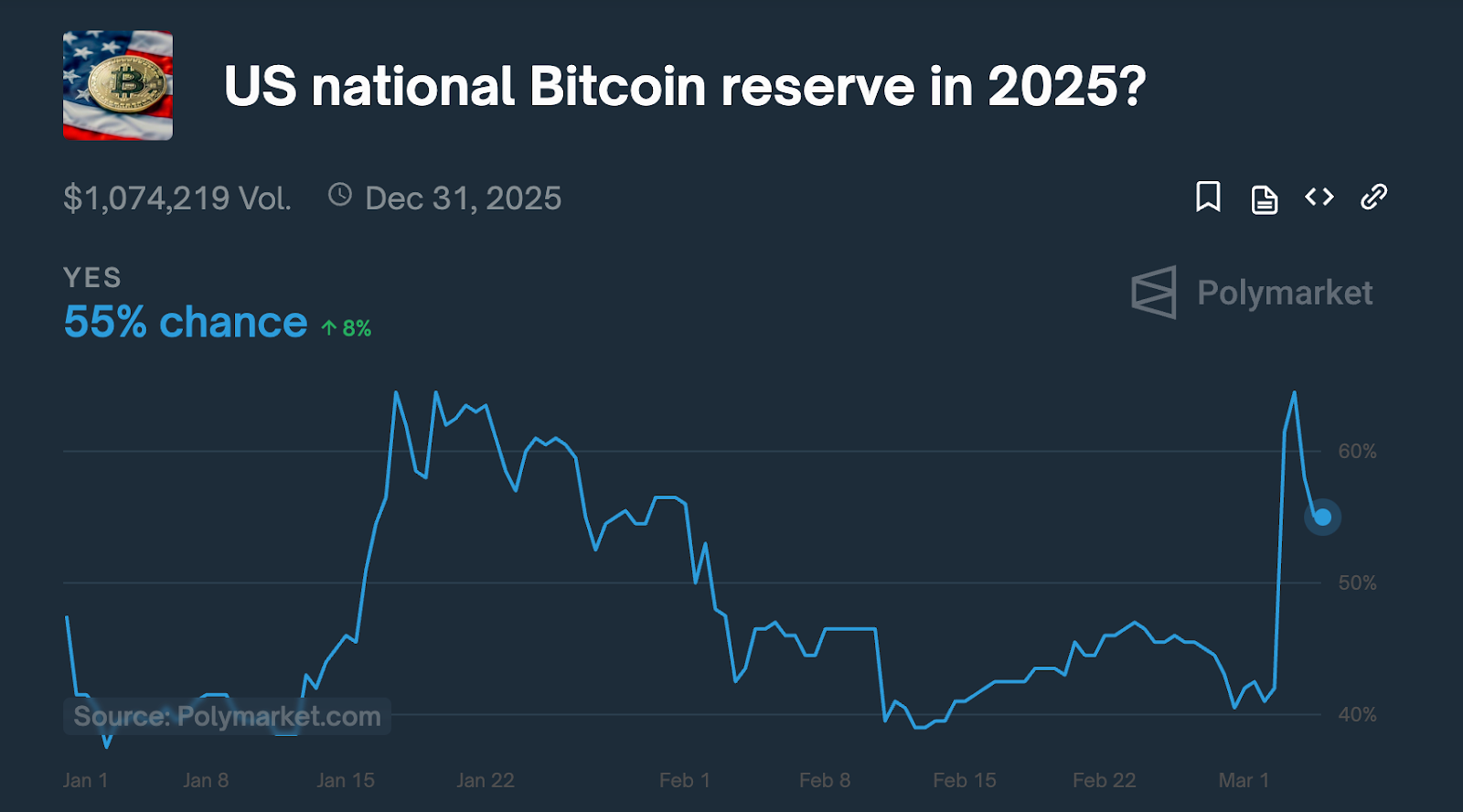

After Trump expressed support for establishing a cryptocurrency strategic reserve, Polymarket's prediction market raised the probability of "the US establishing a national Bitcoin reserve by 2025" to 55%.

Beyond the national level, corporate "strategic reserve assets" help achieve financial stability and enhance risk resilience. The trend of institutional investors indirectly holding Bitcoin through Bitcoin ETFs and trust funds is increasing, with BlackRock and MicroStrategy holding a combined total of over 1 million BTC.

What impact will the rise of Bitcoin as a strategic reserve asset have on the economy?

US Senator Cynthia Lummis once proposed a "plan for the US Treasury to purchase 1 million BTC as a strategic reserve within five years." In response, VanEck's research director suggested that if the US Treasury starts purchasing 1 million Bitcoins at an initial price of $200,000 over five years, assuming US debt grows at a rate of 5% (compared to an 8% annual compound growth rate over the past decade) and Bitcoin's price grows at a compound rate of 25%, by 2050, the US strategic Bitcoin reserve would hold assets equivalent to 36% of its debt.

The fixed supply of Bitcoin has led some supporters to view it as "digital gold," potentially hedging against inflation caused by excessive fiat currency issuance. Standard Chartered Bank analyst Geoff Kendrick believes that if the regulatory environment improves, lowering barriers to entry for investors and reducing volatility, Bitcoin may attract new buyers over time. Ohio State Representative Steve Detremiou stated, "By allowing investment in strategic Bitcoin reserves, we can hedge against inflation and keep Ohio at the forefront of monetary and technological innovation."

Furthermore, if more countries incorporate Bitcoin into their reserves, it may weaken central banks' ability to control the economy through interest rates and money supply. The 21 million supply of Bitcoin determines its asset scarcity, which is unaffected by global monetary policy interventions, and can be freely stored, transferred, and traded globally by individuals, institutions, or sovereign nations. Its anonymity may challenge anti-money laundering (AML) regulatory frameworks.

While El Salvador and the US propose "Bitcoin strategic reserves," there are also countries or regions with differing opinions.

Australian Treasurer Stephen Jones stated that Australia has no plans to establish a crypto reserve, believing that the idea of a crypto reserve is complex and risky, potentially leading to concentration risks for certain tokens. The Swiss National Bank President Martin Schlegel shares this view, stating he does not wish to see Bitcoin as a reserve asset for Switzerland, citing factors such as insufficient stability, liquidity concerns, and security risks.

In the US, five states have rejected Bitcoin reserve bills:

The Montana House rejected the Bitcoin reserve bill, with opponents arguing it would lead the state investment board to engage in excessive speculation with taxpayer funds; South Dakota rejected the Bitcoin reserve bill, with opponents citing "excessive volatility"; Wyoming proposed a bill in January, which failed in February due to concerns from opponents that "digital assets are incompatible with the traditional financial system."

Looking back at the concept of "strategic reserve assets" mentioned at the beginning and the characteristics of traditional strategic assets, to qualify as a strategic reserve asset, it must possess advantages such as "value stability, global recognition, and convenient circulation." Clearly, under this standard, Bitcoin does not meet the criteria in the current situation.

The rise of Bitcoin as a strategic reserve reflects a distrust of the traditional monetary system, but its economic impact remains full of uncertainties. In the short term, Bitcoin is more likely to exist as a "complementary reserve asset" rather than replacing the US dollar or gold. In the long term, technological evolution and the maturity of regulatory frameworks will determine whether it can integrate into the mainstream economic system.

Related: Industry executives voice: US cryptocurrency reserves cannot replace the clarity of SEC regulation

Cointelegraph Chinese official channels

Telegram Community: https://t.me/cointelegraphzh

Telegram Channel: https://t.me/cointelegraphzhnews

X(Twitter): https://x.com/zhcointelegraph

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。