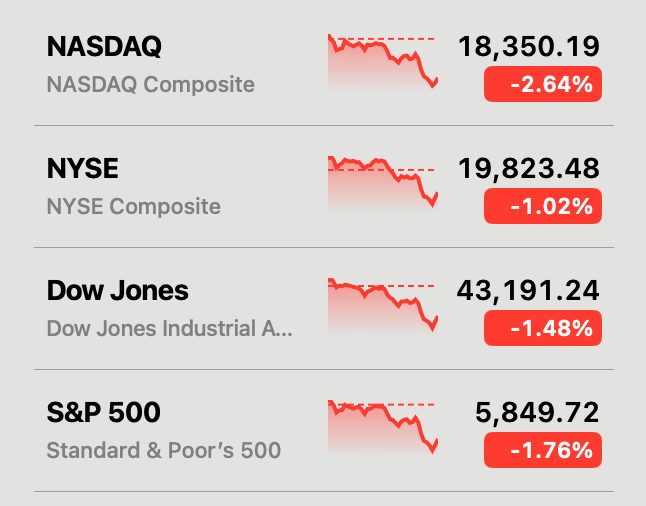

Trump’s plan, set to take effect April 2, 2025, targets all imported agricultural products and expands existing tariffs on goods from Mexico, Canada, and China. The proposal stoked fears of inflation, trade retaliation, and supply-chain disruptions, contributing to a massive 1.76% drop in the S&P 500 on Monday. Analysts have linked the equity sell-off to concerns over escalating trade tensions and their potential impact on consumer prices and global economic stability.

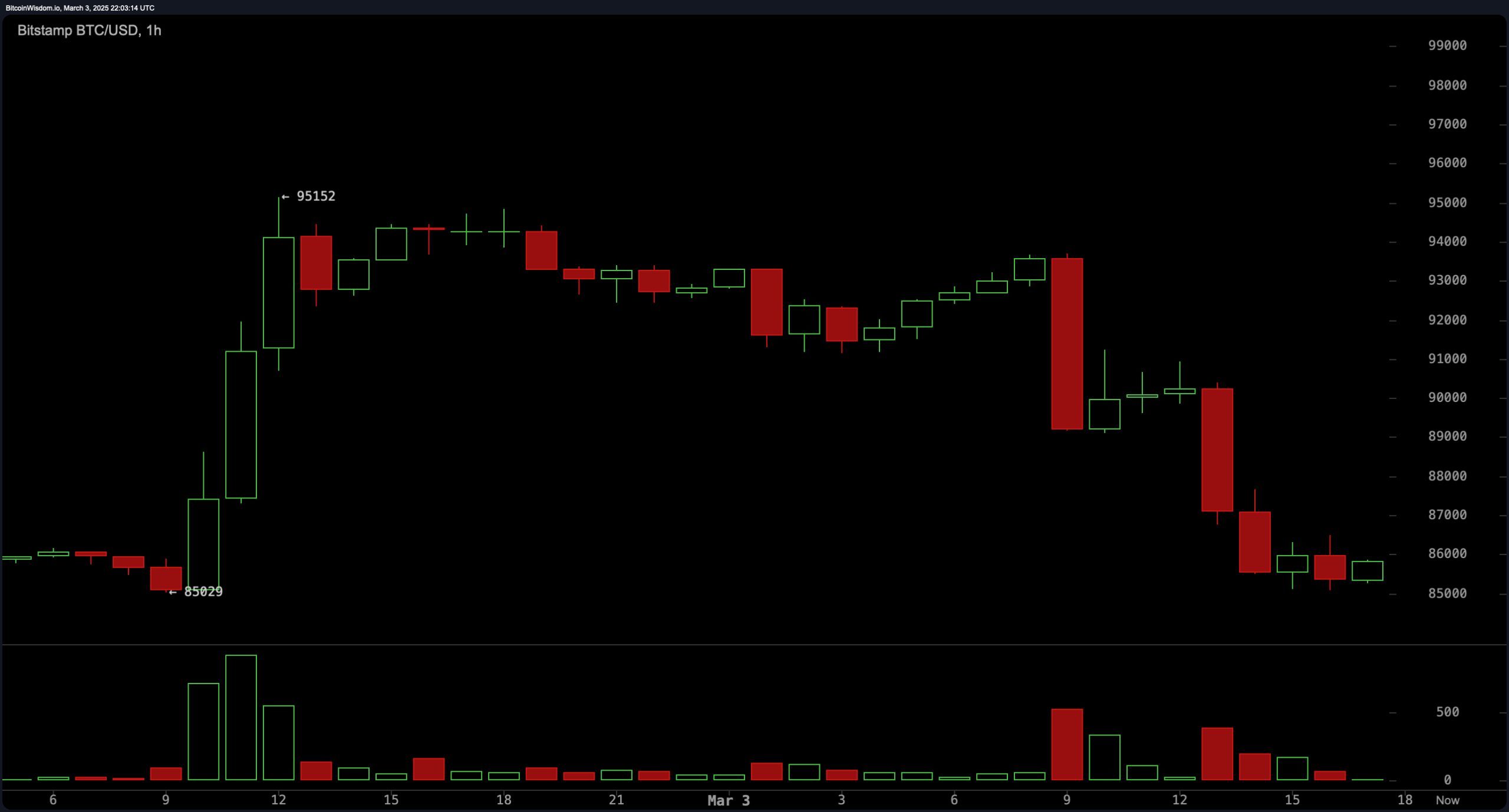

BTC/USD price via Bitstamp 1H chart (or rollercoaster) on March 3, 2025.

Bitcoin (BTC) mirrored traditional market turmoil, fluctuating massively with a significant drop following Trump’s statement on Truth Social, before stabilizing near $85,500 by 4:45 p.m. EST. The cryptocurrency’s volatility coincided with the release of the ISM Manufacturing Index, which fell slightly short of expectations at 50.3% versus a forecasted 50.6%. The data, reflecting a contraction in new orders, amplified investor anxiety in traditional finance about slowing economic growth.

The stock market’s downturn, particularly in tech-heavy indices like the Nasdaq, spilled into crypto markets as investors retreated from risk assets. Price discrepancies across exchanges highlighted the day’s turbulence, with algorithmic trading and reactive investor positioning exacerbating intraday swings.

U.S. stock market indices after the closing bell on Monday.

The episode highlights bitcoin’s sensitivity to macroeconomic developments and Trump’s tariff calls. Analysts urge investors to monitor economic indicators, trade policies, and equity trends when assessing crypto volatility. While bitcoin’s long-term trajectory remains debated, its reaction to Trump’s tariffs for the fourth consecutive time reaffirms its role as a barometer for broader financial risk appetite.

Should monitoring macroeconomic trends feel tedious, fixate instead on Trump’s latest maneuvers: his recent pronouncements have emerged as the pivotal force behind Bitcoin’s dramatic price undulations, casting both bullish and bearish shadows across markets, as vividly illustrated by yesterday’s turbulent spike after the crypto reserve announcement.

At press time, bulls are fighting to hold the $86,000 zone at 5 p.m. (ET) on Monday evening.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。