Bitcoin has navigated an unforgiving week, compounding a 30-day descent of 18.1%, as geopolitical tremors tied to Trump’s tariff policies injected volatility into financial markets. Against this backdrop, South Korea’s BTC valuations have consistently outpaced global averages throughout February, crafting a narrative of localized defiance.

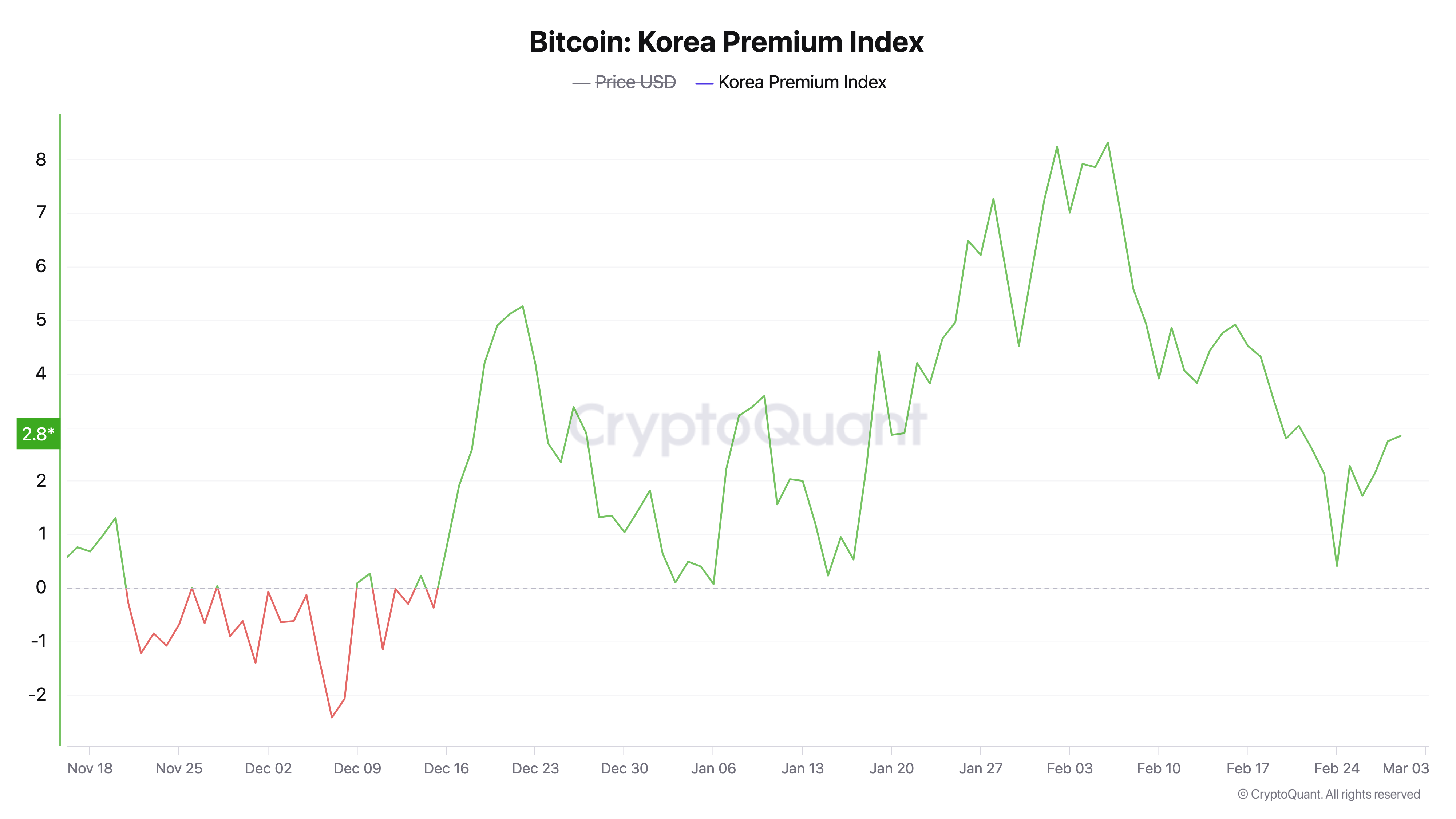

Historical data from cryptoquant.com reveals this premium phenomenon has persisted since Dec. 16, 2024, threading a tale of contrast between regional enthusiasm and broader market trepidation. By the close of December, the bitcoin premium in South Korea reached 5.26%, and by the end of January 2025, it had risen to 7.27%. It did not stop there; on Feb. 8, the premium attained an 8.32% high relative to the weighted global average.

South Korea’s bitcoin premium diminished late February and into early March, resting at 2.84% on March 1 before tapering to 2.18% as of Sunday, March 2, per current metrics. By 8 a.m. Eastern Time (ET) that day, the nation’s BTC valuation eclipsed global averages by $1,870—a persistent and present price anomaly.

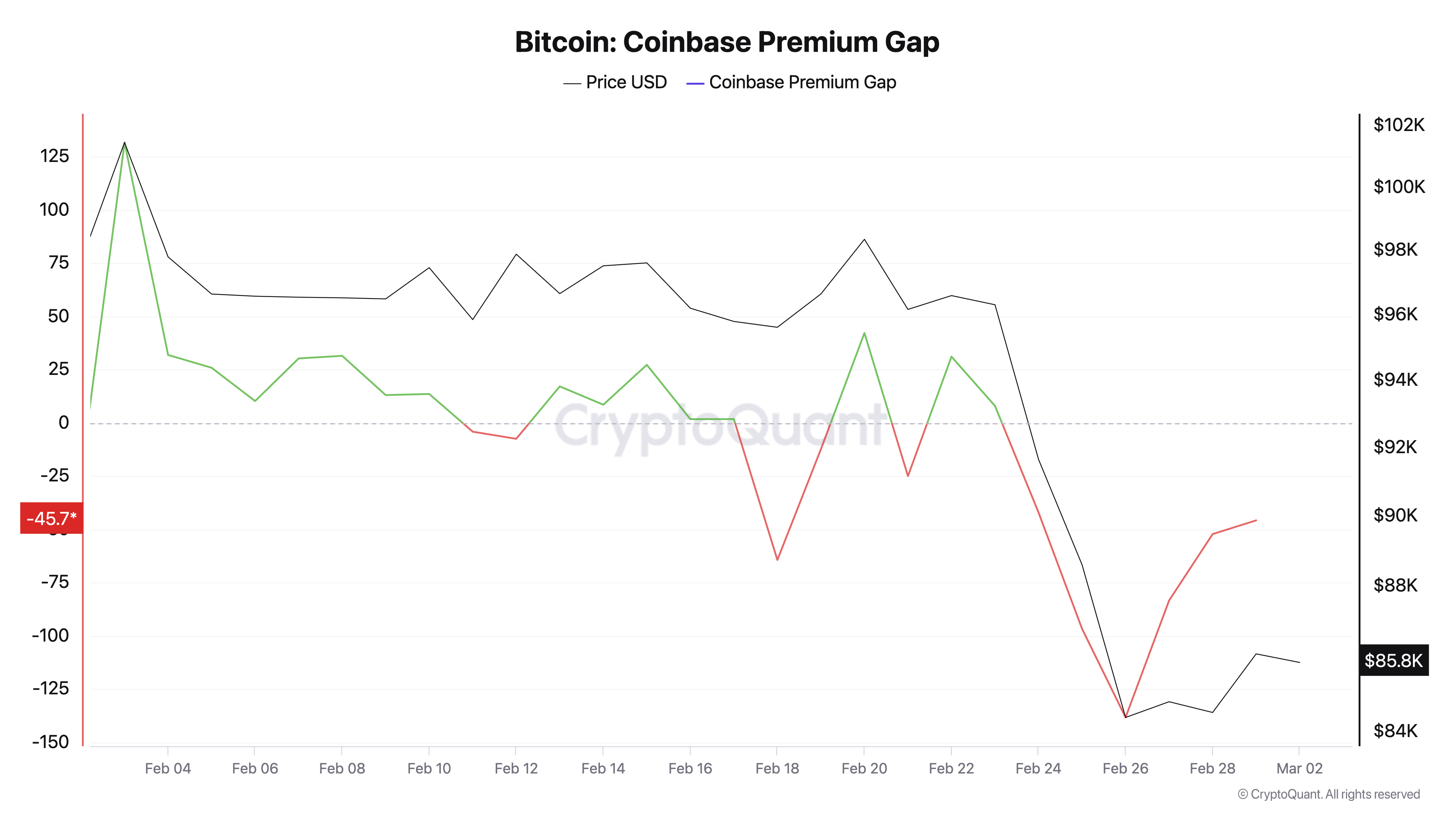

Parallel to this, the Coinbase Premium Index and Gap, hosted on cryptoquant.com, oscillated through February, its erratic undulations hinting at U.S. investors’ cautious inertia. Notably, since Feb. 24, the index has languished in negative territory, framing a stark trans-Pacific contrast: South Korean traders propelled demand with vigor, while their American counterparts exercised restraint.

Beyond stablecoins’ dominance, the U.S. dollar remains BTC’s foremost trading partner, though the South Korean won trails closely behind, accounting for 3.20% to 5.6% of global transactions in the past week. Daily trading volumes for the euro, Canadian dollar, and British pound pale beside the won’s brisk activity. Stablecoins command the lion’s share of BTC volume, trailed by the greenback and the won—a trio that’s been shaping crypto’s liquidity hierarchy over the last year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。