Michael Saylor, executive chairman of software intelligence firm Microstrategy (Nasdaq: MSTR), has provided an update on the company’s bitcoin holdings and financial performance. Microstrategy recently rebranded as Strategy to emphasize its commitment to Btc and artificial intelligence. On March 1, Saylor shared on social media platform X:

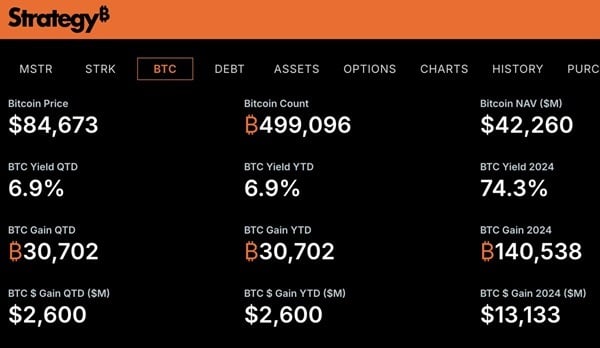

Last year, Strategy delivered a BTC $ gain of $13.1 billion (140,538 BTC). In the first two months of 2025, we have achieved a BTC $ gain of $2.6 billion (30,702 BTC).

This underscores the company’s continued commitment to its bitcoin accumulation strategy, which has played a key role in its financial growth.

Strategy’s performance shared on X by Saylor. Source: Michael Saylor.

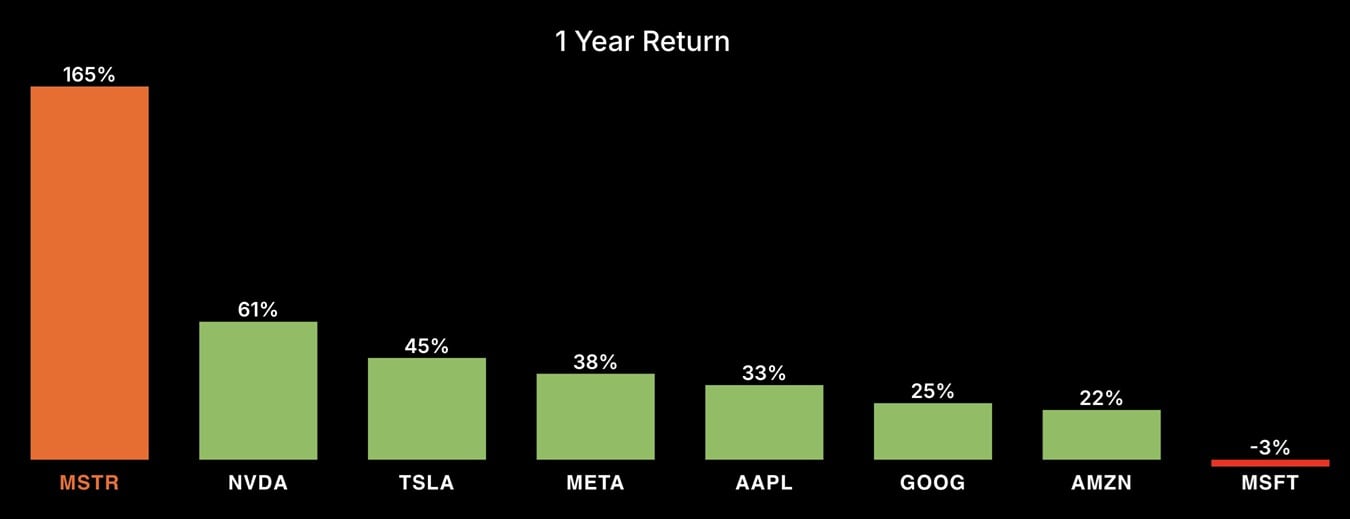

The firm has built one of the largest institutional bitcoin holdings, currently standing at 499,096 BTC. Microstrategy reported a bitcoin yield of 6.9% year-to-date (YTD) and an impressive 74.3% BTC yield for 2024. The company’s significant exposure to bitcoin has contributed to its stock’s remarkable performance, with a 165% one-year return, outperforming major technology stocks such as Nvidia (61%), Tesla (45%), and Meta (38%).

MSTR performance shared by Saylor on Feb. 28. Source: Michael Saylor.

Beyond financial gains, Saylor has also been engaging with regulators. This week, he presented a digital asset framework to the U.S. Securities and Exchange Commission (SEC) and lawmakers, aiming to provide guidance on bitcoin adoption, regulatory clarity, and institutional investment strategies. His discussions with policymakers signal an effort to shape the evolving regulatory landscape for cryptocurrencies while reinforcing bitcoin’s role as a legitimate asset class. As the firm moves further into 2025, its aggressive bitcoin acquisition strategy, combined with Saylor’s regulatory efforts, positions Strategy as a key player in the digital asset sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。