Author: Xiyou, ChainCatcher

In the context of a declining cryptocurrency market, not only are products for earning interest on stored coins and holding USDT more popular, but fixed-rate lending protocol products are also gaining traction in the market.

On February 25, the fixed-rate lending platform Tenor announced the completion of a $2.5 million seed round financing, led by Cherry Crypto, with participation from Coinbase Ventures, Lattice Fund, and developers from Curved Ventures, Moonwell, and Etherfi protocols.

Unlike mainstream lending protocols in the market such as Aave and Compound, Tenor aims to create a lending product based on a fixed-rate protocol.

Tenor's Goal: To Become the Fixed-Rate Lending Infrastructure

Tenor made its debut last August, aiming to build a top-notch fixed-rate lending infrastructure for the on-chain economy, allowing anyone to deploy fixed-rate lending market products and facilitate matching between borrowers and lenders at a fixed rate.

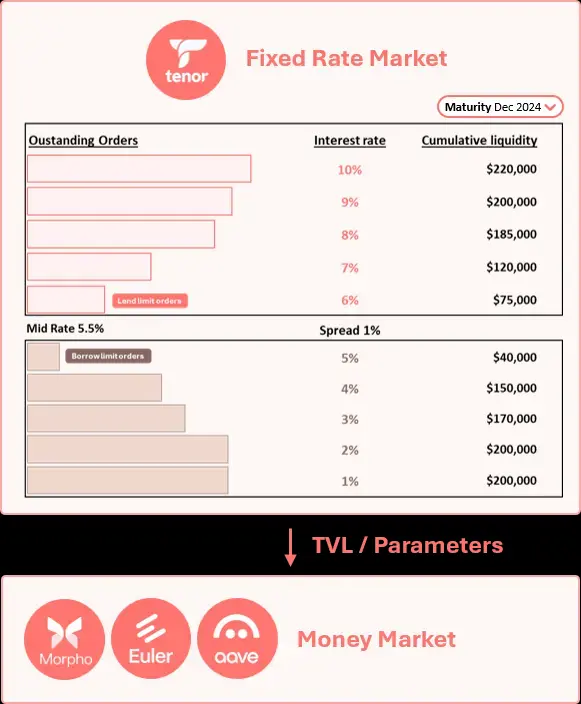

Essentially, Tenor is not just a lending application but also an infrastructure for developing lending products. It provides a comprehensive toolkit for deploying fixed-rate lending products, enabling developers to deploy fixed-rate features or products without permission, further expanding fixed-rate lending products based on existing lending protocols like Morpho and Aave.

Currently, the on-chain lending market is primarily dominated by floating-rate lending protocols such as Aave, Compound, and Morpho. These products have undergone multiple cycles of iteration and optimization of risk management strategies, developing relatively smoothly. However, due to the use of floating-rate strategies, the borrowing rates of leading lending protocol Aave fluctuate between 3.16% and 60%. Especially during market peaks, the floating borrowing rates can rise sharply, with lending spreads often reaching 20% to 40% of the borrowing rate, while during market troughs, borrowing rates can drop to near zero, negatively impacting the user experience for borrowers.

These issues may not be apparent to crypto natives, but they are very unfriendly to institutional users entering the on-chain space, undoubtedly limiting the expansion of the on-chain lending market to more traditional financial use cases. As more institutional users and funds enter the on-chain world, the demand for fixed rates continues to surge.

Tenor hopes to create an efficient fixed-rate lending infrastructure that allows lenders and borrowers to match directly on-chain at a fixed rate, introducing more diverse lending products on-chain.

Operational Model Similar to Traditional Financial P2P Lending On-Chain

The specific implementation involves Tenor building a fixed-rate AMM based on Uniswap V4 Hook, supporting users to lend and borrow at fixed rates, and this functionality can be integrated with other lending protocols.

In product design, Tenor draws on the P2P order matching mechanism of the Morpho lending protocol, allowing anyone to create fixed-rate liquidity pools through Tenor, set fixed borrowing rates and terms, thereby reducing the structural interest spread of traditional lending markets and allowing borrowers to determine borrowing costs, while both parties can match according to their real needs.

In detail, Tenor provides a toolkit for lending AMM, allowing users to lend and borrow at specific rates, set maturity dates, etc.

Users can create fixed-rate liquidity pools using Tenor, setting the interest rate, borrowing term, collateral assets, or some restrictive conditions based on their needs. For example, a lender can set a limit order to lend 1000 USDC at an 8% interest rate, while a borrower can deposit collateral and borrow 1000 USDC at the same 8% interest rate, then the borrower can use it according to their actual situation.

From an operational perspective, Tenor resembles a "P2P lending on-chain version" of traditional finance, providing a matching platform for lenders, where fund providers (borrowers) can publish fixed-rate, fixed-term borrowing targets, and fund users (lenders) can choose matching targets based on their situations, returning principal and fixed interest at maturity.

Tenor's fixed rates can provide borrowers and lenders with a more predictable user experience, addressing the user experience and capital efficiency issues of existing floating-rate lending protocols.

Additionally, Tenor supports integration with existing platforms like Aave and Uniswap that have liquidity pools, creating fixed-rate liquidity pool products.

Audit Costs Subsidized by Uniswap, Seed Round Raised $2.5 Million

Since Tenor's rates are based on the development of Uniswap V4 Hook products, it also participated in the Uniswap Hook incubator program. On January 23, the Uniswap Foundation announced the first batch of nine projects that received audit subsidies from the incubator, providing a total of $1.2 million in funding, with Tenor being on the award list, meaning that the security audit costs for Tenor Labs will be supported by the Uniswap Hook incubation grant.

According to official information, Tenor plans to undergo an audit in 2025, with code auditing services provided by the security auditing company Spearbit.

On February 25, Tenor announced the completion of a $2.5 million seed round financing, led by Cherry Crypto, with participation from Coinbase Ventures, Lattice Fund, and developers from Curved Ventures, Moonwell, Degenscore, and Etherfi protocols.

Currently, Tenor's product has not yet been launched. It is reported that Tenor is currently testing online deployment and has a streamlined application available for early users to test core functionalities.

(This article only introduces early projects and does not constitute investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。