Common traits of losers: lack of technology, information advantage, retail investors blindly chasing highs and cutting losses, and project teams failing to adapt to regulatory changes.

Author: Professor Su

On this day in 2025, with the overall market value of crypto being so high, people will find it increasingly difficult to make money. Most people around them are even losing money, which naturally raises curiosity about who is making money in the market. From the comments of the water friends, I peeled back the layers and took a look, hoping to find the right answers.

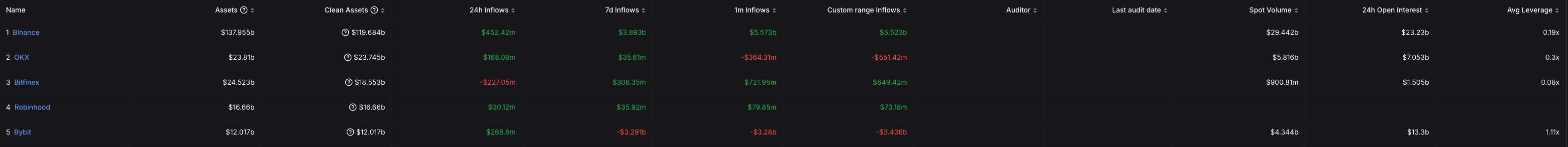

1. Centralized Exchanges (CEX)

Profit logic: Trading fees: During bull markets, trading volume surges (like after the 2024 Bitcoin halving), leading to exponential growth in fee income; in bear markets, income is maintained through derivatives (contracts, options) hedging demand. Listing fees and project incubation: Popular projects (like Meme coins, RWA tracks) pay high listing fees, and some exchanges participate in early investments (like OKX Ventures); Lending and wealth management services: Earn interest spread through user asset accumulation (OKX wealth management);

Typical case: Binance's derivatives trading volume accounted for over 60% in Q4 2023, and spot trading volume rebounded to an average of $30 billion per day at the beginning of the bull market (2024);

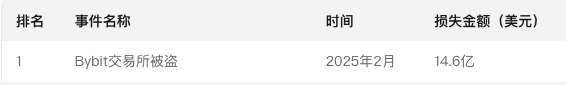

Earnings: Think about how much @Bybit_Official earned after being hacked, proving over $1.5B in annual earnings, and one can imagine the earnings of others, which is quite stimulating;

Most people's trading still occurs on CEX, their money is also held in CEX, and their wealth management is also done in CEX.

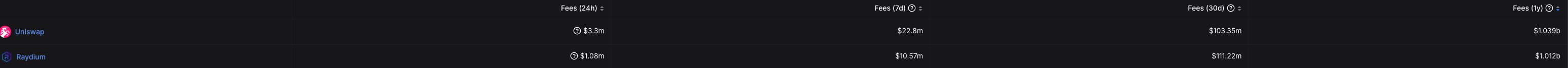

2. Decentralized Exchanges (DEX) and Liquidity Providers (LP)

Profit logic: Trading fee sharing, top DEXs (like Uniswap, Jupiter, Ray, Meteora) earn 0.3%-0.25% in trading fees, especially during the Meme coin speculation period (like in 2024 when monthly trading volume on Solana chain DEX exceeded $10 billion);

Strategy adaptability: LPs need to avoid impermanent loss, as the probability of large fluctuations leading to zero is also high (like choosing stablecoin pairs or low-volatility assets);

In 2024, the total trading volume of DEX was about $22 trillion to $25 trillion, setting a record.

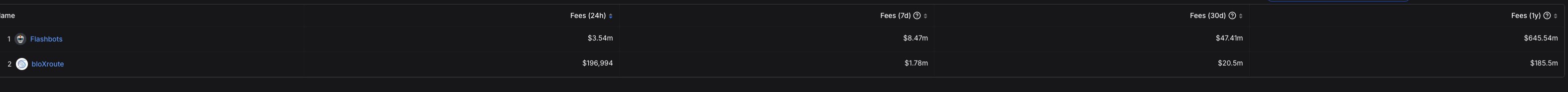

3. MEV (Arbitrage, Liquidation, Sandwich Attacks)

Profit logic: Arbitrage and liquidation, profiting from on-chain price differences (like the price difference between CEX and DEX) and DeFi liquidation events (in 2024, total MEV profits exceeded $2.5 billion); Sandwich attacks: Front-running and back-running large retail trades (accounting for 15% of MEV profits after Ethereum's merge);

Technical barriers: Relying on high-performance nodes and algorithm optimization, top searchers can earn tens of millions of dollars annually;

In simple terms, when CZ buys meme coins on BNBCHAIN, he gets sandwiched 70%, and every time there’s a liquidation on-chain, someone can pick up the pieces.

4. High-Frequency Trading Bots

Profit logic: Arbitrage across exchanges, volatility of new coin listings (like a 20% price difference within 5 minutes of a token being listed on Coinbase); Meme coin sniping: Using on-chain monitoring tools (like GMGN, OKX) to capture early trading signals (like a 100x increase within 3 hours of BOME's listing in 2024). Quick buying of memes: Using trading bots (like GMGN) to quickly buy promising memes, getting in ahead of others (most early investors in Trump used GMGN);

Risks: Need to deal with chain congestion and gas fee fluctuations as well as MEV sandwich attacks;

In short, if bots weren't profitable, you wouldn't see so many people wanting to create them, nor would you see GMGN holding various events.

5. Project Teams with Cash Flow Businesses

- Profit logic: Many projects use airdrops to lure a large number of users to inflate trading volume, earning from gas consumption like LINEA, while some project teams sell services like KAITO, and others help issue tokens like @pumpdotfun;

- Risks: Regulatory pressure (like the SEC's lawsuit against Pump) and project sustainability;

Some project teams actually don’t need to issue tokens, but they need data to perform better, making a year’s worth of money in ten years, so they issued tokens.

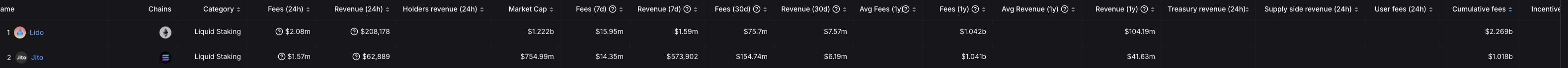

6. Stakers and Node Operators

Profit logic: PoS earnings, with Ethereum's staking annualized returns stabilizing at 4%-6% after the merge, Cosmos ecosystem staking APY generally at 8%-15%, and Solana ecosystem staking APY generally at 4%-5%; Restaking new paradigm: Protocols like EigenLayer, Solayer, Jto stack staking rewards onto other chains (2024 TVL exceeded $5 billion);

Trend: Liquid staking derivatives (LSD) like Lido occupy over 30% of the market share;

For ETH whales, it’s a guaranteed return, plus node operators can prioritize packaging their own nodes, strongly recommending looking at BNBCHAIN.

7. Compliance Service Providers and Infrastructure Providers

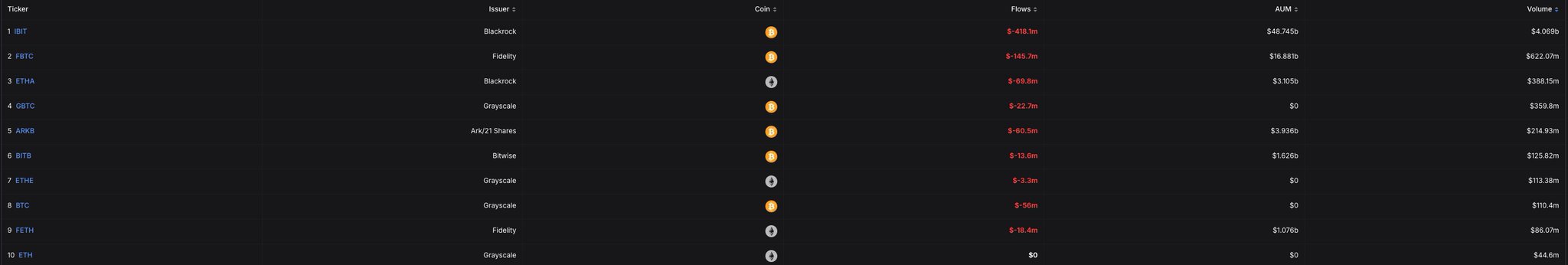

- Profit logic: After the approval of Bitcoin and Ethereum ETFs, management fees from ETFs like BlackRock are substantial, along with various compliance service fees; On-chain compliance tools: Chainalysis, Elliptic provide anti-money laundering solutions for institutions, while security firms like SlowMist conduct audits for projects;

No one thinks Grayscale has earned little from management fees over the years, right? BlackRock has been attracted in and quickly became the largest ETF holder.

8. SEC and Various National Justice Departments

- Profit logic: Fines, the U.S. Justice Department fined the former CEO of @binance over $4 billion last year, and the SEC has fined various exchanges, recently fining @okx $82 million and confiscating illegal gains of $420 million, with other exchanges' fines not yet disclosed;

- Risks and challenges: Countries are eyeing this piece of meat, and the U.S. is eating the whole world, especially after Trump came to power, supporting crypto, and the SEC has started various settlements, with uncertain policies;

The U.S. can fine tens to hundreds of billions a year, and local governments can also do it once a year to make up for budget deficits; everyone wants to generate revenue.

9. Market Makers

Profit logic: Divided into active market makers and passive market makers, most earn from price differences, some are only responsible for "providing liquidity," while others also "pump and dump," and most market makers have negative fee structures, plus they can earn rebates from exchange fees; Simply put, even Citadel plans to enter the crypto industry, which shows how high the profits are;

Risks and challenges: Regulatory pressure, technical competition, strategy competition, insufficient liquidity;

Many traditional market makers are starting to enter the crypto industry; do you think they were converted? They were attracted by the profits.

10. Mining Machine Manufacturers

Profit logic: Selling mining machines is a main theme, especially when POW becomes the norm, hardware sales and iterations, hosting services and ecosystem collaborations, technology licensing and derivative businesses; after all, don’t forget that Bitmain almost became a chip company;

Risks and challenges: Supply-demand imbalance caused by market price crashes, reliance on supply chains like TSMC, regulatory and compliance requirements;

Guaranteed returns, whenever BTC or a certain POW mining coin surges, the price of mining machines also skyrockets, and only good relationships can secure purchases, as supply-demand relationships can easily change.

11. Hackers

Profit logic: Illegally profiting in the cryptocurrency market through technical vulnerabilities and strategic attacks, all are risk-free trades; as long as the technology is good, one can earn easily;

Risks and challenges: Upgraded technical countermeasures, mixers increasingly sanctioned, legal sanctions and cross-border crackdowns, internal divisions exposing themselves;

Hackers engage in risk-free trades; many hackers want to join wealthy companies for insider theft, all hoping for a windfall, but no one dares to steal from generals because it could cost them their lives.

12. Meme coin projects and conspiracy groups

Profit logic: Industrialized issuance and harvesting, market manipulation and insider trading, conspiracy groups formed by KOLs collaborating with project teams or even acting as project teams themselves to directly promote high positions and offload to fans, essentially becoming industrialized, allowing for bulk launches and accumulating small amounts into larger sums;

Risks and challenges: Regulatory issues and the potential for offline rights protection if too many people are cut; KOLs promoting too much may also face legal risks;

Think about how many people want to join conspiracy groups, and you'll understand. You thought the memecoin you were playing with was community-driven, but in reality, it’s all conspiracy groups.

13. Information Arbitrageurs

Profit logic: When a new token is listed on an exchange or breaking news occurs, being able to act immediately, for example, if news of a token listing is one second faster than others, it could lead to significantly higher profits;

Risks and challenges: The success of algorithms has led everyone to start competing, whether in API speed or buying speed, and there’s also the concern of encountering a situation where the price drops immediately after listing, like the incident with why and cheems contracts;

Consider how many people rush to use the algorithm's API for its outputs, and how many want to become the next algorithm, and you'll see how much money can be made.

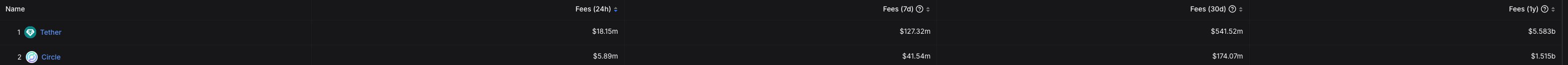

14. Stablecoin Issuers

Profit logic: Investment returns from reserves, fee income, zero-cost liquidity pools, essentially "fiat currency digital arbitrage";

Risks and challenges: Regulatory risks, liquidity risks, systemic risks;

Those who know, know; those who don’t, also know. Just depositing dollars to convert into stablecoins can yield significant returns from interest rate spreads, not to mention other earnings.

15. A Small Number of VC Institutions

Profit logic: Investing at undervalued times, having tokens to sell after TGE, and if the opening unlock doesn’t have a long enough lock-up period, it’s likely just to make a noise;

Risks and challenges: Project teams can arbitrarily change rules, whether it’s unlocking or valuation, and can directly rug pull, etc.;

In this round, very few VCs made money, as very few can negotiate like Dovey, and many project teams this round are CS, able to change terms at will, making the probability of profit very low.

16. KOLs

Profit logic: Project promotion, participation in KOL rounds, sharing profits with project teams, joining conspiracy groups, or even creating their own conspiracy groups; some can directly split quotas with project teams, and the more powerful can even become the boss;

Risks and challenges: Reputation collapse, legal compliance; don’t forget that at Dongda, promoting a zero-value project can get you boxed in;

This round, it’s said that KOLs can directly ask project teams for starting quotas of 1%, and can even use their influence to coerce project teams to follow their lead, which is why KOLs are the top presence at the Hong Kong conference.

Key Common Traits: Core Characteristics of Earners

Technical advantage: MEV searchers and bot developers rely on algorithms and infrastructure (like low-latency nodes);

Market sensitivity: Early investors and project teams accurately capture sector rotations (like BRC-20 in 2023, RWA and AI in 2024);

Anti-cyclicality: CEXs and compliance service providers resist bear markets through diversified businesses (lending, custody);

Economies of scale: Top exchanges and market makers monopolize profits through capital and liquidity;

Influence advantage: Leading VCs and top KOLs leverage their influence to create attention economy;

Cost advantage: Whether it’s $Trump or the memecoin conspiracy groups, they are essentially risk-free trades, so there’s no possibility of losing money.

Risks and Challenges

Regulatory uncertainty: U.S. lawmakers have proposed that public officials should not be allowed to issue tokens, and the SEC is gradually settling with everyone;

Technical vulnerabilities: Cross-chain bridge attacks (like the $250 million theft from Poly Network in 2023), contract vulnerabilities (like the flash loan attack on Curve pools in 2024), exchange hacks (Bybit was recently hacked for over $1.5 billion due to issues with @safe);

Market sentiment fluctuations: Political coin speculation bubbles (like the 2025 TRUMP market cap briefly exceeding $80 billion before plummeting 85%);

Cyclicality: Depending on market cycles, the profit-making effect will also change; the last round was DeFi, this round is AI, and the next round is uncertain.

Summary

The core groups making money are:

Infrastructure monopolists (CEXs, LSD protocols);

Capital whales (stablecoin issuers, market makers);

Tech-driven players (MEV, bots);

Sector catchers (early investors, project teams);

Compliance dividend beneficiaries (licensed exchanges, auditing firms);

Concentrated influence (well-known VCs, celebrities, KOLs);

Common traits of losers: lack of technology, information advantage, retail investors blindly chasing highs and cutting losses, and project teams failing to adapt to regulatory changes.

To be honest, after writing this, I realize I haven’t lost that much money here, and I feel a bit impressive. So many people are making crazy profits, and the vast majority of those who have made money take it away, not leaving it in the circle. What to do???

This round of project teams may not necessarily make money, especially many that people think are profitable. After all, doing projects is a metaphysical issue; whether it can succeed depends not on anything else, but on luck. 😂

I’ve finished writing, and I hope everyone can help supplement it. Later, I’ll open a separate discussion on who has made the most money at each position in this cycle. The premise is that brothers really like to see it, so please comment more.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。