When the yields of interest-bearing stablecoins like YLDS continue to crush bank interest rates, who can foresee how much capital will accelerate into the blockchain?

From Bitcoin spot ETFs to the wave of tokenization, the institutional power represented by Wall Street is profoundly influencing and changing the direction of the crypto market, and we believe this power will grow stronger by 2025. OKG Research has launched the "On-Chain Wall Street" series of studies to continuously focus on the innovations and practices of traditional institutions in the Web3 field, observing how top institutions like BlackRock and JPMorgan embrace innovation. How will tokenized assets, on-chain payments, and decentralized finance shape the future financial landscape?

This article is the fourth in the "On-Chain Wall Street" series.

Previous content can be viewed here:

Figure Markets recently received approval from the U.S. Securities and Exchange Commission (SEC) to launch the first interest-bearing stablecoin, YLDS. This move not only marks the recognition of U.S. regulatory agencies towards crypto financial innovation but also indicates that stablecoins are evolving from mere payment tools to compliant yield-generating assets. This may open up greater imaginative space for the stablecoin sector, making it the next innovative field capable of attracting large-scale institutional funds after Bitcoin.

Why did the SEC give YLDS the green light?

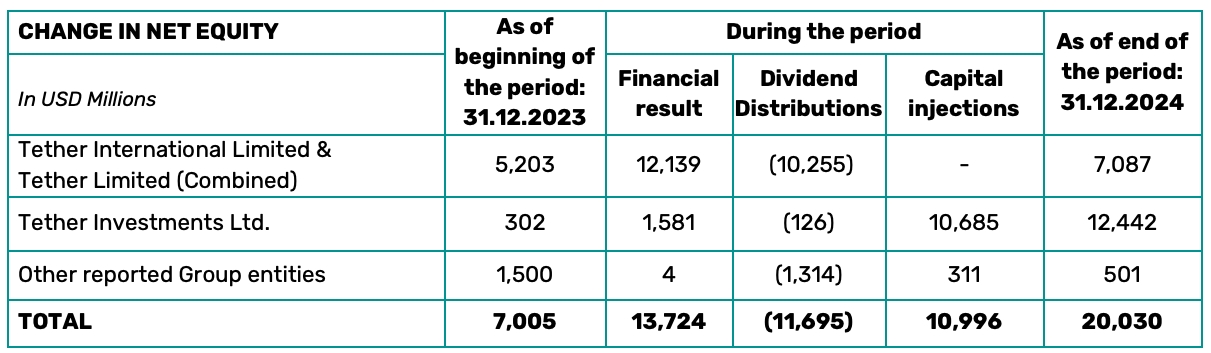

In 2024, Tether, the issuer of the stablecoin USDT, reported an annual profit of $13.7 billion, surpassing traditional financial giant Mastercard (approximately $12.9 billion). Its profits mainly come from investment returns on reserve assets (primarily U.S. Treasury bonds), but these have no relation to the holders, and users cannot leverage USDT for asset appreciation and investment returns—this is precisely the breakthrough that interest-bearing stablecoins see as capable of disrupting the existing landscape.

Tether's financial report (2024)

The core of interest-bearing stablecoins lies in the "redistribution of asset yield rights": under the traditional stablecoin business model, users sacrifice the time value of their funds for stability, but interest-bearing stablecoins can allow holders to directly enjoy returns by tokenizing the yield rights of underlying assets while maintaining stability. More importantly, interest-bearing stablecoins hit the pain point of the "silent majority": although traditional stablecoins can also generate yields through staking, the complex operations and security compliance risks hinder large-scale user adoption. In contrast, stablecoins like YLDS, which allow "holding coins to earn interest," make yield generation accessible without barriers, truly achieving "democratization of returns."

While transferring the yield of underlying assets may reduce the profits of issuing institutions, it significantly increases the attractiveness of interest-bearing stablecoins. Especially in the current unstable global economic environment with high inflation levels, both on-chain users and traditional investors are increasingly demanding financial products that can generate stable returns. Products like YLDS, which are both stable and can provide yields far exceeding traditional bank rates, will undoubtedly become "hot commodities" in the eyes of investors.

However, these are not the main reasons for the SEC's approval of YLDS. The key to YLDS receiving the SEC's green light lies in its circumvention of the core controversies of SEC regulation, making it compliant with current U.S. securities laws. As a systematic regulatory framework for stablecoins has yet to be established, U.S. stablecoin regulation currently relies mainly on existing laws, but various agencies, including the SEC and CFTC, have different definitions of stablecoins, each trying to gain dominance in stablecoin regulation. The power struggles between different regulatory agencies and the discrepancies between regulation and market recognition have led to a chaotic situation in U.S. stablecoin regulation, making it difficult to form a basic consensus. However, interest-bearing stablecoins like YLDS, which can generate yields, structurally resemble traditional fixed-income products, clearly fall under the category of "securities" even within the current legal framework, and there is no controversy. This is a prerequisite for YLDS-type interest-bearing stablecoins to be included in SEC regulation.

But this also means that while the approval of YLDS indicates a continued positive attitude of U.S. crypto regulation, including the SEC, regulatory agencies are actively adapting to the rapidly developing stablecoin and crypto financial markets, shifting stablecoin regulation from "passive defense" to "active guidance." However, this cannot change the regulatory dilemmas faced by traditional stablecoins like USDT/USDT in the short term; more changes will have to wait until the U.S. Congress formally passes stablecoin regulatory legislation. The industry generally expects that the U.S. stablecoin regulatory bill may gradually be implemented within the next 1 to 1.5 years.

However, YLDS distributes the interest income from underlying assets (mainly U.S. Treasury bonds, commercial paper, etc.) to holders through smart contracts and uses a strict KYC verification mechanism to bind income distribution to compliant identities, reducing regulatory concerns about anonymity. These compliance designs provide a reference for other similar projects seeking regulatory approval in the future. In the next 1-2 years, we may see more compliant interest-bearing stablecoin products, compelling more countries and regions to consider the necessity of developing and regulating interest-bearing stablecoins. For regions like Hong Kong and Singapore, which have already implemented stablecoin regulations and mostly view stablecoins as payment tools, when faced with interest-bearing stablecoins that clearly possess securities attributes, in addition to adjusting the existing regulatory framework, they may also consider limiting the types of underlying assets for interest-bearing stablecoins to bring them under the regulatory scope of tokenized securities.

The Rise of Interest-Bearing Stablecoins Will Accelerate the Institutionalization of the Crypto Market

The SEC's approval of YLDS not only demonstrates the current openness and friendliness of U.S. regulation but also suggests that in the mainstream financial context, stablecoins may evolve from "cash substitutes" into a new type of asset that combines the attributes of both "payment tools" and "yield tools," accelerating the institutionalization and dollarization process of the crypto market.

While traditional stablecoins meet the demand for crypto payments, due to the lack of interest income, most institutions only use them as short-term liquidity tools; interest-bearing stablecoins can not only generate stable returns but also improve capital turnover through on-chain trading without intermediaries and around the clock, offering significant advantages in capital efficiency and instant settlement capabilities. Ark Invest noted in its latest annual report that hedge funds and asset management institutions have begun to incorporate stablecoins into their cash management strategies, and the approval of YLDS by the SEC will further alleviate institutional compliance concerns, raising the acceptance and participation of institutional investors in such stablecoins to new heights.

The large-scale influx of institutional funds will further drive the interest-bearing stablecoin market to achieve rapid growth, making it an increasingly indispensable part of the crypto ecosystem. To respond to competition and meet market demand, OKG Research optimistically predicts that interest-bearing stablecoins will experience explosive growth in the next 3-5 years, capturing about 10-15% of the stablecoin market share, becoming another crypto asset category that can attract large-scale institutional attention and investment after BTC.

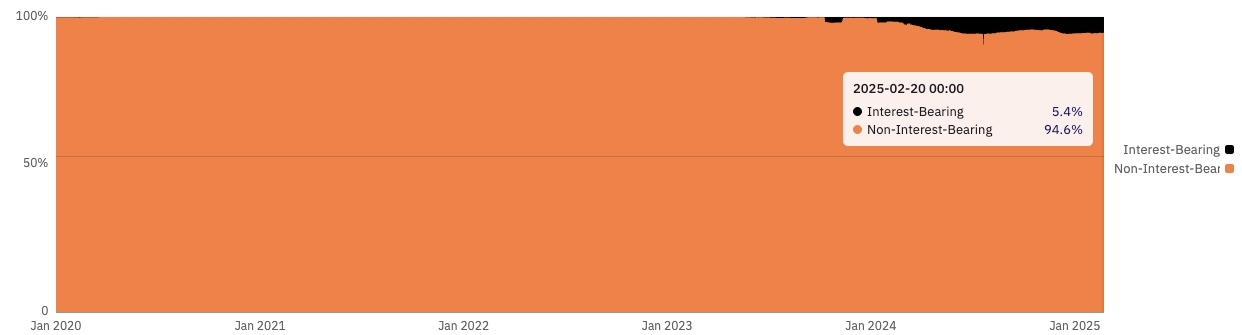

Proportion of interest-bearing stablecoins in the Ethereum ecosystem (@21co, as of 2025/2/20)

The rise of interest-bearing stablecoins will further consolidate the dominance of the dollar in the crypto world. Currently, the yield sources of interest-bearing stablecoins on the market mainly fall into three categories: returns from investing in U.S. Treasury bonds, blockchain staking rewards, or structured strategy yields. Although the synthetic dollar stablecoin USDe launched by Ethena Labs achieved great success in 2024, becoming a major player in the interest-bearing stablecoin market, this does not mean that staking and structured strategies as yield sources will become mainstream. On the contrary, we believe that interest-bearing stablecoins backed by U.S. Treasury bonds will still be the preferred choice for future institutional investors.

Despite the physical world accelerating de-dollarization—China and Japan have sold large amounts of U.S. Treasury bonds in recent years, and Saudi Arabia announced in June 2024 that it would no longer renew the "petrodollar agreement" that had lasted for half a century, causing the dollar to decouple from oil after it had already decoupled from gold, while BRICS countries are continuously trying to bypass the SWIFT network to reduce dependence on dollar payments—the digital on-chain world continues to gravitate towards the dollar. Whether through the large-scale application of dollar stablecoins or the tokenization wave initiated by Wall Street institutions, the U.S. is continuously strengthening the influence of dollar assets in the crypto market, and this trend of dollarization is being reinforced.

The likelihood of a short-term reversal of this trend is low because, in terms of liquidity, stability, and market acceptance, there are currently no more alternatives to tokenization innovation and the crypto financial market other than dollar assets represented by U.S. Treasury bonds. The SEC's approval of YLDS further indicates that U.S. regulatory agencies have now given the green light to dollar-backed interest-bearing stablecoins, which will undoubtedly attract more projects to launch similar products in the future. This is also why, despite knowing that the yield models of future interest-bearing stablecoins will definitely become more diversified and reserve assets may expand to include real estate, gold, corporate bonds, and more types of RWAs, we still believe that U.S. Treasury bonds, as a risk-free asset, will continue to dominate the underlying asset pool of interest-bearing stablecoins.

Conclusion

The approval of YLDS is not only a compliance breakthrough for crypto innovation but also a milestone for financial democratization. It reveals a simple truth: under the premise of controllable risk, the market's demand for "money making money" is eternally present. With the improvement of the regulatory framework and the influx of institutional funds, interest-bearing stablecoins may reshape the stablecoin market and enhance the dollarization trend of crypto financial innovation. However, this process also needs to balance innovation and risk to avoid repeating past mistakes. Only in this way can interest-bearing stablecoins truly achieve "allowing everyone to earn money effortlessly."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。