Market stability and the emergence of new projects will be key factors.

Author: Frontier Lab

Market Overview

Overall Market Situation

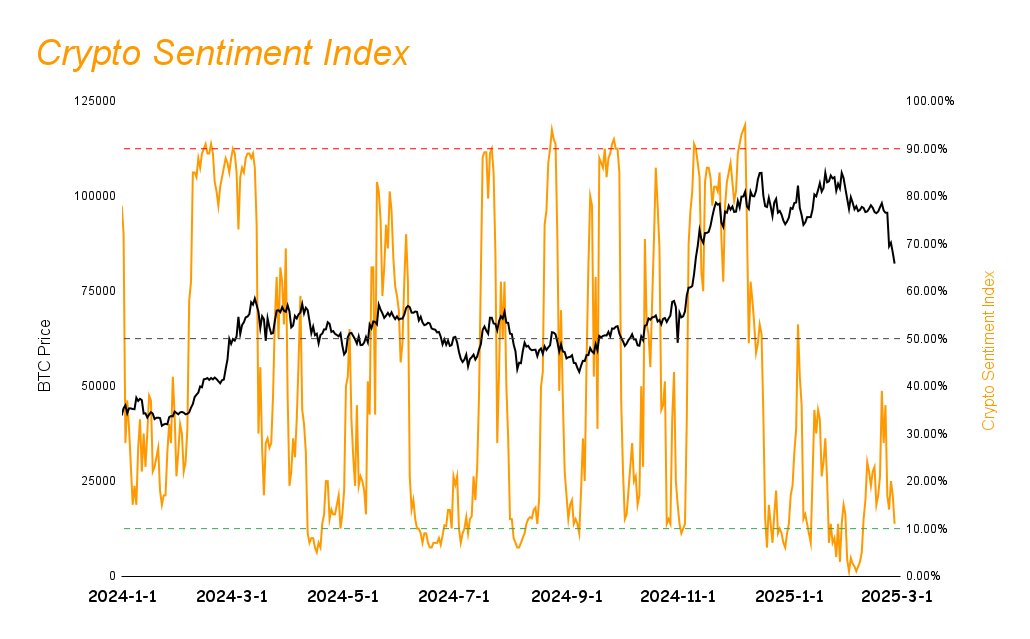

This week, the cryptocurrency market is in a rapid decline, with the market sentiment index dropping from 33% to 11%. The market capitalization of stablecoins has essentially stopped its continuous growth (USDT reached 142 billion, USDC reached 55.9 billion, with changes of 0.02% and -0.53% respectively), indicating that as the market experiences severe declines, institutional funds have stopped entering and are beginning to exit. The panic in market sentiment is mainly due to the hacking of $1.5 billion in assets from the Bybit exchange and Trump's aggressive tariff policies, which have heightened concerns about inflation, reducing the likelihood of interest rate cuts by the Federal Reserve, and increasing fears of an economic recession in the U.S. This has had a strong impact on market sentiment, plunging overall sentiment into extreme panic, with Altcoins generally underperforming the benchmark index.

Predictions for Next Week

Bullish Targets: LTC, S, SOSO, BERA

LTC: This week, LTC rose against the trend, showing strength in a generally declining market. This is mainly due to increased expectations for its LTC ETF approval. This week, the spot LTC ETF proposed by Canary Capital has already been listed on the custody trust and settlement company (DTCC) system, and LTC's betting approval on Polymarkt has reached 87%. Currently, the market has high expectations for the approval of the LTC spot ETF, so there will be continuous speculation on the LTC spot ETF event until its official approval.

S: Sonic has recently begun to venture into the DeFi industry, attracting a large number of on-chain users and funds with its high APY from its on-chain DeFi projects. In its main liquidity staking projects, Beets and Origin, the APY based on the S token can reach up to 32.22% and 123% respectively. In Sonic's on-chain lending protocol, the average borrowing rate for S tokens is 10.21%, allowing users to achieve a yield of over 20%. Additionally, the recent popularity of the Sonic chain has increased market demand for the S token, causing its price to rise against the trend, thus providing higher returns for Sonic chain users. Therefore, in the current declining market, the ability for users to still achieve over 20% risk-free returns will attract a large number of users to participate in borrowing, increasing market demand for the S token and driving its price in a spiraling upward trend.

SOSO: The SoSoValue project can continuously adjust its future development direction based on market trends. Originally, SoSoValue aimed to establish itself as a one-stop investment service platform enhanced by AI technology, wanting to keep up with the market trend of AI Agents. After the decline of AI Agents, attention and funds have shifted back to DeFi projects, allowing SoSoValue to seize the current trend of attracting users with high APY. It has rebranded itself as a wealth management service center, subtly integrating its AI technology into its products without emphasizing it, instead focusing on promoting its ability to provide high APY. Recently, it launched a second season mining activity, where users holding or staking SSI packaged index tokens can mine SOSO tokens, allowing users' staking rewards combined with additional airdropped SOSO tokens to reach a maximum of 42% APY, thus attracting more users to participate in mining and further increasing bullish expectations for SOSO tokens.

BERA: This week, the overall market is in a downtrend, and initially, BERA was also affected by the market and experienced a decline. However, the Berachain project team quickly adjusted the staking yield of its on-chain LSD project. The main LSD project on Berachain, Infrared Finance, has raised the APY of WBERA to a maximum of 123%, and the borrowing rate for BERA in its on-chain lending project has reached 23.68%, allowing arbitrage users to earn 100% risk-free annualized returns, quickly curbing the downtrend and turning it into an uptrend. The strategy adopted by the Berachain project team is similar to Sonic's, both attracting on-chain users and funds with high APY to achieve: staking lock-up → liquidity release → DeFi empowerment → token appreciation, thereby increasing market demand for the main token BERA and promoting the price increase of BERA tokens.

Bearish Targets: ETH, SOL, ADA, AI, TKO, RUNE

ETH: This week, 491,000 ETH were stolen from Bybit. Although Bybit has compensated for the stolen ETH through purchases and exchanges, the purchasing power generated has not reflected in the market price, indicating that investors still have FUD sentiments towards ETH. After all, it will continuously face selling pressure from hackers. Furthermore, the investigation report from Bybit clearly stated that the theft was mainly due to a vulnerability in the safe, and the exchange's infrastructure did not have any vulnerabilities, leading to significant doubts about safe technology. Since most projects in the Ethereum ecosystem use safe technology, this poses a potential danger to the security of many projects in the Ethereum ecosystem in the future. Additionally, Ethereum's Pectra upgrade will go live on the testnet this weekend. According to previous practices, there will usually be a price pump before a project's technical upgrade, followed by a pullback after the positive news is realized. This time, the Pectra upgrade has not injected much energy into ETH's price, so it is likely that ETH's price will decline after its implementation.

SOL: This week, SOL experienced a significant decline following the market trend, mainly due to the recent retreat of the Meme coin wave. As Solana is the public chain with the highest returns from Meme coins, it has also been affected by various FUD voices in the market, causing on-chain funds to start fleeing, with its TVL dropping from $12.1 billion to $7.3 billion, a decrease of 39.66%. The on-chain liquidity staking yield has also fallen from 10.29% to 7.26%, and the on-chain trading volume has dropped from $35.5 billion to $2.4 billion, a decrease of 93.23%. It is evident that Solana's on-chain ecosystem is nearing collapse. Additionally, on March 1, 11.2 million SOL will be unlocked, and these tokens are held by institutions, which may lead to continued selling pressure, exacerbating market investors' panic towards SOL.

ADA: This week, Cardano's on-chain TVL experienced a significant decline, dropping 26.88% to $308 million, down 56.06% from its peak of $701 million. All on-chain projects in its ecosystem have seen a decline of over 10% in TVL, indicating a rapid outflow of funds from the Cardano ecosystem, which proves that market users currently have FUD sentiments towards the Cardano ecosystem. The trading volume on its on-chain DEX has decreased by over 68%, and the current borrowing rate for ADA tokens is 3.29%, indicating that almost no one is participating in borrowing within its ecosystem, leading to borrowing rates far below those of other public chain tokens. Therefore, if funds continue to flow out of the Cardano chain, it is expected that ADA will continue to decline next week.

AI: Sleepless AI is an AI-based Gamefi project, and the AI and Gamefi sectors occupied by Sleepless AI have experienced the deepest pullback during this decline. Investors in the market have lost interest in the Play-to-Earn model of Gamefi, leading to a gradual decrease in users and almost no new funds entering. There is a general belief that AI projects are currently overvalued, and projects in the AI sector have been in a significant downtrend. Additionally, AI will unlock 17.27 million tokens next week, accounting for 1.73% of the current circulating supply. Given the large unlock ratio and the recent poor performance of this sector, it is expected that there will be a decline shortly after the token unlock.

TKO: Tokocrypto is the largest cryptocurrency exchange in Southeast Asia. Due to the recent Bybit theft incident, various centralized exchanges have been negatively impacted, leading to unsatisfactory performance of tokens across exchanges. Additionally, TKO is about to unlock 10 million tokens, which accounts for 2.02% of the current circulating supply. Given the large unlock ratio, a decline is expected after the unlock.

RUNE: THORChain is a decentralized cross-chain AMM trading protocol. This week, it experienced a significant reverse trend increase from Monday to Wednesday, mainly because the hackers who stole from Bybit continuously transferred the stolen ETH into THORChain for money laundering transactions. This led to a significant increase in THORChain's trading volume and fees, causing it not to follow the market's downward trend. After the market exposed that hackers were using THORChain for money laundering, THORChain developer Pluto announced his resignation. It is expected that next week, with the decrease in trading volume and market FUD regarding its alleged money laundering activities, the price will continue to decline.

Market Sentiment Index Analysis

The market sentiment index has dropped from 33% last week to 11%, indicating that it is nearing the extreme panic zone.

Hot Sectors

Sonic

Current Hot Status

In recent weeks, Sonic's chain TVL has maintained a rapid growth trend, and this week, most chains have been in a downward trend, while Sonic is the only chain among those with over $50 million in TVL that has maintained a 10% growth rate, with a growth rate of 10.32% this week, bringing its on-chain TVL to $683 million. This shows that even in an extremely panicked declining market, its on-chain ecosystem can still experience continuous capital inflow. Additionally, Sonic's token S has risen by 7.63% this week. Although the increase is not high, it demonstrates market recognition as it has managed to rise amid a market crash.

Reasons for Popularity

Recently, Sonic has shifted its project focus from Gamefi to DeFi, adopting a strategy of high APY to attract on-chain users. In its main liquidity projects, it can provide users with an APY of up to 123%, while offering around 10% borrowing rates to users. This allows on-chain users to achieve over 100% arbitrage APY. In the current declining market, an APY exceeding 100% is highly attractive to on-chain users, prompting them to choose to purchase or borrow tokens to participate in arbitrage, thereby increasing the demand for token S and resulting in better performance compared to most other tokens.

Future Outlook

We can see from the recent popularity of the Sonic ecosystem that it is mainly due to the increase in annualized returns of the LSD projects within the Sonic ecosystem, attracting more on-chain users to participate in arbitrage activities. Therefore, we can conclude that a path for an ecosystem to develop rapidly is to achieve efficient driving of its economic flywheel, with the project team focusing on the DeFi sector to enable efficient asset utilization. Asset empowerment around DeFi requires focusing on asset staking and liquidity, allowing assets to generate compound returns in DEX, lending, and asset management. The economic flywheel of the on-chain ecosystem must form a positive cycle through: staking + liquidity + DeFi empowerment + user growth. The core driving force lies in the dual drive of staking and liquidity release of the on-chain native token, allowing it to generate compound returns in scenarios such as DEX, lending, and asset management, realizing "staking is productivity." Once on-chain users are attracted to the ecosystem by high APY, a positive cycle must be formed: staking lock-up → liquidity release → DeFi empowerment → token appreciation → user return → re-staking → developer aggregation. Otherwise, if the funds of new users entering the market are insufficient to cover the selling pressure from arbitrage, the price of the S token will decline. When the S token price declines, the yields of various projects will inevitably decrease, leading to the exit of arbitrageurs. This would be a significant blow to an ecosystem, so we need to continuously monitor the APY of Sonic's on-chain DeFi projects. By observing the on-chain APY, we can determine whether the Sonic chain still has development momentum.

However, it is important to note that although Sonic's TVL was the fastest-growing among all chains exceeding $100 million this week, its TVL did not continuously rise but experienced a spike followed by a pullback.

Berachain

Current Situation

This week, the entire market is in a rapid decline, with all top ten projects in TVL, except for Berachain, experiencing a downturn. Although Berachain's TVL increased by only 4.66% this week, maintaining positive growth in the current environment is still commendable, with a TVL of $3.194 billion, ranking sixth among all public chains, surpassing the Base chain. The price of its token BERA also maintained an increase this week, rising by 7.26%, placing it in a strong position among Altcoins.

Reasons for Popularity

This week, the growth rates of the top DEX, lending, and LSD projects within the Berachain ecosystem have slowed down, and Berachain's TVL experienced a decline in the first half of the week. However, due to the main LSD project on Berachain, Infrared Finance, raising the APY of WBERA to a maximum of 121%, and the emerging LSD project Stride achieving an APY of 190.12%, along with a borrowing rate of 23.68% for BERA in Berachain's lending projects, users participating in arbitrage can earn 100% risk-free annualized returns, quickly curbing the downtrend and turning it into an uptrend.

Future Outlook

Berachain's continued popularity this week is mainly due to its on-chain DeFi projects increasing APY, maintaining a relatively high attraction for on-chain users, leading a large number of on-chain users to invest funds into Berachain. Berachain's development path is roughly similar to Sonic's, so it faces similar issues. Currently, Berachain has achieved the process of: staking lock-up → liquidity release → DeFi empowerment → token appreciation, but there have not been outstanding on-chain projects emerging during the user return → re-staking → developer aggregation process. Therefore, while Berachain's high-interest model can lead to rapid development of the on-chain ecosystem in the short term and promote the rapid rise of the project token BERA, it will inevitably face increasing selling pressure in the future. When the funds of new users entering the market are insufficient to cover the selling pressure from arbitrage, the price of the BERA token will decline. Once the BERA token price declines, the yields of various projects will inevitably decrease, leading to the exit of arbitrageurs. Thus, in the future, more attention should be paid to whether new star projects emerge within the Berachain ecosystem and whether the interest rates offered by on-chain LSD projects significantly decrease.

Overall Market Overview

Data Source: SoSoValue

According to weekly return rate statistics, the Sociafi sector performed the best, while the PayFi sector performed the worst.

Sociafi Sector: In the Sociafi sector, TON and CHZ have a significant share, accounting for a total of 95.17%, with weekly declines of -4.86% and -4.79% respectively. Although both are in a downward trend, they still performed better than other Altcoins, leading to the overall Sociafi sector index performing the best.

PayFi Sector: In the PayFi sector, XRP, LTC, and XLM have a significant share, accounting for a total of 94.62%, with weekly declines of -19.23%, -1.21%, and -16.96% respectively, resulting in the PayFi sector performing the worst.

Next Week's Major Crypto Events

Monday (March 3): U.S. February ISM Manufacturing PMI

Wednesday (March 5): U.S. February ADP Employment Numbers; Pectra network upgrade plan to launch on Ethereum testnet

Friday (March 7): U.S. February Adjusted Non-Farm Payrolls; U.S. February Unemployment Rate

Summary

This week, the cryptocurrency market experienced a significant decline, with the market sentiment index sharply dropping, indicating widespread investor concerns. Despite this, some projects like LTC, Sonic, SoSoValue, and Berachain attracted users through high APY strategies. However, in the long run, market stability and the emergence of new projects will be key factors. Investors are advised to closely monitor market dynamics and proceed with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。